- Analysts are highlighting a number of catalysts for BTC’s transfer to an ATH together with a possible ‘golden cross’ formation.

- Additional, each technical and on-chain knowledge signaled a bullish outlook for BTC however after a pullback.

Bitcoin [BTC] skilled a surge over the weekend, briefly climbing again to the $60,000 mark. Nevertheless, it has since returned to a press time value of $58,507.40.

Regardless of the value solely rising by a modest 0.14% over the past seven buying and selling days, there was a notable 33% rise in buying and selling volumes, indicating a rising curiosity.

Though the present value motion seems sluggish, two analysts have argued that this development is just short-term and has justified their outlook.

AMBCrypto has expanded on these analysts’ views and, in accordance with our unbiased evaluation, a pointy enhance in Bitcoin’s value appears inevitable at this juncture.

Specialists’ view on why a BTC rise is imminent

One crypto analyst, Moustache, in a “friendly reminder,” has highlighted an 11-year trendline sample that BTC has revered each as resistance and help.

In line with the chart he shared, it seems that this trendline is regularly changing into a vital help once more, because it had earlier this yr.

Ought to BTC bounce off this trendline, we might witness a speedy ascent, much like earlier patterns when this trendline first acted as help.

Moustache additionally famous that Bitcoin’s easy transferring common signifies a possible rally.

He added

“First ever golden cross of the 50/100 SMA is also in the making.”

Ought to the 50 SMA (crimson line) cross above the 100 SMA (blue line), BTC is predicted to see a notable enhance in worth, probably rising into the $60k zone or larger.

Whereas this bullish outlook is evident, one other analyst, Mister Crypto, has added to the optimistic sentiment. He shared a chart demonstrating BTC’s efficiency post-Bitcoin halving.

In each eventualities he introduced, from 2016 and 2020, BTC skilled a big value enhance post-halving, reaching new all-time highs every time.

Mister Crypto described this sample as:

“A #Bitcoin supply shock is coming”

This implies that the worth of BTC might quickly oscillate between the $60k and $70k vary if this historic sample continues to carry.

Golden Cross would possibly drive BTC’s rise to $70k

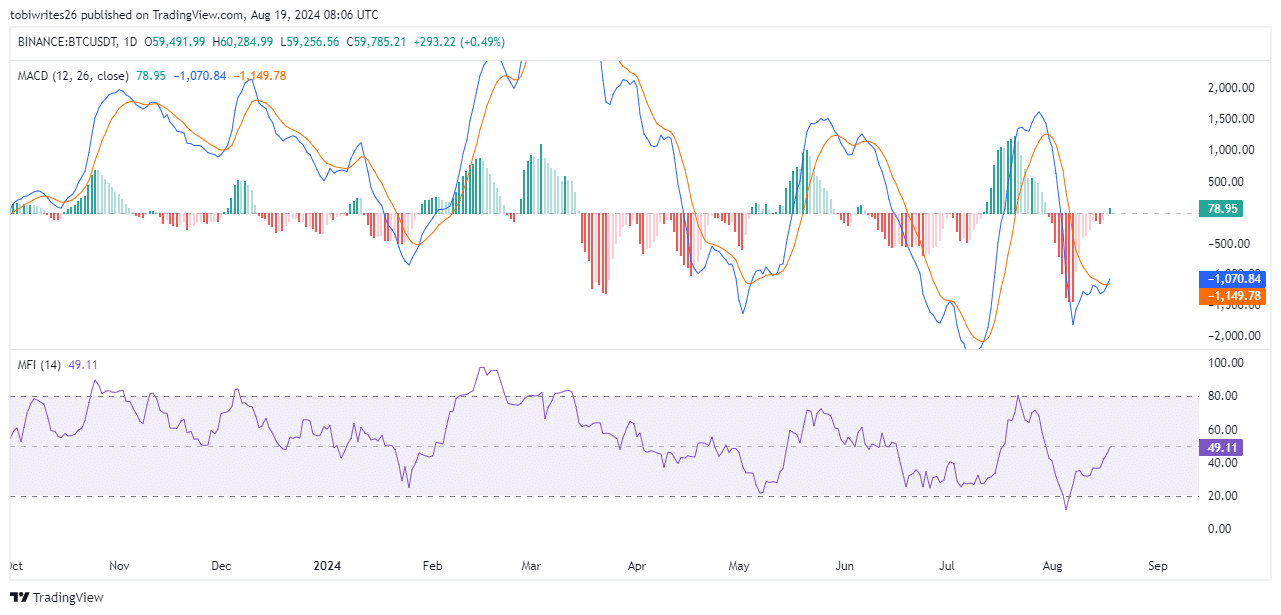

In line with AMBCrypto’s newest evaluation, BTC has simply witnessed a golden cross on the transferring common convergence and divergence (MACD) technical indicators.

A golden cross happens when the MACD line (blue) crosses above the sign line (orange), giving an indication of a bullish flip that sometimes predicts a big upward motion in value.

As an illustration, when this sample final appeared on July 12, BTC’s value rose from a low of $56.5k to a excessive of roughly $70k by July 29. If this sample holds, BTC might attain comparable heights within the coming weeks.

Additional evaluation of the Cash Stream Index (MFI)—a technical indicator that merges value and quantity knowledge to pinpoint overbought or oversold circumstances and anticipates value reversals—signifies that bulls are regularly taking management of the market.

The MFI has been climbing steadily over the previous few days and at the moment stands at 49.11. Ought to this uptrend persist, Bitcoin might quickly be buying and selling at or above $70k.

Anticipated pullback earlier than a leg-up

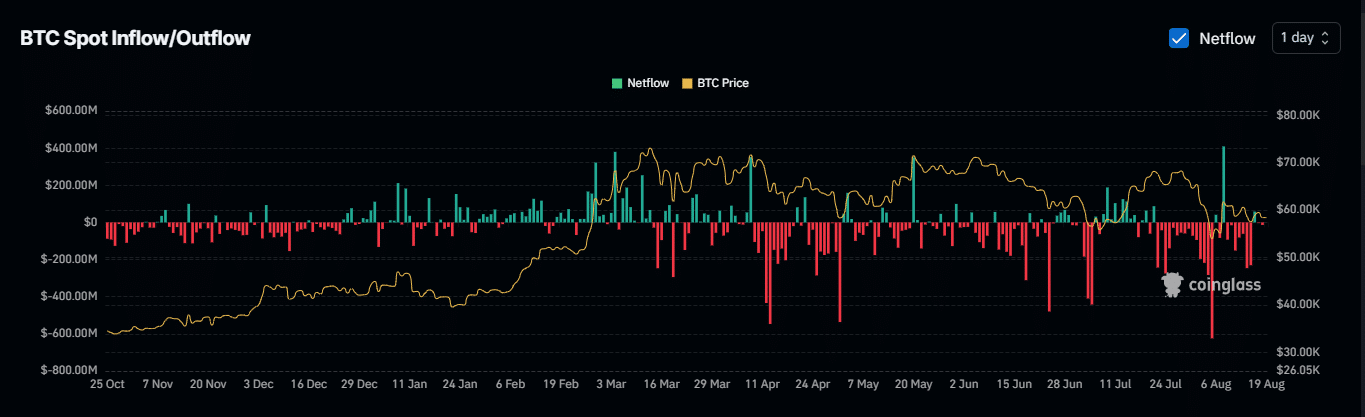

Evaluation of Netflow on BTC throughout weekly and every day timeframes Coinglass signifies a predominantly bullish development.

A detrimental web circulation suggests BTC holders are transferring their property from exchanges to chilly storage, implying they don’t seem to be planning to commerce their BTC within the close to future.

This discount in BTC provide on exchanges might drive up demand, probably pushing costs larger.

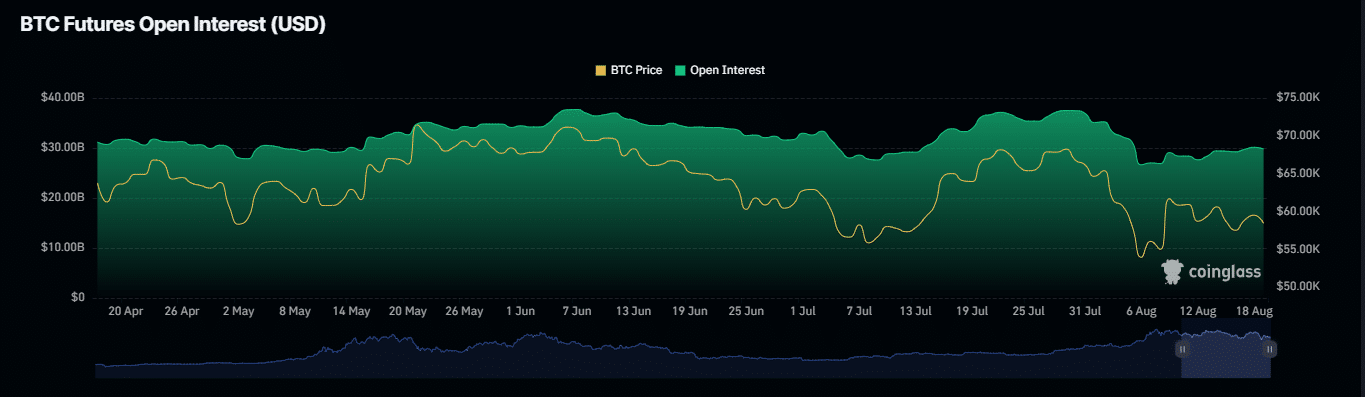

The open curiosity (OI), representing the overall variety of unsettled spinoff contracts like futures or choices, gives additional bullish indicators.

From August 12 to August 19, OI rose from $27.64 billion to $29.81 billion, indicating rising bullish momentum in anticipation of a rally.

Nevertheless, within the quick time period, many lengthy merchants have confronted liquidation in accordance with a dataset from Coinglass.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

This happens when merchants with lengthy positions are pressured to shut their contracts because the market strikes in opposition to them, typically leading to a sell-off to satisfy margin necessities.

This case means that Bitcoin would possibly expertise a downward push earlier than it might probably rally to probably new highs.