- On-chain metrics revealed that promoting sentiment was dominant throughout the market

- A key market indicator hinted at a development reversal, however others remained bearish

Bitcoin’s [BTC] week-long bull rally got here to a halt as its day by day chart turned purple over the previous few hours. The truth is, BTC misplaced some momentum between 16 and 17 Might after a promote sign flashed on its value chart. Therefore, it’s price Bitcoin’s state to see whether or not this development is more likely to proceed within the near-term.

Bitcoin hits the pause button

In response to CoinMarketCap, Bitcoin was having a cushty weekly rally as its value hiked by greater than 4%. The value uptrend allowed BTC to climb as excessive as $66k. Nevertheless, the king coin quickly hit a roadblock after the emergence of a promote sign.

Ali, a well-liked crypto analyst, shared a tweet highlighting this improvement. The tweet additionally talked about that he expects one to 4 candlestick corrections for BTC.

The evaluation turned out to be correct, because the king of cryptos’ value did drop. BTC’s value declined by 0.71% and on the time of writing, the coin was buying and selling at $65,464.76 with a market capitalization of over $1.29 trillion.

AMBCrypto then assessed CryptoQuant’s knowledge to see whether or not this halt to BTC’s rally would last more. As per our evaluation, BTC’s aSORP was purple, which means that extra traders at the moment are promoting at a revenue. In the midst of a bull market, it could point out a market high.

Additionally, its Web Unrealized Revenue and Loss (NULP) revealed that traders are in a perception part, one the place they’re at present in a state of excessive unrealized income.

Will this development final?

Upon nearer inspection, AMBCrypto discovered that promoting sentiment on the whole appeared dominant throughout the market. The truth is, BTC’s web deposit on exchanges was excessive, in comparison with the final 7 days’ common.

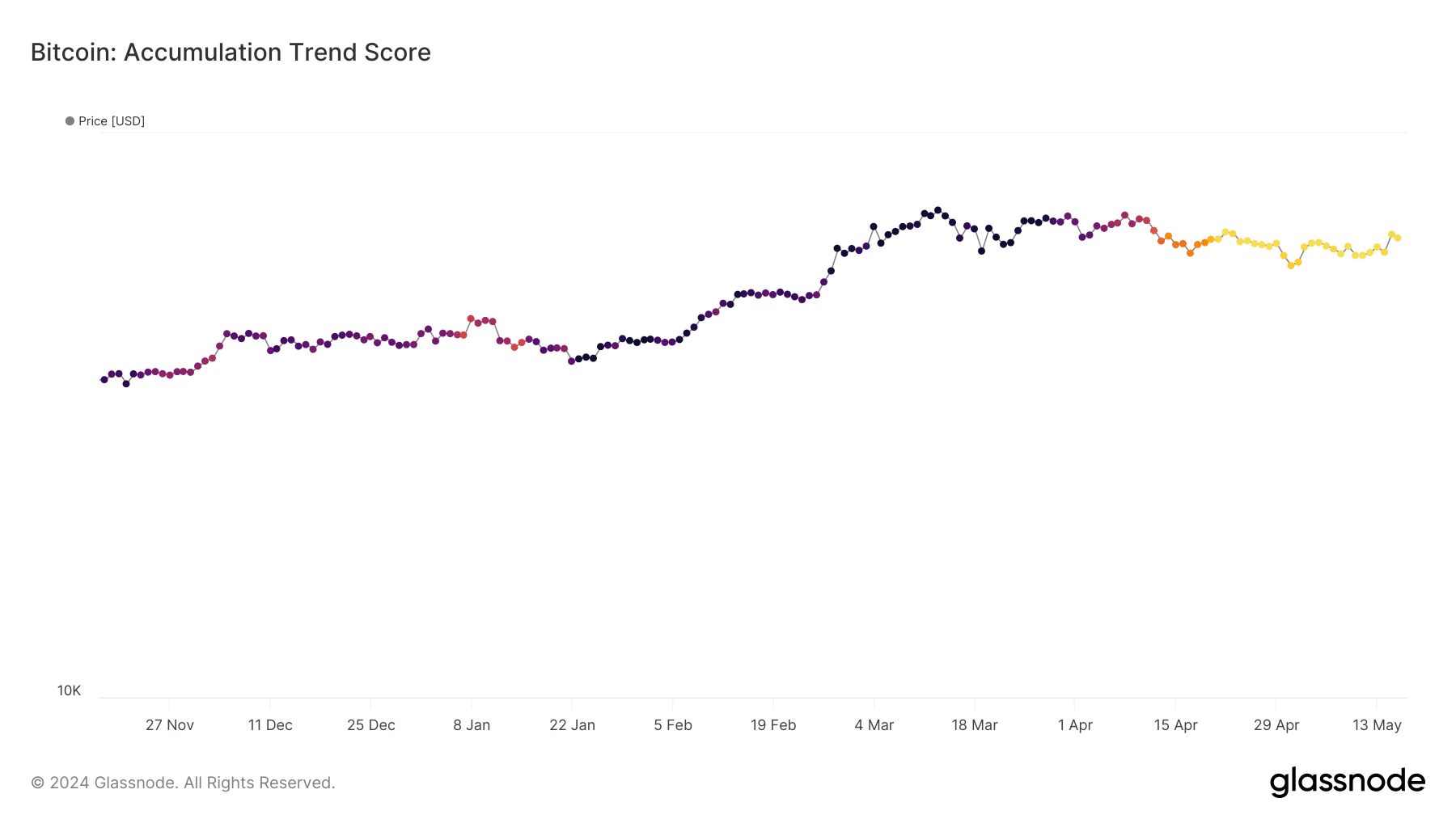

A take a look at Glassnode’s knowledge revealed one more bearish metric. Bitcoin’s accumulation development rating had a worth of 0.0061 at press time, indicating that traders haven’t been stockpiling BTC.

For starters, the Accumulation Pattern Rating is an indicator that displays the relative measurement of entities which can be actively accumulating cash on-chain when it comes to their BTC holdings. A worth nearer to 1 signifies excessive accumulation, and a worth nearer to 0 suggests traders are distributing or not accumulating.

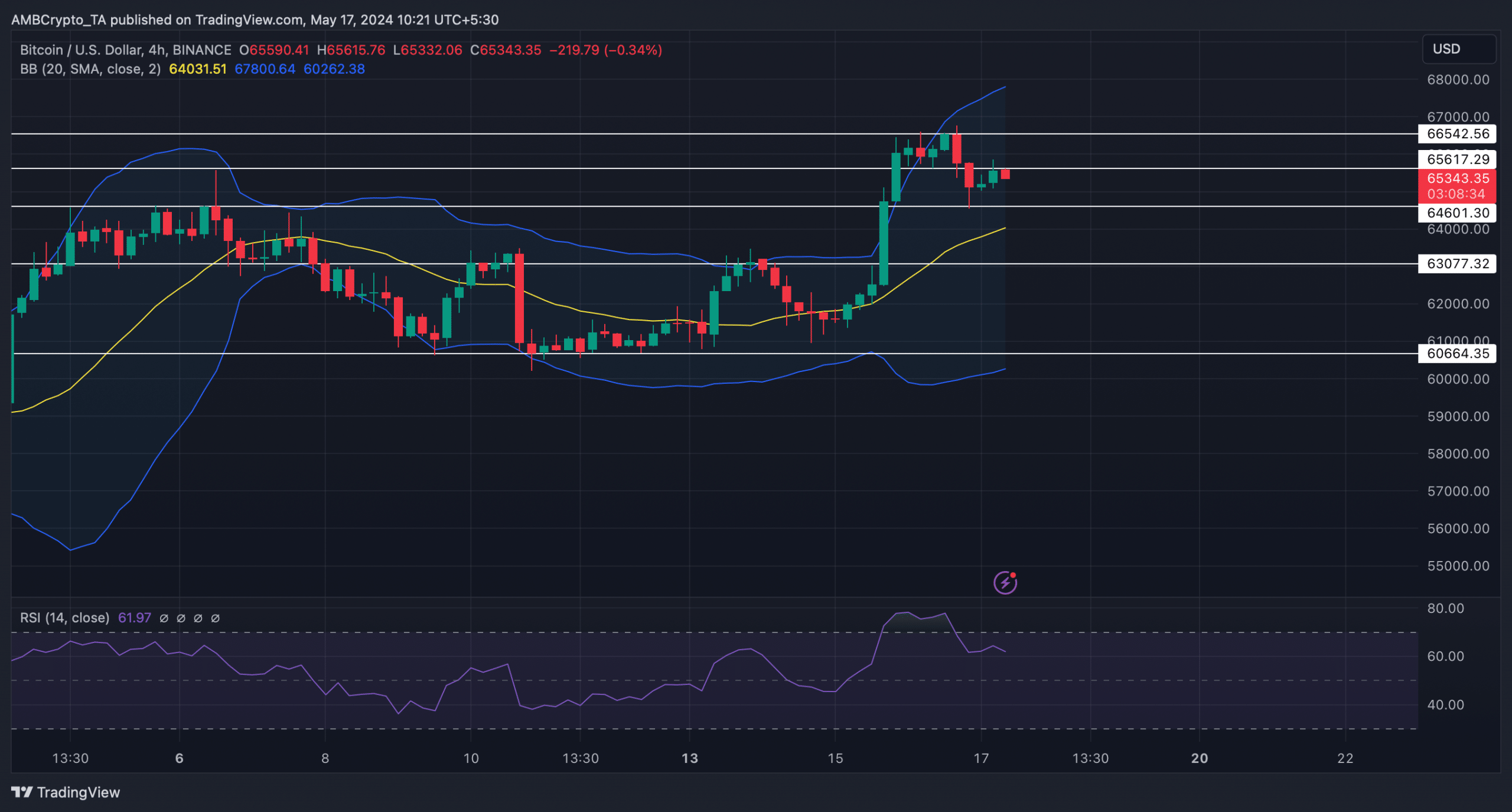

Lastly, AMBCrypto analyzed BTC’s 4-hour chart to raised perceive the potential of Bitcoin resuming its bull rally anytime quickly. On the time of writing, BTC was testing its resistance at $65.6k. A profitable breakout above that degree would enable BTC to show bullish once more.

Is your portfolio inexperienced? Test the Bitcoin Revenue Calculator

Additionally, the Bollinger Bands revealed that BTC was buying and selling effectively above its 20-day easy transferring common (SMA) – A bullish sign. Nevertheless, the Relative Energy Index (RSI) registered a decline. This might be an indication that BTC may not handle to breach its resistance within the brief time period.