- Bitcoin MVRV momentum reveals a possible return to bullish territory.

- BTC has surged by 4.95% over the previous week.

Over the previous week, Bitcoin [BTC], has skilled a powerful upward momentum. The worth restoration has seen BTC reclaim increased resistance ranges thus reviving market optimism.

In actual fact, as of this writing, BTC was buying and selling at $63,062. This marked a 4.95% enhance over the previous week.

These positive aspects on weekly charts have pushed BTC to file optimistic positive aspects on month-to-month charts recovering from a month-to-month low of $52,546 by a 3.95% rise.

Undoubtedly, these latest value actions have sparked widespread dialogue amongst analysts. Certainly one of them is the favored crypto analyst Ali Martinez who has predicted an upcoming bullish run citing the MVRV momentum.

What market sentiment says

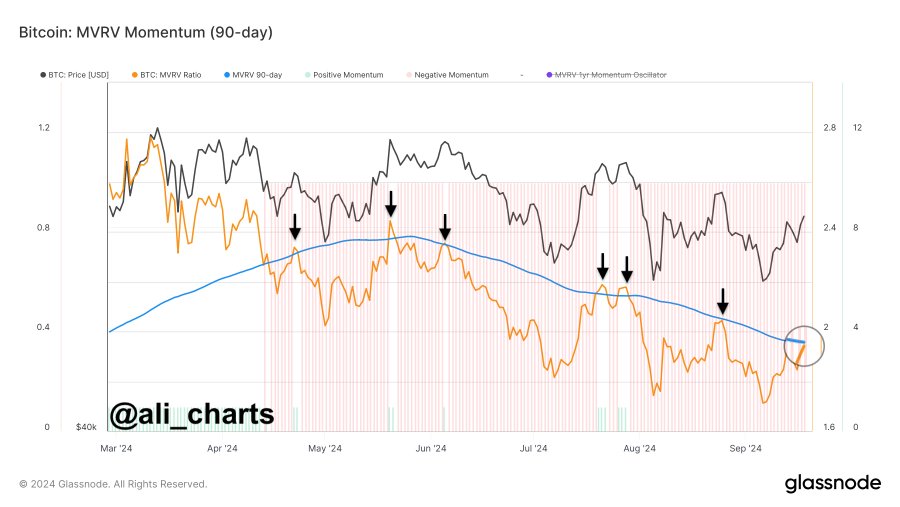

In his evaluation, Martinez cited the most recent shift of MVRV from unfavourable to bullish territory.

Supply: X

In keeping with his evaluation, MVRV shifted to unfavourable momentum in late April. Throughout this era, BTC declined from a excessive of $67,241 to an area low of $49,577 earlier than a brief restoration and one other decline.

Based mostly on this statement, after an extended interval of unfavourable momentum, now MVRV reveals a return to bullish if it manages to shut above its 90-day shifting common.

What this implies is that the downtrend is reversing, and the market may shift again to bullish with the potential for additional positive aspects.

For instance, the final time, it fell beneath its 90-day MA was mid-2023. After a restoration, costs stabilized adopted by a sustained rise.

Subsequently, with the market having utilized the shopping for alternative, BTC is well-positioned for value development.

What BTC charts counsel

As noticed by Martinez, BTC market is displaying a possible return to bullish territory after a sustained interval of decline. Thus, the present market sentiment may set Bitcoin for additional value development.

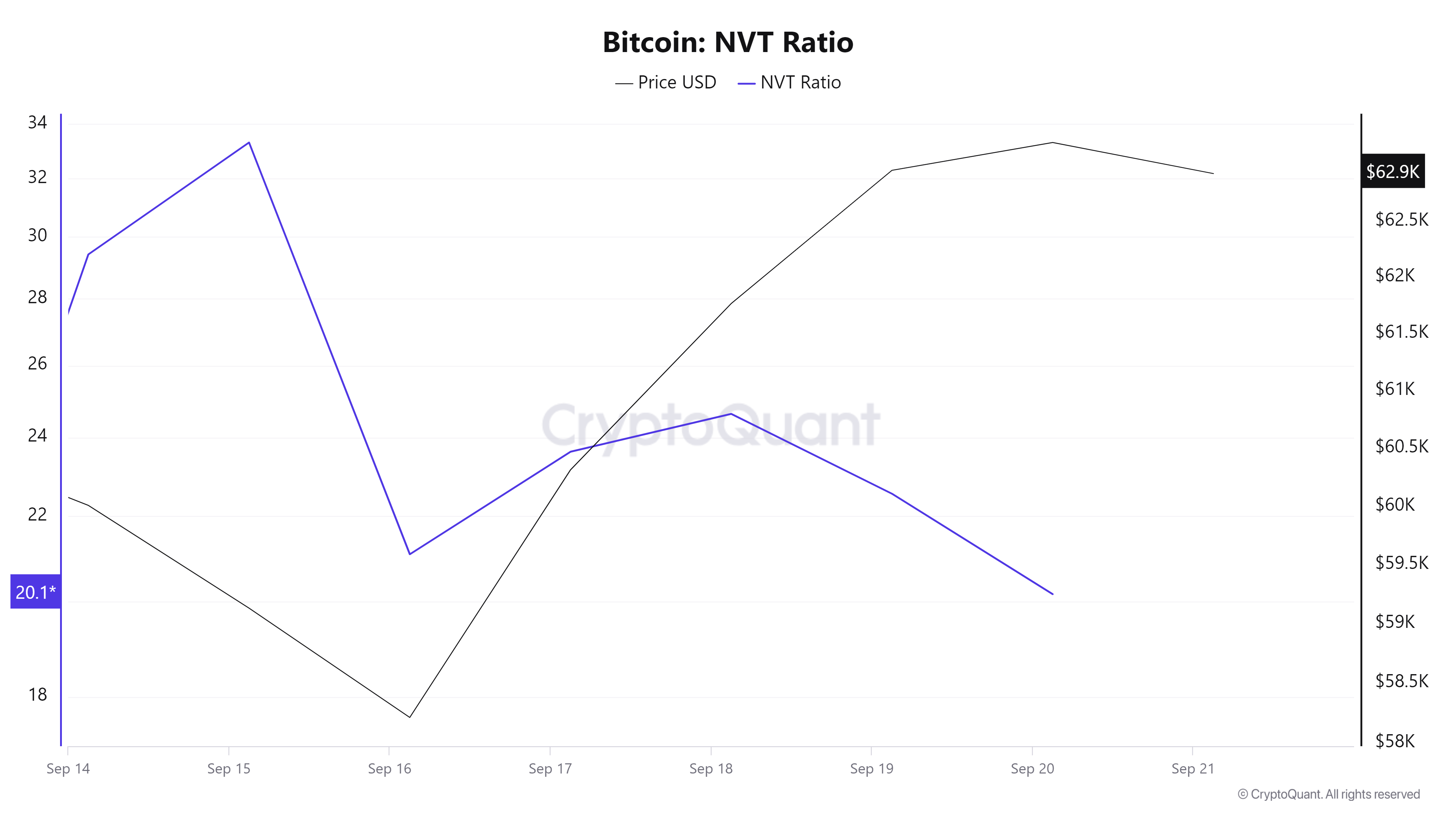

For instance, Bitcoin’s NVT ratio has declined from 33.3 to twenty.1 over the previous week suggesting that on-chain transaction quantity is rising sooner than MC.

This acts as a bullish indicator because it implies the community is getting used actively and the value is much less valued in comparison with the utility. Such a decline indicators investor’s confidence within the community’s long-term viability.

Supply: Cryptoquant

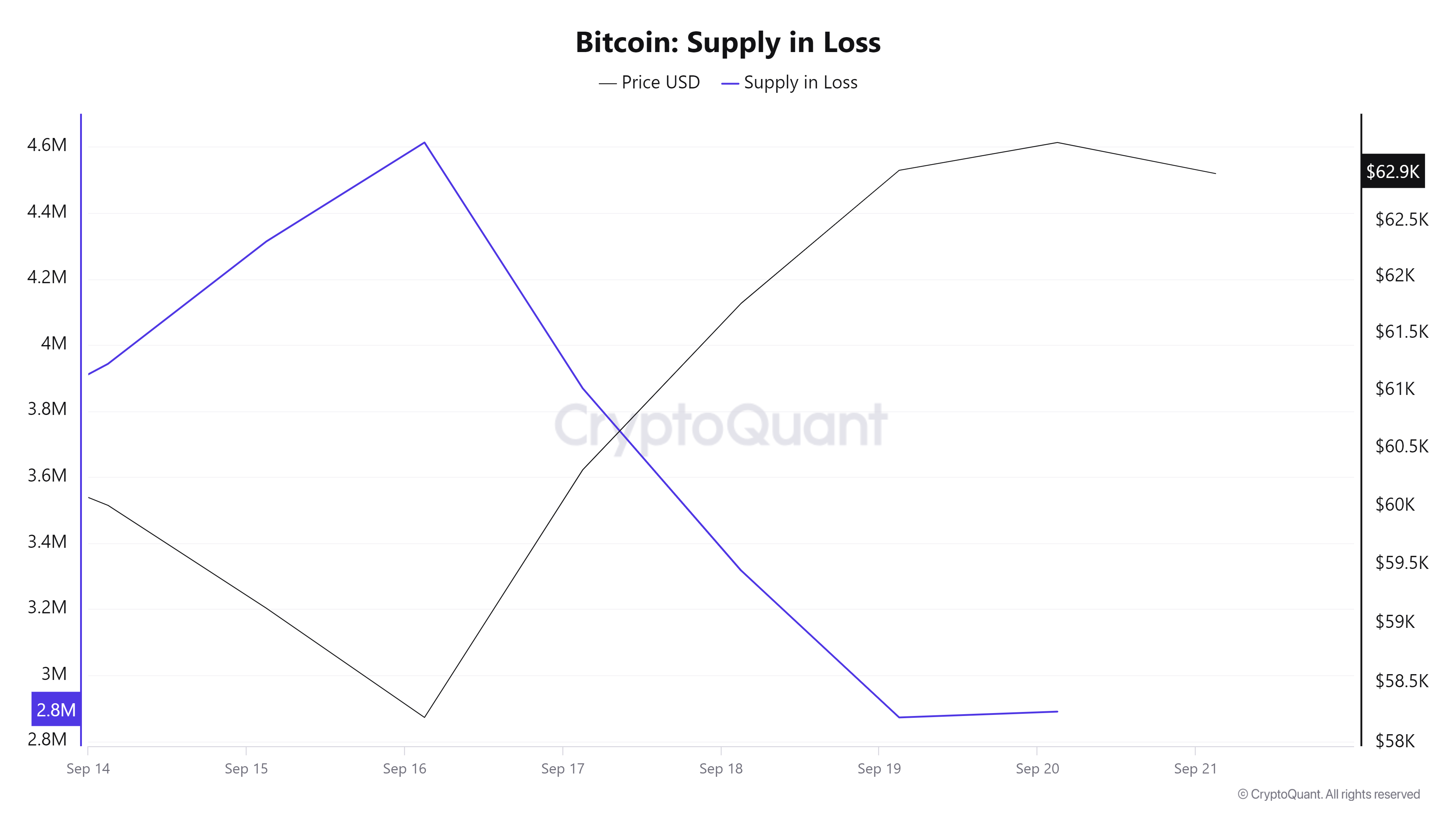

Moreover, Bitcoin’s provide in loss has declined over the previous week from 4.2 million to 2.8 million. This decline means that the BTC value is rising pushing earlier underwater property into profitability. That is one other bullish sign indicating upward momentum.

Supply: Cryptoquant

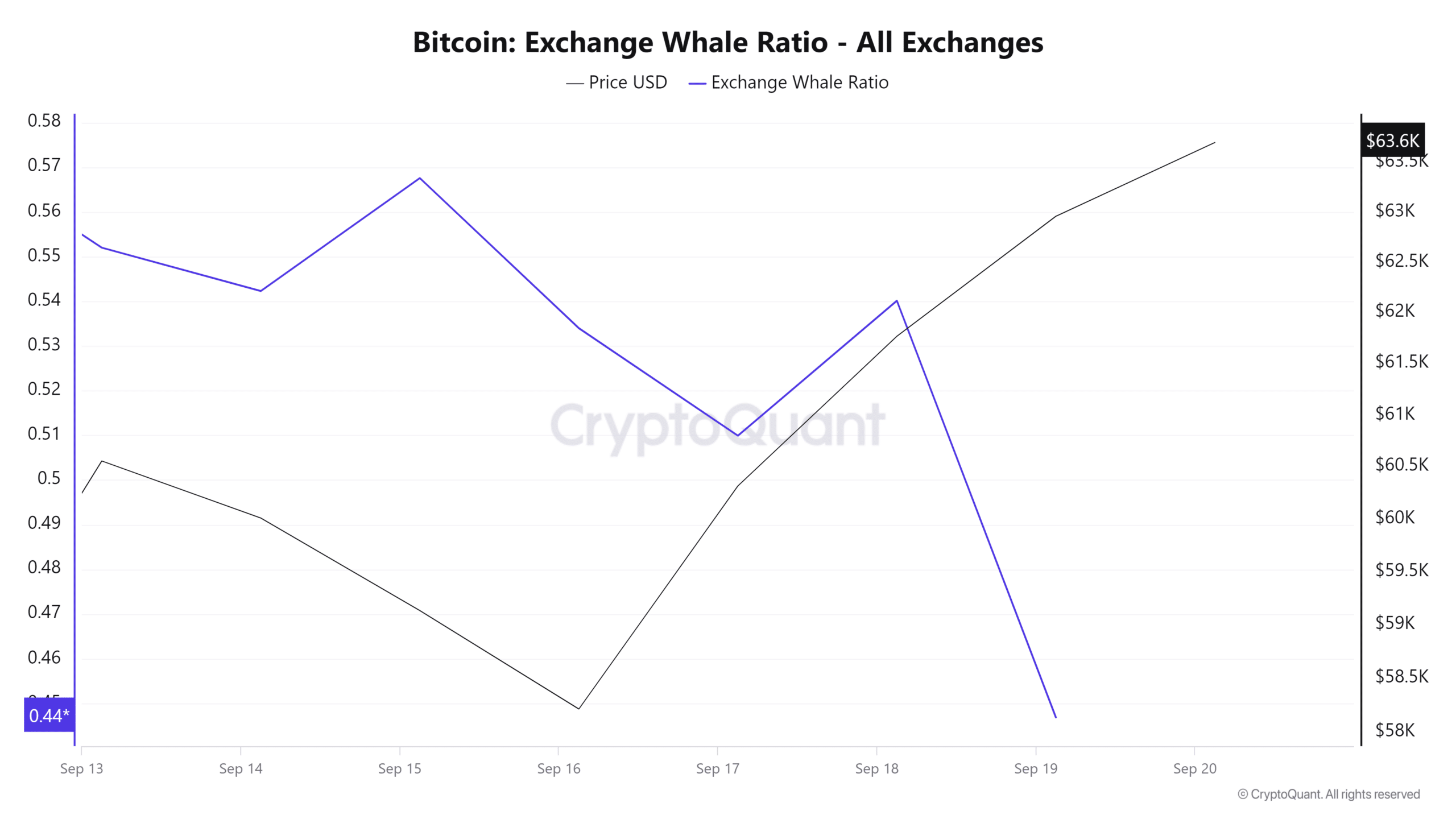

Lastly, Bitcoin’s Change provide ratio has declined over the previous week from a excessive of 0.13128 to 0.1308. This means that holders are shifting their BTC from exchanges to chilly wallets.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

This means holding conduct for long run quite than promoting. Such exercise reduces promoting stress, which is often a bullish signal.

Subsequently, as noticed, BTC is more and more having fun with increased investor favorability. If the present market sentiment holds, BTC will problem the subsequent resistance degree of $64262.