- Bitcoin’s leverage ratio climbed to a 2-year excessive, fueling fears of over-leveraging

- On the value charts, BTC appreciated by 10.21% over the previous week

The final 7 days noticed Bitcoin climb to a brand new ATH on the value charts. As anticipated, the cryptocurrency’s new ATH of $77,270 spurred vital market euphoria, with the identical leading to a rise in leverage throughout the board.

A distinct sort of ‘high’

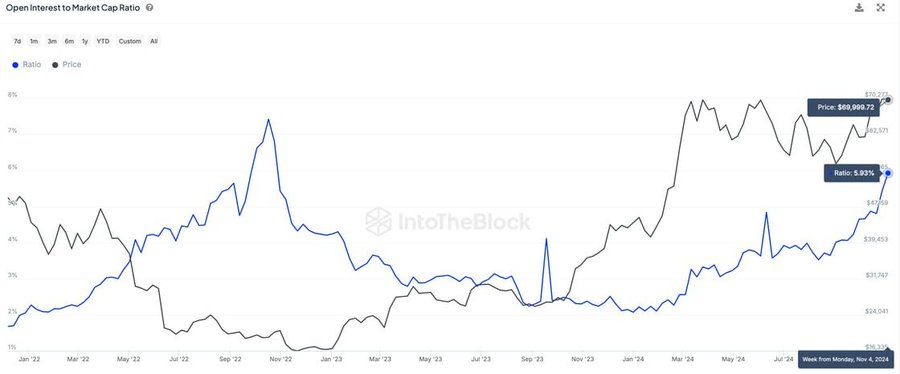

In response to an evaluation of IntoTheBlock, BTC’s leverage ratio climbed to a 2-year excessive not too long ago.

In response to the identical, the Open Curiosity in BTC perpetual swaps relative to its market cap reached ranges unseen for the reason that 2022 collapse of FTX.

Once we say that BTC’s leverage is at 2 12 months excessive, it implies that extra merchants are utilizing borrowed funds to commerce BTC than they’ve over the previous 2 years. This ratio compares the quantity of Open Curiosity to the crypto’s market cap.

A better leverage ratio is consequential as a result of it signifies that buyers are more and more assured of their bets on Bitcoin’s value motion. This often results in volatility, when leverage is excessive. In actual fact, even a small value motion can set off liquidations, thus leading to greater value swings.

Right here, it’s price noting that when the leverage ratio spiked in 2021, as a consequence of deleveraging, a market correction adopted. This primarily arises as a result of a small transfer leads to greater liquidations, cascading to an even bigger market drop.

Merely put, an increase within the leverage ratio factors to a possible market pullback in the direction of sustainable ranges.

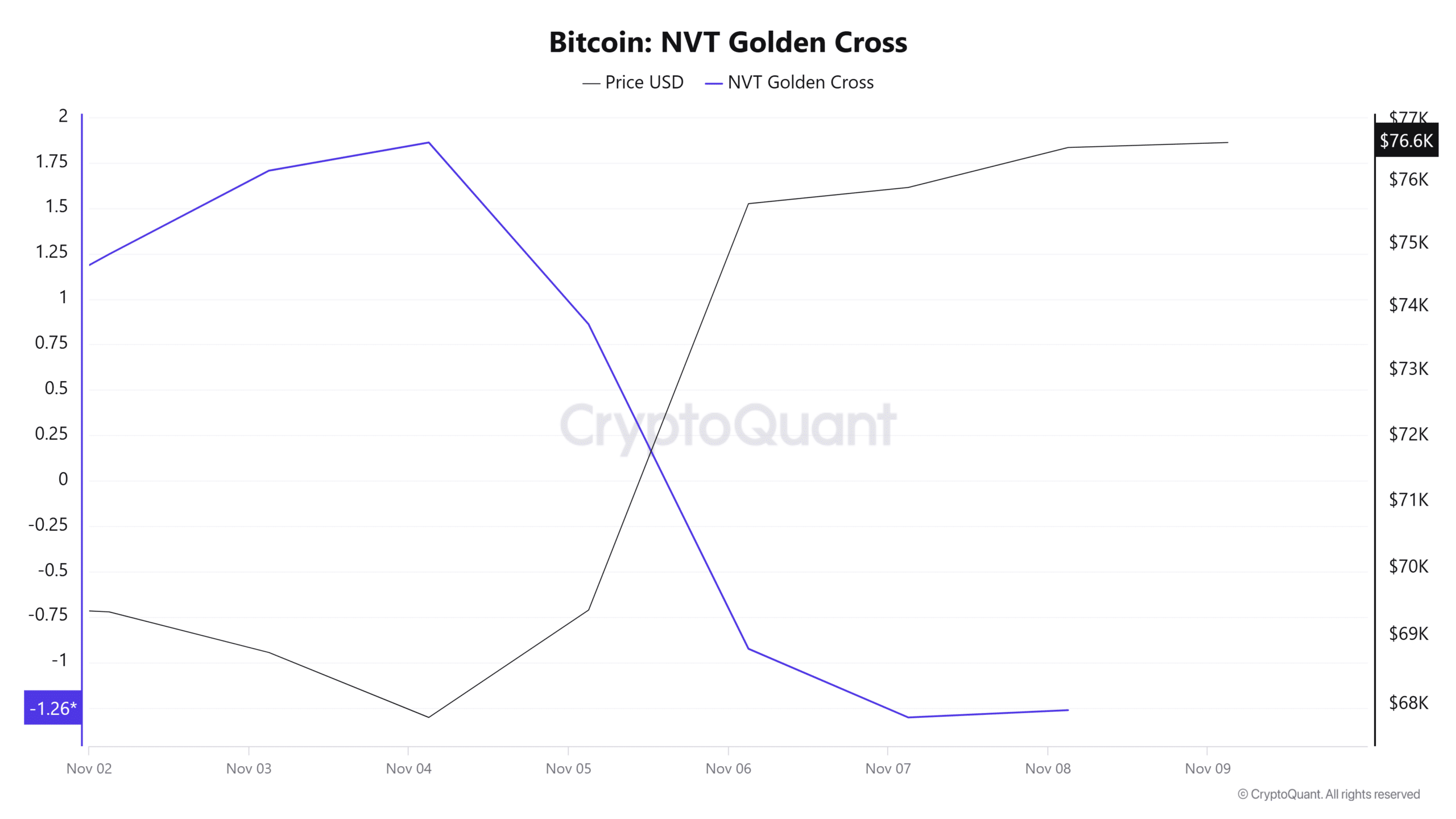

This potential unsustainability of the rally appeared to be supported by a declining NVT Golden Cross.

Whereas a golden cross is a bullish sign, a declining NVT Golden cross implies that the continuing value surge could also be pushed by speculative investments, relatively than robust utilization of the community. Thus, the asset is perhaps overvalued based mostly on community utilization.

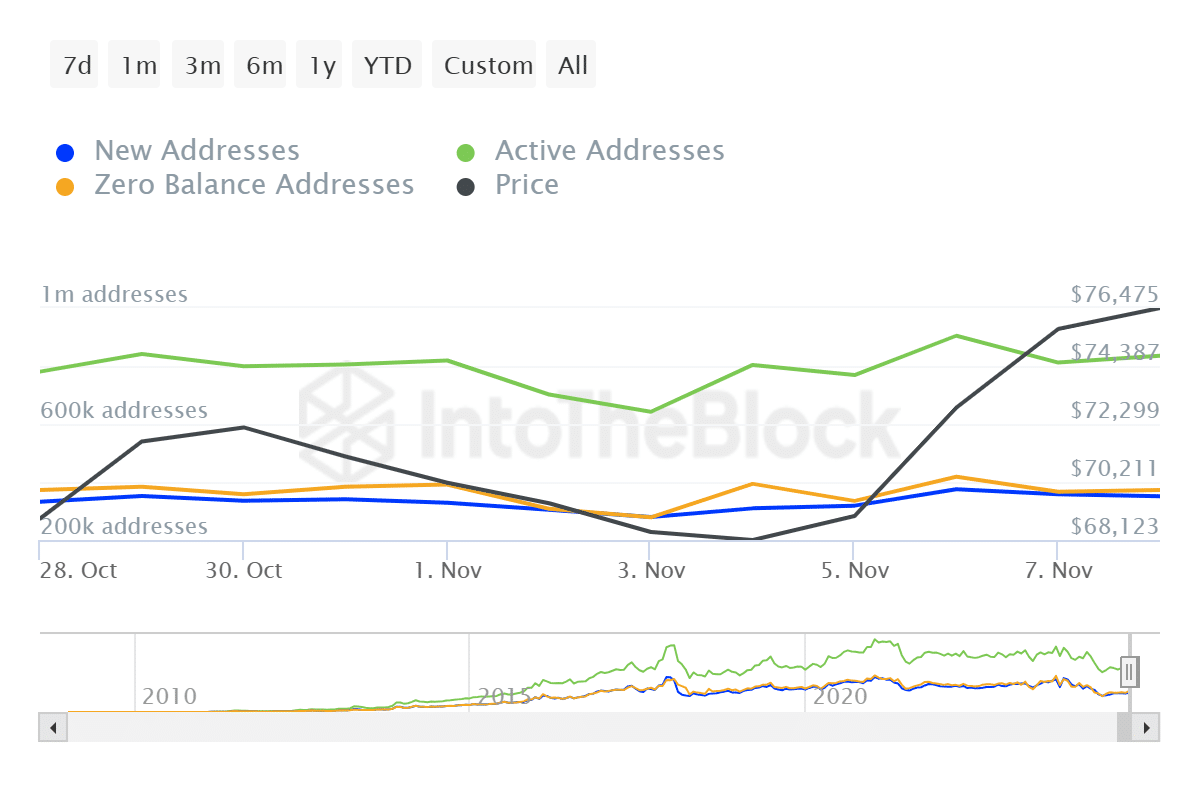

This phenomenon may be additional supported by a drop in lively addresses. As such, since peaking at 901k, lively addresses declined to 835k, based on IntoTheBlock.

A decline in lively addresses implies decrease utilization and community participation.

What it means for BTC’s value charts

Over-leveraging often makes the market extra delicate to cost adjustments.

When a big portion of the market is over-leveraged, even small value drops can set off a wave of liquidations resulting in sharp sell-offs and excessive volatility. When this occurs, Bitcoin’s value will register a pullback to seek out help at round $73,600.