- Bitcoin’s market stability considerably unsettled as a consequence of extra lengthy/brief positions

- Geopolitical tensions are affecting Bitcoin’s worth

The bigger cryptocurrency market is experiencing a decline, with Bitcoin (BTC) main this downward pattern. Whereas it hit the next excessive of $66k in the direction of the tip of September, it was valued at simply over $60k, at press time.

In response to Hyblock Capital knowledge, Bitcoin’s market stability is considerably unsettled. In consequence, BTC may be primed for one more correction, notably within the early phases of 2024’s final quarter.

This excessive investor habits supplies perception into potential market turning factors. When there are extreme lengthy or brief positions, it implies that the market stability is disturbed.

Understanding market stability is essential, as extreme lengthy or brief positions usually sign potential corrections or pattern reversals.

Many merchants had anticipated a bullish pattern, however present dynamics are steering the sentiment in one other path.

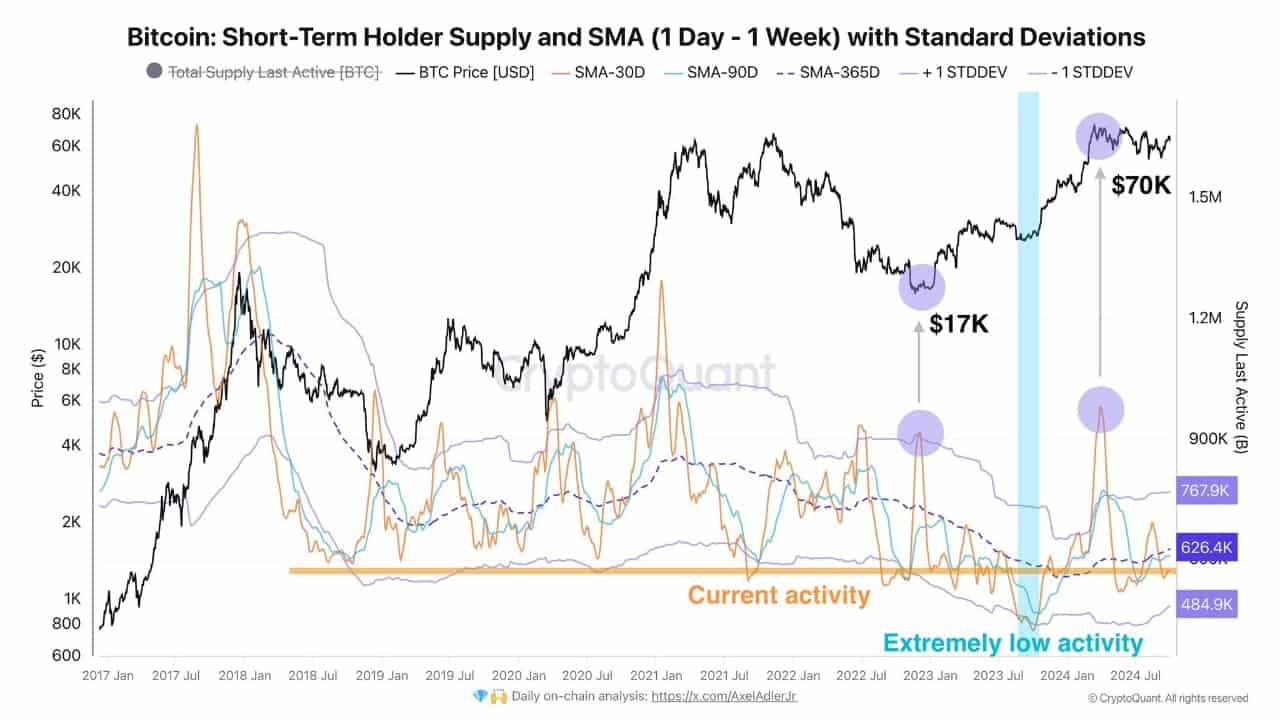

Bitcoin Quick-Time period holder provide

If short-term traders cut back their provide by 80,000 BTC, it might pave the best way for a brand new bullish pattern. This discount would assist stabilize the market, making it simpler for Bitcoin to regain its footing.

In current weeks, there was an inflow of provide flooding exchanges, contributing to downward strain on Bitcoin’s worth. On the time of writing, Bitcoin’s exercise was buying and selling under the 365-day SMA, reinforcing a bearish outlook.

As provide will increase whereas demand decreases, the worth of BTC is more likely to proceed declining. Because of this a correction could also be imminent.

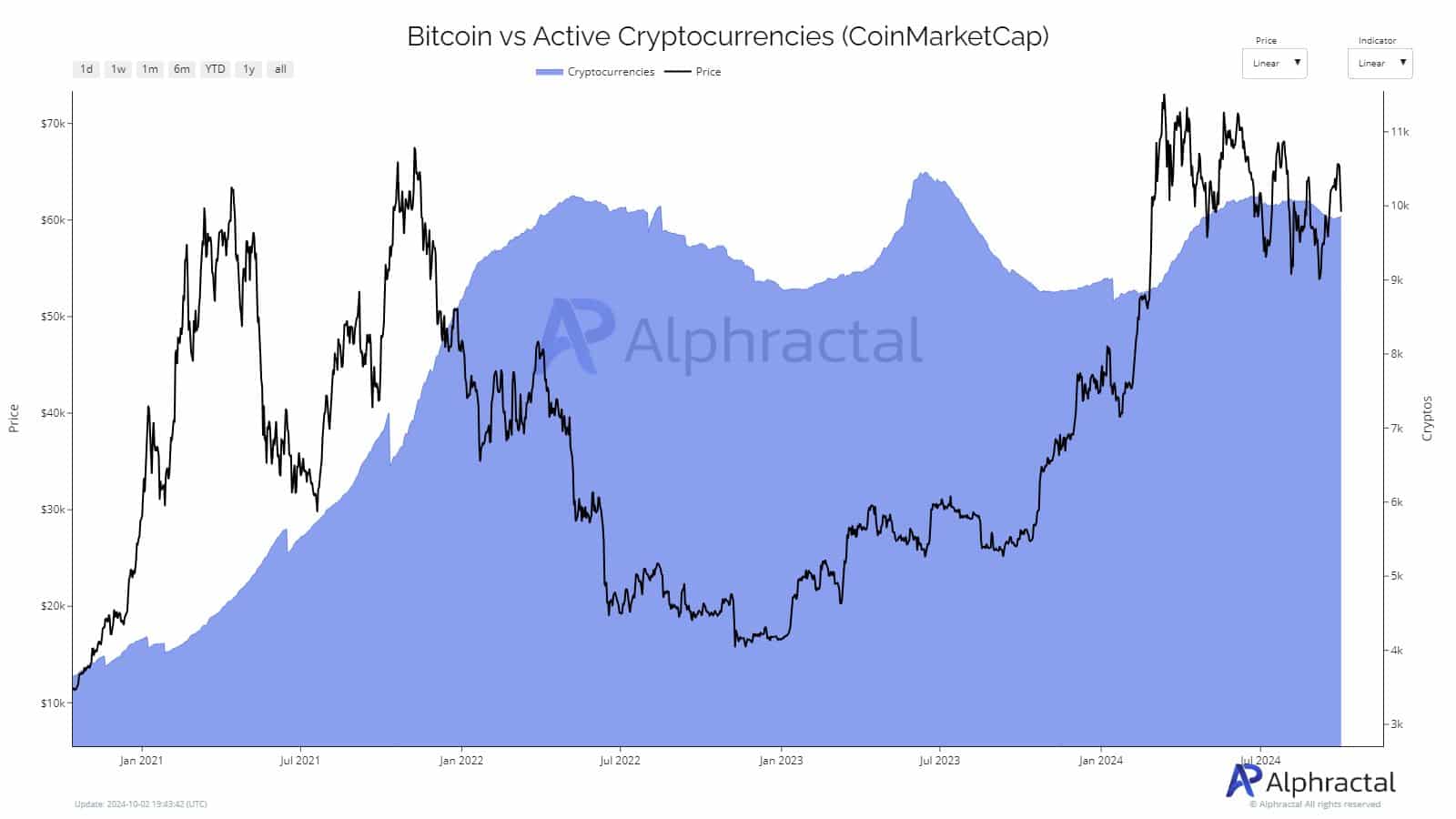

Curiosity in lively cryptocurrencies

On the identical time, the variety of lively cryptocurrencies has stagnated because the finish of 2021. This lack of development could also be an indication of decreased curiosity in launching new tasks.

A number of elements can contribute to this pattern, together with market weak spot and regulatory pressures. This example is additional indication that Bitcoin could possibly be headed for a correction on the charts quickly.

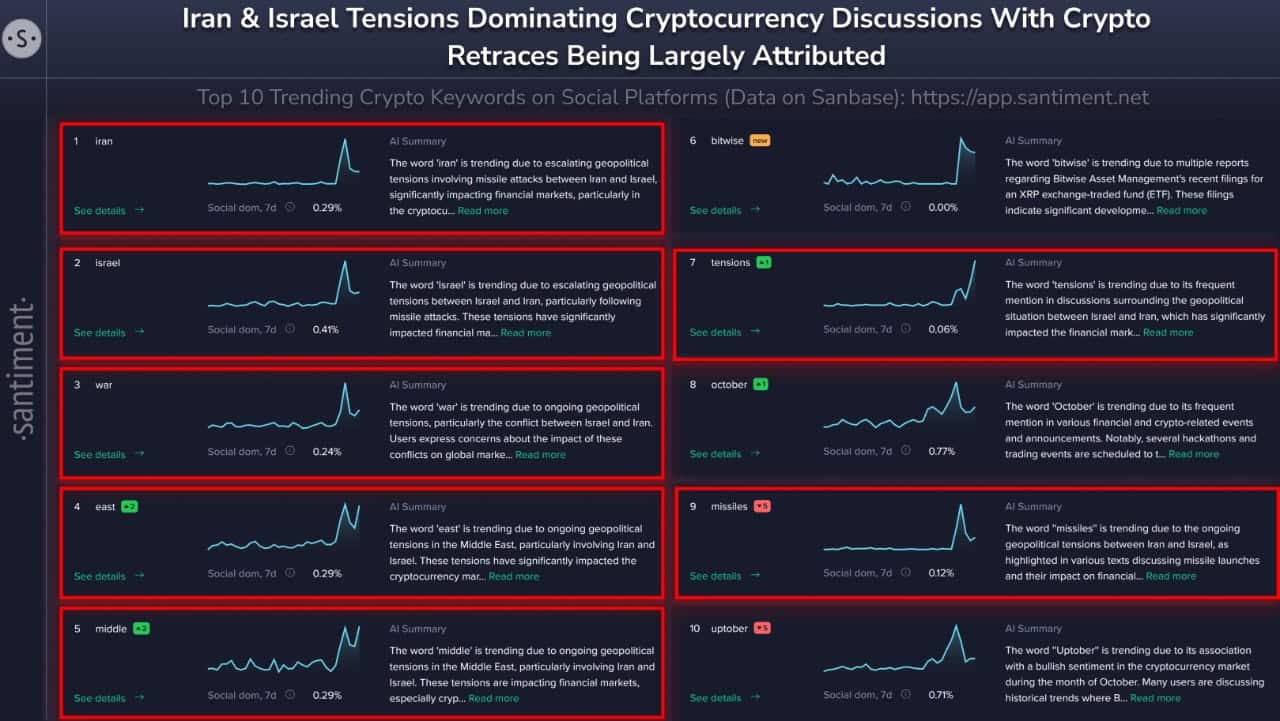

International tensions affecting costs

Present geopolitical tensions, notably the battle between Iran and Israel, are influencing cryptocurrency costs too. In reality, historic knowledge confirmed that in real-world conflicts, Bitcoin costs usually see preliminary drops, adopted by recoveries.

As an example, in October 2023, Bitcoin fell by 5% within the first 4 days. Nonetheless, it then rebounded by 12% over the next 9 days.

Equally, through the Ukraine-Russia battle in February 2022, BTC dropped 10% on the primary day, however surged by 27% within the subsequent six days.

Given these patterns, it seems that Bitcoin is present process a correction, earlier than a possible rally within the final quarter. Nonetheless, can the unscarred whales assist BTC maintain above the $60k degree now?

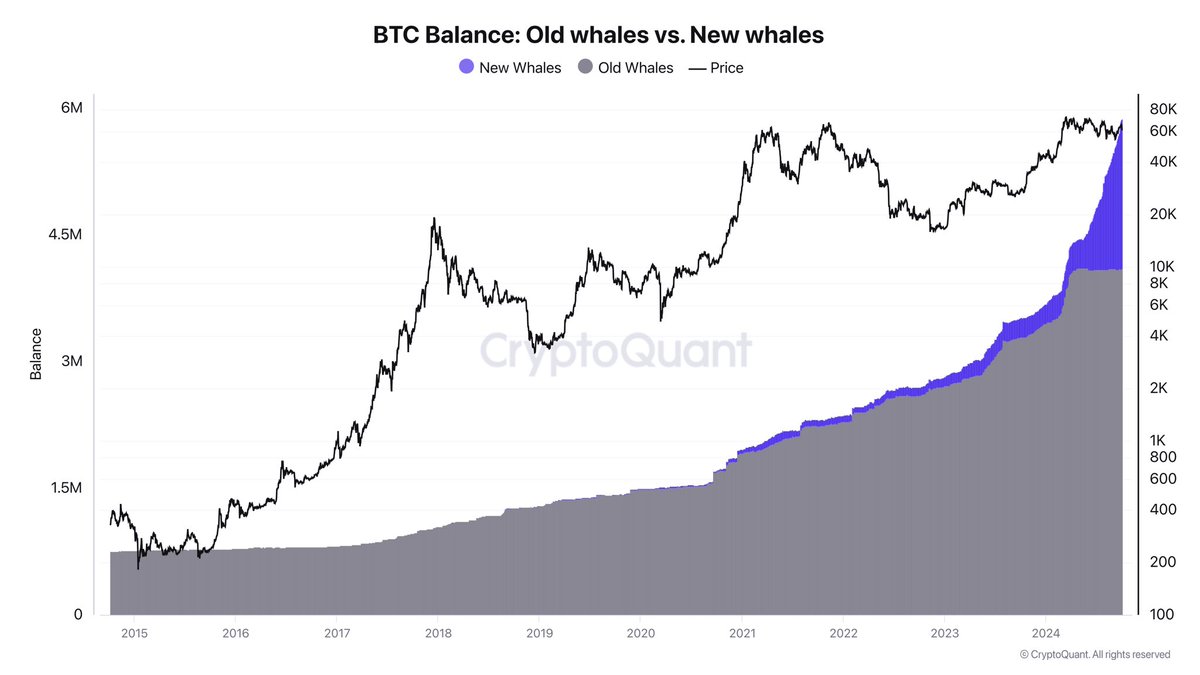

BTC’s whale exercise

Regardless of present market volatility, each new and outdated whales stay unfazed. The actions within the Futures market are a part of a broader technique, one the place actual market adjustments happen by means of spot buying and selling and over-the-counter (OTC) markets, as Ki Younger Ju famous on X.

The stream of Bitcoin into custody wallets implies that everlasting holders are growing their stakes. By doing so, they’re supporting a bullish outlook for Bitcoin in the long term.

In reality, CryptoQuant knowledge revealed that older whales have been seeing minimal returns, whereas newer whales are aggressively accumulating Bitcoin.

This can probably assist BTC maintain above the $60k degree. Value noting although that the bias is topic to the unpredictable nature of crypto markets.