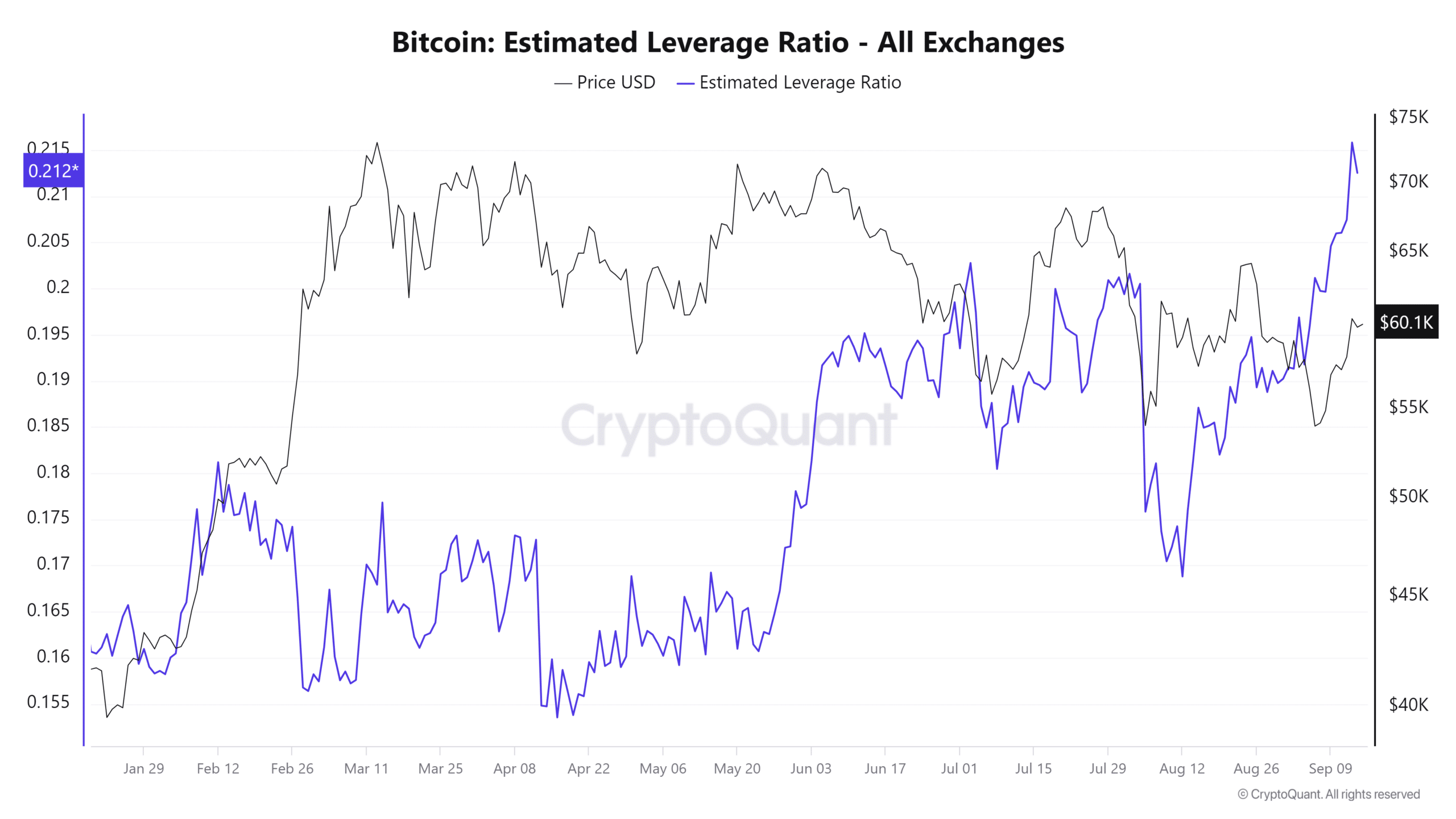

- The borrowed funds in BTC have hit a yearly excessive.

- The value continues to wrestle across the $60,000 worth vary.

Bitcoin [BTC] lately broke via its psychological barrier, getting into the $60,000 worth vary. Nonetheless, this milestone has introduced vital stress, with some whales taking earnings and Bitcoin’s Estimated Leverage Ratio hitting a year-high.

Bitcoin leverage hits a year-high

In keeping with knowledge from CryptoQuant, Bitcoin’s Estimated Leverage Ratio surged to 0.216, the very best stage seen in 2024. This metric reveals how a lot leverage (borrowed funds) is being utilized in Bitcoin buying and selling.

A rise in leverage usually means that merchants are taking up extra danger. Suppose the BTC worth strikes in the other way of those leveraged positions.

In that case, it will possibly result in large-scale liquidations as leveraged positions are forcefully closed. This usually leads to fast worth drops.

Moreover, a rising leverage ratio indicators potential worth volatility. As extra leverage enters the market, worth actions, whether or not upward or downward, are amplified.

If BTC continues to rise alongside growing leverage, it might result in an overheated market, the place any pullback may trigger vital liquidations.

Alternatively, a sudden worth drop might set off liquidations, inflicting a pointy decline in BTC’s worth.

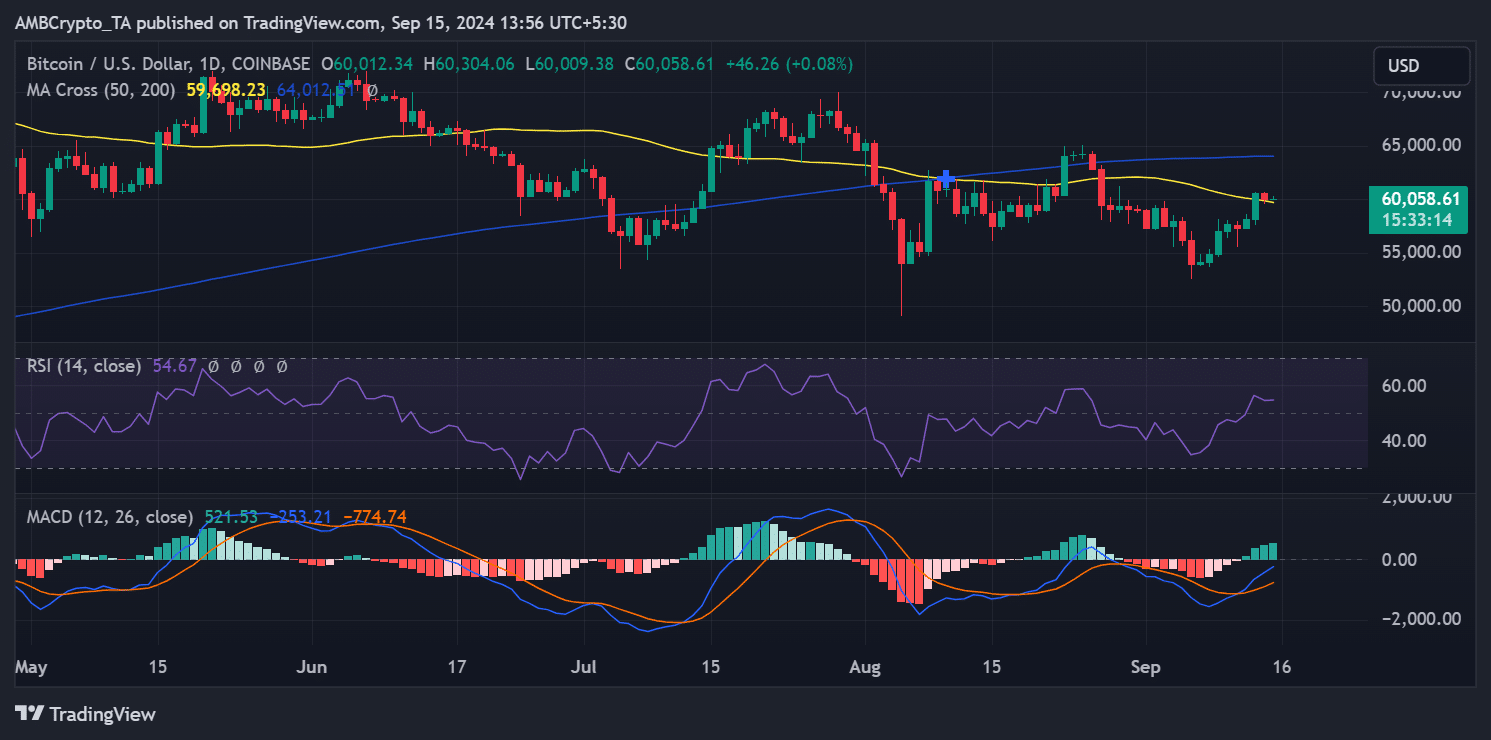

Bitcoin faces resistance after worth break

After surging by over 4% on thirteenth September, Bitcoin broke via its short-moving common, buying and selling at round $60,543.

Nonetheless, it struggled to maintain this momentum, as seen from subsequent developments. Bitcoin dropped by 0.8% within the following buying and selling session to round $60,012.

BTC has barely elevated buying and selling at round $60,095 as of this writing. The dearth of a powerful follow-up signifies that the asset has confronted substantial promoting stress, with some buyers taking earnings after BTC’s rise.

Whales reap the benefits of worth rise

Information from CryptoQuant confirmed that Bitcoin whale addresses took benefit of the current worth surge to understand earnings. When BTC broke the $60,000 barrier, the realized earnings of those whales spiked.

Learn Bitcoin (BTC) Worth Prediction 2024-25

Whale addresses reportedly took earnings exceeding $50 million, capitalizing on the value improve.

This whale exercise underscores Bitcoin’s stress at this worth stage as massive buyers lock in positive aspects, probably resulting in short-term worth volatility.