- A dormant pockets transferred 8,000 BTC, valued at roughly $536.5 million.

- It suggests a renewed curiosity in BTC as new and former traders have interaction with the market.

The cryptocurrency market has been navigating by way of turbulent waters, with Bitcoin [BTC] struggling to retest its earlier highs.

At the moment, Bitcoin is buying and selling at roughly $67,302, marking a close to 6% lower over the previous week, and a slight drop of 0.7% in simply the previous 24 hours.

This downturn was a part of a broader decline throughout the crypto market, which has seen its whole valuation dip to round $2.57 trillion—a 1.3% fall inside a day.

New exercise: Vital whale motion

Amidst this broader market pullback, an intriguing improvement occurred involving a long-dormant Bitcoin pockets. This pockets, which had not seen any exercise since December 2018, all of the sudden transferred 8,000 BTC, valued at roughly $536.5 million.

The transaction was initiated from a pockets related to Coinbase’s chilly storage, shifting the funds on to a identified Binance deposit deal with.

The sequence of those transactions raises a number of questions in regards to the intentions behind them and their potential market impression.

Initially obtained in a number of tranches in late 2018, when Bitcoin’s worth hovered round $3,750, these cash have appreciated considerably.

The transaction from the dormant pockets didn’t embrace any check transfers, which is commonly uncommon for actions involving such important sums.

Traditionally, when dormant wallets with giant balances change into energetic, it usually indicators potential promoting strain available in the market, particularly if funds are moved to trade addresses.

This sample means that the pockets proprietor might be gearing as much as money out, capitalizing on the practically 1,700% worth enhance for the reason that BTC was first acquired.

Furthermore, the activation of such wallets can generally coincide with broader market actions. Chainalysis studies that almost 1.8 million Bitcoin addresses have been inactive for over a decade, representing a considerable $121 billion in potential market worth.

Not all of those wallets will change into energetic—many are seemingly inaccessible on account of misplaced non-public keys—however people who do can considerably impression market dynamics.

Uptick in Bitcoin community participation

The current transaction coincides with an uptick in general market exercise.

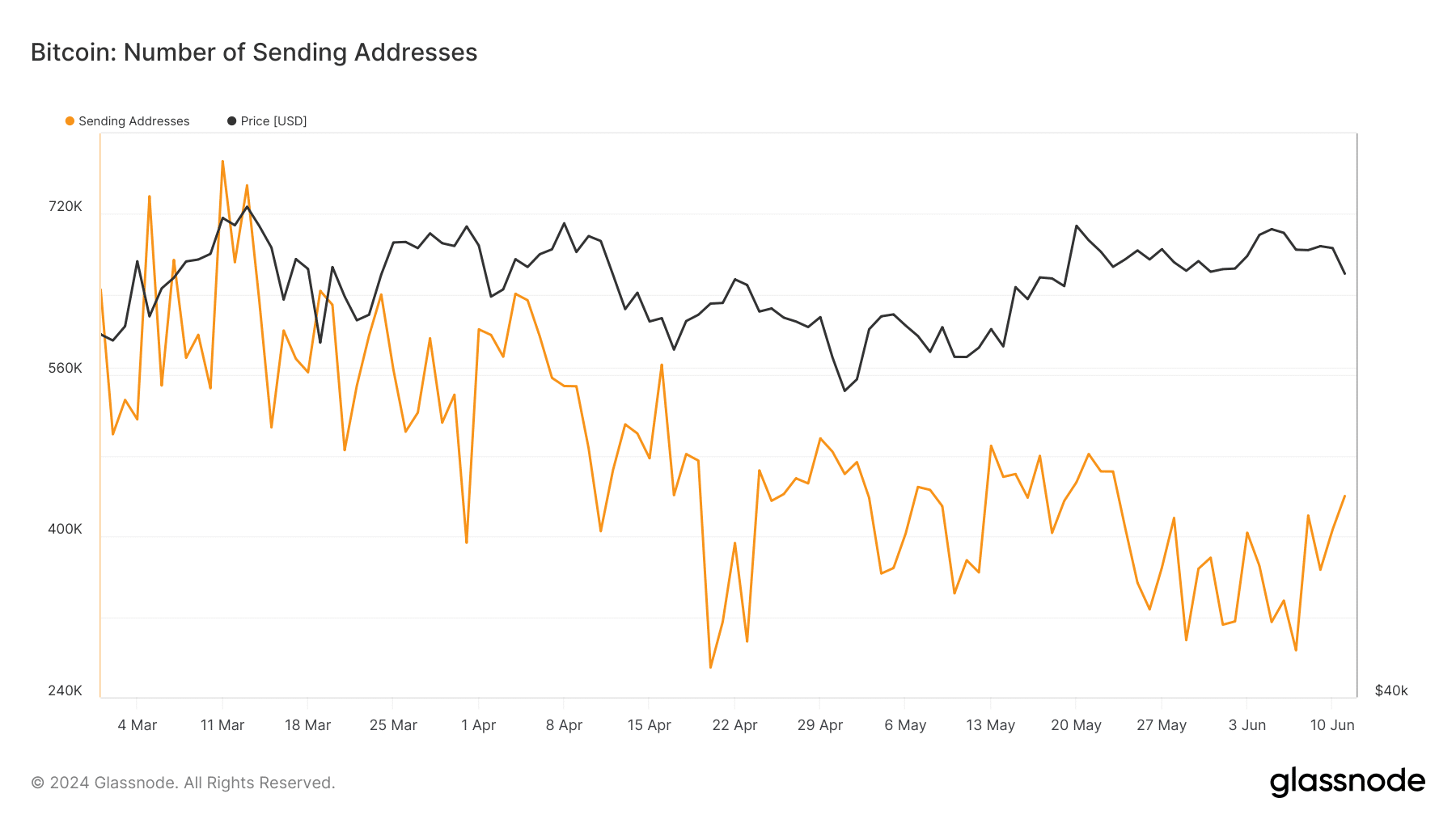

Information from Glassnode reveals a rise within the variety of energetic sending addresses on the Bitcoin community, rising from beneath 300,000 to over 400,000 just lately.

Learn Bitcoin’s [BTC] Value Prediction 2024-2025

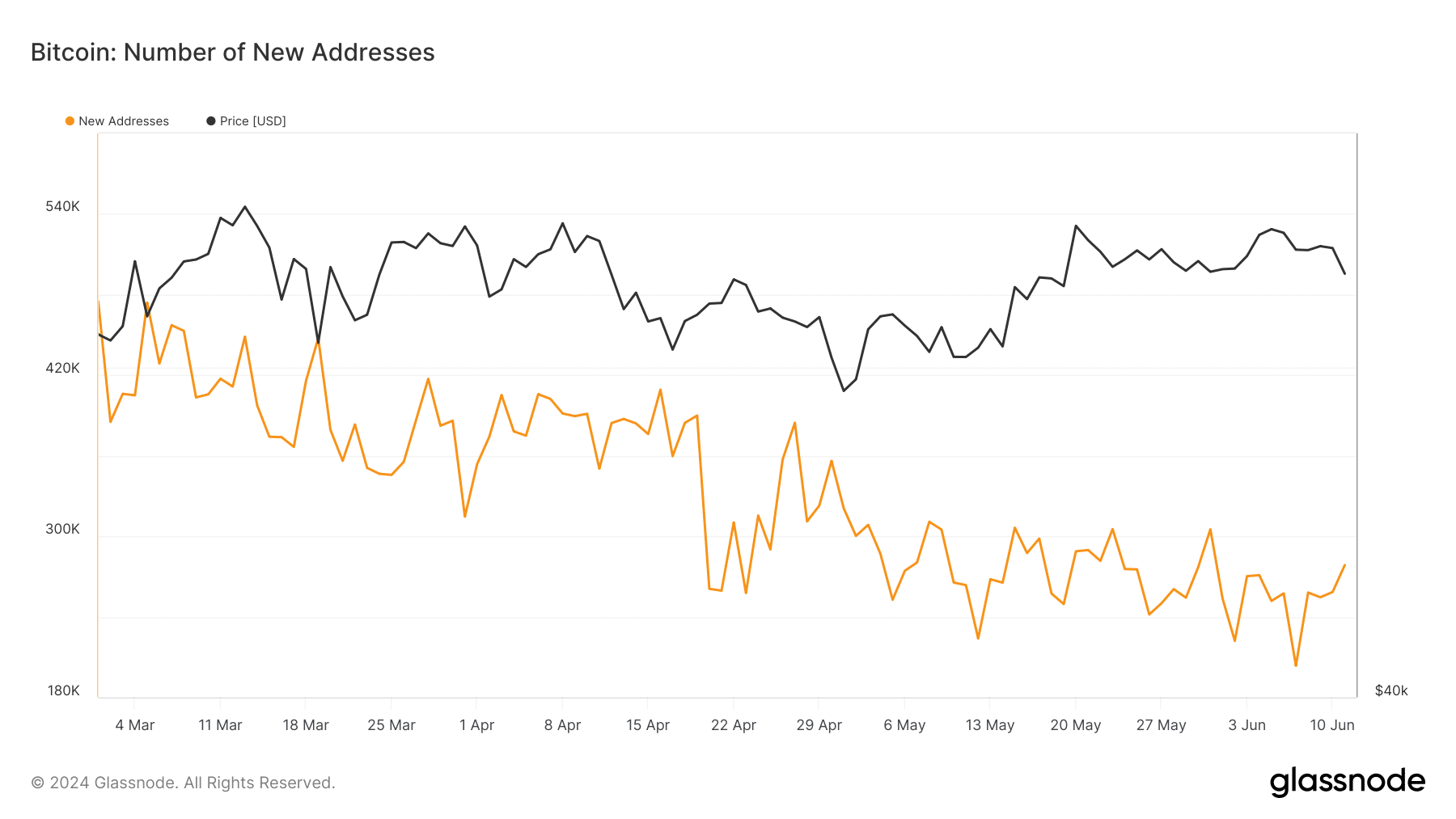

This resurgence in energetic addresses, coupled with a noticeable rise in new Bitcoin addresses—from 203,000 to 278,000—suggests a renewed curiosity or presumably speculative exercise as new and former traders have interaction with the market.

Whereas it’s unsure how this single transaction may affect Bitcoin’s general market standing, AMBCrypto just lately highlighted the significance of Bitcoin sustaining its strong help stage to maintain an upward pattern.