Bitcoin’s realized cap displays recent capital inflows

Bitcoin’s realized cap — which displays the combination worth of cash at their final transaction value — has seen good development, underscoring recent capital inflows into the market.

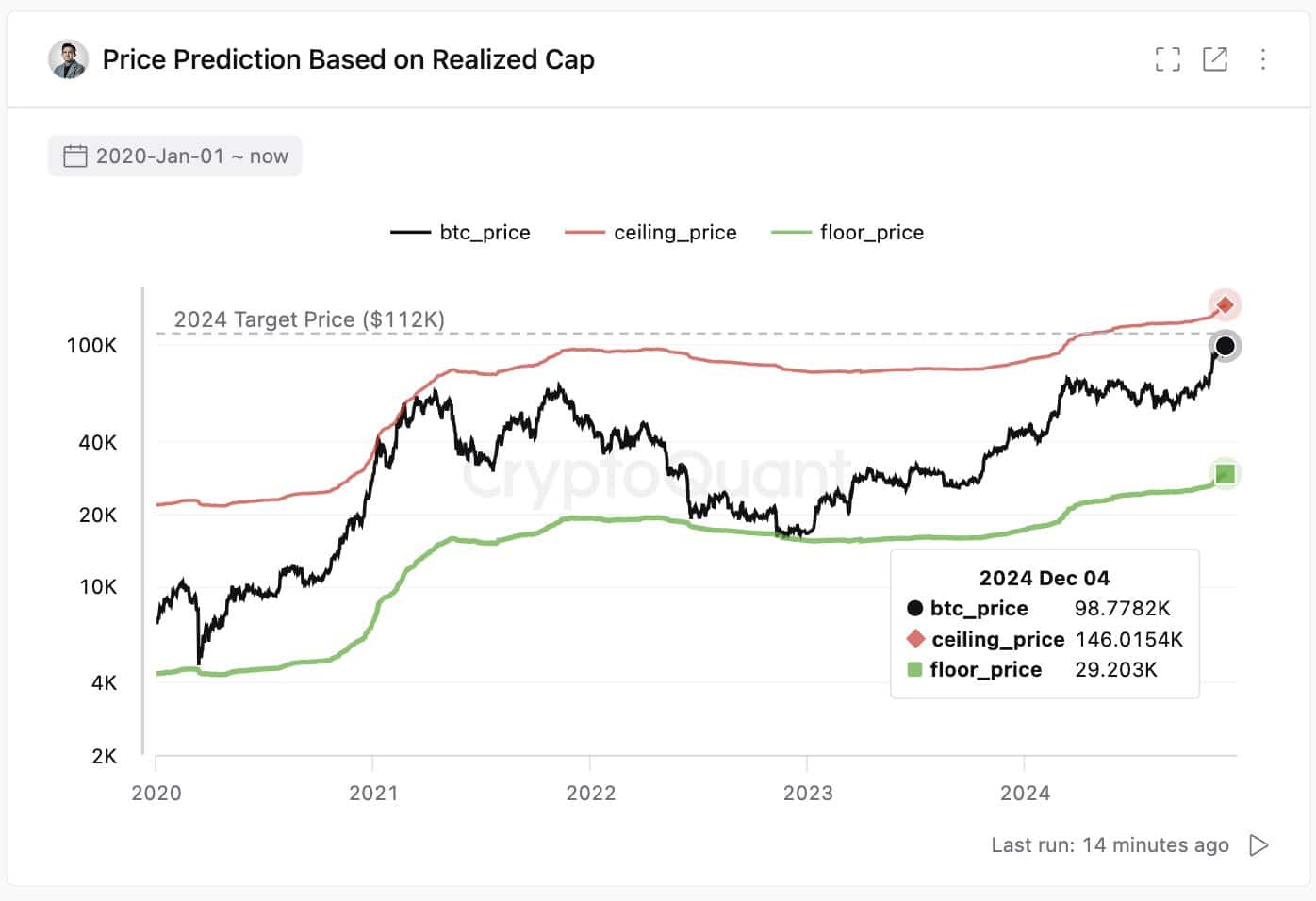

Over the previous 30 days, Bitcoin’s ceiling value surged from $129K to $146K, as famous by CryptoQuant CEO Ki Younger Ju, highlighting elevated investor confidence and new liquidity coming into the ecosystem.

This dynamic is a important indicator of market well being, displaying that latest value motion isn’t solely pushed by speculative buying and selling however supported by tangible shopping for exercise.

Notably, at $102K, Bitcoin remained properly under the bubble threshold, which might require a 43% rise to breach.

Such knowledge factors to a balanced market rally, grounded in sustainable demand relatively than irrational exuberance.

The mix of realized cap with value means that Bitcoin’s upward momentum might have additional room to develop, pushed by stable fundamentals.

Bitcoin’s $102K value and the 43% surge

Bitcoin’s present value of $102K locations it firmly in a development part, but nonetheless removed from the $146K ceiling value — a degree typically related to “bubble” situations.

The 43% hole underscores the relative sustainability of the present rally in comparison with previous euphoric peaks.

This threshold, as derived from Bitcoin’s realized cap knowledge, represents a hypothetical higher restrict the place speculative exuberance might dominate rational valuation.

The necessity for a 43% surge displays each the size of liquidity required and the tempered tempo of present inflows, suggesting market members are targeted on accumulation relatively than chasing parabolic strikes.

Learn Bitcoin’s [BTC] Value Prediction 2024-25