Ethereum has placed on a disappointing efficiency for its traders over the previous few weeks, resulting in considerations on whether or not the second-largest cryptocurrency by market cap has misplaced its shine. The cryptocurrency continues to skirt across the $3,100 stage, not making any vital breaks upward. This factors to weak fundamentals that might set off a value decline.

Ethereum Fails To Make Significant Strikes

Markus Thielen, Head of Analysis at 10x Analysis, has identified some worrying developments with the Ethereum value. In a brand new report shared with NewsBTC, he explains that regardless of Ethereum remaining extremely correlated to Bitcoin with an R-Sq. of 95%, it continues to carry out poorly whereas the latter has made new all-time highs.

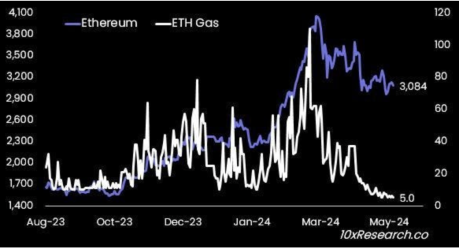

Thielen factors again to ETH’s efficiency within the final bull market, which was carefully tied to new sectors coming out of the community, akin to decentralized finance (DeFi) and non-fungible tokens (NFTs). This brought on demand to skyrocket, and in flip, the worth adopted as customers devoured up ETH for the excessive fuel price required to transact on the blockchain.

Nonetheless, Ethereum has failed to take care of this momentum, which could be attributed to its incapacity to deliver the upgrades that customers wanted in time. Thielen explains that the Dencun improve which helped solved the excessive fuel price points had come three years too late as a result of by 2024 when the improve arrived, customers had moved on to Layer 2 networks. Additionally, throughout this time, different Layer 1 networks have seen an increase in customers and Solana is one instance of this.

Supply: 10x Analysis

The researcher additional defined that the weak fundamentals of ETH at the moment are not solely affecting its value however has had a spillover impact to Bitcoin. “Ethereum’s weak fundamentals are becoming a roadblock for Bitcoin as they prevent broad fiat inflow into the crypto ecosystem,” Thielen said.

Higher To Quick ETH

Thielen’s evaluation of Ethereum additionally spreads to the drop in stablecoin utilization on the community. Again in 2021, Ethereum had dominated stablecoin transactions akin to USDT and USDC. Nonetheless, it looks like, with different issues, the excessive charges have pushed customers in the direction of different networks. Blockchains akin to Tron (TRX) at the moment are dominating stablecoin transactions, leaving ETH within the mud.

Moreover, there may be additionally the truth that ETH’s issuance is popping inflationary as soon as once more. After the London Arduous Fork, often known as EIP-1559, was accomplished in 2021, the community noticed its issuance flip deflationary for the primary time as ETH burned shortly surpassed ETH being introduced into circulation.

Nonetheless, this has now modified prior to now months as there have been extra ETH issued than these burned, Thielen notes. To place this in perspective, a complete of 74,000 ETH have been issued in comparison with solely 43,000 ETH burned. This inflation, coupled with the truth that staking rewards have now dropped to three%, beneath the 5.1% supplied by Treasury Yields, Ethereum has had a tough time sustaining bullish sentiment.

Given these developments, the researcher believes it’s higher to be bearish on Ethereum proper now. “Right now, we would be more comfortable holding a short position in ETH than a long one in BTC as Ethereum’s fundamentals are fragile, which is not yet reflected in ETH prices,” Thielen concludes.

ETH value fails to carry $3,100 | Supply: ETHUSD on Tradingview.com

Featured picture from Watcher Guru, chart from Tradingview.com

Disclaimer: The article is supplied for instructional functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding choices. Use info supplied on this web site fully at your personal danger.