- Institutional gamers doubled on ETH as CME Futures OI hit a document excessive of $2.5 billion

- With ETH gaining floor in opposition to BTC, will the momentum be sustainable this time?

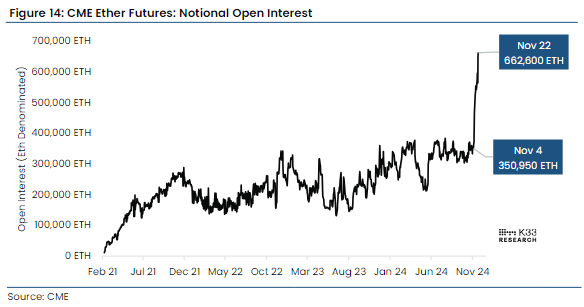

Institutional curiosity in Ethereum [ETH] greater than doubled in November, with CME Futures Open Curiosity (OI) hitting a document excessive of 662,600 ETH (about $2.5 billion).

In reality, in line with K33 Analysis, this pointed to a pointy bounce from 350,950 ETH on 4 November, simply earlier than the Presidential elections in america.

ETH closes in on BTC

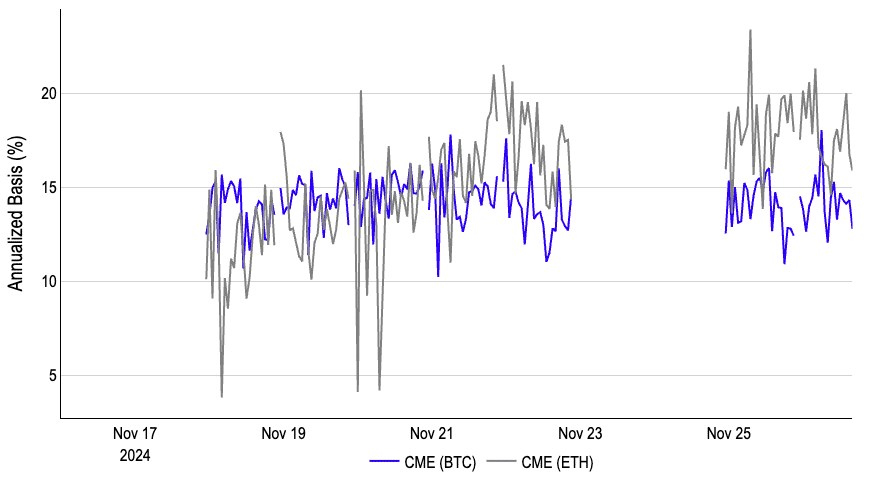

On 25 November, the CME ETH Futures quantity climbed even greater. The ETH annualized foundation – the premium hedge funds get after they purchase U.S spot ETH ETFs and quick ETH Futures – additionally edged greater.

This pattern has since outpaced the BTC sample for the reason that U.S elections, famous Coinbase analysis analyst David Han. Han said,

“CME ETH basis has recently expanded beyond BTC as well after trailing behind it for the past several months.”

Whereas the hike in institutional curiosity could possibly be a internet constructive for ETH’s worth, hedging methods adopted by hedge funds can expose the asset to wild worth swings accelerated by liquidations.

That being stated, ETH’s rising momentum in opposition to BTC was additionally evident within the ETHBTC ratio, with the identical monitoring the altcoin’s relative efficiency to BTC.

In reality, ETH has attracted extra flows over the previous seven days, as evidenced by the practically 15% hike within the ETHBTC ratio.

This meant that ETH outperformed BTC over the previous few days, particularly throughout BTC’s newest stoop.

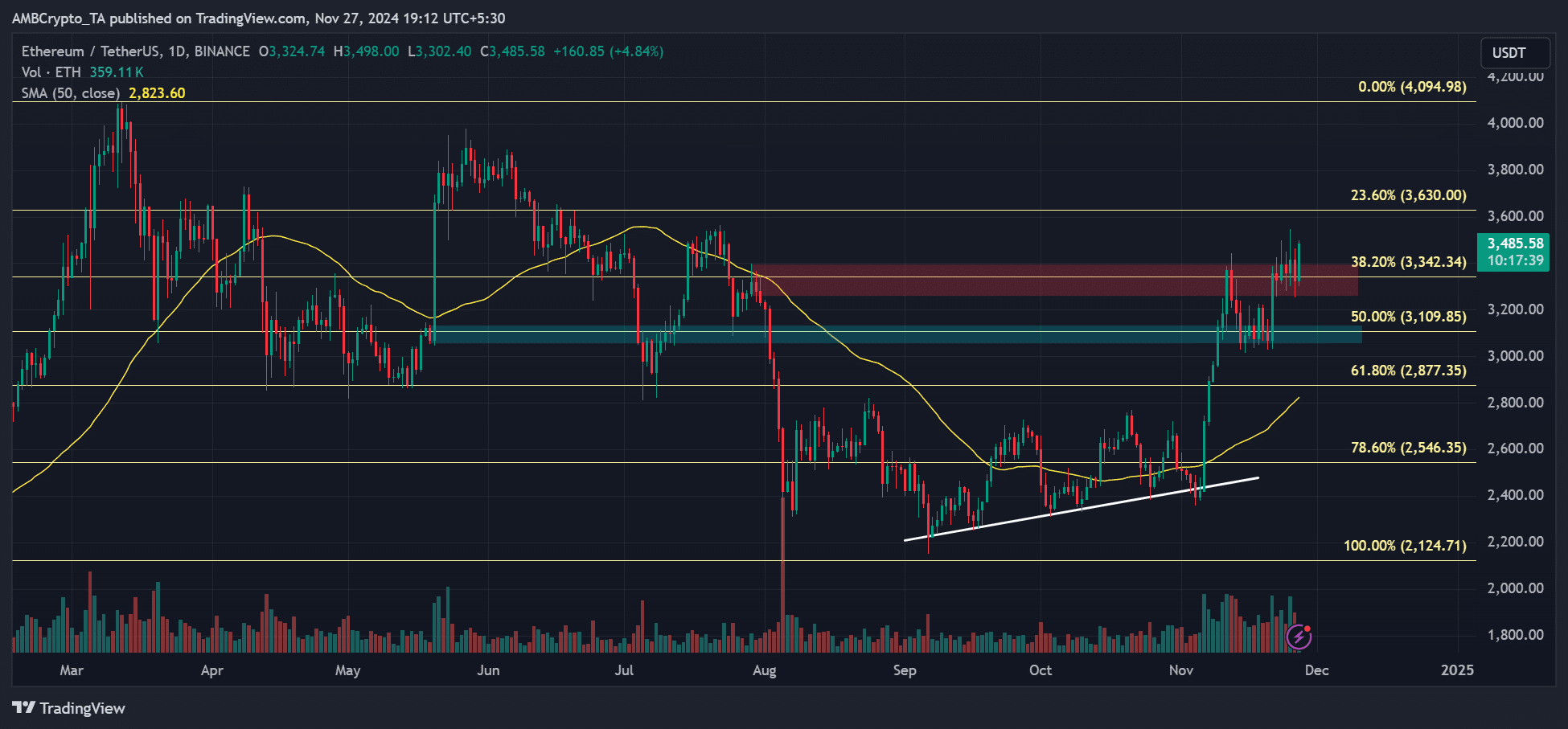

Nonetheless, the pattern might solely be sustainable if the ETHBTC ratio decisively soared above the 50-day SMA (Easy Shifting Common).

Learn Ethereum [ETH] Worth Prediction 2024-2025

We noticed a false breakout in early November, which led ETH to underperform afterwards. Will this time be completely different, with the ETHBTC ratio flirting with the 50-day MA?

At press time, ETH was valued at $3.4K, up 4% within the final 24 hours, with the speedy targets at $3500 and $3600.