- Bitcoin’s $100K breakthrough triggers file volumes and volatility in crypto buying and selling markets.

- Large liquidations and leveraged positions drive Bitcoin’s unsure retest of $100K resistance.

Bitcoin [BTC] has achieved a historic milestone, marking its first-ever each day shut above $100,000, in accordance with crypto analyst Rekt Capital.

In the meantime, the value breakthrough displays rising bullish momentum within the crypto market and has sparked discussions about Bitcoin’s subsequent potential strikes because it retests this key degree.

Risky retest at $100K resistance

Rekt Capital’s evaluation factors to ongoing volatility as Bitcoin undergoes its third consecutive retest of the $100,000 degree.

Whereas the symmetrical triangle breakout earlier in December signaled bullish continuation, the present worth motion stays unsure.

The essential zone of $99,757.85, recognized as a key resistance-turned-support space, is being carefully monitored.

If BTC fails to carry above this degree, analysts counsel it might retrace to deeper help areas reminiscent of $91,070.40 and even $87,325.43, ranges seen throughout prior consolidation phases.

Nevertheless, if the $100K retest holds, Bitcoin might set up this degree as new help, paving the best way for additional upward motion.

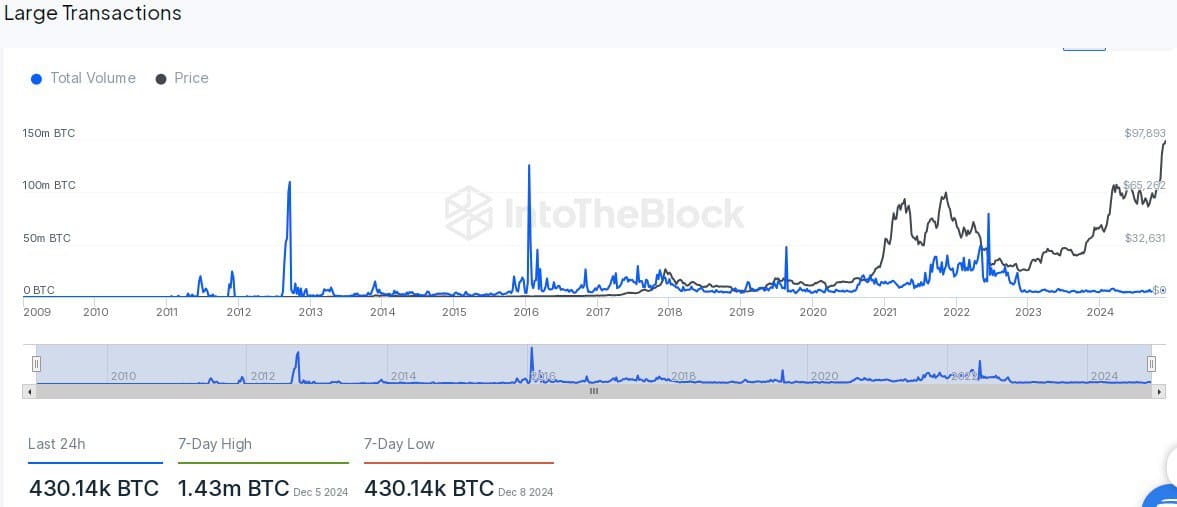

Massive transactions and market exercise tendencies

Information from IntoTheBlock reveals tendencies in Bitcoin’s giant transaction volumes, which frequently spike throughout bullish cycles.

Historic knowledge reveals that transaction peaks have aligned with main bull markets in 2013, 2017, 2021, and early 2024.

Over the previous seven days, Bitcoin noticed a notable 1.43 million BTC in transaction quantity on fifth December, 2024, which has since dropped to a 7-day low of 430,140 BTC on eighth December.

This discount suggests cooling exercise following the historic worth milestone, as institutional gamers and whales could also be ready for worth stabilization earlier than rising exercise once more.

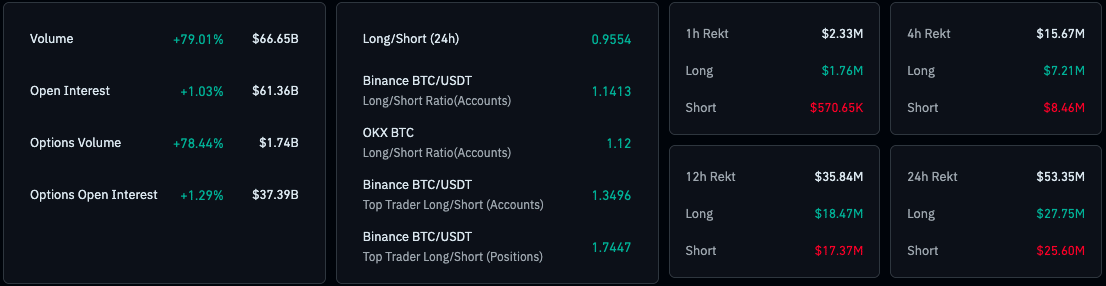

Liquidations and leverage knowledge counsel energetic volatility

CoinGlass knowledge reveals important exercise in leveraged positions as merchants navigate Bitcoin’s worth actions.

The 24-hour liquidation complete reached $53.35 million, break up between $27.75 million in longs and $25.60 million in shorts, indicating balanced strain on either side of the market.

The most important liquidations occurred prior to now 12 hours, the place lengthy positions dominated with $18.47 million liquidated.

Quick positions, nonetheless, noticed heavy liquidations over shorter timeframes, together with $8.46 million in a 4-hour interval, reflecting elevated volatility across the $100K mark.

Derivatives and buying and selling metrics

Trading metrics additionally counsel elevated market exercise. Bitcoin’s 24-hour buying and selling quantity rose by 79.01% to $66.65 billion, whereas open curiosity grew by 1.03% to $61.36 billion.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

In choices markets, quantity elevated by 78.44% to $1.74 billion, with choices open curiosity rising by 1.29% to $37.39 billion.

These figures point out heightened curiosity from merchants and traders, significantly in derivatives markets, as Bitcoin’s worth actions appeal to speculative and hedging exercise.