- The funding charge indicated a bullish sign, nevertheless, the Coinbase Premium Index would possibly resist the uptrend.

- BTC might need hit a neighborhood high, therefore, its rise to a brand new excessive could possibly be delayed.

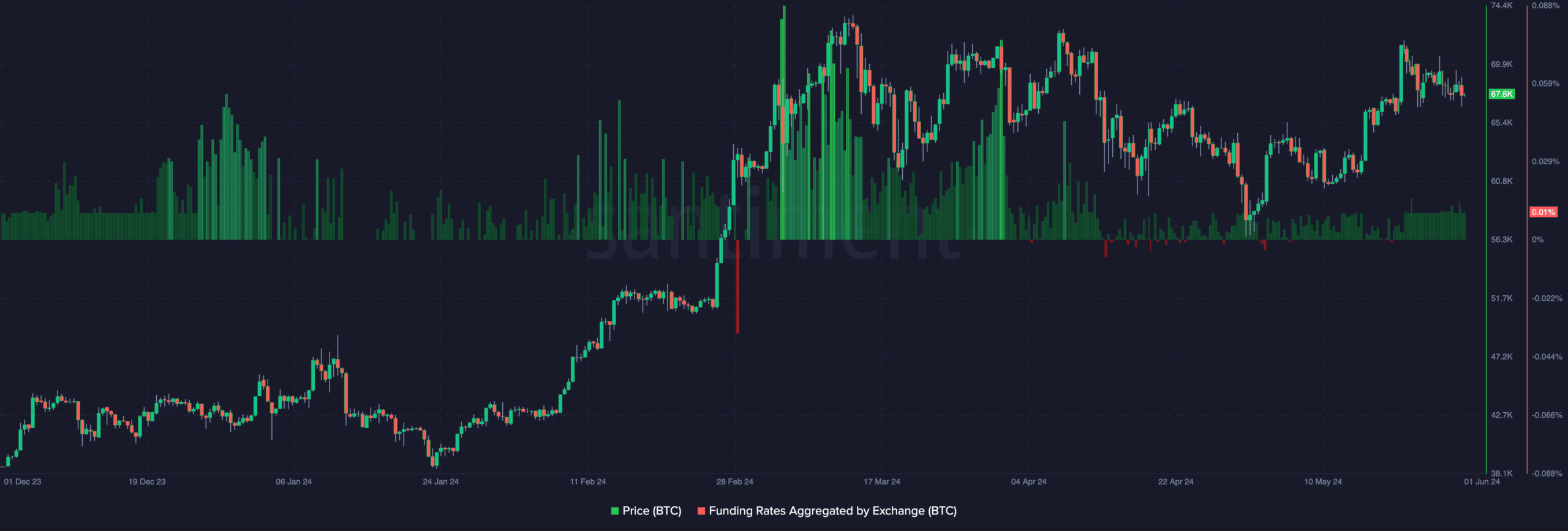

Bitcoin’s [BTC] funding charge has been low since mid-Might, AMBCrypto confirmed. Although this implied low investor expectations, it could possibly be good for BTC’s value.

Funding charge is the price of holding an open contract out there. When the studying is constructive, it implies that the perp value is buying and selling meaningfully above the index worth

Decrease optimism, increased BTC costs?

Then again, a unfavourable funding charge means that the spot value is increased than the contract value. At press time, Bitcoin’s funding charge was $0.01%.

However regardless of being constructive, this was a decrease studying in comparison with what it was just a few weeks in the past. From a buying and selling perspective, the low funding charge alongside the declining value signifies that perp consumers had been fading Bitcoin’s transfer.

Nevertheless, it additionally implies that spot merchants had been turning into aggressive. If this continues, Bitcoin may revisit $70,000 inside a brief interval.

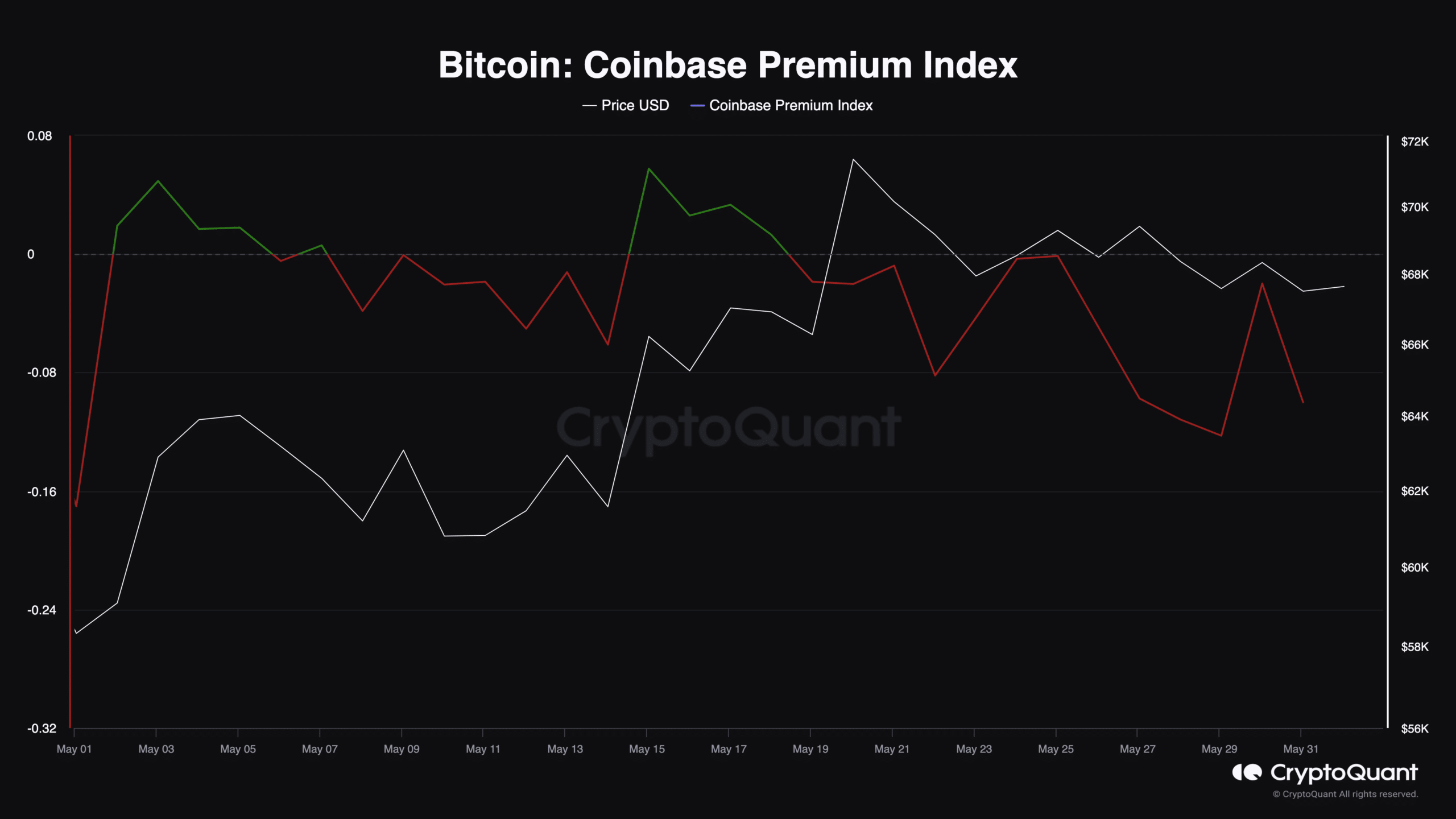

However the revival won’t be fast. That is due to the situation of the Coinbase Premium Index. The index is the distinction between BTC’s value on the Coinbase change and the worth on different exchanges.

If the worth of the index is excessive, it implies that U.S. traders are shopping for a variety of BTC, thereby placing good strain on the value. Nevertheless, a decline within the metric signifies a rise in gross sales of Bitcoin by traders within the nation.

As of this writing, the Coinbase Index Premium was -0.10, indicating that promoting strain was intense. From the chart beneath, AMBCrypto seen that this lower was one of many causes Bitcoin stored getting rejected.

Bearish forces are nonetheless at work

Nevertheless, if the studying will increase, it may set off a breakout for BTC. Analyst TraderOasis additionally agreed with this in his evaluation on CryptoQuant, noting that,

“As a result, when the price reaches the daily gap, the increase in the Coinbase Premium Index indicator will be our signal.”

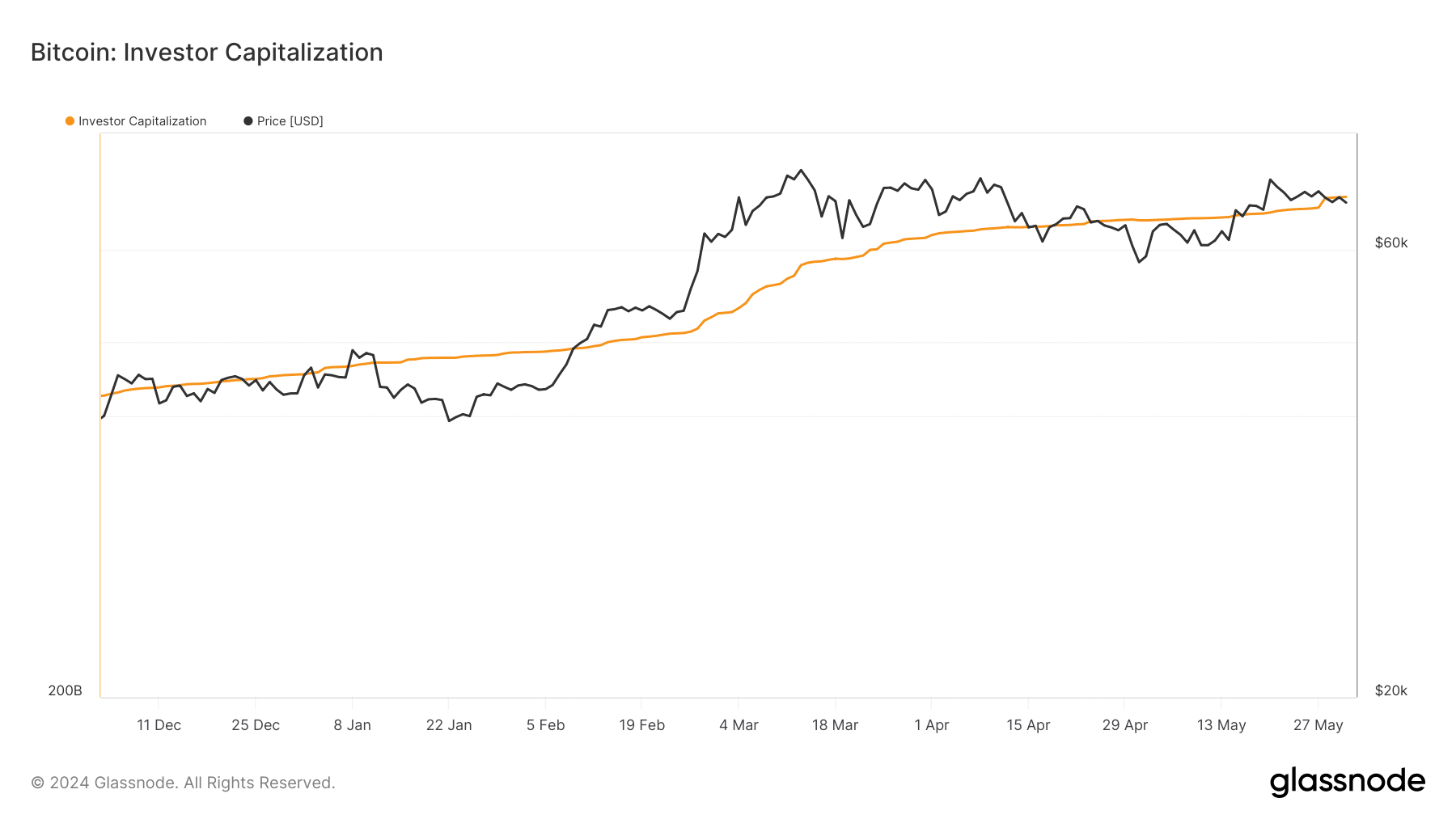

Moreover, AMBCryto examined the investor capitalization offered by Glassnode. Investor capitalization can inform if BTC is near the underside or has hit a neighborhood high.

At press time, the metric was across the identical spot as Bitcoin’s value, indicating that the coin was in a important space. Ought to the metric rise above BTC, then it will point out a neighborhood high and pressure a correction.

Conversely, if the value of Bitcoin jumps a lot increased than it, the worth would possibly recognize, and it’d retest $70,000.

Is your portfolio inexperienced? Examine the Bitcoin Revenue Calculator

Nevertheless, volatility round BTC remained low at press time. This means that the value would possibly hold swinging in a decent vary for a while.

Shifting on, there’s a likelihood that the metrics talked about above may change to the constructive signal. If that is so, the value of the coin may try to surpass its all-time excessive earlier than the tip of June.