- Chainlink was up by greater than 8% within the final 24 hours.

- Most metrics and market indicators appeared bullish on LINK.

Chainlink’s [LINK] value registered a pointy decline on the nineteenth of January 2024, which raised issues. Nonetheless, issues turned in LINK’s favor quickly, because the token was fast to get well. However will this uptrend final?

Are Chainlink whales shopping for?

Chainlink’s value witnessed an sudden drop in its value within the current previous as its worth fell to $14.71. When the token’s value dropped, a whale used that chance to build up LINK.

Lookonchain posted a tweet declaring this episode. As per the tweet, after LINK’s value plummeted, a whale spent $8.9 million to purchase 601,949 LINK at $14.81 with three new wallets. This instructed that the whale was assured of a LINK restoration.

After the worth of $LINK dropped in the present day, a whale spent 8.9M$ to purchase 601,949 $LINK at $14.81 with 3 new wallets.https://t.co/W7BjWM2XsP pic.twitter.com/xlFPqWv4ko

— Lookonchain (@lookonchain) January 19, 2024

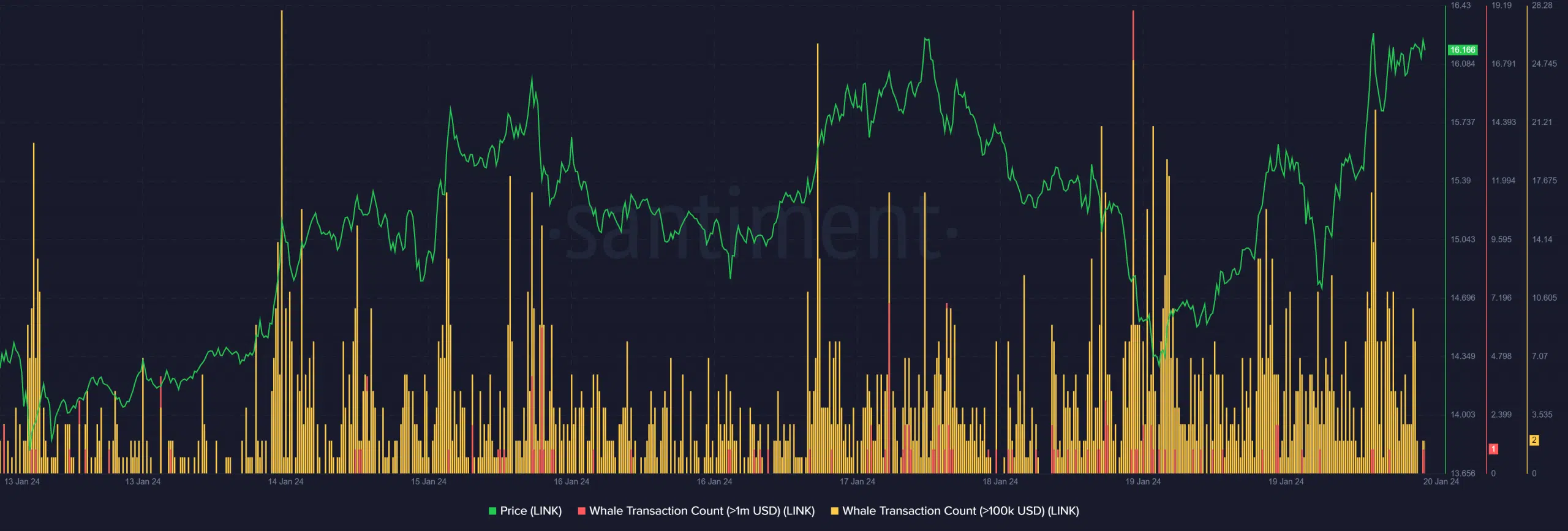

Whereas one whale purchased LINK, AMBCrypto checked Santiment’s information to see whether or not this development was additionally true for the general market. Our evaluation revealed that whale exercise across the token truly registered a rise on the nineteenth of January 2024.

This was evident from the appreciable rise in Chainlink’s variety of whale transactions. The truth is, as per Whalestats, LINK was the tenth most bought token among the many high 100 ETH whales within the final 24 hours.

Chainlink recovered rapidly!

Whales’ confidence in Chainlink paid off quickly sufficient because the token recovered from its value correction fairly swiftly.

In line with CoinMarketCap, within the final 24 hours alone, LINK was up by greater than 8.%. On the time of writing, LINK was buying and selling at $16.15 with a market capitalization of over $9.1 billion, making it the twelfth largest crypto.

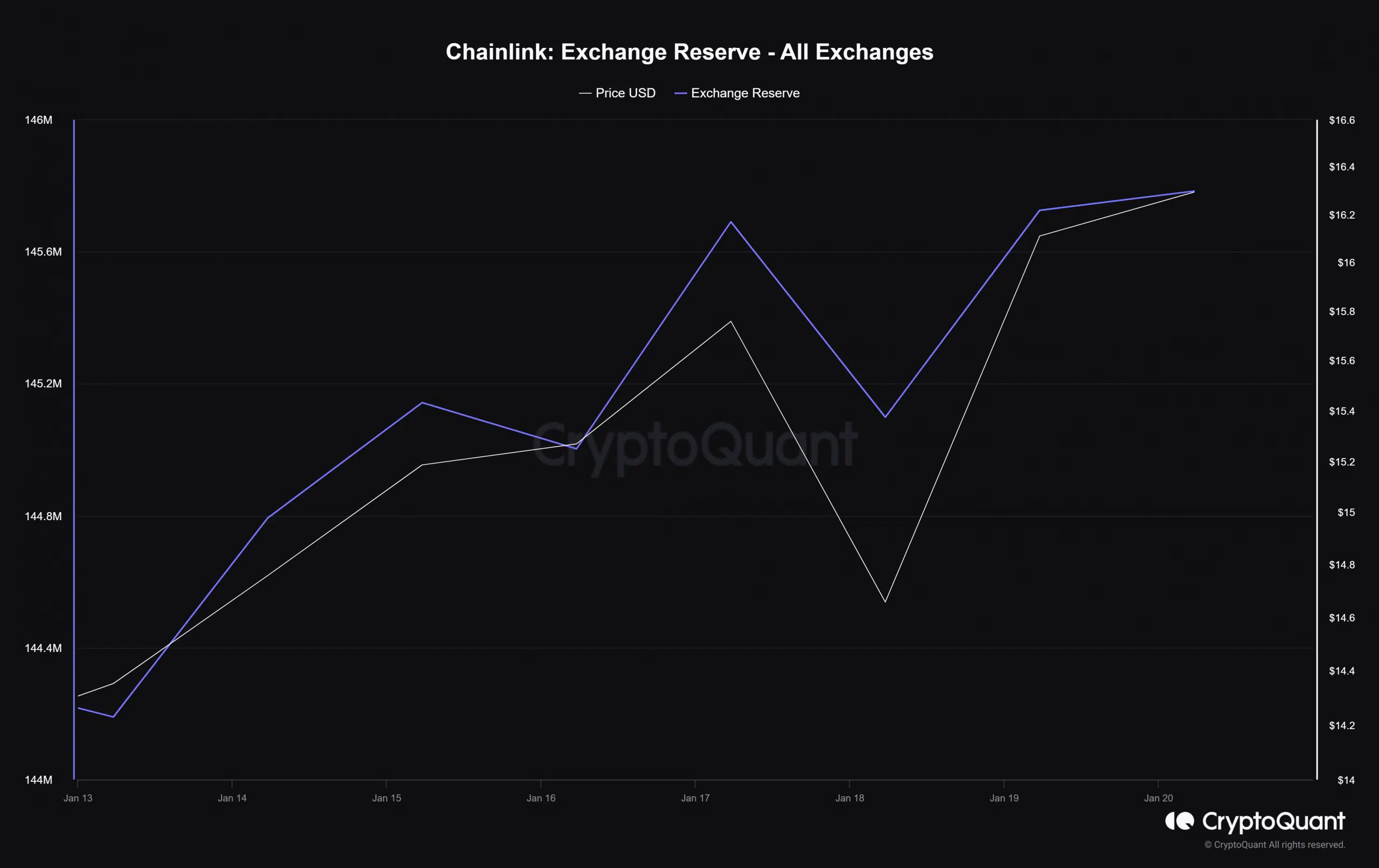

It was stunning to see that, regardless of the current uptrend, traders had been promoting LINK.

When AMBCrypto checked CryptoQuant’s information, we discovered that LINK’s change reserve shot up sharply over the past week, which is mostly a bearish sign.

Although the change charge was excessive, the remainder of the on-chain metrics appeared optimistic.

As an example, Chainlink’s MVRV ratio registered an uptick within the current previous. Issues on the derivatives aspect additionally appeared bullish, as its Binance funding charge was inexperienced.

Furthermore, LINK’s open curiosity additionally shot up. Each time the metric rises, it hints that the potential of a development continuation is excessive.

Life like or not, right here’s LINK’s market cap in BTC phrases

To raised perceive what to anticipate from LINK, AMBCrypto checked its every day chart. We discovered that each its Relative Power Index (RSI) and Chaikin Cash Circulate (CMF) registered upticks and had been shifting above the impartial mark.

This clearly indicated that Chainlink would possibly be capable to preserve its value uptrend within the coming days.