- Bitcoin has just lately dipped to $57,770, marking a 21% decline from its peak.

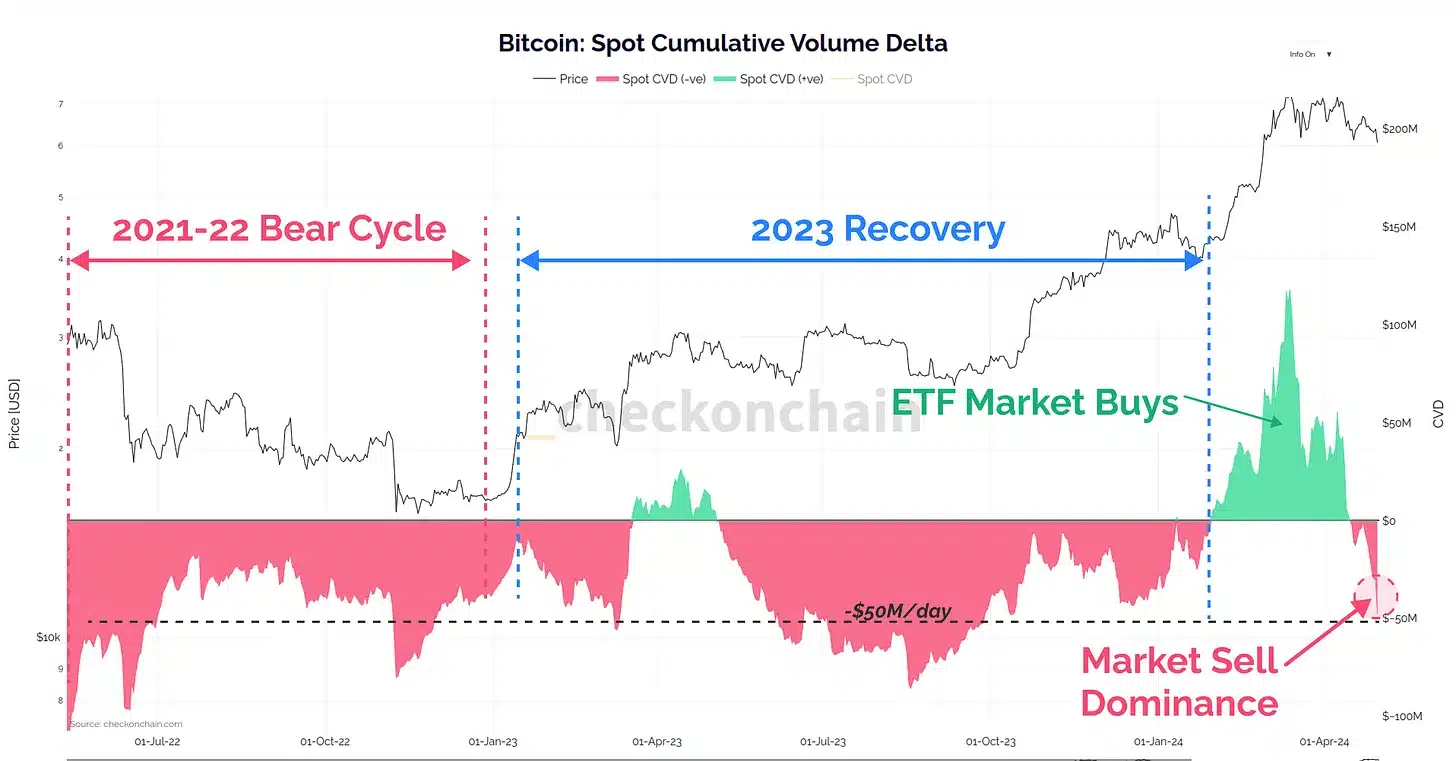

- There’s a shift in BTC Cumulative Quantity Delta (CVD) to promote facet stress.

The cryptocurrency market has just lately witnessed vital volatility, with Bitcoin main the downturn. Over the previous week, Bitcoin [BTC] has seen a decline of about 21% from its March peak, which stood above $73,000, marking a substantial shift in market dynamics.

As of now, Bitcoin trades at roughly $57,770, persevering with its downward trajectory with a slight 0.2% drop within the final 24 hours.

Market mechanics and the position of derivatives

James Examine, an on-chain analyst, delved into the elements contributing to Bitcoin’s present bearish section. In an in depth report, Examine identified the similarities between the present market situations and the 2021 crash. Again then, an extreme reliance on leveraged positions in futures contracts led to a pointy and painful correction.

This state of affairs appears to be considerably completely different at this time. Whereas there’s a noticeable enhance in long-side liquidations, Examine observes that the general futures open curiosity isn’t alarmingly excessive in comparison with the market dimension, indicating that derivatives may not be the first driver of the present sell-off.

As a substitute, Examine suggests wanting on the on-chain and spot market information for clearer insights.

He notes a major shift within the Cumulative Quantity Delta (CVD), which has swung into sell-side stress, indicating that promote orders are outpacing buys by roughly $50 million per day.

This shift is a reversal from the heavy shopping for exercise that accompanied Bitcoin’s ascent to its all-time excessive.

The ETF affect and future outlook

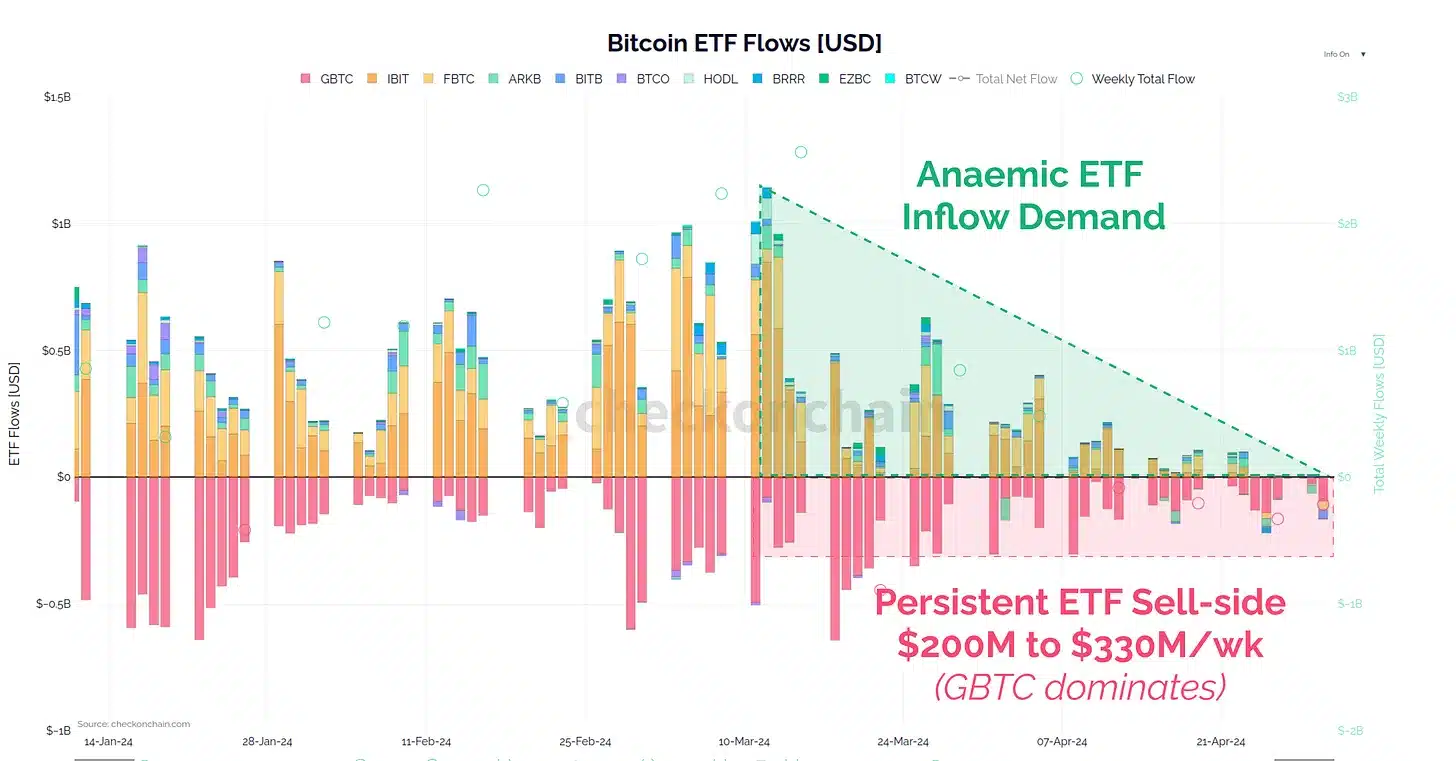

The market’s response to the current ETF exercise additionally sheds mild on investor sentiment. Bitcoin ETFs have skilled subdued demand, with notable outflows in current weeks.

The Grayscale Bitcoin Belief (GBTC) and different ETFs have seen a mixed outflow of about $200 million to $330 million, suggesting a cooling curiosity amongst institutional buyers.

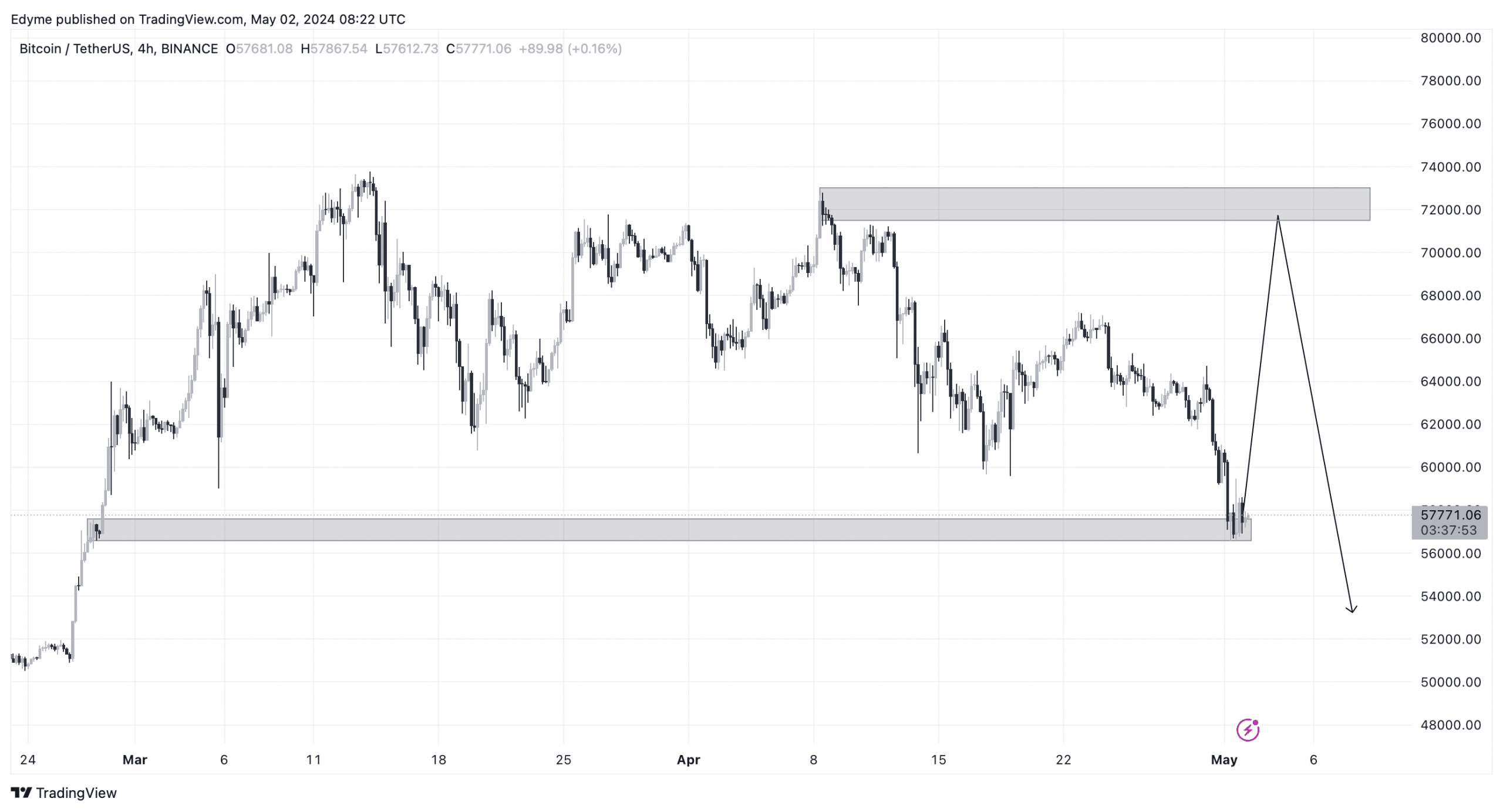

Regardless of the gloomy present outlook, there seems to be possibilities of a possible rebound. On the technical entrance, Bitcoin has damaged construction to the draw back.

Nonetheless, on the 4-hour chart, it has encountered a crucial help zone, particularly an order block, which traditionally has led to cost rebounds.

Is your portfolio inexperienced? Try the BTC Revenue Calculator

Notably, this place might catalyze a short lived rally, permitting Bitcoin to collect extra liquidity at greater ranges earlier than probably persevering with its descent.

Distinguished analysts, together with Michael van de Poppe echoes this rally facet, suggesting that the market is perhaps nearing a backside. Van de Poppe highlighted that altcoins are starting to point out power in opposition to Bitcoin, which regularly precedes broader market recoveries.