- CryptoQuant analyst believes Bitcoin merchants are nonetheless in a bull market, regardless of the current value drop

- Miners income for Bitcoin declined materially over the previous couple of days

Bitcoin [BTC] appeared to be stagnating across the $66,000 mark, on the time of writing. And but, regardless of its iffy value motion, the outlook for the world’s largest cryptocurrency stays as optimistic as ever.

Bull run season?

CryptoQuant analyst Ki Younger Ju believes Bitcoin merchants are nonetheless in a bull market, regardless of the current value drop. His optimism stems from the truth that the typical entry value for Bitcoin merchants is round $47,000. Because of this though BTC is down round 27% from its all-time excessive, most Bitcoin merchants are nonetheless sitting on earnings and haven’t been compelled to promote.

For his half, Ki Younger Ju interprets this information as an indication of sustained bullish sentiment. Traditionally, in bull markets, the worth of Bitcoin tends to remain above the typical entry value of merchants.

It is a signal that many merchants are doubtless ready for the worth to rise once more, earlier than promoting. It’s price noting, nonetheless, that the analyst additionally suggested warning, recommending a long-term bullish strategy whereas avoiding extreme dangers within the present risky market.

Most of those addresses holding BTC are long-term holders. Lengthy-term holders are those that purchase Bitcoin with the intention of holding it for an prolonged interval, usually years and even a long time. They’re usually much less fazed by short-term value fluctuations, focusing as an alternative on the potential for Bitcoin’s worth to develop over the lengthy haul. That is mirrored within the present common entry value.

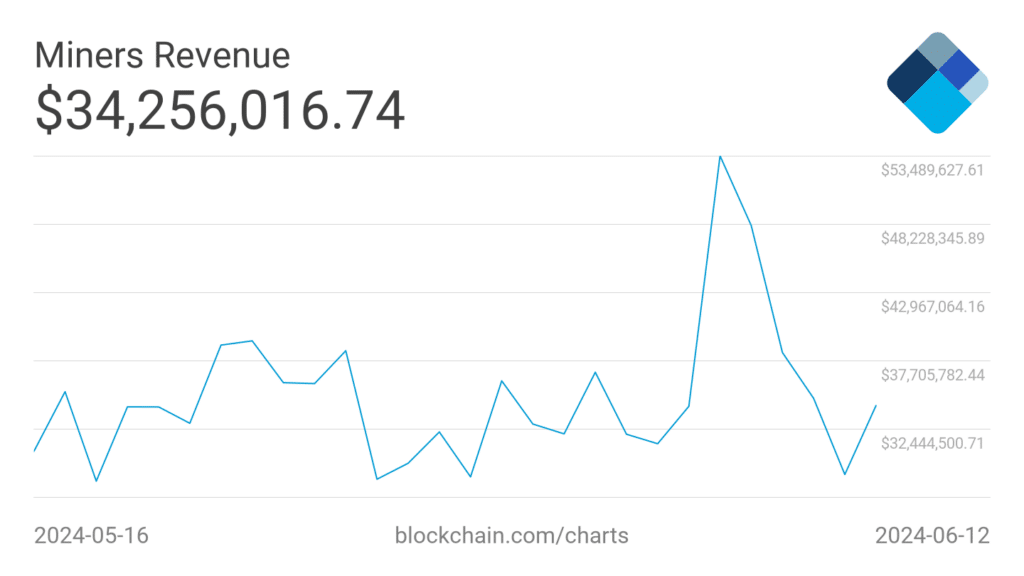

One other issue that might affect the worth of BTC may very well be the state of the business’s miners. Over the previous couple of days, the each day income generated by miners has declined considerably from 53 million to 34 million. If the income generated by the miners continues to say no, it is going to change into tough for the miners to stay worthwhile.

In such a case, they’d be compelled to promote their BTC holdings, contributing to promoting strain on BTC and by extension, an additional decline in value.

A fall in exercise and…

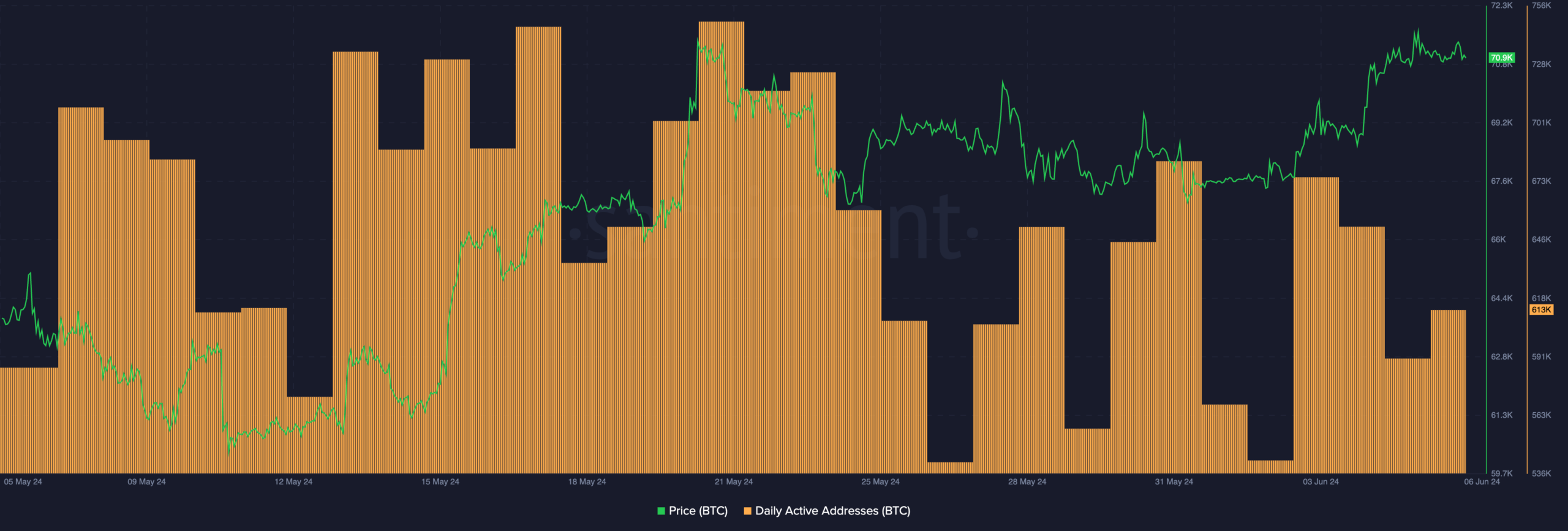

Exercise on the Bitcoin community can have an effect on the income generated by these miners considerably. In reality, AMBCrypto’s evaluation of Santiment’s information revealed that the variety of energetic addresses on the community climbed from 688,000 to 613,000 over the previous month.

The decline in exercise and falling curiosity in Bitcoin’s ecosystem may lend extra downward strain on BTC’s value motion on the charts.

Learn Bitcoin (BTC) Value Prediction 2024-2025