- CME itemizing of XRP and SOL might actually be a game-changer—if it shifts from hype to actuality.

- Is the “hype” surrounding futures contracts a game-changer?

Among the many high-caps, XRP and SOL had probably the most bullish begin to the 12 months, every seeing a major capital inflow. Undoubtedly, the talk over a possible spot ETF for each intensified.

If this wasn’t sufficient, speculations relating to a potential launch of futures on Ripple and Solana by CME Group started circulating. Social media shortly grew to become saturated with ‘sell-the-news’ hype.

However did the hype oversell? And what would CME futures imply for his or her costs?

CME itemizing: A real game-changer

Consider CME Group because the go-to platform for the derivatives market – a Centralized Alternate (CEX) the place merchants purchase and promote futures contracts.

With the market rising quick, it’s no shock this information grabbed consideration. Open Curiosity (OI) for XRP and SOL hit report highs following the post-election rally.

If CME lists these high-caps, anticipate the futures market to warmth up much more, drawing in additional speculative capital.

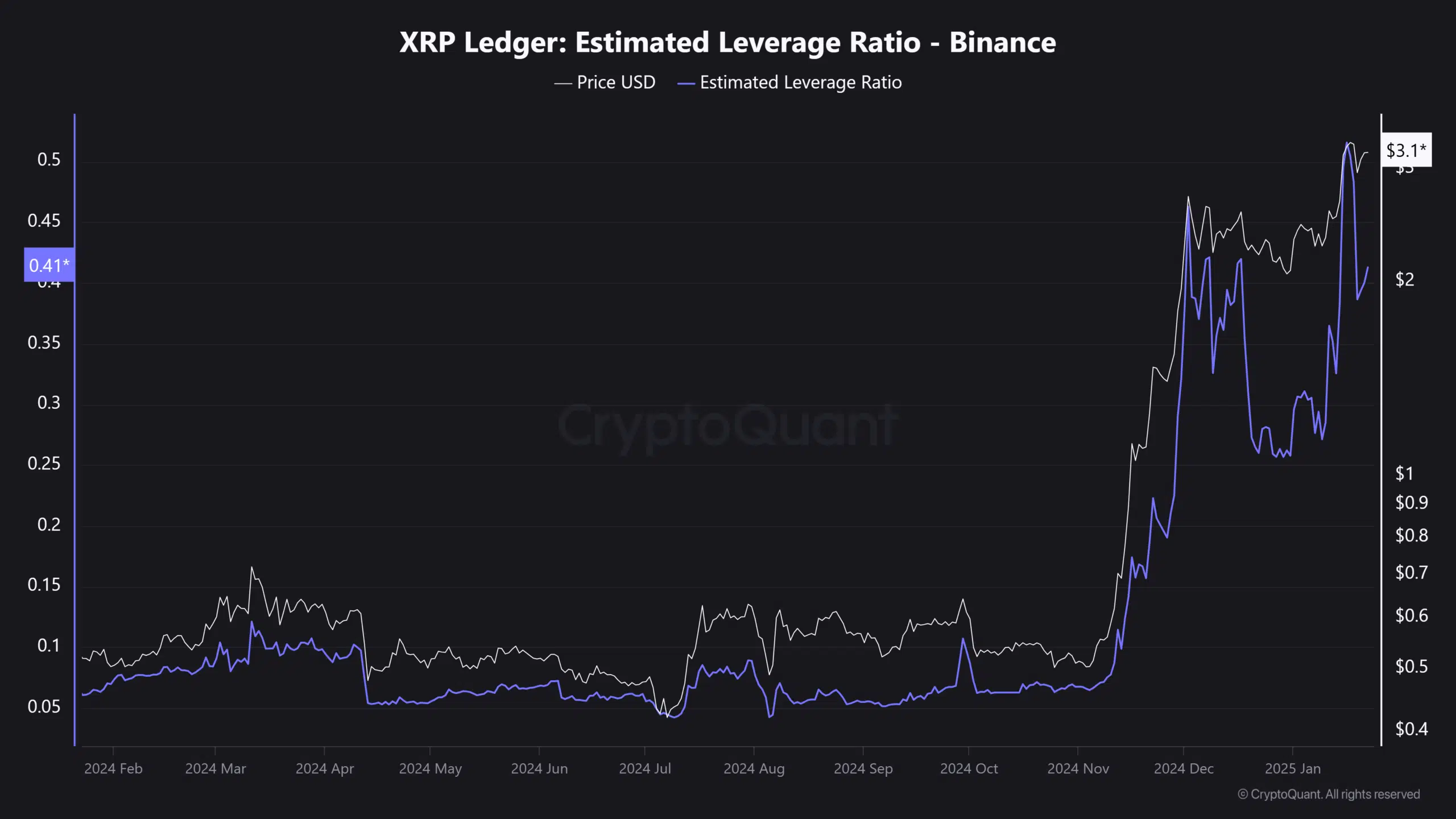

Take XRP, for instance, the Estimated Leverage Ratio (ELR) on Ripple shot as much as an all-time excessive this month, simply as XRP broke by means of the $3 mark. It’s clear – merchants shortly dove in, taking high-leverage positions and snapping up contracts.

What units CME aside? A extra regulated buying and selling atmosphere, one thing Bitcoin and Ethereum futures merchants already worth. With higher regulation, extra “risk-averse” patrons might enter the market – this could possibly be a real game-changer.

Nonetheless, excessive threat prevails

It’s no shock that hundreds of thousands, generally billions, are misplaced within the derivatives market when funding charges soar and leverage will get excessive. In these situations, a reversal is nearly assured.

Whereas XRP and SOL haven’t escaped these liquidations, they’re nonetheless nowhere close to Bitcoin’s staggering $90 million in closed positions at press time.

This provides Ripple and Solana room to develop, as buyers typically transfer capital into altcoins when Bitcoin turns into too leveraged. A CME itemizing might deliver contemporary capital, but it surely might additionally introduce extra threat.

Sensible or not, right here’s XRP market cap in BTC’s phrases

Regardless that that is based mostly on historic patterns, it’s sensible to remain cautious. The itemizing hasn’t been confirmed but, so it’s nonetheless simply an assumption for now.