- Low UTXO Age Bands and dominant quick liquidations counsel that the worth can hike

- Previous palms have reverted to accumulating too

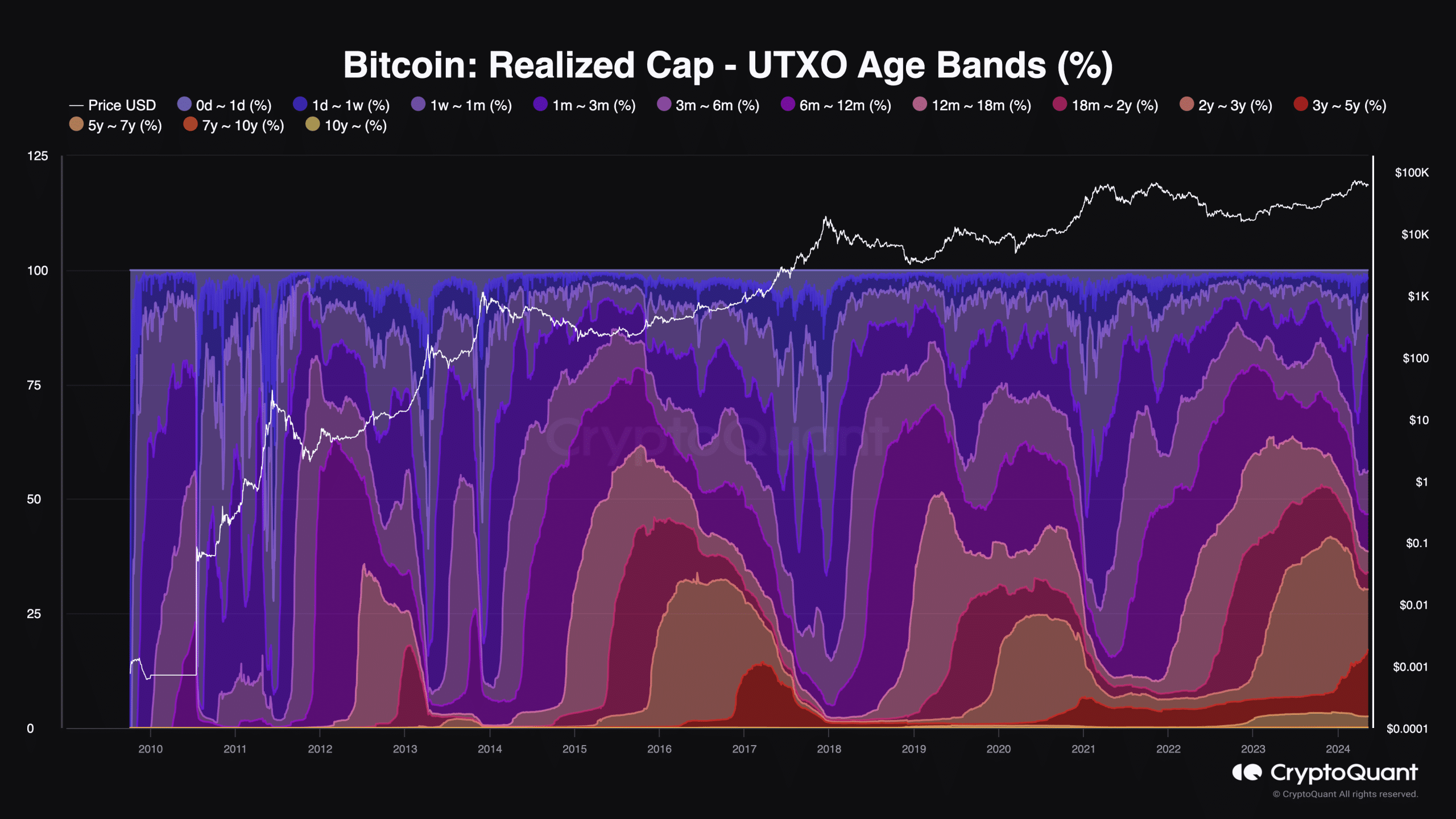

Bitcoin [BTC] has not hit the highest of this cycle, based on indicators from the Realized Cap. For context, the Realized Cap tracks the worth of every UTXO based mostly on the worth at which it was final moved, in comparison with the present worth of the coin.

UTXO stands for Unspent Transaction Output and represents the quantity of Bitcoin left after a transaction. AMBCrypto’s evaluation of CryptoQuant’s knowledge revealed that the UTXO Age Bands, at press time, weren’t near the zenith that was hit in the course of the 2021 bull market.

This metric measures energetic particular person purchases out there. When this metric is extraordinarily excessive, it implies that some huge cash is flowing into Bitcoin. It additionally signifies that the tip of the bull cycle may very well be shut.

Is one other 80% hike doable?

Nevertheless, that has not been the case as the proportion stays a lot decrease than its earlier peak. Owing to this knowledge, one can assume that BTC’s value will climb previous its $73,750-high from March.

Crypto Dan, an analyst and writer on CryptoQuant, additionally shared an analogous view. In line with him, Bitcoin has solely achieved 20% of this bull cycle. He famous,

“The current short-term money inflow situation is significantly smaller than the peak of the past bull cycle.”

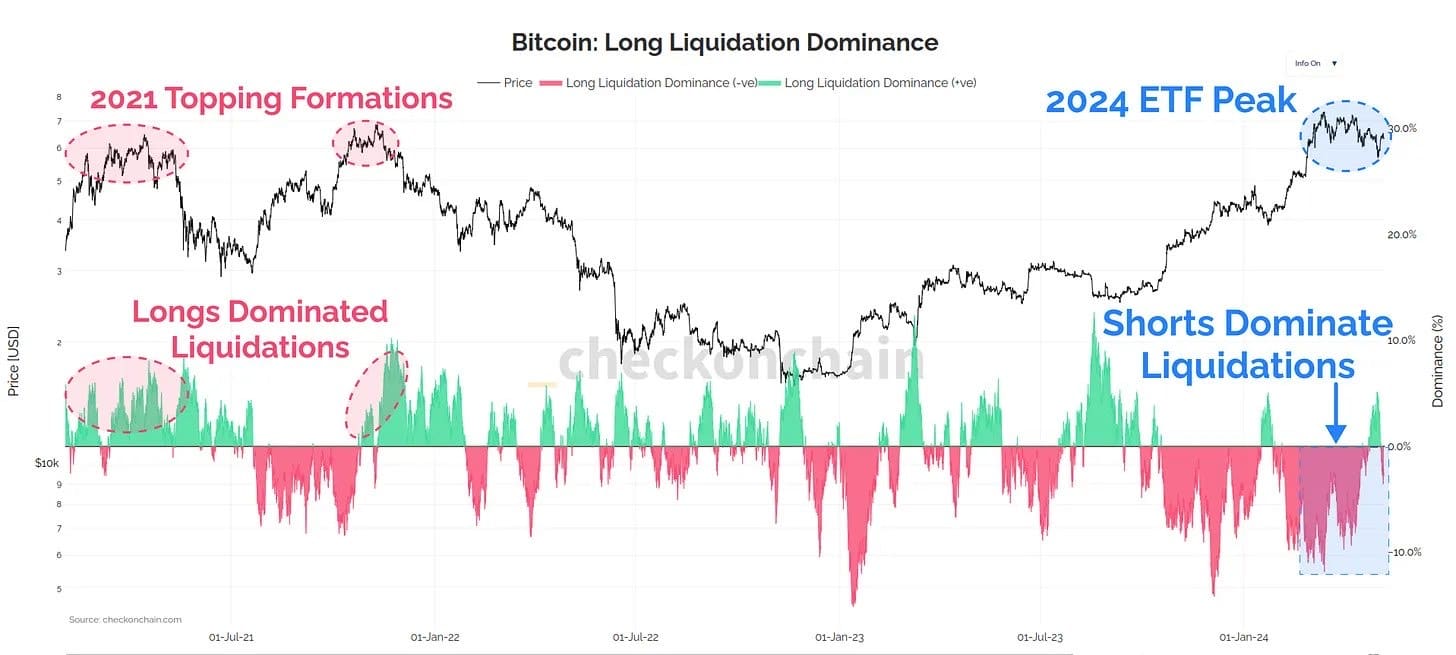

Nevertheless, that was not the one signal that BTC would possibly rise greater this cycle. Checkmate, a pseudonymous on-chain analyst, additionally weighed in on the matter.

Nevertheless, this time, the analyst targeted on what’s occurring within the derivatives market. From the information the analyst shared, the 2021 peak was marred by a surge in lengthy liquidations. In his e-newsletter, he stated,

“Last time, this was actually a signal the market had topped out.”

For the uninitiated, liquidations happen when a dealer’s place is closed resulting from an inadequate margin steadiness to maintain it open. It additionally occurs if a dealer makes use of excessive leverage and the goal hits cease loss.

HODLing is the best way to go

Excessive lengthy liquidations indicate that almost all positions worn out are these betting on a value hike. Nevertheless, this 12 months, most liquidations have been quick, reinforcing Bitcoin’s potential to hit a brand new all-time excessive.

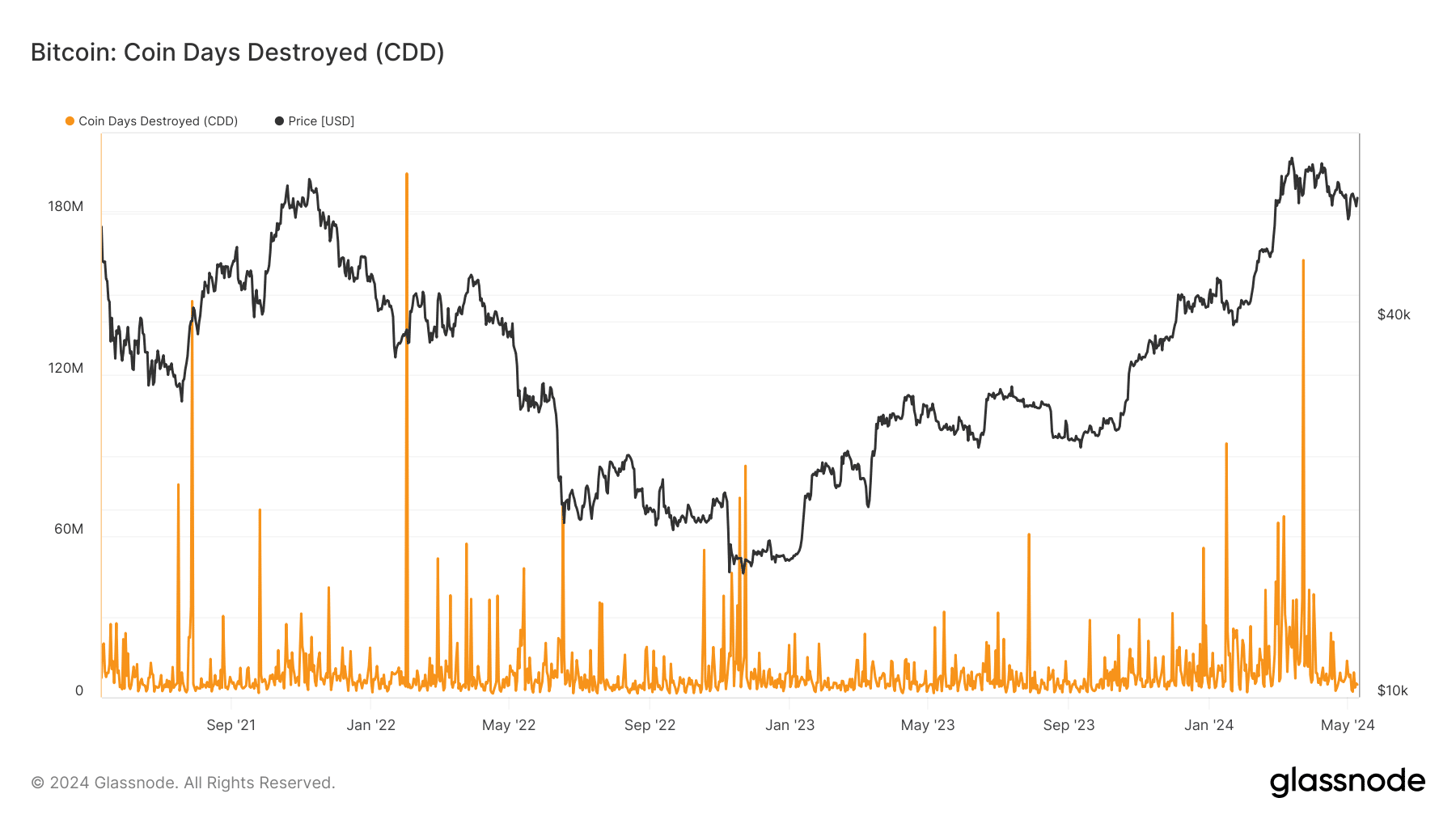

Moreover, AMBCrypto appeared on the Coin Days Destroyed (CDD). This metric exhibits if HODLers are actively spending their cash or accumulating extra.

A excessive CDD signifies a surge in spent cash and will result in a value lower. Primarily based on our evaluation, we discovered {that a} hike within the metric occurred on 24 March, following which Bitcoin’s value tumbled.

Is your portfolio inexperienced? Verify the Bitcoin Revenue Calculator

On the time of writing, the CDD had returned to the baseline it occupied in 202o, earlier than the explosive run of 2021. Since HODLing continues to be the popular choice of traders, Bitcoin would possibly nonetheless produce a monster rally earlier than this cycle hits its peak.