- Bitcoin’s Open Curiosity soared whereas its provide on exchanges dropped sharply

- A worth correction might push BTC right down to $66k and even $62k

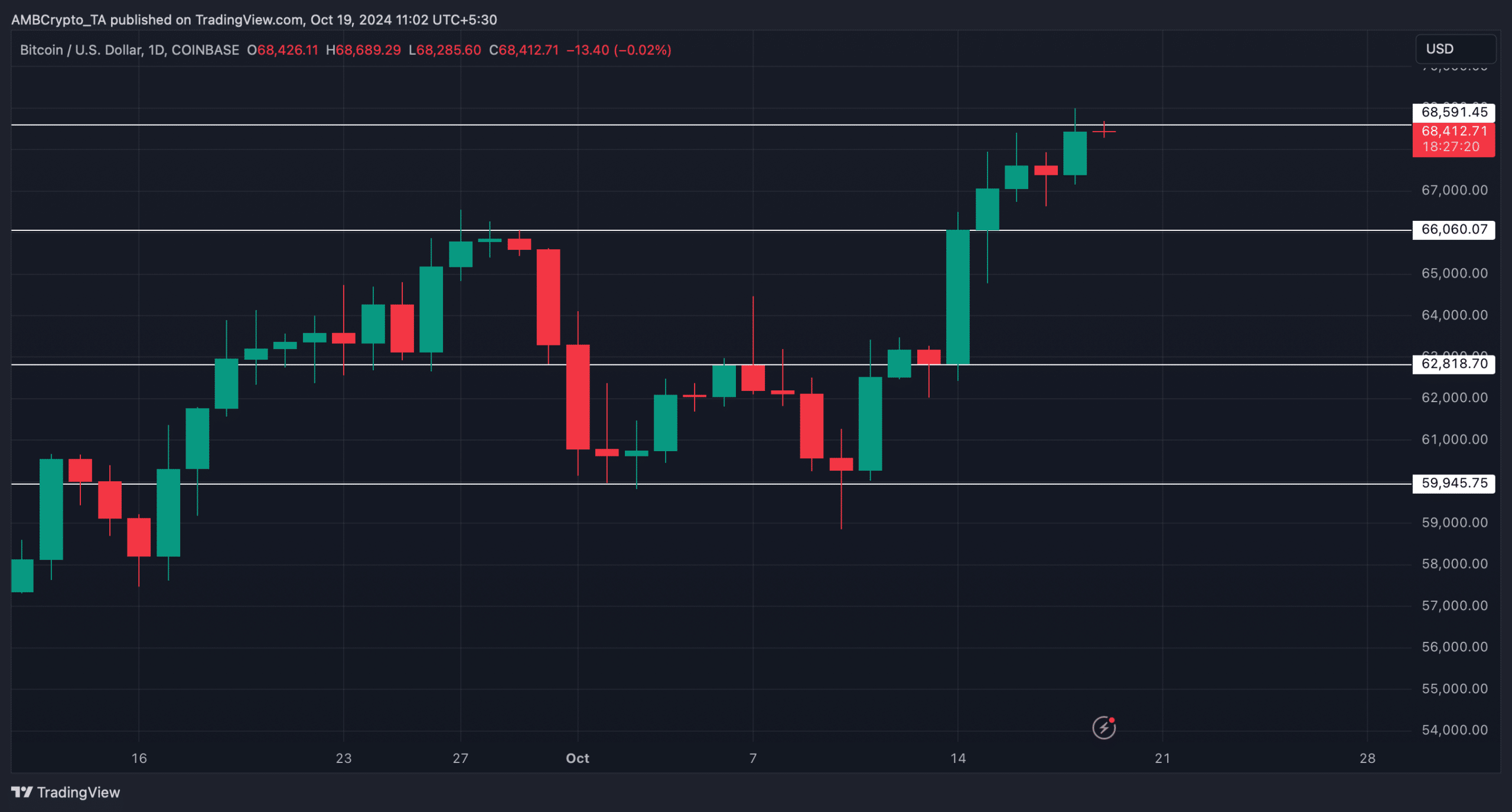

Bitcoin [BTC] has been on regular hike over the previous week. In reality, its newest bull pattern allowed the king coin to cross $68k on the value charts. Nevertheless, the prevailing pattern may change quickly, albeit for a short time.

This appeared to be the case, particularly as a bearish divergence appeared on Bitcoin’s worth chart.

Bitcoin’s main strengths

In response to CoinMarketCap, the crypto’s worth appreciated by over 9% final week, permitting it to leap above $68k. AMBCrypto reported beforehand a number of developments that would have performed a serious function in BTC’s most-recent rally.

For example, Bitcoin’s provide held on exchanges dropped to a 5-year low. This clearly meant that purchasing sentiment was dominant available in the market – Hinting at a worth hike.

Aside from that, AMBCrypto additionally reported how BTC’s Open Curiosity soared. To be exact, Bitcoin’s Open Curiosity hit a report $20 billion, simply 8% under its ATH. Every time the metric rises, it signifies that the probabilities of the continued worth pattern persevering with are excessive.

Satoshi Membership, a well-liked X deal with that shares updates associated to cryptos, lately posted a tweet highlighting one more main growth. In response to the identical, BTC’s provide held by addresses that purchased within the final 12 months is now at a 2-year excessive. This pattern has accelerated lately on the again of ETFs seeing inflows of $2.1 billion over the past 5 days.

Nonetheless, not all the pieces has been working within the king coin’s favor. Ali, a well-liked crypto analyst, shared a tweet, mentioning a bearish divergence. This indicated that there have been probabilities of a short-term worth correction right here. Therefore, it’s value taking a more in-depth take a look at the present state of Bitcoin.

Is a worth correction inevitable?

AMBCrypto’s evaluation of CryptoQuant’s knowledge revealed fairly a number of attention-grabbing metrics. For example, the king coin’s binary CDD was inexperienced, that means that long-term holders’ motion within the final 7 days was decrease than the typical. They’ve a motive to carry their cash.

Nevertheless, the aSORP urged that extra buyers have been promoting at a revenue. In the midst of a bull market, it may point out a market high.

Furthermore, the NULP was additionally bearish, because it indicated that buyers have been in a perception section the place they have been in a state of excessive unrealized income.

Lastly, we then took a take a look at Bitcoin’s every day chart to search out the potential assist the coin may drop to in case of a worth correction.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

In response to our evaluation, a worth correction may lead to BTC as soon as once more dropping to $66k. A slip underneath that degree might push the coin additional right down to $62.8k.