- BTC has declined by 10% over the previous 30 days, but it was in declining bullish consolidation.

- An analyst eyed a brand new ATH, based mostly on earlier consolidation cycles.

Bitcoin [BTC], the biggest cryptocurrency, has skilled a pointy decline during the last weeks. Actually, at press time, the king coin was buying and selling at $57736 after recording a 9.58% decline previously week.

The month of August noticed the crypto expertise an especially unstable market. The interval noticed the crypto drop to an area low of $49k earlier than making a reasonable restoration.

Regardless of the current decline, BTC continues to be 16.6% above its current native low, consolidating in a declining but bullish pattern. Equally, it was 59.94% above the yearly low of $38505 recorded earlier this 12 months.

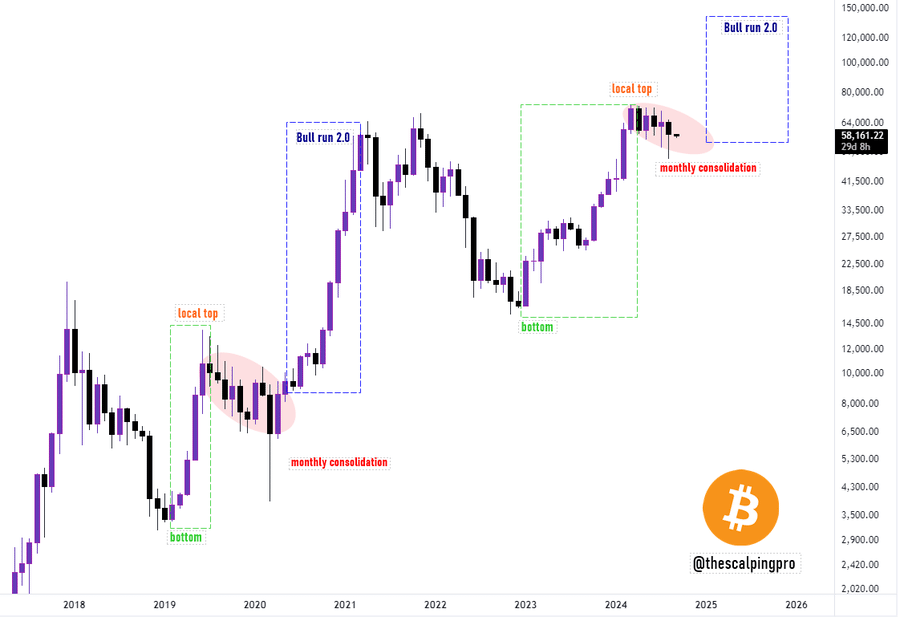

These indicators and market habits have left analysts predicting a repeat of a bull run 2.0 to a brand new document excessive. As an illustration, common crypto analysts Mags eyes a brand new document excessive, citing historic cycles.

Market sentiment

In his evaluation, Mags cited the earlier two cycles with month-to-month consolidation, leading to one other bull run.

Primarily based on the cycle analogy, after BTC hits a backside after which an area high, a interval of consolidation follows, which is later preceded by a robust bull run.

He shared his evaluation by means of X (previously Twitter), noting that,

“Bitcoin – Bull run 2.0 Incoming. The current monthly consolidation on BTC looks a lot like the previous cycle when the price surged all the way to its all-time high.”

This argument factors to the earlier bull run, which resulted from months of consolidation.

Notably, consolidation performs a vital function in stabilizing the markets. This era permits the market to soak up current worth motion, thus stopping excessive volatility.

Additionally, it helps within the discount of speculative stress since short-term merchants have a tendency to shut their positions.

With the entrants of long-term merchants, traders begin accumulating which step by step builds demand thus leading to elevated shopping for exercise.

What Bitcoin’s charts recommend

Mags believed that one other bull run was imminent for the king coin. The query is, what do different indicators present?

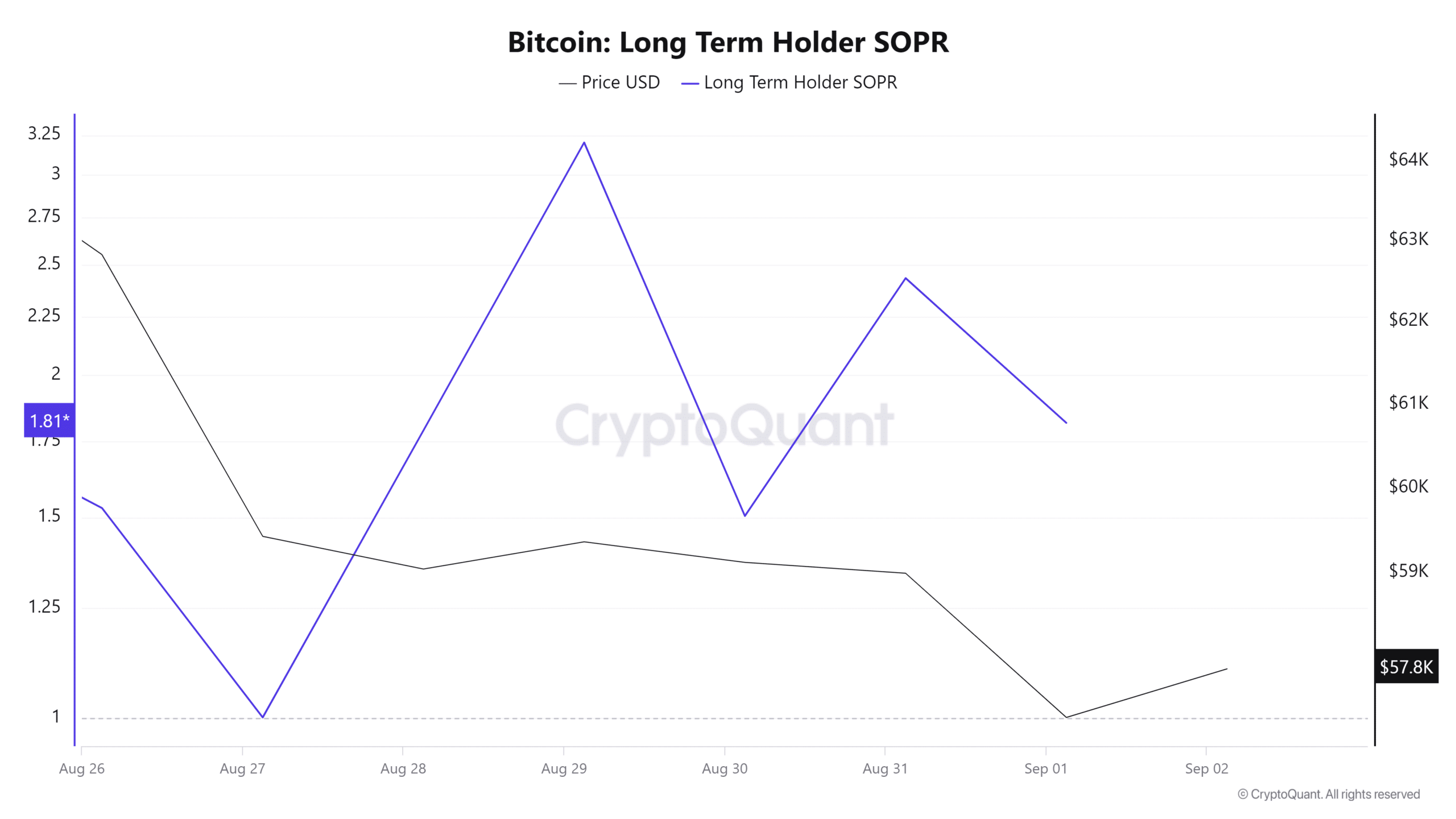

For starters, Bitcoin’s long-term holder’s SOPR has averaged round one over the previous seven days. When long-term holders’ spent output revenue ratio stays round one, it suggests crypto is bought at a value foundation.

This exhibits market consolidation, with long-term holders neither in revenue nor losses. Such a state of affairs makes long-term holders proceed holding to attend for worthwhile gross sales sooner or later.

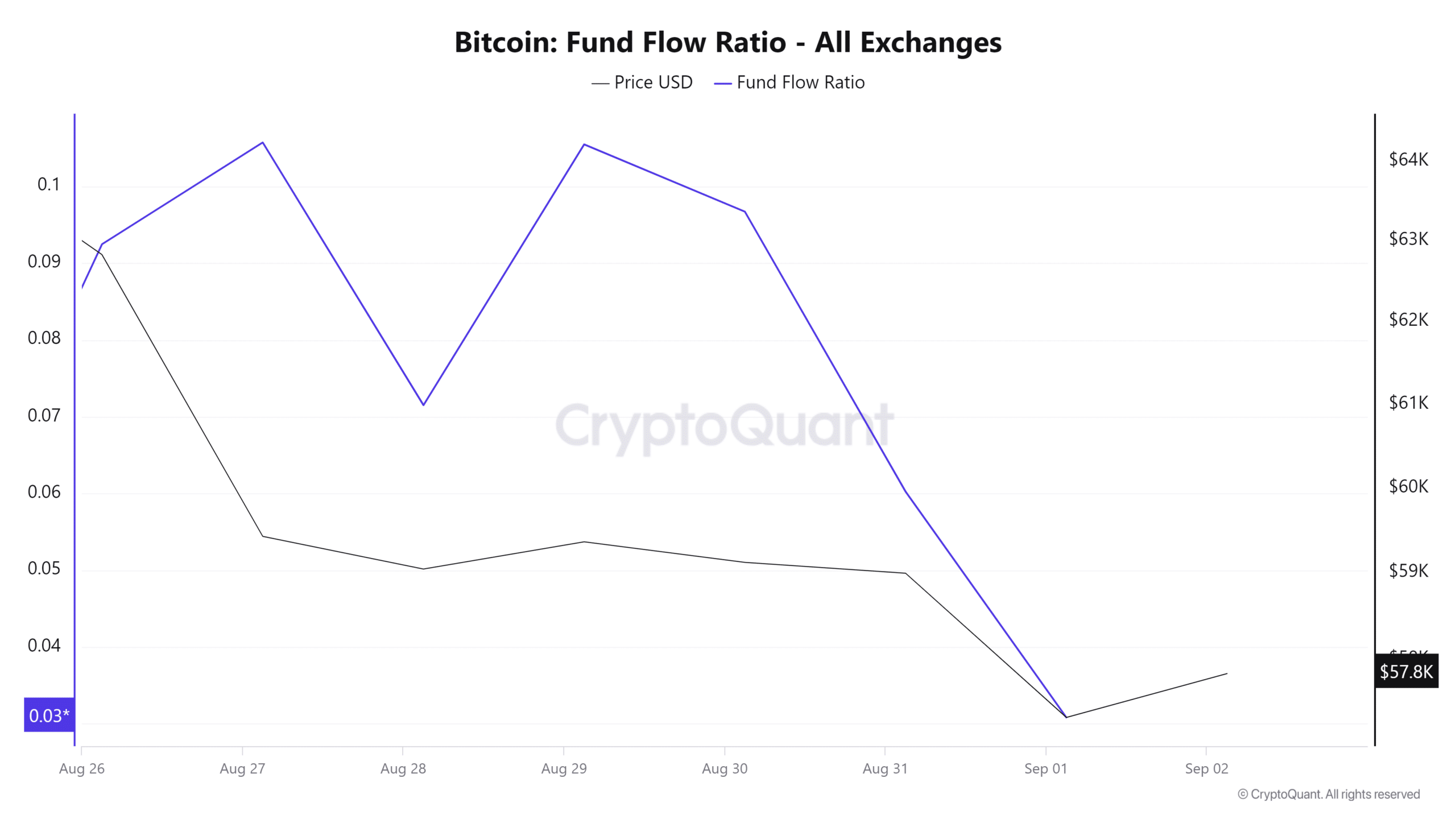

Moreover, the fund circulation ratio has been constantly beneath 1 over the previous seven days. Which means extra BTC has been withdrawn from exchanges, moderately than being deposited.

It is a bullish sign, indicating traders are transferring their crypto off exchanges for long-term holding, thus decreasing provide out there for instant promote.

Such strikes cut back promoting stress and improve demand, which in flip helps in pattern reversal.

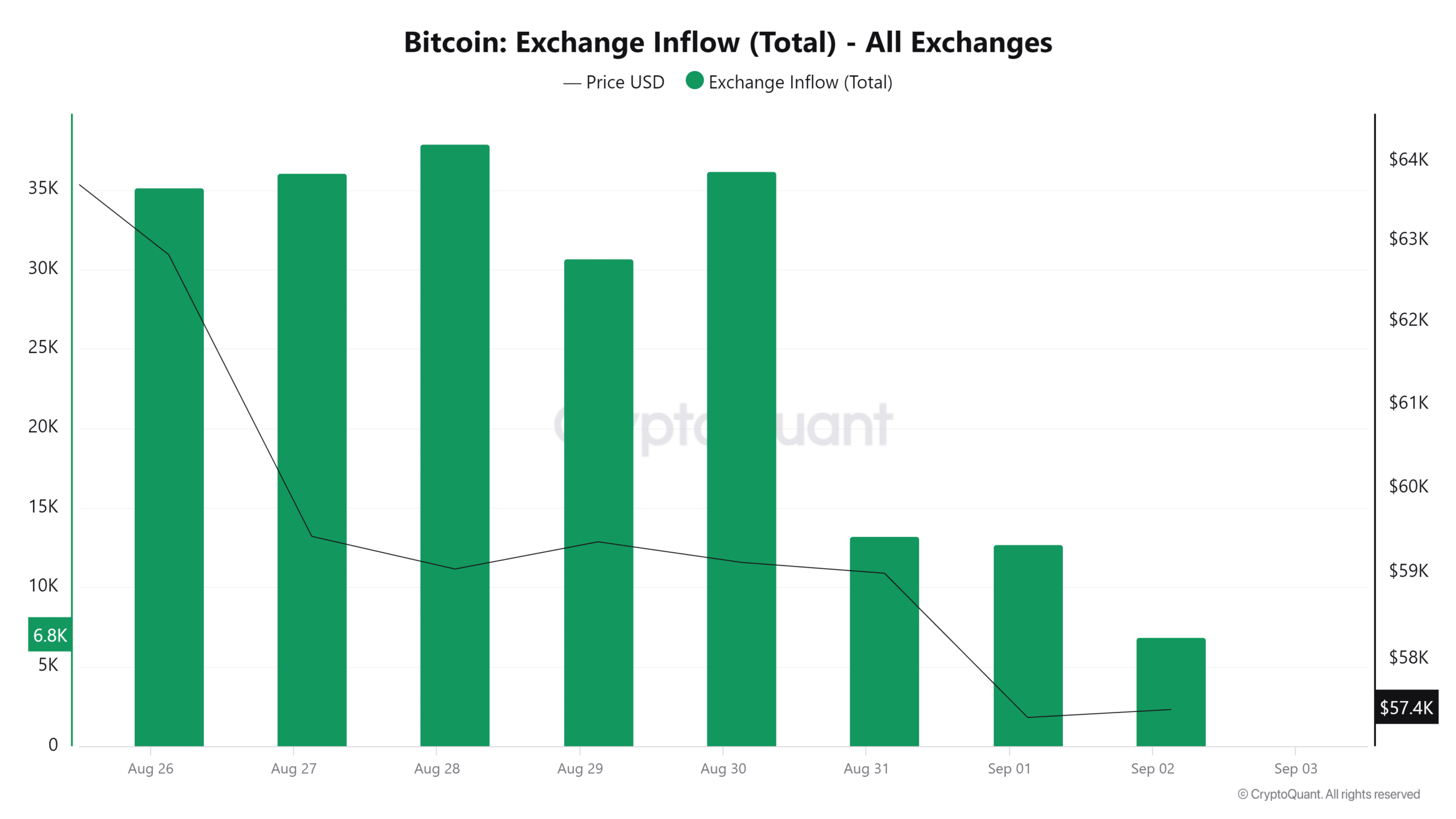

Lastly, BTC alternate influx has diminished over the previous three days, from a weekly excessive of 37899.7 to a low of 6869. Such a decline in alternate influx signifies holding habits, as traders anticipate greater costs.

This market sentiment reduces promoting exercise, which is bullish as fewer cash are available for commerce.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

Though BTC has declined over the previous 30 days, it’s in declining however a bullish consolidation. With elevated market indecision, traders are turning to carry, thus decreasing provide.

Such accumulation habits results in diminished provide and a rise in demand, which permits bulls to reclaim the markets. It will result in BTC breaking out above the $61159 resistance stage, probably in direction of $70k.