- Greater than 98% of BTC addresses have been in revenue, due to its bullish worth development.

- Accumulation was excessive, however indicators advised that Bitcoin was getting overvalued.

Bitcoin [BTC] lived as much as buyers’ expectations final week by pumping its worth properly sufficient. Nevertheless, the king coin began to consolidate over the previous few days because it continued to maneuver in direction of the $100k mark.

In the meantime, a vital BTC metric turned bearish, hinting at a pullback.

Bitcoin buyers are getting ‘GREEDY’

BTC managed to push its worth by 8% final week. In actual fact, AMBCrypto reported earlier that this push allowed BTC to flip its $96k resistance into a brand new help, hinting at an extra rise above $100k.

Due to that, 53.24 million BTC addresses have been in revenue, which accounted for 98% of the full variety of Bitcoin addresses.

Nevertheless, the coin began to consolidate within the final 24 hours as its each day chart turned purple. At press time, the king coin was buying and selling at $97.7k. Whereas that occurred, Ali Martrinez, a well-liked crypto analyst, posted a tweet revealing a notable improvement.

As per the tweet, long-term BTC holders have been displaying indicators of rising greed. Traditionally, this habits suggests it may take 8-11 months for BTC to hit a market high.

If this seems to be true on this event, BTC reaching a market high would possibly get delayed. To be exact, buyers would possibly see BTC reaching that degree solely by June or September 2025.

Assessing BTC’s metrics

To see whether or not the rising greed available in the market will end in a correction, AMBCrypto assessed Glassnode’s knowledge. After a pointy decline, Bitcoin’s NVT ratio began to rise once more. This meant that BTC was getting overvalued, suggesting a worth drop quickly.

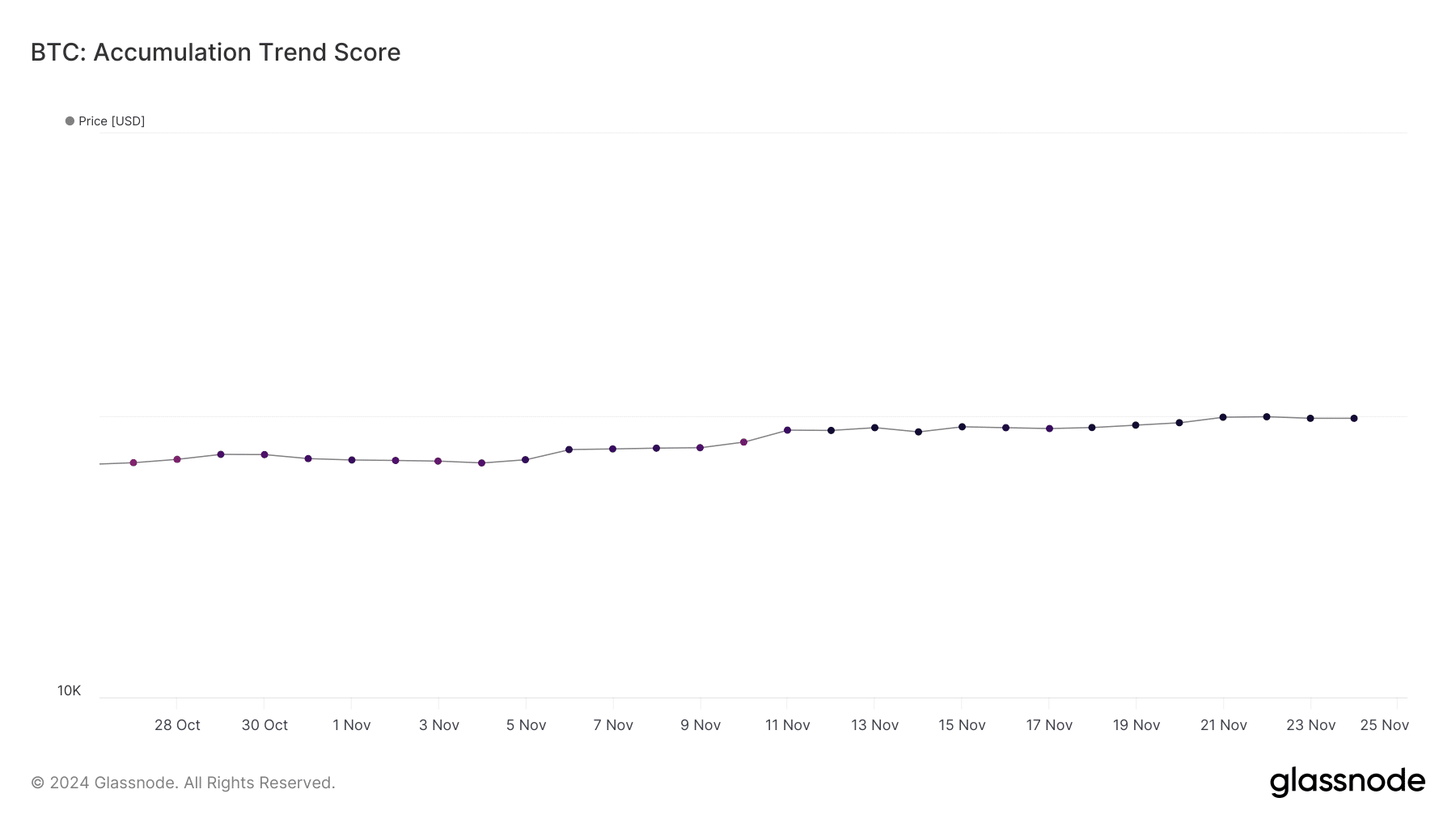

Nonetheless, the market at giant continued to stay optimistic on BTC. This was evident from the coin’s accumulation development rating, which had a worth of over 0.9.

For initiators, a worth nearer to 1 signifies excessive shopping for stress. Usually, rising shopping for stress leads to continued worth hikes. Due to this fact, the probabilities of BTC not getting affected by the rising greed available in the market can’t be dominated out but.

Aside from that, Bitcoin’s Open Curiosity (OI) additionally remained excessive. At any time when the metric rises, it signifies that the probabilities of the continuing worth development persevering with are excessive. Nonetheless, a take a look at BTC’s each day chart revealed that the coin was testing a trendline resistance.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

The MACD displayed the probabilities of a bearish crossover. Furthermore, the Relative Power Index (RSI) was resting within the overbought zone.

This would possibly set off a sell-off, which may prohibit BTC from breaking above the resistance within the near-term.