- Binance faces large Bitcoin withdrawal amid backlash.

- Liquidations intensify as Bitcoin EFTs face detrimental internet movement.

Bitcoin [BTC] skilled a subdued day yesterday, the twenty eighth of August, with the main cryptocurrency dealing with declines throughout numerous markets, together with spot buying and selling and Bitcoin ETFs standard within the U.S. Markets.

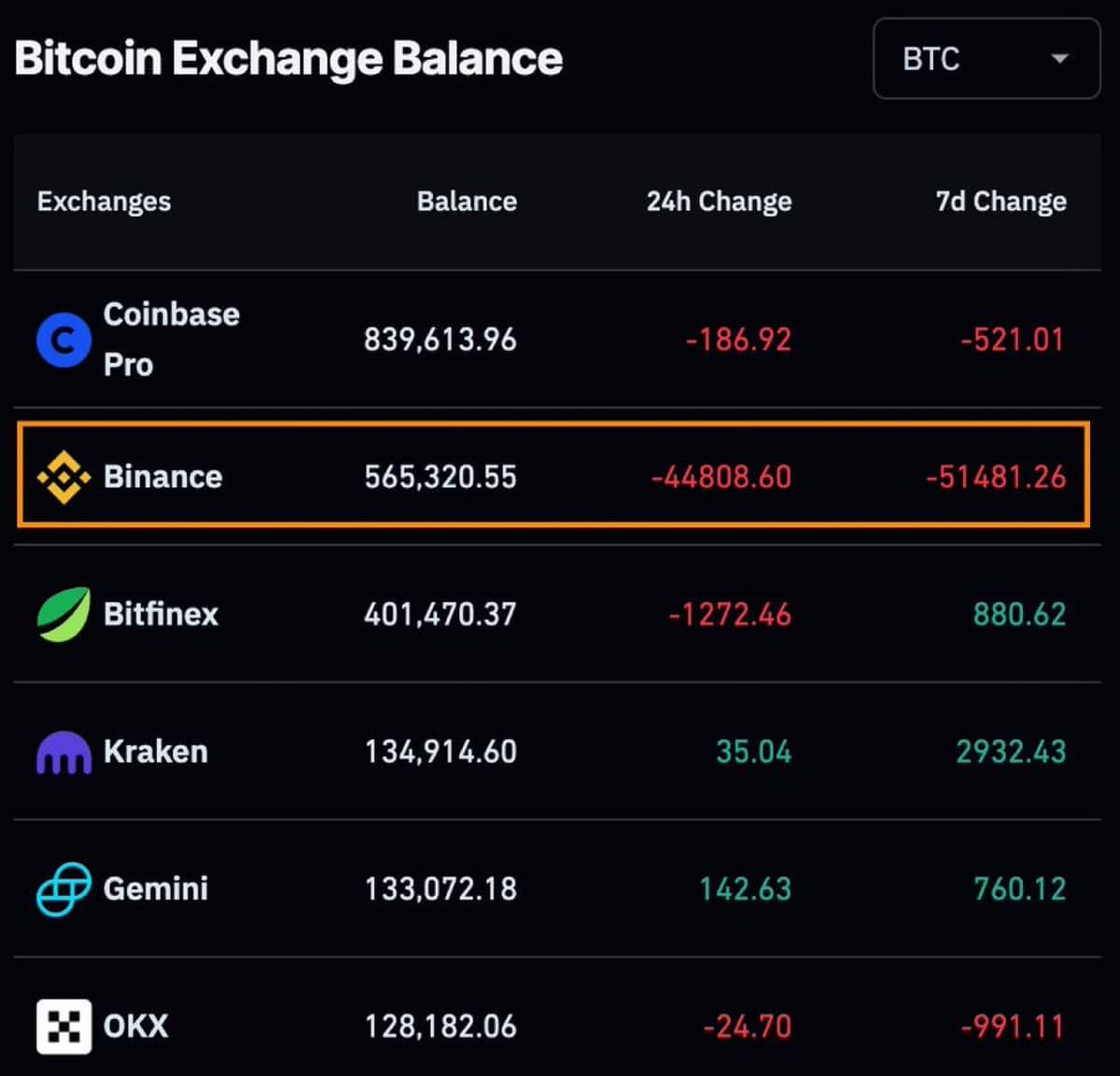

The market downturn coincided with an enormous outflow of 44,808 BTC, price over $2.6 billion, withdrawn from Binance within the final 24 hours.

This vital Bitcoin withdrawal adopted allegations that Binance seized Palestinian property on the request of Israeli authorities. Amid backlash, Binance rapidly unfroze the accounts.

This large outflow of Bitcoin is prone to impression the value of BTC, with potential results in each instructions.

First, the Bitcoin could also be held for long-term good points, presumably driving the value increased. Then again, a big sell-off may result in a value decline, given the substantial quantity concerned the Bitcoin market may very well be shaken,

Large liquidations

Moreover to the Binance withdrawal, previous 24 hours have seen 66,423 merchants liquidated, amounting to $161.12M.

The biggest single liquidation occurred on Bybit’s BTC/USD pair for $3.52 million, adopted by a $12.67 million liquidation on Binance’s ETH/BTC pair the day earlier than.

These occasions have contributed to over $4.8 billion in liquidations for August 2024, the very best since 2021, with two days nonetheless remaining.

Because the market matures and grows heavier, contributors are taking over bigger leverage, resulting in elevated losses throughout robust market actions.

Supply: Coinglass

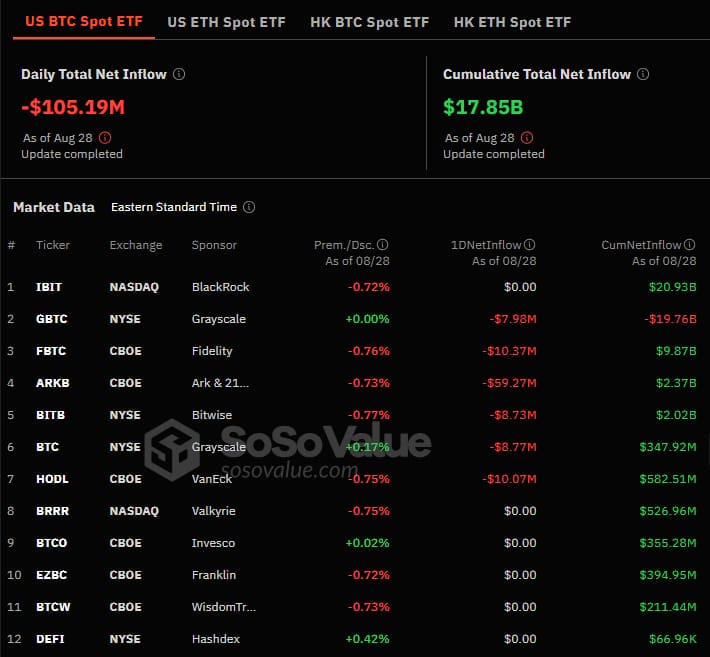

Bitcoin ETFs face detrimental NetFlow

The large BTC withdrawal from Binance additionally affected ETFs, which noticed a internet outflow of $105.19 million on August twenty eighth, the identical day because the Binance BTC withdrawal.

Ark & 21Shares’ $ARKB led the outflows with $59.27 million, adopted by Constancy’s $FBTC, VanEck’s $HODL, and Grayscale’s $GBTC with $10.37 million, $10.07 million, and $7.98 million outflows, respectively.

Supply: Soso Worth

These continued detrimental occasions elevate issues about BTC’s means to recuperate, as its value motion hovers across the $60K mark.

Will stablecoin provide assist Bitcoin recuperate?

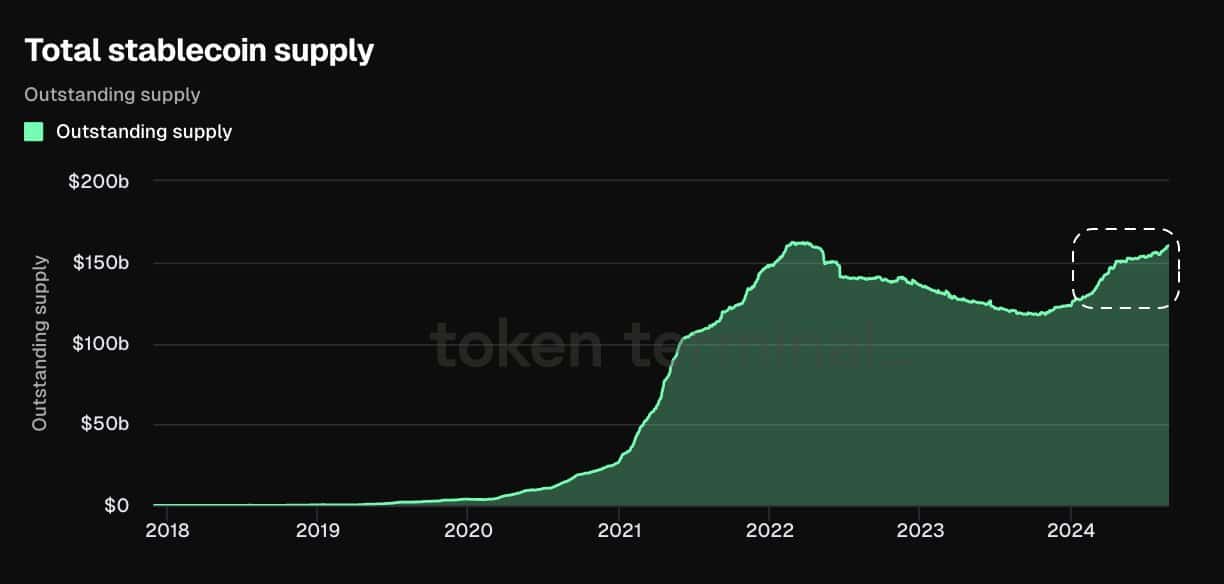

Regardless of the huge BTC withdrawal from Binance, widespread liquidations, and detrimental ETF outflows, there’s hope that Bitcoin’s detrimental correlation with stablecoins may result in a turnaround.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

The final 24 hours have seen over $67 million in USDC minted, $70M in USDC transferred to unknown pockets and one other $100 million USDT being transferred to Bitfinex.

Supply: Token Terminal

This inflow of stablecoins into the market may inflate costs and doubtlessly drive Bitcoin increased. With stablecoin graphs close to all-time highs, a reversal for Bitcoin and different cryptocurrencies may very well be on the horizon.