- BlackRock’s IBIT spot Bitcoin ETF noticed report inflows, marking sturdy investor curiosity.

- Bitcoin ETF’s demand hinted on the asset surpassing Satoshi Nakamoto’s holdings, signaling institutional confidence.

Since its debut, spot Bitcoin [BTC] Trade-Traded Funds (ETFs) have attracted widespread curiosity, though success has diverse amongst suppliers.

Whereas BlackRock’s IBIT noticed spectacular inflows surpassing $25 billion since its launch on the eleventh of January, Grayscale’s GBTC, conversely, recorded a big $20 billion in whole outflows.

Blackrock’s Bitcoin ETF breaks report

BlackRock’s spot BTC ETF (IBIT) noticed a significant milestone, recording its largest single-day influx since January.

Knowledge from Farside Buyers revealed that on the thirtieth of October, amid a crypto market rally, IBIT pulled in $875 million. IBIT has now surpassed its earlier report influx of $849 million, set on March twelfth.

This current surge marked IBIT’s thirteenth consecutive day of inflows. IBIT gathered round $4.08 billion throughout this era.

In distinction, Ethereum ETFs confronted challenges, with solely $4.4 million in inflows on the identical day and BlackRock’s ETHA recorded no new investments throughout the identical interval.

How did Bitcoin ETFs assist Bitcoin?

Hypothesis amongst merchants suggests {that a} billion-dollar influx day could be on the horizon, underscoring rising market confidence in BlackRock’s Bitcoin ETF as investor demand continues to speed up.

This coincided with Bitcoin just lately surging to a powerful $72,247.96, reflecting a robust 7.3% weekly improve.

Nevertheless, in response to CoinMarketCap’s newest replace, BTC has seen a minor 0.17% dip over the previous 24 hours.

The current rise in BTC ETF inflows highlighted that institutional and retail traders are more and more investing in Bitcoin via these funds, signaling heightened market confidence and demand for BTC.

This development factors to a optimistic outlook for Bitcoin. Many speculate that continued inflows may additional help upward worth momentum.

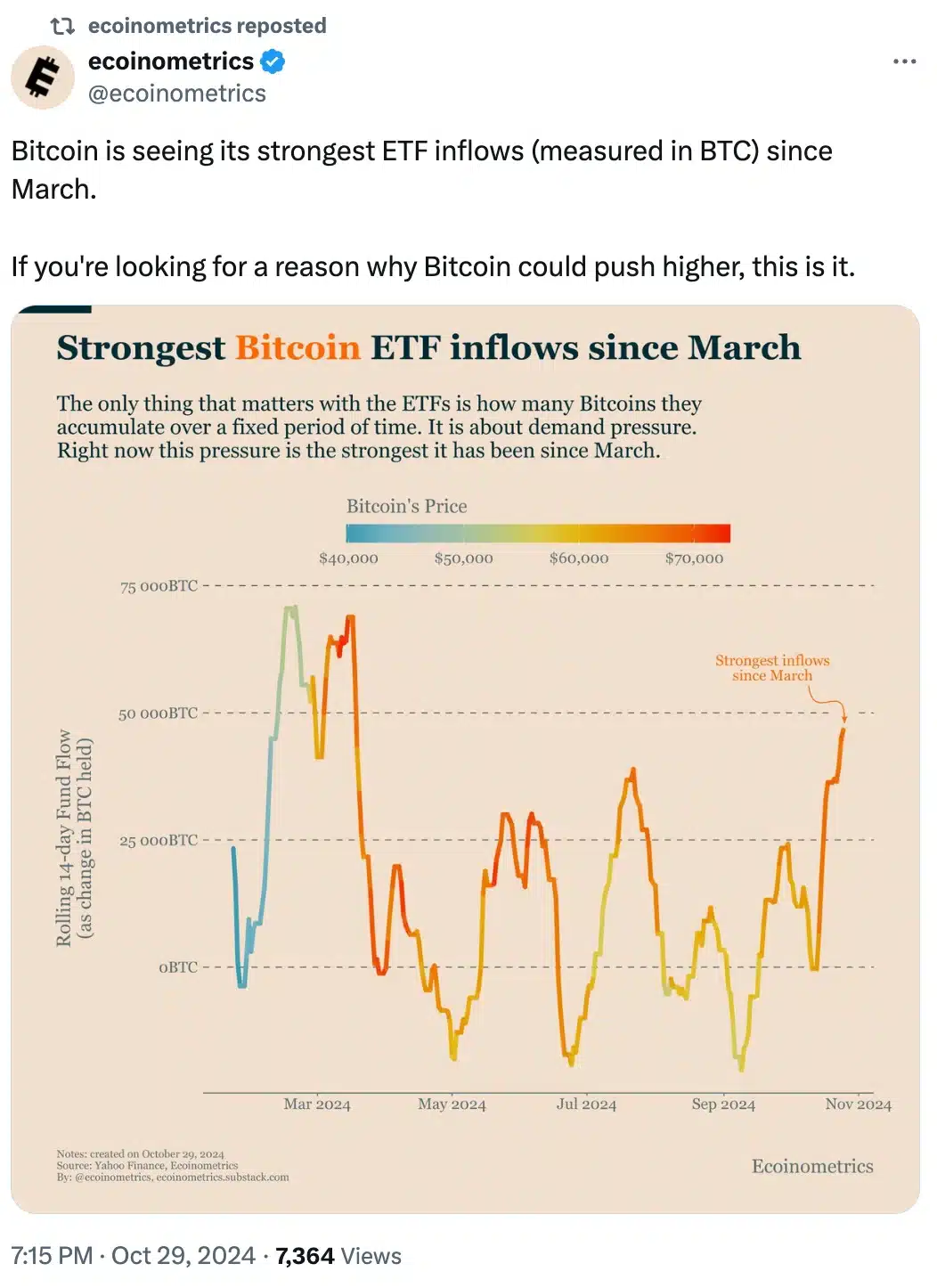

Remarking on the identical, ecoinometrics famous,

Will Blackrock’s Bitcoin ETF surpass Satoshi’s holdings?

With inflows hovering, hypothesis is rising that U.S. spot Bitcoin ETFs may exceed Satoshi Nakamoto’s BTC holdings.

Bloomberg’s Senior ETF Analyst, Eric Balchunas, acknowledged this risk, highlighting the ETF inflows as important for Bitcoin’s rising institutional traction.

As extra traders purchase into these funds, BTC possession may change considerably. ETF holdings may surpass these of Bitcoin’s mysterious creator.