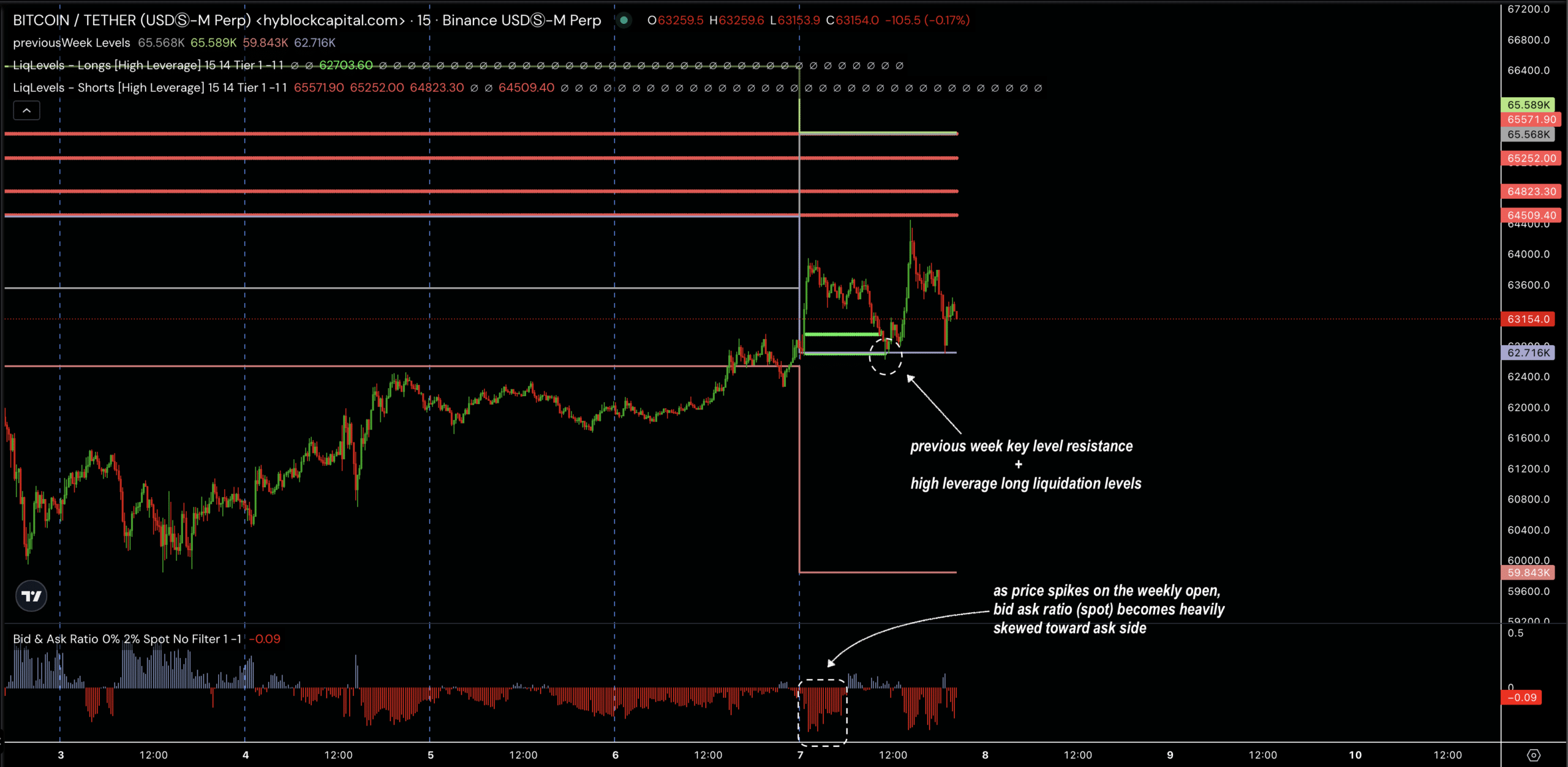

- BTC liquidation ranges and pwEQ may very well be key for potential bounces.

- The 50 & 200-Day Shifting Averages forming a Golden Cross.

Bitcoin [BTC], probably the most dominant digital asset, continues to draw consideration, with its worth drawing important evaluation.

With the present market momentum, merchants are actively looking for alternatives, particularly in zones with excessive risk-to-reward ratio.

Lately, Bitcoin surged throughout the weekly open, creating two main lengthy liquidation ranges on account of excessive leverage, which aligned completely with final week’s equilibrium (pwEQ).

The pump confronted resistance because the bid-ask ratio tilted closely towards the ask facet. This led to a retracement, bringing BTC again to vital ranges, making these liquidation factors and pwEQ key areas for potential worth bounces.

The bid-ask ratio is now exhibiting a shift towards demand, with extra bids showing inside 2% of the present worth.

This means that entry ranges round $62K to $63K may provide excessive returns if Bitcoin continues its upward momentum.

Trying additional into BTC/USD worth motion, the $62K to $63K zone is rising as a vital stage.

The 50-day and 200-day MAs are nearing a golden cross formation, a bullish sign indicating potential upward momentum.

This sample, mixed with the liquidation ranges and pwEQ alignment, strengthens the argument for additional positive factors.

The final time an analogous golden cross occurred was final yr, which preceded a big bullish run, hinting {that a} breakout may very well be close to as bulls take management.

BTC provide and momentum

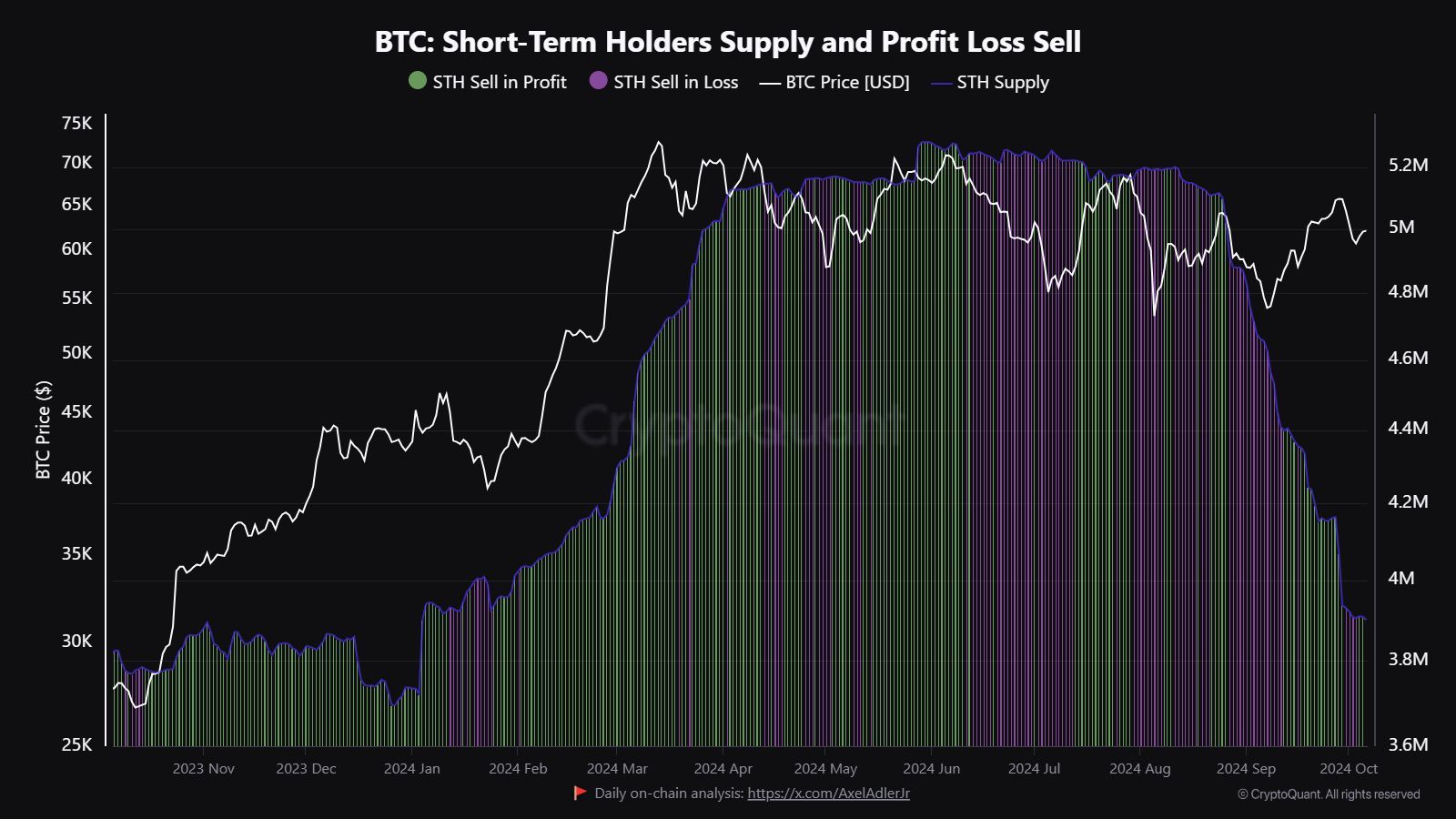

Moreover, analyzing short-term holder conduct reveals that weaker palms have been exiting the market. When Bitcoin’s worth drops, short-term holders typically panic-sell, sometimes locking in losses.

That is mirrored in a rise in purple bars on the chart, marking sell-offs throughout downturns. As weak palms exit, Bitcoin shifts to stronger palms, doubtlessly stabilizing the market.

The STH provide has declined considerably, particularly after main sell-offs, suggesting that promoting stress has eased.

This decline in provide may create favorable situations for accumulation, additional supporting the significance of the $62K — $63K zone for top risk-to-reward alternatives.

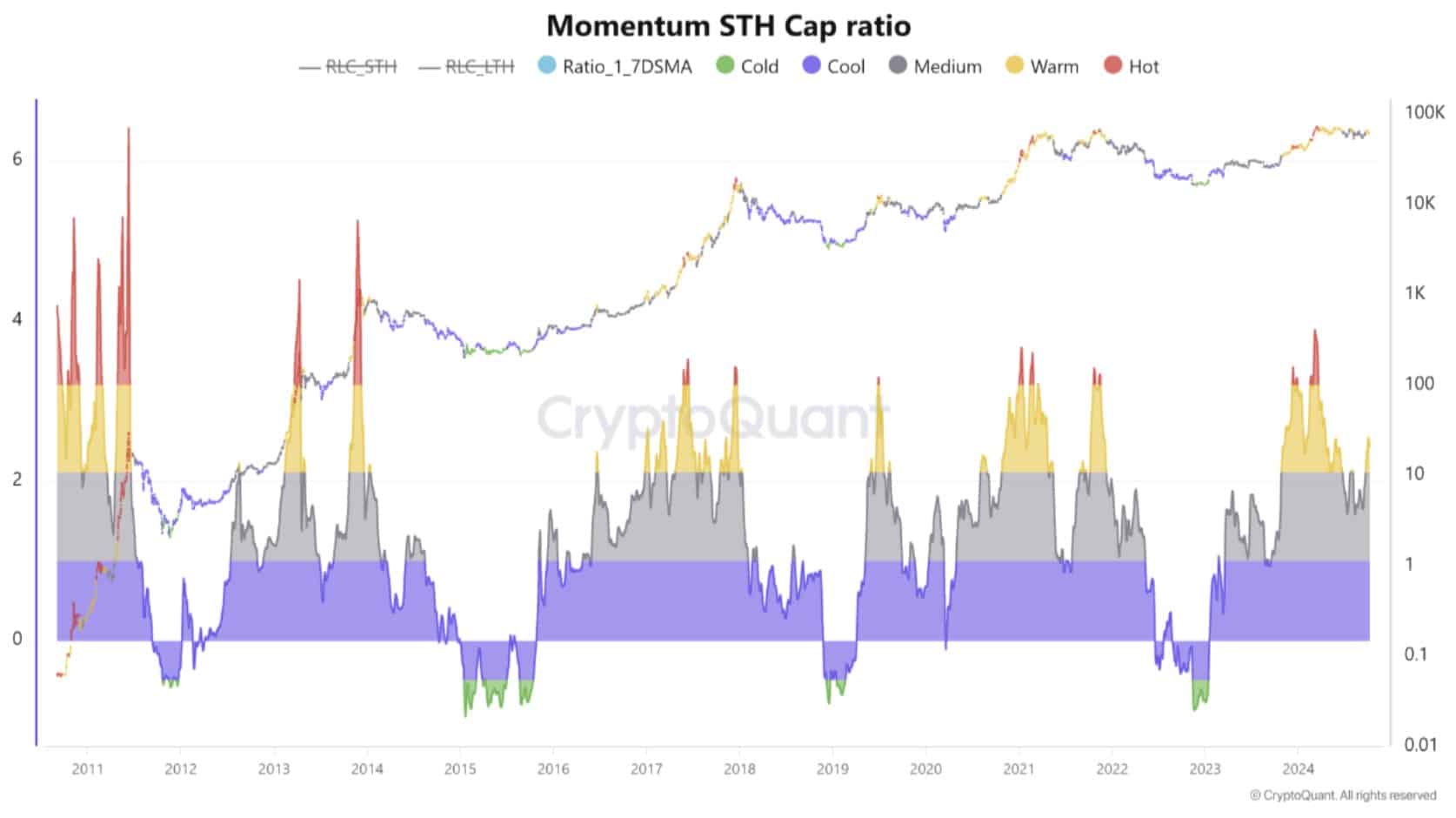

Lastly, the Momentum Brief-Time period Cap indicator, which measures the distinction between Bitcoin’s market cap and realized cap over short-term durations, is exhibiting indicators of restoration, although slowly.

This ratio is a dependable indicator of market peaks for short-term holders, highlighting potential worth thresholds.

Whereas the present ratio signifies that the market is warming up, macroeconomic components and gradual restoration in momentum recommend that Bitcoin’s subsequent main transfer could take time.

Nonetheless, as soon as these situations enhance, momentum may return quickly, doubtlessly pushing Bitcoin’s worth increased and signaling the highest of the present cycle.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

Bitcoin’s present worth ranges provide important potential, particularly with robust technical indicators just like the golden cross and declining STH provide pointing towards a bullish outlook.

With momentum constructing, BTC may see increased costs within the coming months.