- Bearish sentiment retained its dominance in Bitcoin’s market

- King coin would possibly fall to $64k earlier than one other rally

Bitcoin [BTC] recorded a significant worth correction over the past 24 hours, a correction which might be attributed to conventional markets tanking and geopolitical uncertainty. The timing right here is vital, particularly since BTC is awaiting its subsequent halving in underneath every week.

Nonetheless, buyers shouldn’t lose hope as there are possibilities the cryptocurrency will get better on the charts quickly.

Bitcoin’s chart turns purple

In line with CoinMarketCap, Bitcoin’s worth fell by greater than 5% within the final 24 hours. On the time of writing, it was buying and selling at $67,241.90 with a market capitalization of over $1.32 trillion.

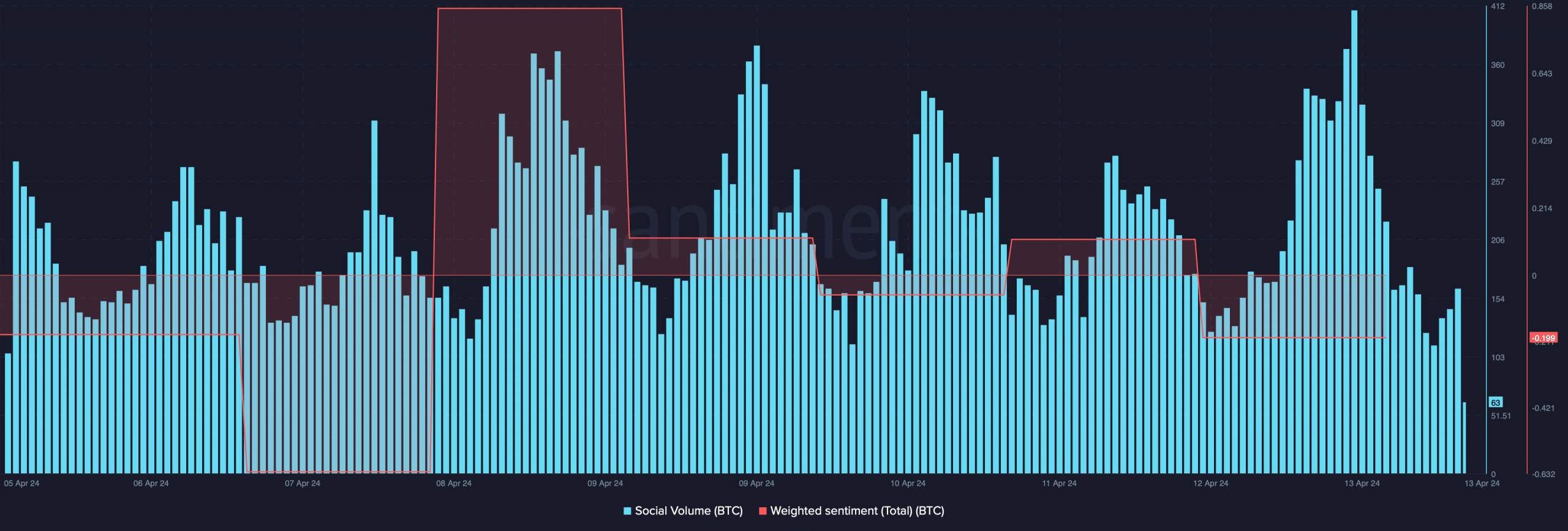

The worth decline made BTC a subject of dialogue within the crypto-space, with the identical evidenced by the hike in its social quantity. Nonetheless, its weighted sentiment graph entered the detrimental zone, that means that bearish sentiment retained its dominance out there.

Nonetheless, the aforementioned correction would possibly simply be a deception.

Captain Faibik, a preferred crypto-analyst, just lately shared a tweet highlighting an attention-grabbing replace. As per the identical, BTC’s worth remains to be transferring inside a bull sample. A profitable breakout above the sample might lead to BTC hitting a brand new ATH within the coming weeks. Earlier than that occurs although, there are possibilities BTC’s worth would possibly fall again to $66k.

Will BTC get better quickly?

AMBCrypto’s have a look at Bitcoin’s metrics revealed that BTC would possibly fall additional within the brief time period.

Our evaluation of CryptoQuant’s information highlighted that the crypto’s internet deposit on exchanges was excessive, in comparison with the final seven days’ common. Its change reserves have been climbing too – An indication of excessive promoting strain.

Moreover, Bitcoin’s aSORP was purple, that means that extra buyers have been promoting at a revenue. On prime of that, BTC’s Internet Unrealized Revenue and Loss (NULP) steered that buyers have been in a “belief” section, one the place they have been in a state of excessive unrealized income. All these metrics hinted at an extra downtrend.

As per our evaluation of Hyblock Capital’s information, if the downtrend continues, BTC’s worth would possibly quickly contact $66k or $64k. As soon as BTC reaches that degree, the possibilities of a fast restoration are excessive if BTC checks the bull sample that shaped on its chart. Nonetheless, if Bitcoin fails to check the sample, then buyers would possibly as properly see BTC falling to $57k.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

The halving impact

Although a number of metrics flashed bearish indicators, Bitcoin has a trick up its sleeve, one which might help flip the scenario the wrong way up. The king of cryptos is awaiting its subsequent halving in just below every week. The halving will cut back BTC’s issuance fee. This drop may end up in a rise in BTC’s demand and assist elevate its worth.

Moreover, the occasion also can fire up bullish sentiments across the coin, which might assist in BTC’s restoration within the coming days.