- Regardless of ETF inflows and SEC’s Ethereum ETF approval, the crypto market confronted a downturn.

- Merchants foresee Bitcoin’s rise at the same time as BTC dropped to $67k.

Regardless of Bitcoin [BTC] spot exchange-traded funds (ETFs) witnessing inflows totaling $107.9 million on the twenty third of Might, BTC seems to be going through a bearish pattern.

Together with Bitcoin, main altcoins have been additionally within the purple, signaling a crypto massacre.

Analysts foresee Bitcoin’s bullish pattern

Regardless of vital promoting strain, some merchants anticipate a “massive leg up soon.” Providing additional evaluation on BTC’s present worth motion, Mags, a crypto dealer, elaborated.

Reiterating the identical viewpoint, Jelle, an unbiased analyst drew a sample with BTC’s earlier cycles and mentioned,

“Bitcoin is still following a similar path to 2016-2017. Once that 2021 ATH breaks, there will be no stopping the king. Bring on $100,000.”

What’s on the worth entrance?

Opposite to widespread expectations of Bitcoin’s bull run, the main cryptocurrency at press time was down by 3.71%, buying and selling on the $67,000 stage.

Nevertheless, regardless of BTC’s unfavourable worth motion, key technical indicators such because the Relative Energy Index (RSI) remaining above the 50-level mark and the Transferring Common Convergence Divergence (MACD) line positioned above the sign line verify bullish sentiment.

Bitcoin’s rising investor sentiment

In actual fact, throughout Anthony Pompliano’s current livestream with Jack Mallers, Founder & CEO of Strike, Pompliano questioned Mallers in regards to the rationale behind Wall Avenue’s choice for Bitcoin over different belongings.

To which Mallers replied,

“I think it’s the best expression of fiat debasement. It is the antithesis of fiat currency. It has no Central Bank, it has no government, its monetary policy is fixed, its supply is capped, it’s everything that fiat isn’t. And so, if your problem is fiat debasement then it’s best expressed through Bitcoin.”

He even went additional and added,

“I think Bitcoin hits 250 to a million in this cycle.”

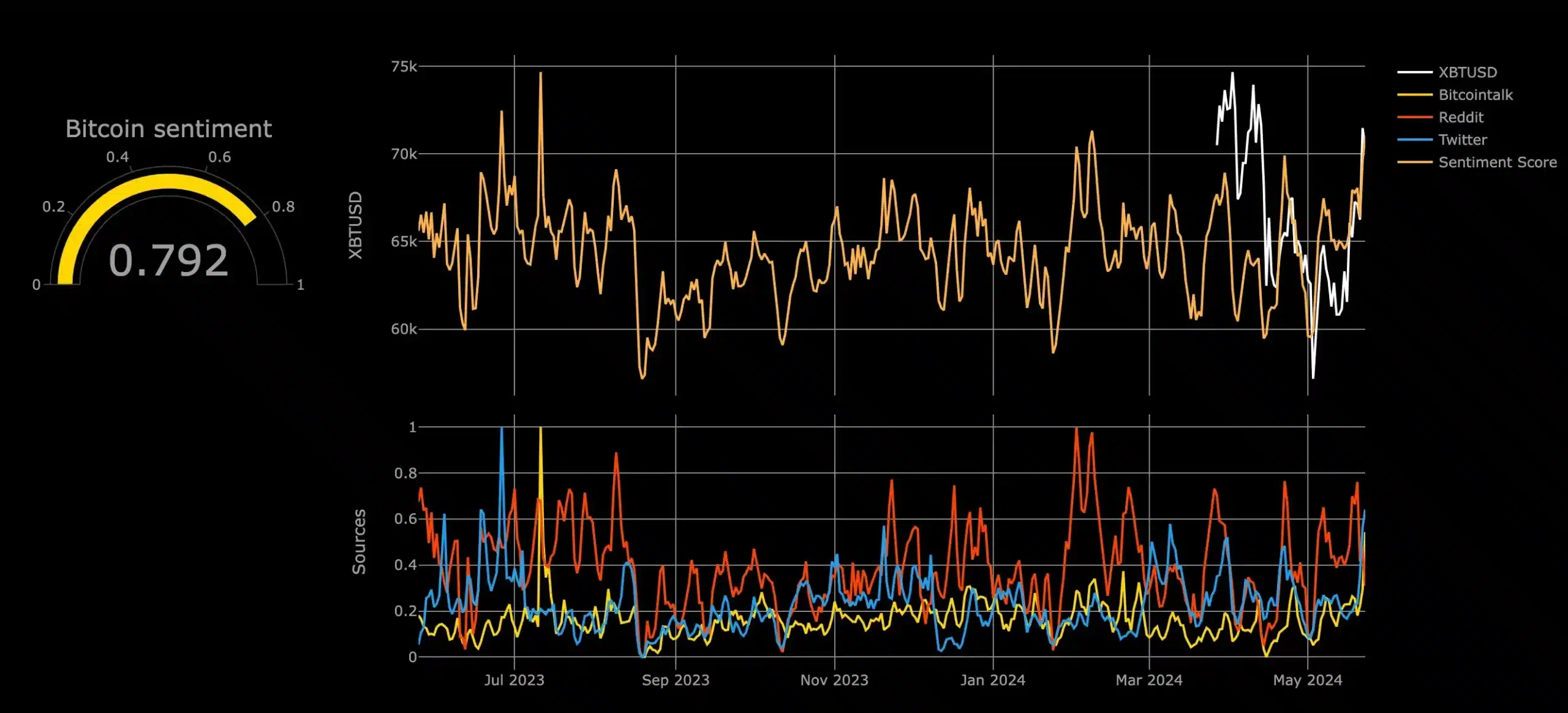

These exchanges recommend a looming bullish pattern for Bitcoin, which was additional confirmed by Augmento’s knowledge on social media discussions.

In conclusion, with a BTC sentiment rating of 0.792 on Augmento’s scale, the place 0 is extraordinarily bearish and 1 is extraordinarily bullish, the most recent knowledge signifies a prevailing bullish sentiment for Bitcoin.