- Bitcoin cleared its March excessive, pushing it in direction of a brand new ATH on the charts

- Metrics instructed the crypto might probably go as excessive as $80k

Bitcoin [BTC] is within the information right now after it briefly hit a brand new all-time excessive (ATH) of over $75,116 on Election Night time in the USA. Regardless of some depreciation, on the time of writing, the cryptocurrency was nonetheless buying and selling slightly below the aforementioned degree, with a price of $74,791.

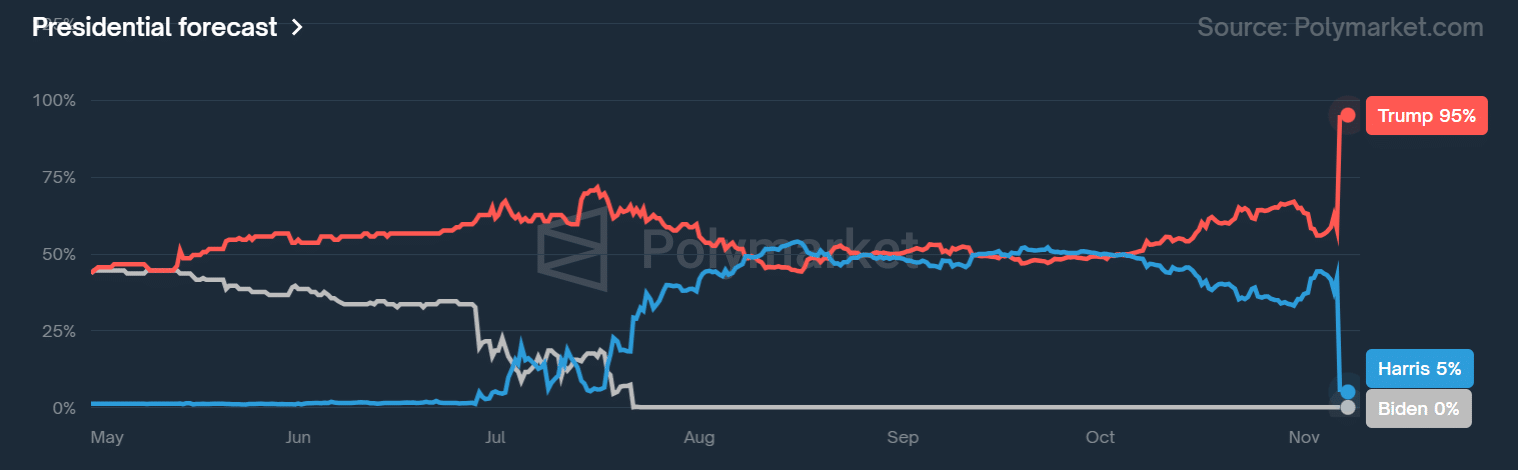

That’s not all although because the odds of a possible Donald Trump win surged above 90% on Polymarket. This confirmed a few of the election targets AMBCrypto projected primarily based on the U.S election’s final result.

On the again of those preliminary outcomes, the development appeared to level to a possible bullish final result for the markets, ought to Trump be declared the official winner.

Nonetheless, with BTC above $70k now, is it too costly to bid at these ranges, or can latecomers nonetheless profit? Let’s discover key valuation metrics and community statistics for some solutions.

What’s subsequent after BTC’s new ATH?

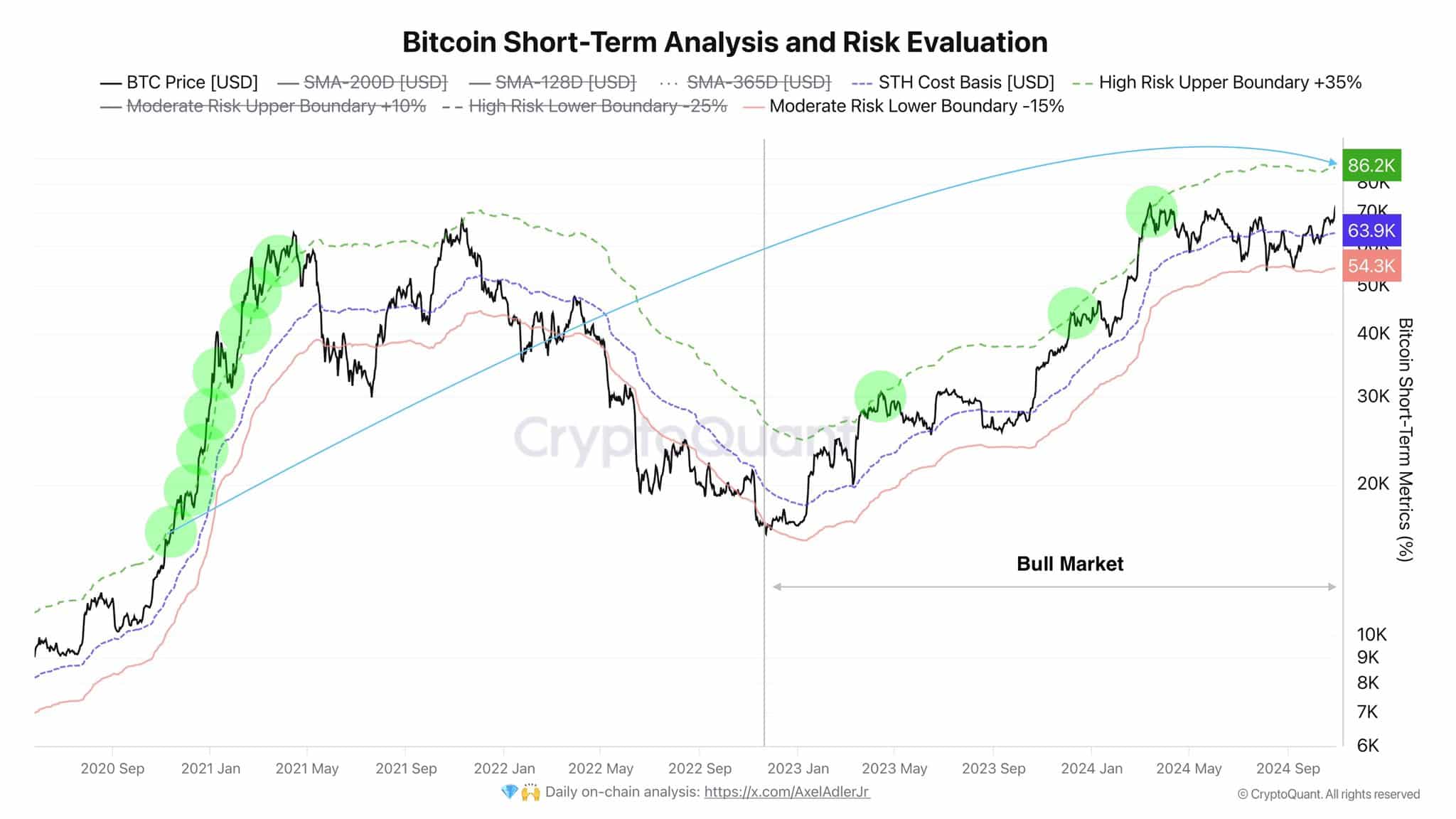

Based mostly on Bitcoin’s short-term threat analysis, CryptoQuant analyst Axel Adler not too long ago projected that $86k might be the following goal. He mentioned,

“At the $86.2K level, the fate of the bull run will be decided. If the price breaks above this point and forms a strong bullish momentum, we’ll finally see what everyone has been waiting for.”

In 2020, BTC noticed a parabolic rally when it broke above the high-risk higher boundary. This might be the important thing degree to observe and break in 2024.

Big room for an additional BTC rally

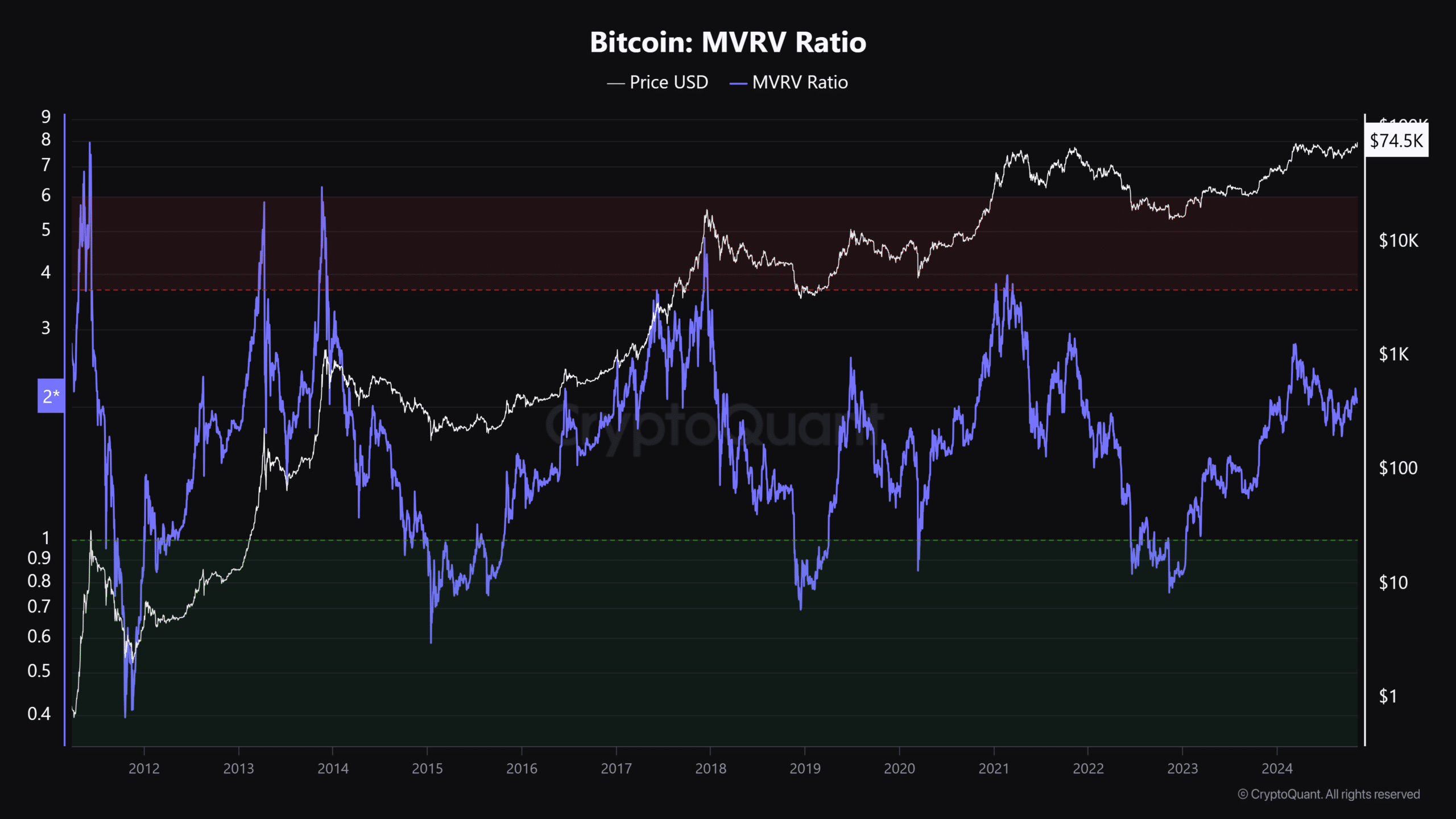

One other valuation metric, the MVRV (market worth to realized worth) ratio, additionally signalled an enormous progress potential. MVRV tracks whether or not BTC is reasonable (undervalued) or too costly (overvalued).

Regardless of its new ATH, BTC was nonetheless low-cost as per the MVRV, standing at 2. This appeared to reflect the 2017/2020 patterns, simply earlier than its explosive runs. Normally, an MVRV ratio of 4 (pink) is taken into account overheated or overvalued, whereas 1 and under is deemed low-cost.

Learn Bitcoin [BTC] Worth Prediction 2024-2025

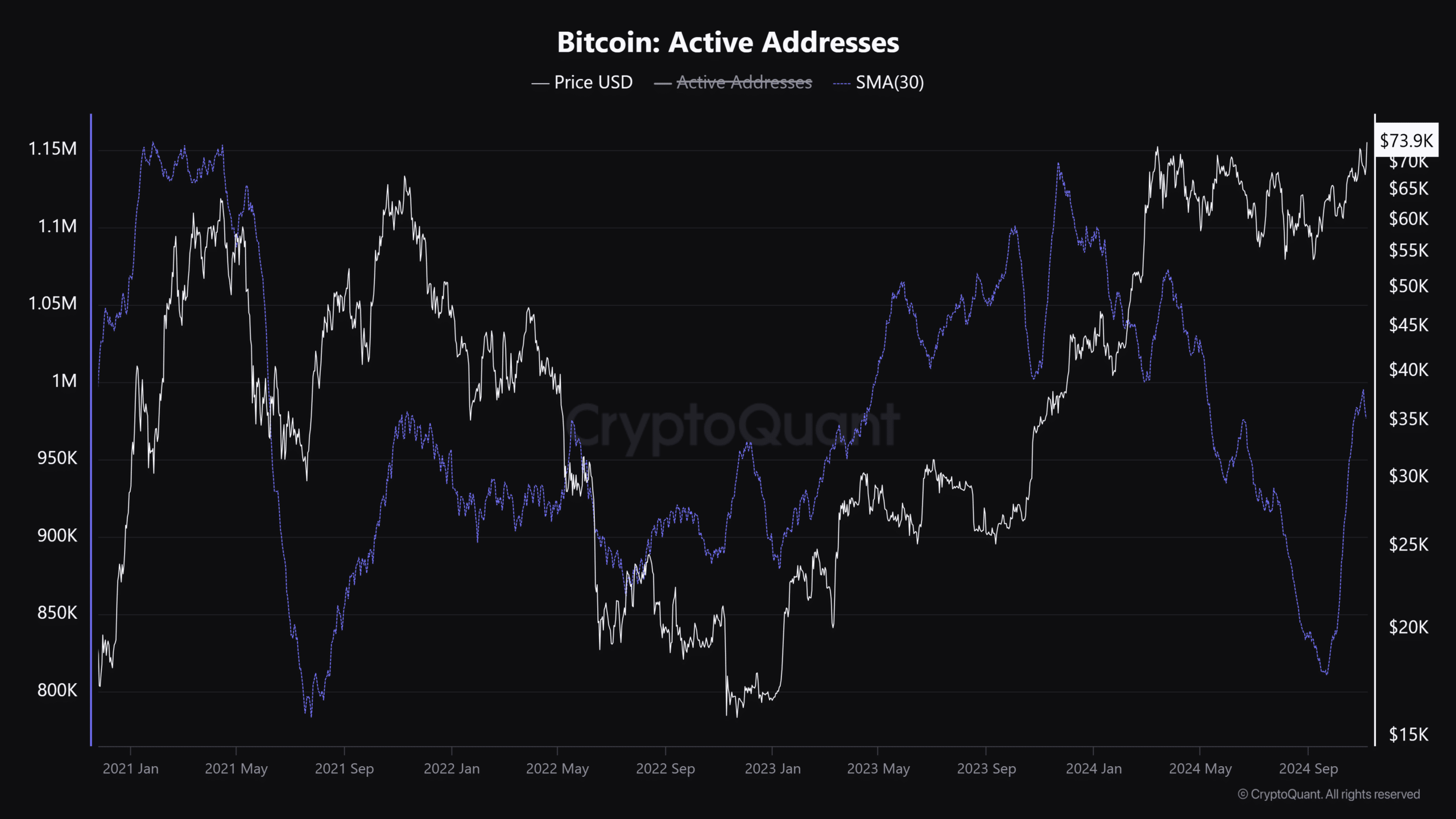

Lastly, the community progress additionally seemed nice for Bitcoin’s additional rally. The every day lively addresses reversed from its lows since September, with the identical climbing in direction of the 1 million mark – An indication of better demand and market curiosity for BTC.

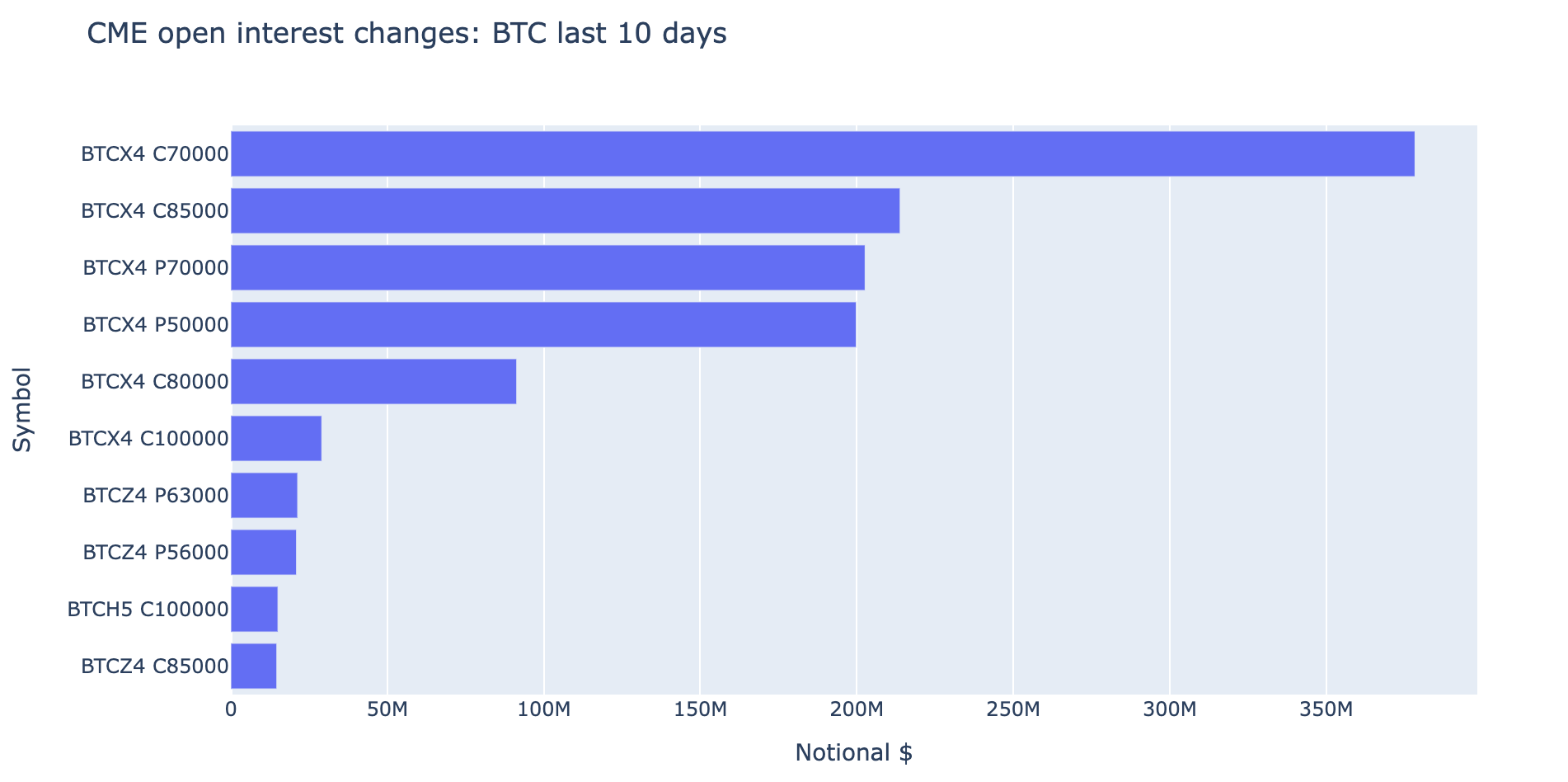

On the Choices market, after the $70k-level, which has already been hit, giant gamers positioned large bets on $80k and $85k targets for November primarily based on current inflows on CME BTC Futures.

At press time although, there have been nonetheless protecting bets (draw back safety) for $50k, most likely if Kamala wins, as famend Choices dealer Peter Stewart famous. He mentioned,

“CME has added a similar notional clip (but lower premium) in Nov29 85k Calls, and also a clip of Nov29 80k Calls too. On the protective side, $200m notional of Nov29 70k-50k Put spreads were bought.”

In conclusion, metrics and Choices information indicated that the +$80K medium-term goal could be possible. Nonetheless, any detrimental macro surroundings updates, or a Kamala Harris win might dent or delay these bullish projections.