- Bitcoin’s increasing triangle sample indicators excessive volatility, setting the stage for a breakout or drop.

- MVRV ratio suggests holders are in revenue, however there’s room earlier than important profit-taking ranges are reached.

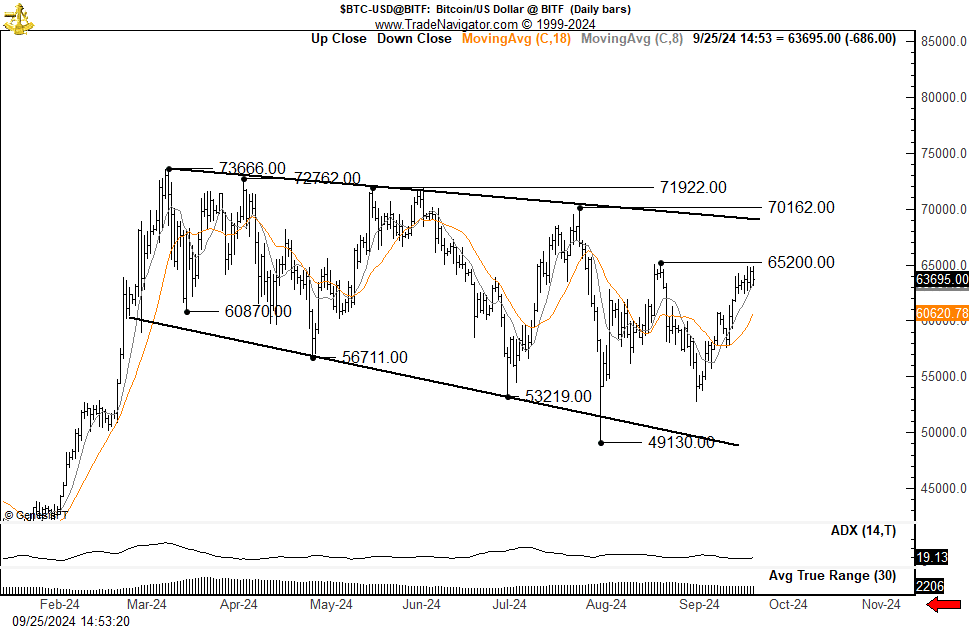

Bitcoin’s [BTC] worth continued to type an increasing triangle sample at press time, catching the eye of analysts.

This formation, characterised by a broadening worth motion, suggests market indecision with rising volatility.

Crypto analyst Peter Brandt notes that Bitcoin is in a sequence of decrease highs and decrease lows, which can persist until the worth closes meaningfully above the July highs.

The present technical setup could possibly be setting the stage for a significant breakout or additional draw back dangers.

Increasing triangle and assist ranges

Bitcoin’s increasing triangle formation displays uncertainty available in the market, with widening worth swings that sign rising volatility. Traditionally, such patterns have typically preceded sharp strikes, both upwards or downwards.

Bitcoin’s decrease boundary round $49,130 and former lows at $53,219 are essential assist ranges to observe. A break beneath these factors might point out additional draw back dangers, probably resulting in extra vital losses.

As of press time, Bitcoin was buying and selling round $63,838.14, exhibiting a slight 0.01% achieve within the final 24 hours and a 2.85% improve over the previous week.

The market stays on edge, ready for a decisive transfer as the worth hovers close to important resistance ranges.

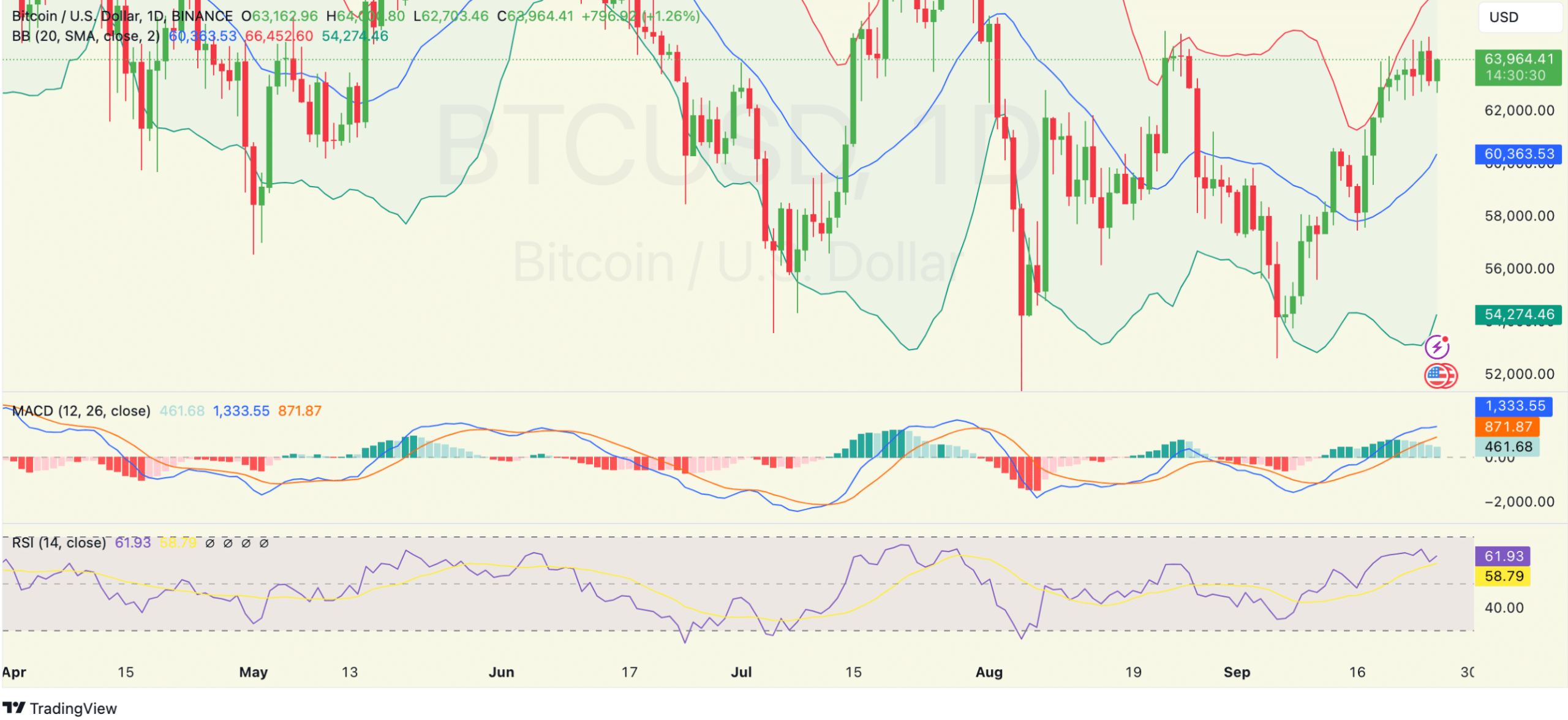

Bollinger bands and momentum indicators

The value motion is consolidating close to the higher Bollinger Band, which suggests Bitcoin is testing resistance at round $63,800.

The widening of the bands signifies a possible improve in volatility, typically seen earlier than a major market transfer. If Bitcoin manages to maintain momentum above this resistance, it might sign additional upward motion.

Conversely, failure to take care of this stage could lead to a pullback in the direction of the center band close to $60,355.

Momentum indicators, such because the MACD, present a bullish stance with the MACD line above the sign line and in constructive territory.

Nevertheless, declining histogram bars trace at a slowdown in bullish momentum, elevating warning for merchants.

A possible bearish crossover might function an early warning of a reversal, prompting cautious monitoring of those technical indicators.

The Relative Energy Index (RSI) is presently round 61, indicating Bitcoin is in bullish territory however not but overbought.

This means there may be room for additional worth appreciation earlier than reaching overbought circumstances, which usually set off profit-taking.

Ought to the RSI rise above 70, merchants could start to see elevated promoting stress, probably resulting in a worth pullback.

Bitcoin income close to peak?

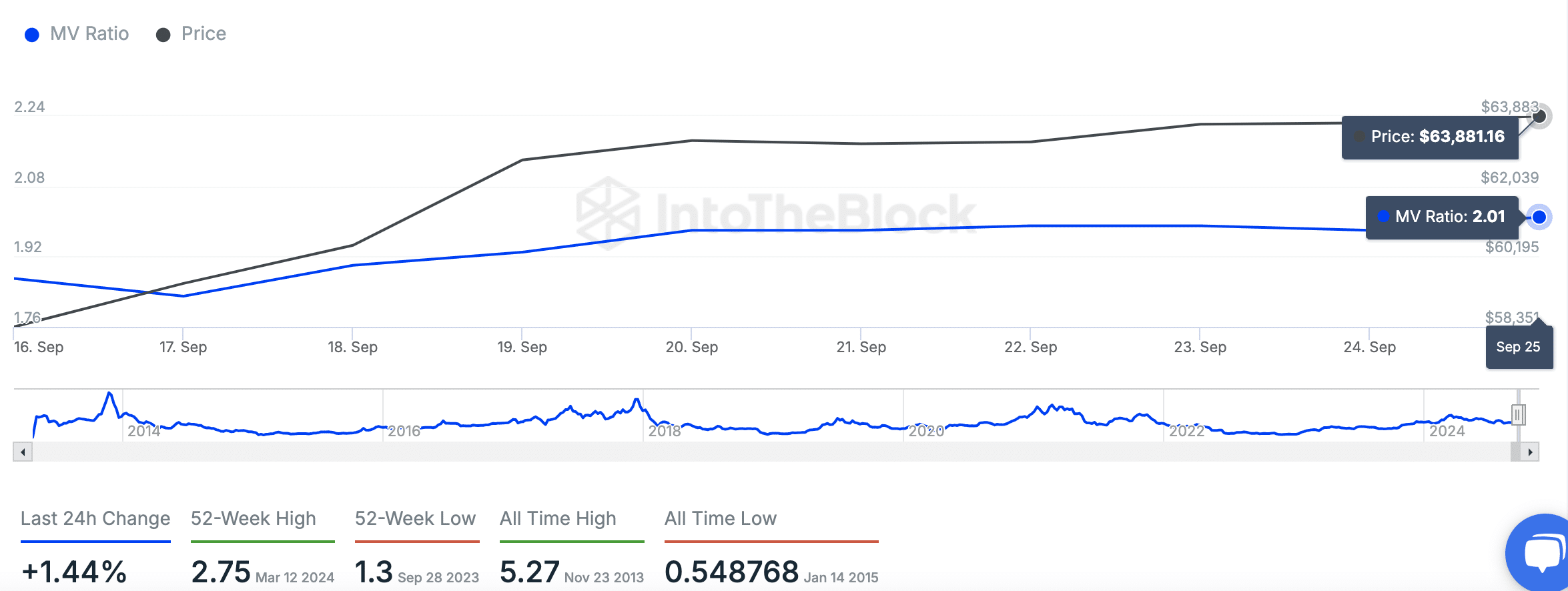

On-chain information reveals that Bitcoin’s MVRV ratio is at 2.01, reflecting that the market worth is double the realized worth.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

This ratio is rising, suggesting that holders are more and more in revenue, which might result in promoting if the ratio continues to climb.

Nevertheless, with the MVRV nonetheless beneath the 52-week excessive of two.75, there stays room earlier than reaching traditionally vital profit-taking ranges.