- BTC fell by 6.31% over the previous week.

- An analyst famous additional draw back, citing the Pi Cycle MA.

Whereas October is normally related to an uptrend, Bitcoin’s [BTC] latest worth motion has didn’t mirror it. As such, BTC has skilled a pointy decline over the previous week. The truth is, at press time, Bitcoin was buying and selling at $61,436.

This marked a 6.31% decline in weekly charts.

Nevertheless, the previous 24 hours noticed a slight restoration on BTC worth charts, rising by 0.92%. Additionally, on month-to-month charts, Bitcoin has been in an uptrend, climbing by 8.18%.

Subsequently, the shortage of clear route with worth motion has left the crypto group speaking. One in all them is the favored crypto analyst Rekt Capital, who steered that BTC is about for an additional downtrend.

A have a look at the market sentiment

In his evaluation, Rekt Capital posited that BTC is regularly dealing with rejection from the PI Cycle MA.

In response to this evaluation, so long as PI Cycle MA is performing because the resistance, BTC will proceed to type a downtrend. Thus, BTC will affirm the downtrend if it tags the sunshine blue downtrend, particularly if the present development persists.

Nevertheless, the analyst additionally famous that patrons are beginning to accumulate at the same time as the value continues to say no. This was demonstrated by the truth that BTC is beginning to type a 4-hour bullish divergence.

In context, repeated rejections from this stage point out that patrons are struggling to push the costs above the resistance.

Subsequently, each rejection provides to bearish strain, highlighting that Bitcoin is at the moment dealing with a provide barrier, thus halting its momentum.

Thus, based mostly on this instance, BTC is about to expertise additional decline on its worth charts if the present market sentiment persists.

What do BTC charts counsel?

Notably, the evaluation above offers an in depth bearish outlook for Bitcoin. Nevertheless, it’s important to find out what different market indicators say.

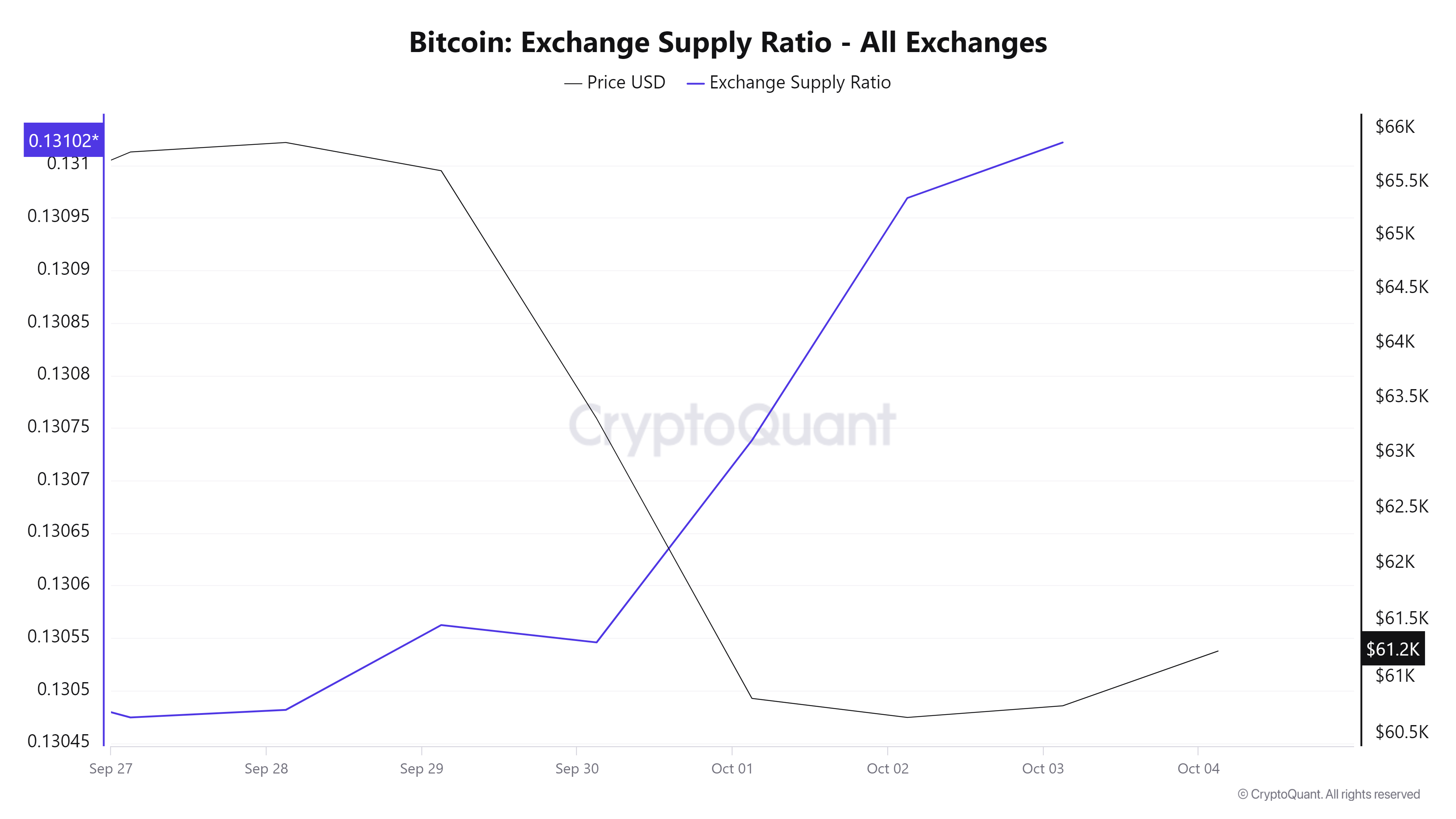

Firstly, Bitcoin’s trade provide ratio has spiked over the previous couple of days, climbing from 0.1304 to 0.131.

The spike in trade provide implies that traders are depositing their belongings into exchanges to promote. Such market habits causes downward worth strain, particularly if promoting actions intensify.

Supply: Santiment

Moreover, Bitcoin’s MVRV Lengthy/Brief distinction has been declining over the previous 7 days, dropping from a excessive of 4.3% to three.2%.

This decline alerts weaker confidence amongst long-term holders as their profitability margins decline. The shift suggests bearish sentiment as long-term holders are much less incentivized to carry their positions.

Supply: Santiment

Additional, this insecurity amongst traders is illustrated by a declining Open Curiosity(OI) per trade. OI has dipped from $6.1 billion to $5.2 billion. Such a decline means that traders are closing their positions with out opening new ones.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

Merely put, the present market sentiment is bearish.

Subsequently, if these situations maintain, Bitcoin will discover the subsequent assist across the $58272 resistance stage. Subsequently, a development reversal will see BTC reclaim $62700.