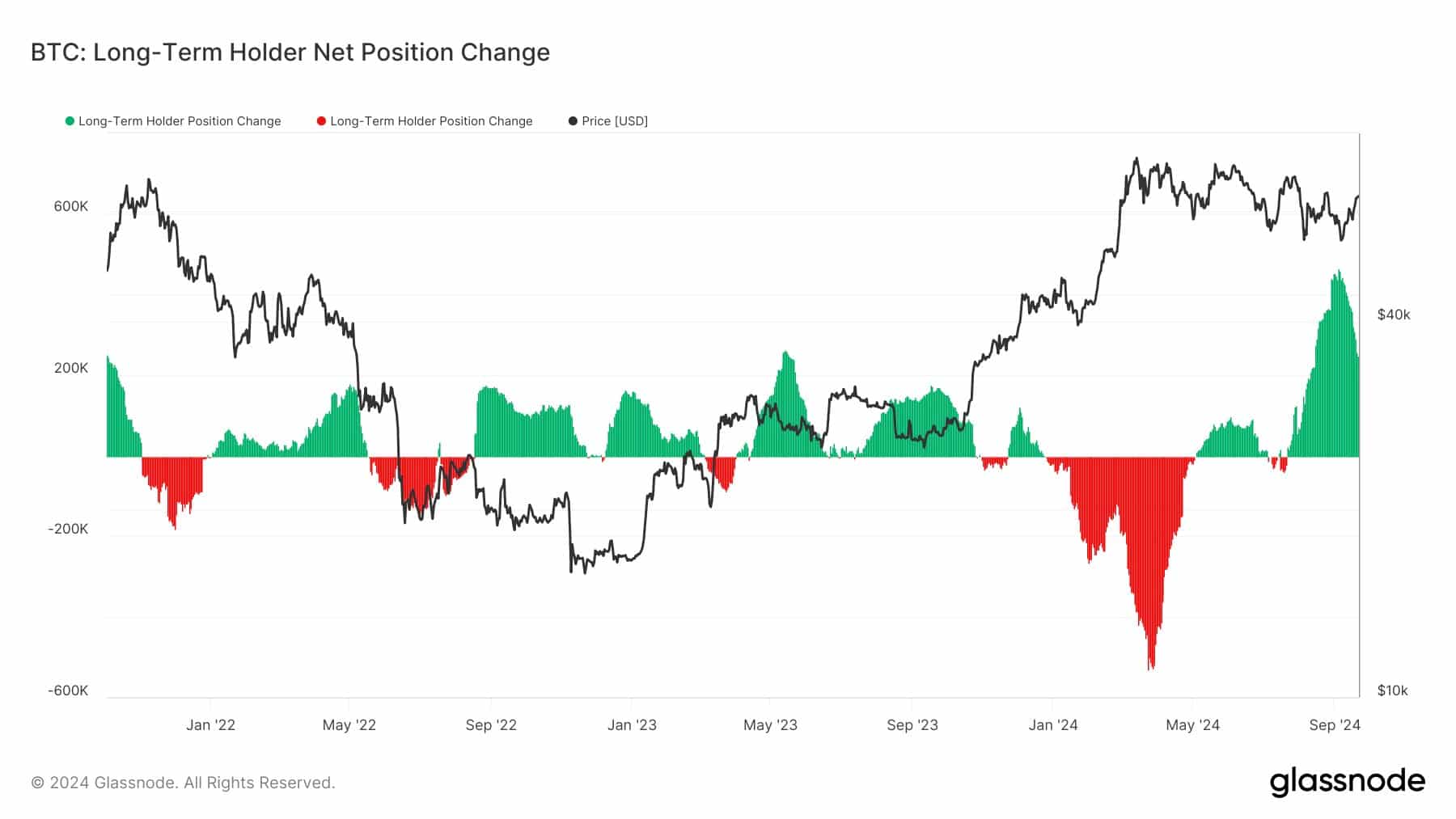

- Bitcoin long-term holders have been shopping for aggressively.

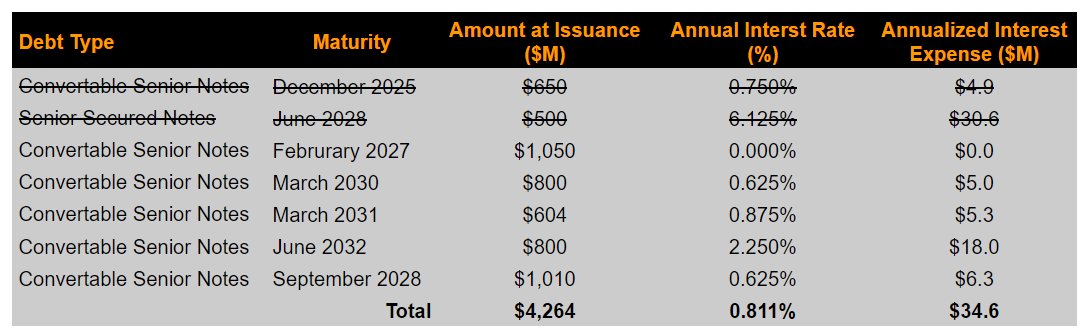

- MicroStrategy’s convertible debt will allow extra buy of Bitcoin.

Bitcoin [BTC] continued to exhibit power because the crypto market rebounded after a six-month downturn. Lengthy-term holders’ actions are essential for BTC merchants, providing insights into commerce timing.

Over the past two months, long-term holders have amassed extra BTC, marking the very best accumulation interval within the final three years.

Moreover, these traders, together with new entrants, have collectively bought over 1 million BTC since from the 12 months 2022.

This aggressive shopping for conduct indicators robust confidence in Bitcoin’s future. A few of the earliest Bitcoin mining addresses have not too long ago turn out to be energetic, additional rising the long-term provide of BTC.

MicroStrategy (MSTR) leads prime 10 performing shares within the S&P 500, continues to assist Bitcoin with beneficial properties of over 1000% since adopting its BTC technique.

Just lately, MSTR issued $1 billion in convertible debt at a low 0.625% rate of interest to redeem $500 million of senior secured notes with a 6.125% price to fund the acquisition of Bitcoins.

This transfer diminished its blended rate of interest to 0.81% from 1.6%, decreasing annual curiosity bills.

Remarkably, this debt providing additionally strengthens MicroStrategy’s stability sheet, permitting it to probably purchase extra Bitcoin sooner or later, even when BTC costs fall.

The continuing acquisitions by main establishments like MSTR place Bitcoin for future development.

Bitcoin 3-day MACD crossed bullish

Furthermore, BTC’s 3-day MACD has crossed into bullish territory, signaling continued power as BTC trades above $63K.

With expectations of breaking the $65,000 stage quickly, Bitcoin is exhibiting resilience and a rising pattern of reclaiming the 100-day transferring common.

This upward momentum urged that being bearish on BTC presently could also be dangerous, particularly as Bitcoin seems poised to succeed in new highs.

Efficiency from cycle lows

Lastly, analyzing Bitcoin’s value efficiency since its cycle lows revealed that within the final three market cycles, BTC has constantly completed larger within the month of September.

Bitcoin is up roughly 300% from the low of the present cycle. If BTC continues its historic sample and finishes the 12 months between the earlier cycles, the value goal might probably attain $108K.

With bettering market situations, this goal is turning into more and more potential.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

Bitcoin’s robust institutional backing, rising long-term holder exercise, and bullish technical indicators level to the potential of BTC value transferring considerably larger within the close to future.

The rising confidence amongst traders and main gamers like MicroStrategy solely strengthens the outlook for Bitcoin because it continues to rise in each value and market dominance.