- Bitcoin has lacked the momentum to interrupt key resistance ranges in current months.

- The waning bullish momentum was evident within the Bitcoin NVT Golden Cross metric.

Bitcoin [BTC] was in a tricky place at press time.

The spot ETF inflows have been unfavorable and the current sharp value drop induced giant liquidations. The huge outflow of BTC from Binance didn’t bolster the market sentiment both.

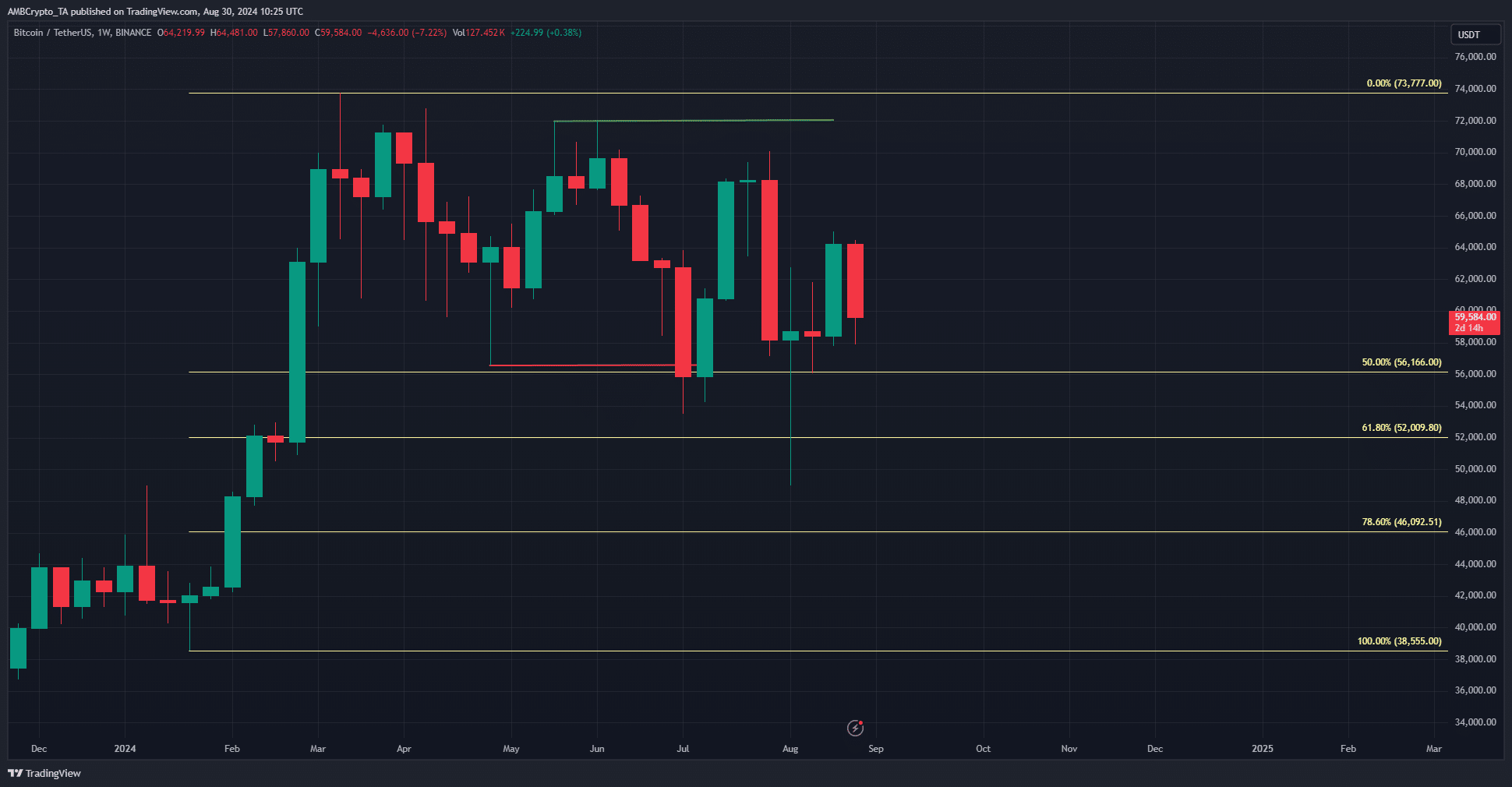

On the weekly chart, the market construction remained bearish. A brand new excessive was not reached, and the king of crypto was forming a sequence of decrease highs since April. Ought to merchants anticipate extra weak spot?

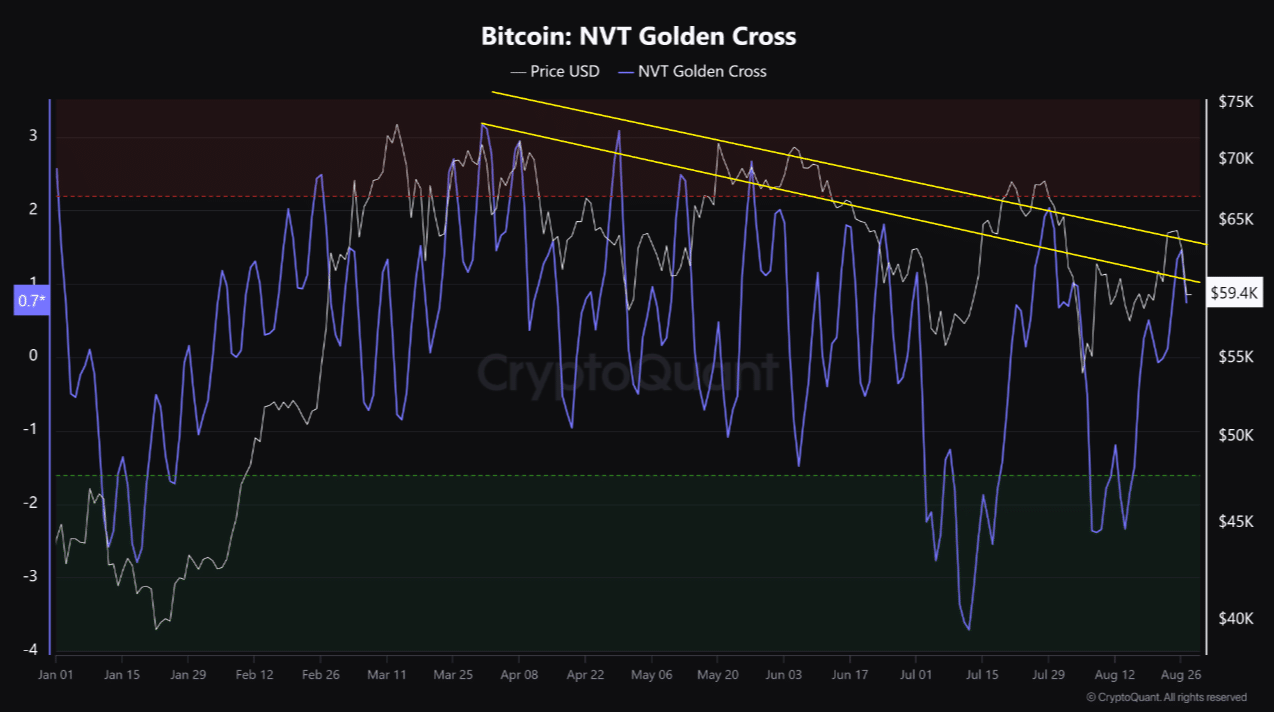

The Bitcoin Golden Cross development

Supply: CryptoQuant

In a publish on CryptoQuant, crypto analyst Burrak Kesmeci noticed that the peaks of the Bitcoin NVT Golden Cross have been in a downward development over the previous six months.

The values of the peaks fell from 3.17 on the thirty first of March to 1.46 on the twenty sixth of August.

The Community Worth to Transactions (NVT) Golden Cross metric compares the short-term and long-term development of the NVT metric, giving a Bollinger Bands-like signaling indicator.

Values of above 2.2 point out the community is probably going overpriced, whereas values underneath -1.6 sign a market backside.

The decline within the peak values since late March is an indication that Bitcoin is likely to be undervalued relative to its transaction quantity and introduced an accumulation alternative.

It additionally highlighted the bulls’ incapacity to power a breakout previous key resistance ranges equivalent to $70k.

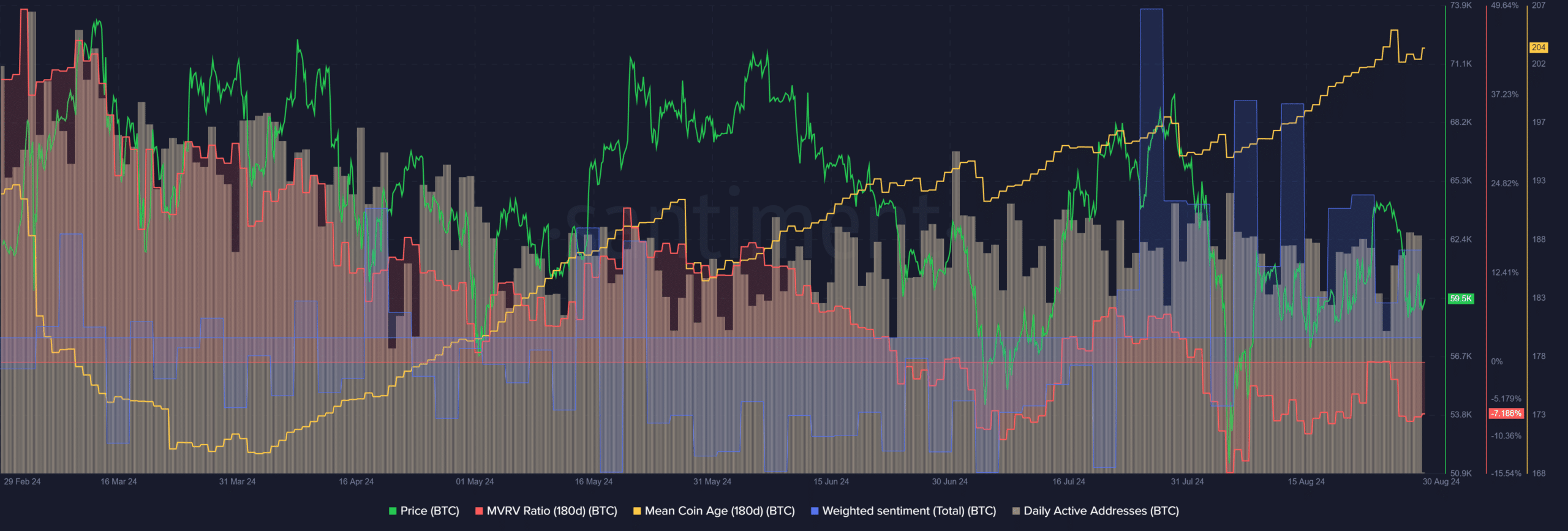

On-chain information helps the bullish facet

Supply: Santiment

The 180-day imply coin age continued to development upward since late March, though the weekly market construction turned bearish in current months.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Additionally, the previous month noticed strongly constructive social media engagement, though the Bitcoin value development was uneven.

The MVRV was unfavorable to point out holders have been at a loss and that the asset was doubtless undervalued. In the meantime, the every day lively addresses metric has been secure since June.