- Analyst believes the world’s largest cryptocurrency may subsequent goal $78k

- Shopping for stress has been rising these days, alluding to an upcoming value hike

After a drop to $60k, Bitcoin [BTC] bulls have once more gained management of the market over the past 24 hours. What subsequent although? Effectively, some analysts consider that the world’s largest cryptocurrency may quickly chart a path in direction of $78k now.

Monitoring Bitcoin’s path

AMBCrypto reported beforehand that Bitcoin has been in a consolidation part these days. The truth is, CryptoQuant Founder and CEO Ki Younger Ju famous that we’re heading in the right direction to have the longest sideways value motion in a halving yr.

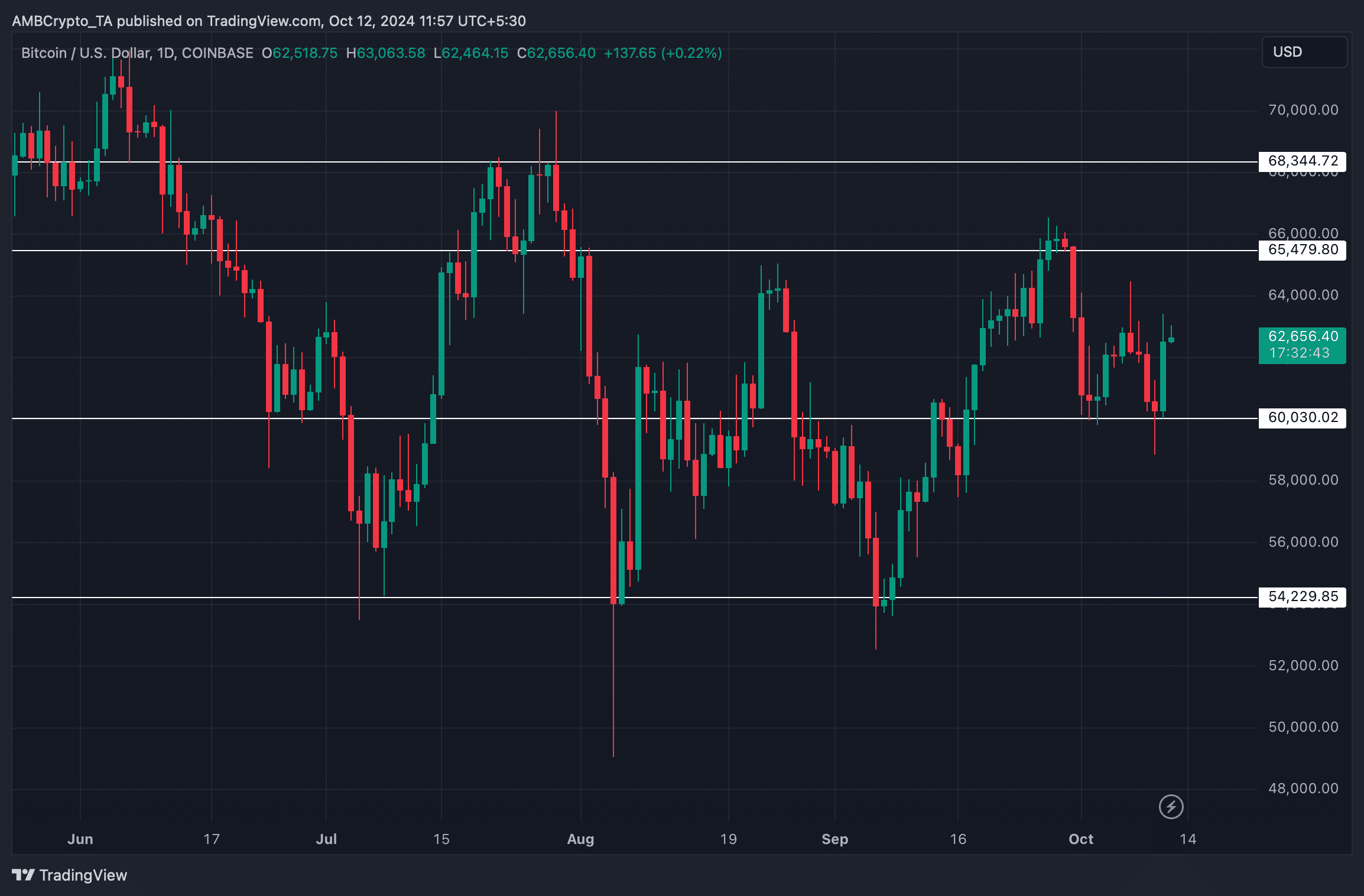

On high of that, Ali, a preferred crypto analyst, additionally shared a tweet revealing BTC’s potential path. As per the tweet, BTC’s value has been consolidating inside a channel. Whereas the coin dropped to $60k initially, it then touched $66k on the charts.

Following the identical, the coin as soon as once more plummeted to $57k. At press time, Bitcoin was exhibiting indicators of restoration as its worth surged by 3% within the final 24 hours alone.

If this not too long ago gained bullish momentum lasts, this simply may be the start of the street in direction of $78k.

BTC’s street forward

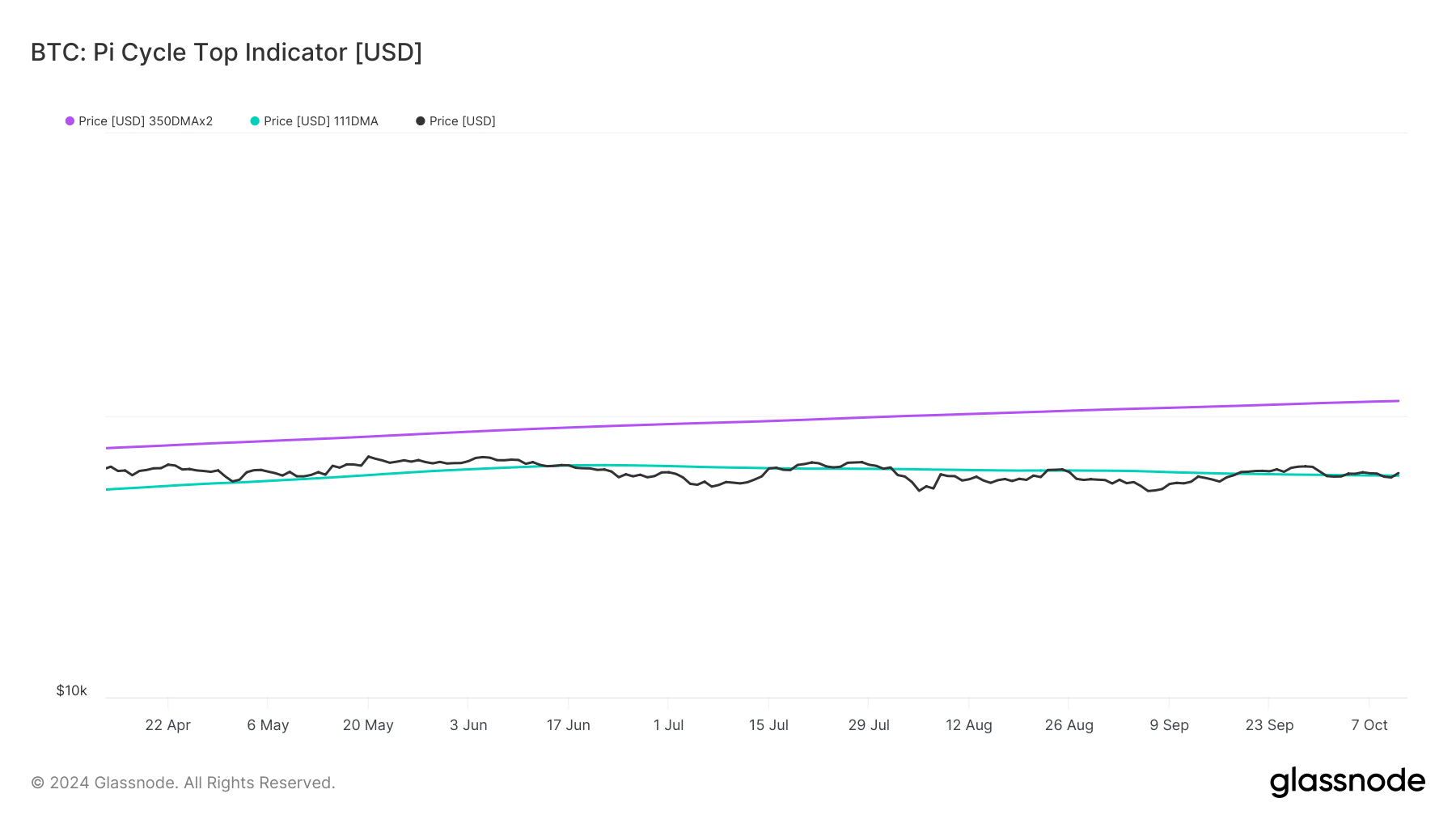

For the reason that aforementioned evaluation pointed to the potential for a breakout in direction of $78k, AMBCrypto deliberate to test BTC’s on-chain knowledge. As per our evaluation of Glassnode’s knowledge, Bitcoin simply crossed above its potential market backside.

If the Pi Cycle High indicator is to be believed, then the possibilities of Bitcoin going above its present ATH are excessive proper now. This can be the case, particularly because the metric underlined a potential market high at $112k.

Bitcoin’s NVT ratio additionally dropped over the previous week. A decline within the metric implies that an asset is undervalued, suggesting that it would quickly start a bull run.

Other than this, AMBCrypto’s evaluation of CryptoQuant’s knowledge revealed one more bullish sign. Bitcoin’s change reserves have been dropping. What this steered was that that purchasing stress on BTC has been rising – A discovering that always leads to value upticks.

On the derivatives entrance too, all the things appears fairly optimistic proper now.

For instance, the coin’s taker purchase/promote ratio turned inexperienced. This clearly meant that purchasing sentiment was stronger amongst Futures buyers. Moreover, the coin’s funding price additionally rose.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Lastly, AMBCrypto checked Bitcoin’s every day chart to search out out if there are any essential resistance ranges forward earlier than it retests its ATH.

We discovered that Bitcoin could also be heading in the right direction because it gave the impression to be approaching its resistance close to $65.4k. A profitable breakout would push the coin in direction of $68k. In case the coin manages to leap above that, then buyers may see BTC retesting its ATH once more.