- Bitcoin confronted a important resistance at $102,350, with sturdy assist round $96,147.

- Market sentiment remained balanced as transaction quantity declined, indicating doable short-term volatility.

Bitcoin [BTC] has lately reclaimed a important assist zone between $96,475 and $99,360, signaling potential bullish momentum.

At press time, Bitcoin’s worth was at $98,079.85, reflecting a 0.91% drop over the previous 24 hours.

Regardless of this minor decline, Bitcoin’s general momentum remained sturdy, particularly with the $102,350–$103,900 provide wall in sight. If Bitcoin breaks by this stage, we might see the subsequent part of its bullish cycle.

What does Bitcoin’s chart reveal?

The king coin’s worth chart confirmed an incoming inverted head and shoulder sample, which is commonly seen as a bullish sign. The value has consolidated between $96,147 and $102,806, forming a important resistance zone.

Bitcoin is testing this zone, and if it holds above $96,147, it might break by the $102,350–$103,900 area, pushing in direction of $104,000.

Moreover, the Relative Energy Index (RSI) was at 44.45 at press time, indicating that BTC was approaching oversold circumstances.

Thus, Bitcoin could expertise a short-term pullback or consolidation earlier than gaining sufficient energy to interrupt the $102,350 provide wall.

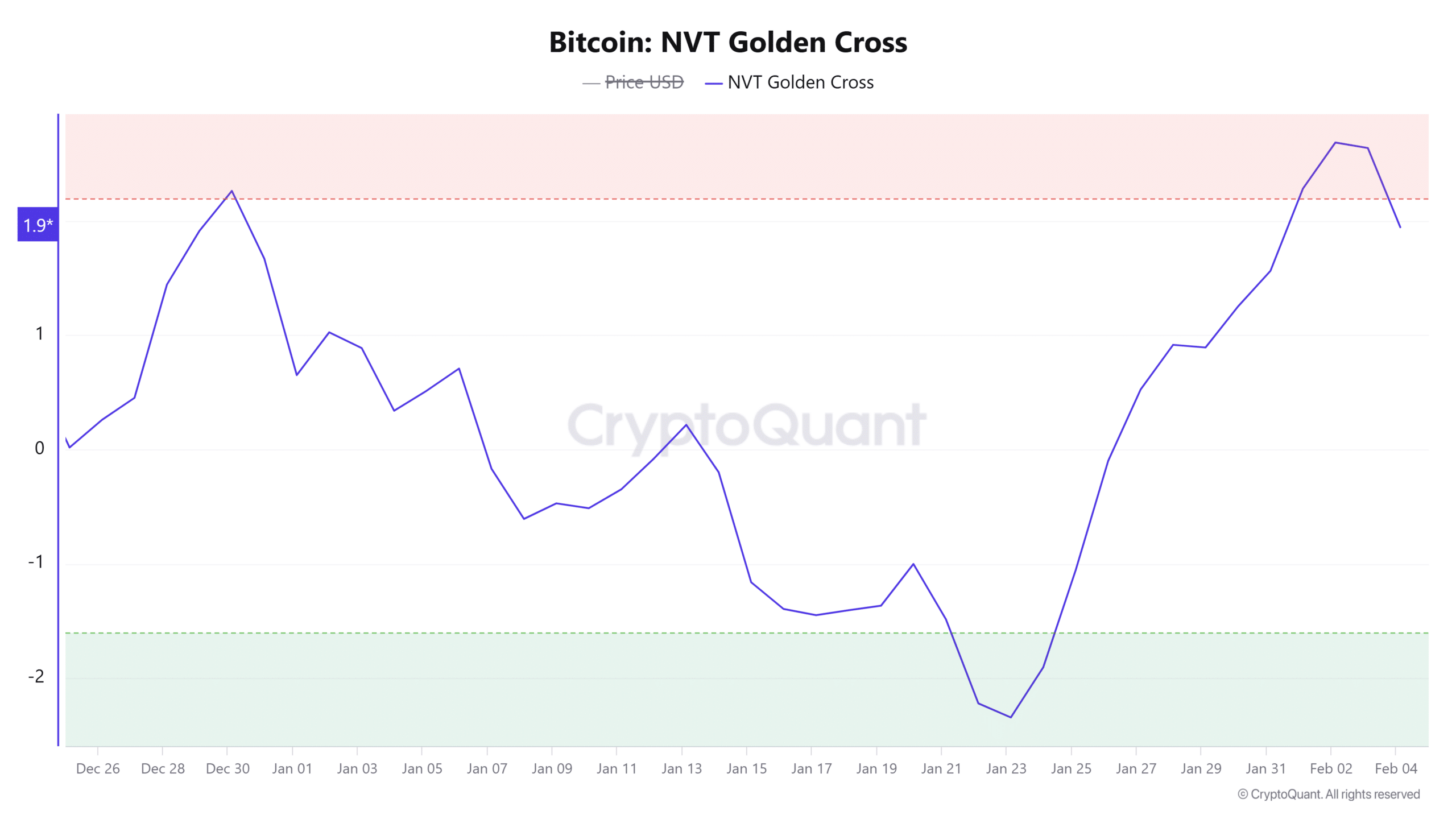

What’s the NVT Golden Cross telling us?

The NVT Golden Cross indicator, which measures Bitcoin’s community worth to transaction quantity, confirmed a 24-hour proportion change of -23.09%.

This indicated a decline in transaction quantity relative to BTC’s worth enhance, suggesting that the rally might not be absolutely supported by community exercise.

Though BTC remained bullish, the dearth of ample transaction quantity might sign that the rally could lose steam.

Subsequently, if transaction quantity doesn’t choose up quickly, Bitcoin could expertise a short pullback earlier than resuming its upward development.

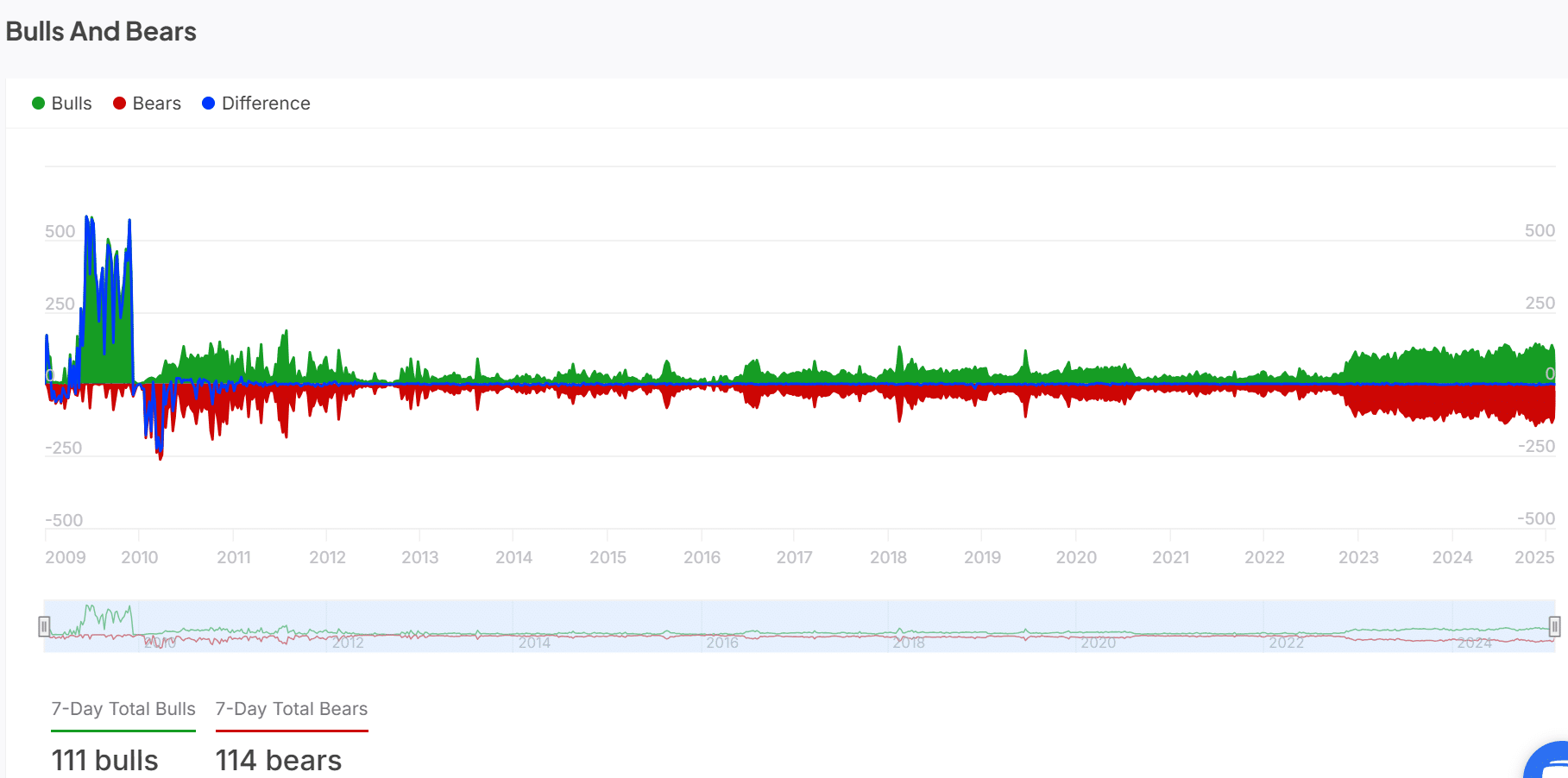

Bulls vs. bears: Who has the higher hand?

Market sentiment confirmed that bulls and bears had been in a good contest. With 111 bulls versus 114 bears prior to now week, the market sentiment stays comparatively balanced.

Regardless of some bullish outlooks, bear strain persevered, signaling that BTC might face resistance because it approaches the $102,350 provide wall.

The result of this tug-of-war between the bulls and bears will seemingly decide whether or not Bitcoin can break by this resistance and proceed climbing.

Lengthy vs. quick positions: What are merchants anticipating?

Bitcoin’s Lengthy/Brief Ratio revealed that extra merchants had been betting in opposition to additional worth will increase. At press time, 45.16% of positions had been lengthy, whereas 54.84% had been quick.

This instructed {that a} majority of merchants had been anticipating a worth pullback within the quick time period.

BTC’s volatility performs a task on this cautious stance, as many merchants are unsure in regards to the sustainability of the current worth motion.

Merchants can be watching carefully to see if the bullish momentum can overpower the quick positions.

BTC can break the $102,350 wall, however…

BTC’s current restoration, mixed with its important assist ranges and potential bullish patterns, means that the cryptocurrency will seemingly break by the $102,350–$103,900 provide wall.

Whereas some bearish sentiment stays available in the market, the general technical setup is promising.

Learn Bitcoin’s [BTC] Value Prediction 2025–2026

Nonetheless, the present lack of sturdy transaction quantity and continued resistance from the bears could lead to some volatility.

Consequently, whereas Bitcoin is poised to interrupt the provision wall, the journey could contain some fluctuations earlier than a transparent breakout.