- BTC’s value has appreciated by over 6% because it approached $63k on the charts

- Most metrics and indicators flashed inexperienced too

Bitcoin’s [BTC] value motion as soon as once more turned risky because it swiftly approached $63k on the charts. Within the meantime, nevertheless, a sample appeared to be forming on the cryptocurrency’s value chart – An indication that BTC’s value may hit $75k within the coming weeks.

Bitcoin’s value motion seems promising

In response to CoinMarketCap, BTC has gained by greater than 6% over the previous week, with it appreciating by 3% within the final 24 hours alone. On the time of writing, BTC was buying and selling at $62,998.95 with a market capitalization of over $1.24 trillion.

Regardless of its fall from its ATH, nevertheless, most market analysts stay optimistic in regards to the crypto’s value motion. The truth is, AMBCrypto had beforehand reported that Ki Younger Ju, CEO of analytics agency CryptoQuant, claimed that Bitcoin’s community fundamentals might help a market valuation “three times its current size.”

Whereas BTC’s value motion turned bullish, Titan of Cryptos, a well-liked crypto-analyst, identified in a tweet that an inverse head-and-shoulder sample was forming on BTC’s value chart. As per the tweet, the sample recommended that BTC’s value may quickly cross its all-time excessive (ATH) and hit $75k within the coming weeks.

Nevertheless, the tweet additionally talked about the antagonistic situation. If every part doesn’t fall into place, then BTC may drop all the way down to $56k once more. Therefore, it’s value taking a better take a look at the cryptocurrency’s state to see which consequence is extra probably.

What to anticipate from Bitcoin?

AMBCrypto’s evaluation of CryptoQuant’s information revealed that Bitcoin’s alternate reserves have been dropping. This clearly meant that purchasing stress was excessive, which might be inferred as a bullish sign.

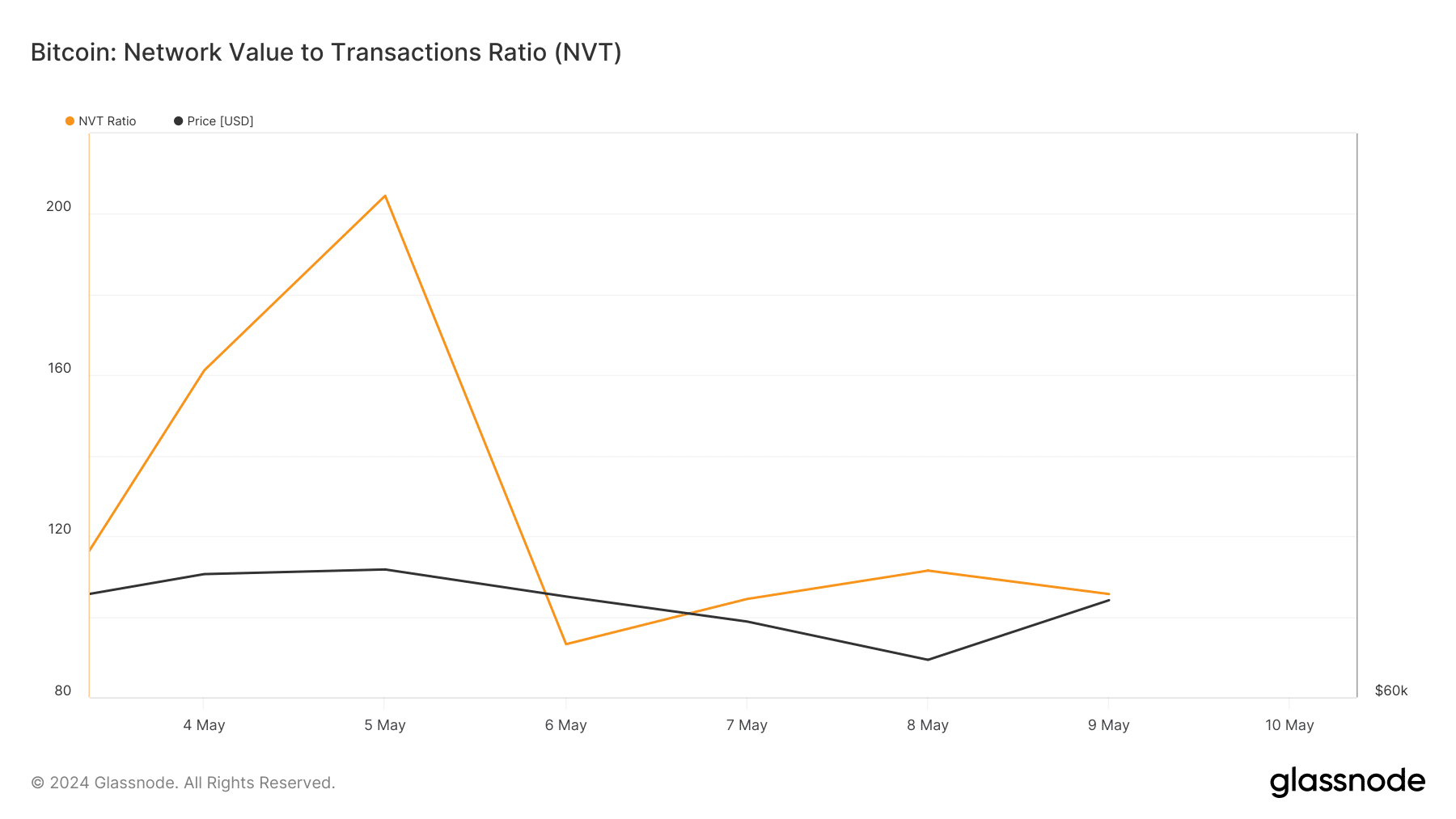

Its binary CDD recommended that long-term holders’ actions within the final 7 days have been decrease than common, that means that they’ve a motive to carry their cash. On high of that, BTC’s NVT ratio dropped final week, that means that it was undervalued. These metrics backed the potential for BTC touching or going above its ATH.

Nevertheless, its aSORP flashed opposing alerts.

At press time, BTC’s aSORP was crimson, indicating that extra buyers have been promoting at a revenue. In the course of a bull market, this could point out a market high.

To examine whether or not the market has reached its high, AMBCrypto then analyzed BTC’s every day chart. As per our evaluation, BTC was testing its 20-day exponential shifting common (EMA) on the time. A profitable breakout above it might guarantee a sustained bull rally.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Its Cash Move Index (MFI) additionally registered a pointy uptick.

Quite the opposite, the Chaikin Cash Move (CMF) seemed bearish. This was an indication that BTC’s value may begin to decline, which might push its worth all the way down to $56k on the charts.