Ethereum, much like most altcoins, is beneath vital promoting stress, struggling to shake off the weak point of early August. Regardless that there have been flashes of energy after the climactic sell-off on August 5, costs are nonetheless beneath $2,800.

The one constructive for now, no less than wanting on the day by day chart, is the spectacular bulls’ resilience. Regardless of the wave of decrease lows, patrons have soaked within the deluge of promoting stress, holding costs above the $2,500 mark.

The bearish formation, nonetheless, stays, however one analyst thinks the rejection of decrease costs beneath $2,500 is important.

Ethereum Bulls Should Hold Costs Above $2,500

In a put up on X, the analyst mentioned that bulls should maintain Ethereum above $2,500 for the uptrend to stay. The spherical quantity, value evolution within the day by day chart, marks the bottom of the bull flag.

Associated Studying

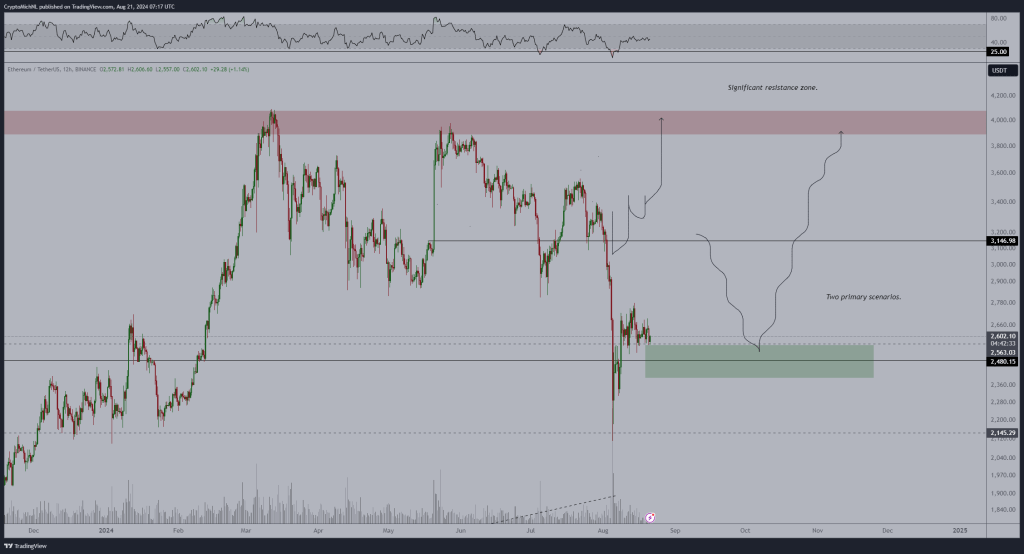

Up to now few buying and selling days because the spike on August 8, Ethereum has been trending beneath the $2,700 and $2,800 resistance zones. On the identical time, help stays clearly at $2,500. As value motion consolidates, a bull flag has fashioned, signaling energy.

In line with the analyst, if patrons maintain $2,500 as their anchor, Ethereum is about to fly, reaching $3,150 within the subsequent session. The restoration is welcomed, contemplating that the sell-off of August 1 via 5 was a bearish breakout formation. This sell-off breached the important help zones of April to July 2024.

Impression Of Spot ETFs and Ecosystem Progress

The leg up, the analyst added, would possible be pushed by influx into spot Ethereum ETFs. Since approving spot ETFs in July, establishments have been eager to search out publicity.

Taking to X, one ETF analyst notes that inflows now exceed $2 billion, excluding the outflows from Grayscale’s ETHE. Throughout this era, BlackRock’s iShares Ethereum ETF has been driving demand.

Past the influx from spot Ethereum ETFs, Vitalik Buterin thinks there was constructive progress which will prop up costs. Amongst these is the drop in gasoline charges within the mainnet and by way of layer-2 options like Base.

Associated Studying

Furthermore, the co-founder famous that decentralization efforts by Arbitrum and Optimism is huge. Arbitrum and Optimism not too long ago introduced their fault-proofs. Nonetheless, Optimism reverted to a centralized fault-proof system after an audit report, permitting flaws to be fastened.

Function picture from DALLE, chart from TradingView