- Coinbase’s Q3 income dropped amid lowered buying and selling however achieved a $75 million revenue.

- The agency strengthened its crypto stance with a $1 billion buyback and Fairshake PAC help.

In an sudden flip, on the thirtieth of October, Coinbase revealed a drop in quarterly income. This factors to a decline in crypto buying and selling exercise amongst customers over the summer season months.

As per the report, the change’s income dipped to $1.2 billion in Q3 2024, down from $1.45 billion within the prior quarter. Regardless of this, Coinbase posted a notable turnaround with a $75 million revenue.

This can be a stark enchancment from the $2 million loss reported final 12 months.

Coinbase Q3 income sparks considerations

Coinbase skilled a 27% drop in transaction charges in comparison with the earlier quarter attributable to declining buying and selling volumes.

The corporate’s shareholder letter outlined ongoing market challenges. The letter highlighted that subscription and providers income had decreased by 7%, bringing in $556.1 million for the quarter.

This income comes from merchandise like stablecoins, staking, and leverage for Prime merchants.

In its shareholder letter, the agency famous,

“We are working to drive revenue growth through products like derivatives, international expansion, custody, and deeper integration of USDC into the cryptoeconomy.”

Nonetheless, Anil Gupta, Coinbase’s vice chairman of investor relations, appeared optimistic as highlighted in a dialog with a publication the place he marked the corporate’s fourth consecutive worthwhile quarter.

“It was a solid quarter for the business across the three priorities we set forth early in the year: driving revenue, driving crypto utility, and driving regulatory clarity.”

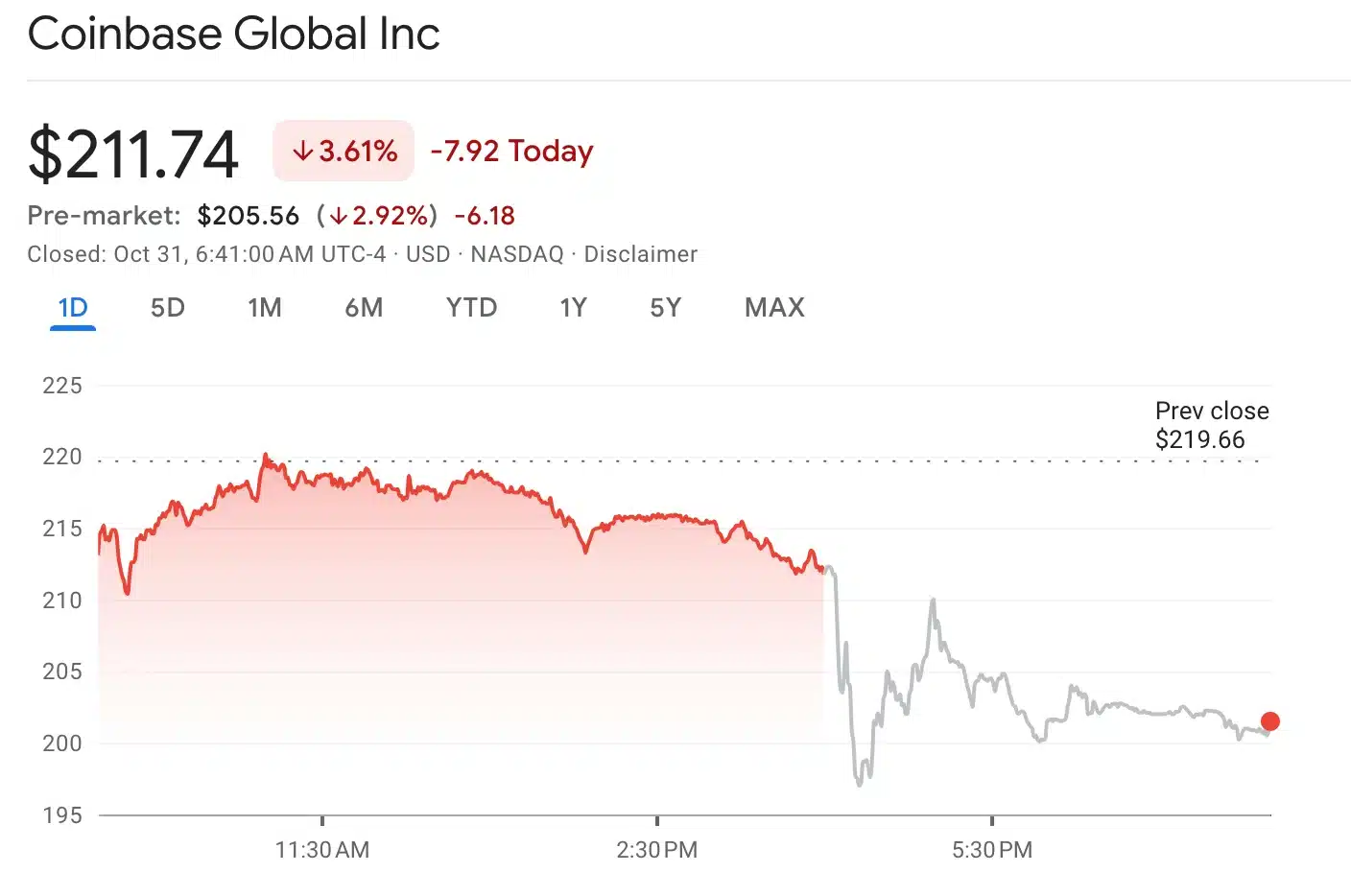

Coinbase inventory worth development

In March, Coinbase’s inventory worth surged to a peak of $279, fueled by Bitcoin [BTC] reaching a report excessive of almost $73,000.

Though shares have since dipped to $211 as of thirtieth October’s shut, they continue to be up 35% year-to-date.

Nonetheless, in after-hours buying and selling, Coinbase’s inventory noticed an additional decline, dropping to $202.

As of the newest replace, Bitcoin’s worth settled at $72,288.21 after a slight 0.37% lower within the final 24 hours, whereas Coinbase shares traded at $211.74, down by 3.61% at press time.

What lies forward?

Oppenheimer analysts projected a dip in Coinbase’s buying and selling quantity attributable to an absence of sturdy market catalysts and election uncertainty.

Analysts stay cautiously optimistic, noting VP Kamala Harris’s endorsement of a digital asset regulatory framework.

This might drive Coinbase buying and selling exercise in This autumn, probably offsetting the slowdown.

The introduction of a $1 billion inventory buyback program underscores the corporate’s optimistic long-term outlook, aimed toward rewarding traders.

Moreover, Coinbase’s stablecoin income noticed development, notably with USDC, supported by platform incentives and expanded product integration.

On the political entrance, Coinbase is reinforcing its dedication to pro-crypto coverage by contributing $25 million to Fairshake PAC, a transfer meant to again crypto-friendly candidates within the 2026 elections.

This may solidify its position in shaping favorable regulatory outcomes for digital property.