- Bitcoin maintains energy above key degree regardless of indicators of potential draw back.

- Shorts face the sharp fringe of the knife as value sustains within the $58k vary.

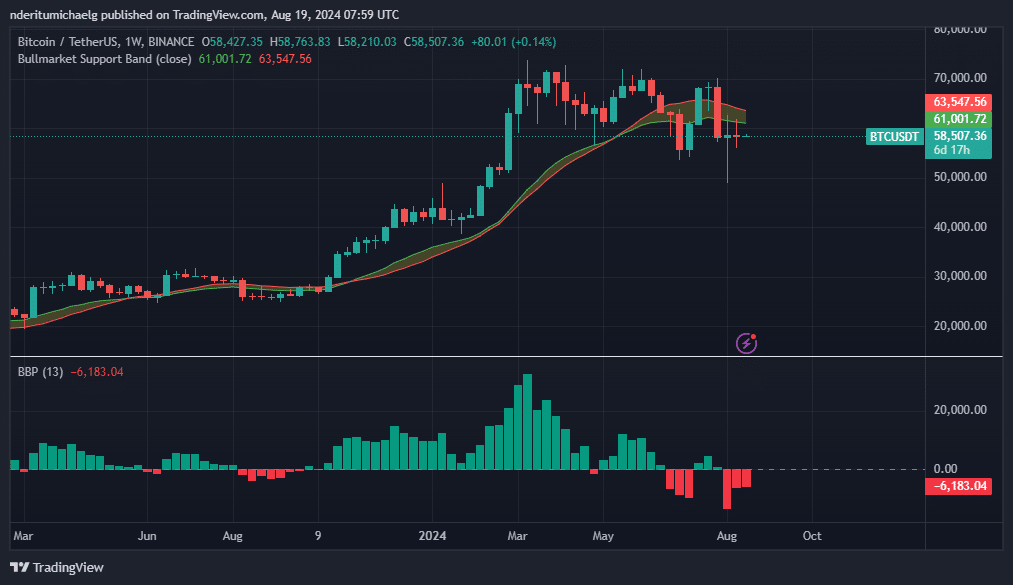

Bitcoin [BTC] simply closed one other week beneath its bullish market assist band on the 1-week timeframe. Consequently, extra merchants are turning bearish, however regardless of this, issues have been fairly rocky for leveraged shorts merchants.

Though Bitcoin made a restoration try after its crash earlier this 12 months, weak bullish momentum triggered extra bearish sentiments.

In the meantime, the value has been caught in a slim vary evident within the weekly timeframe. On prime of that, Bitcoin’s value remained beneath bullish assist band, fueling extra bearish hypothesis.

The Bitcoin bull market assist band inversion is simply one of many bearish indicators suggesting extra potential draw back forward. Brief merchants have been doubling down on their positions.

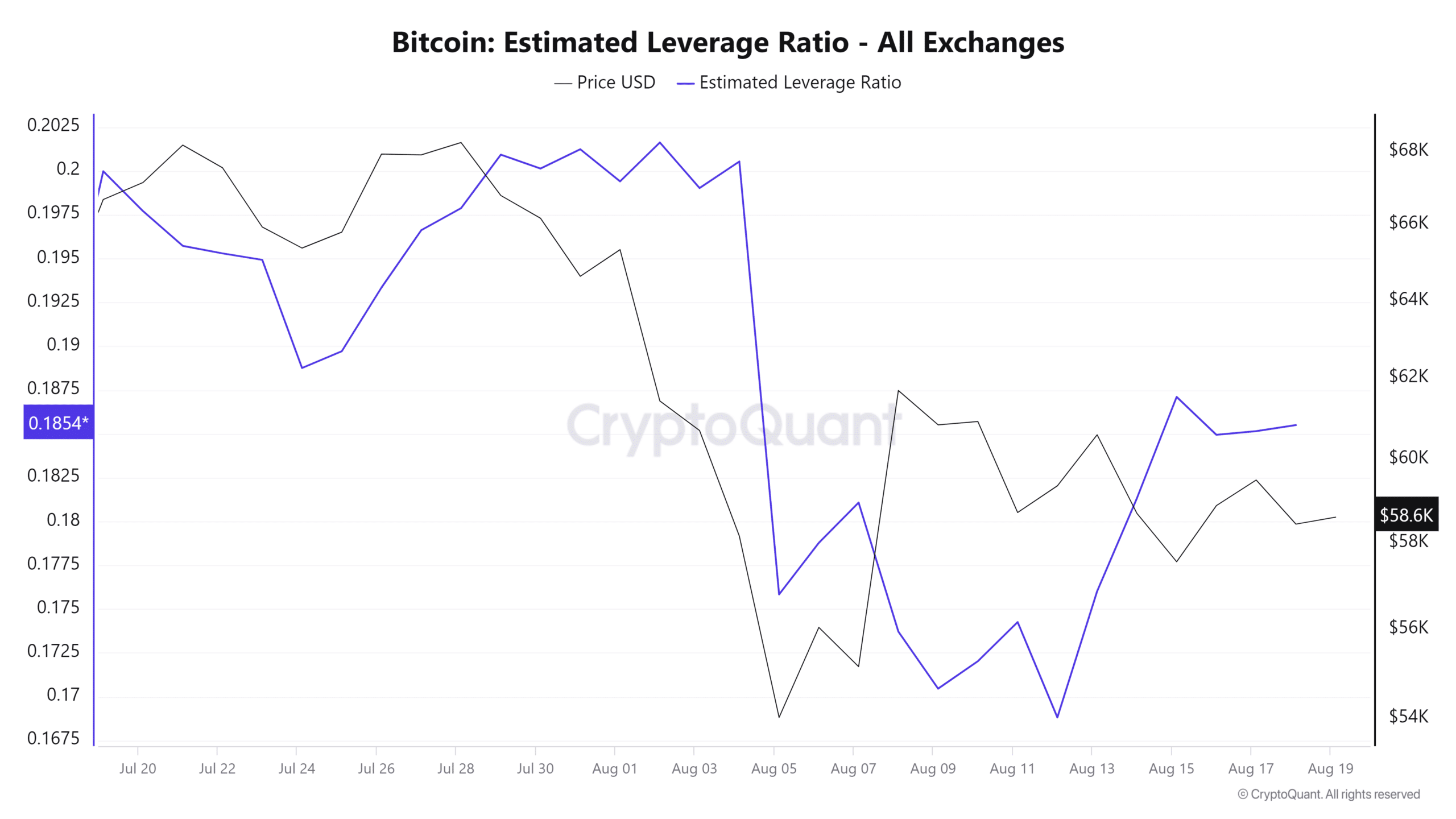

Urge for food for leverage has been on the rise for the final week or so. That is evident within the estimated leverage ratio which bottomed out on 12 August. This means that the market anticipates extra volatility within the coming days.

The variety of Bitcoin leveraged shorts have been rising, with the expectations of extra value weak point. Nevertheless, BTC’s value motion seems to be placing on a present of energy in opposition to the draw back close to the $58,000 value vary.

Latest findings revealed that over $1.65 billion value of leveraged shorts have been lately liquidated.

Regardless of these findings, the variety of shorts liquidations have been nonetheless low in comparison with what we noticed earlier this month. However a very powerful query on most Bitcoin holders’ minds is whether or not the cryptocurrency will proceed to drop.

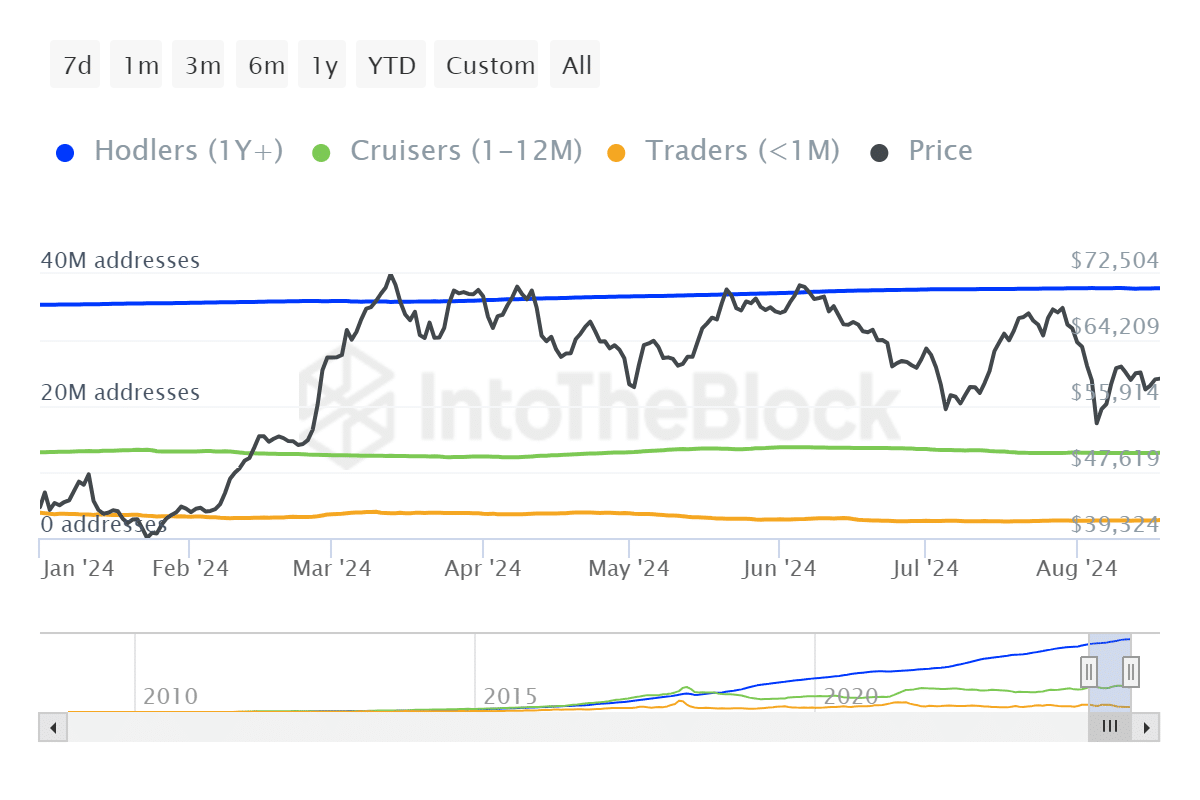

A number of key observations to notice. The slim value vary means that Bitcoin holders are nonetheless opting to carry on to their cash.

Bitcoin possession stats by time held reveals that whales proceed to HODL. For instance, the variety of whales HODLing BTC on a YTD timeframe grew from 35.33 million addresses to 37.88 million addresses as of the most recent stats.

Whales holding on to Bitcoin is an efficient signal as a result of they’ve a major affect available on the market collectively. Nevertheless, the identical knowledge additionally signifies that the retail class of holders have declined throughout the identical interval.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

A possible purpose for the above might be that the upper value of dwelling and market uncertainty could have pressured retail holders to promote.

In the meantime, whales opting to HODL suggests long run bullish expectations stay sturdy regardless of short-term headwinds. Each dip up to now has been accompanied by strong accumulation, which has shielded Bitcoin from extra draw back.