- Bitcoin worth projections revealed a spread of $145k to $249k by 2025

- CryptoQuant’s evaluation linked BTC development to realized cap and declining miner reserves

Bitcoin [BTC] buyers could also be an explosive market by 2025, with new information revealing potential worth targets that might push BTC into uncharted territory. With projections displaying Bitcoin’s market cap hitting almost $5 trillion below optimum circumstances, the query is now not ‘if’ however ‘how high?’

The newest insights come from Ki Younger Ju, Founder and CEO of Cryptoquant. He shared a spread of doable outcomes for Bitcoin’s realized cap development. These eventualities recommend BTC may skyrocket to as a lot as $249,000 by 2025, with a conservative estimate nonetheless putting the cryptocurrency’s worth at $145,000.

An outline of core insights

CryptoQuant’s mannequin presents three Bitcoin eventualities for 2025, primarily based on realized cap development and market multipliers. Within the “upper” situation, a $520 billion realized cap development, multiplied by six, would push Bitcoin’s market cap to $4.969 trillion and its worth to $249,000.

Whereas the chart simplified these eventualities, the implications are profound.

The “upper” goal assumes a continuation of institutional adoption, bolstered by the incoming pro-crypto U.S administration and powerful capital inflows. At $197,000 within the mid-tier situation, Bitcoin would nonetheless be a standout performer in monetary markets, reflecting regular development even in a reasonably bullish local weather.

The conservative projection, with a $145,000 goal, highlights Bitcoin’s resilience and talent to retain investor curiosity regardless of potential macroeconomic headwinds.

Analyzing key metrics

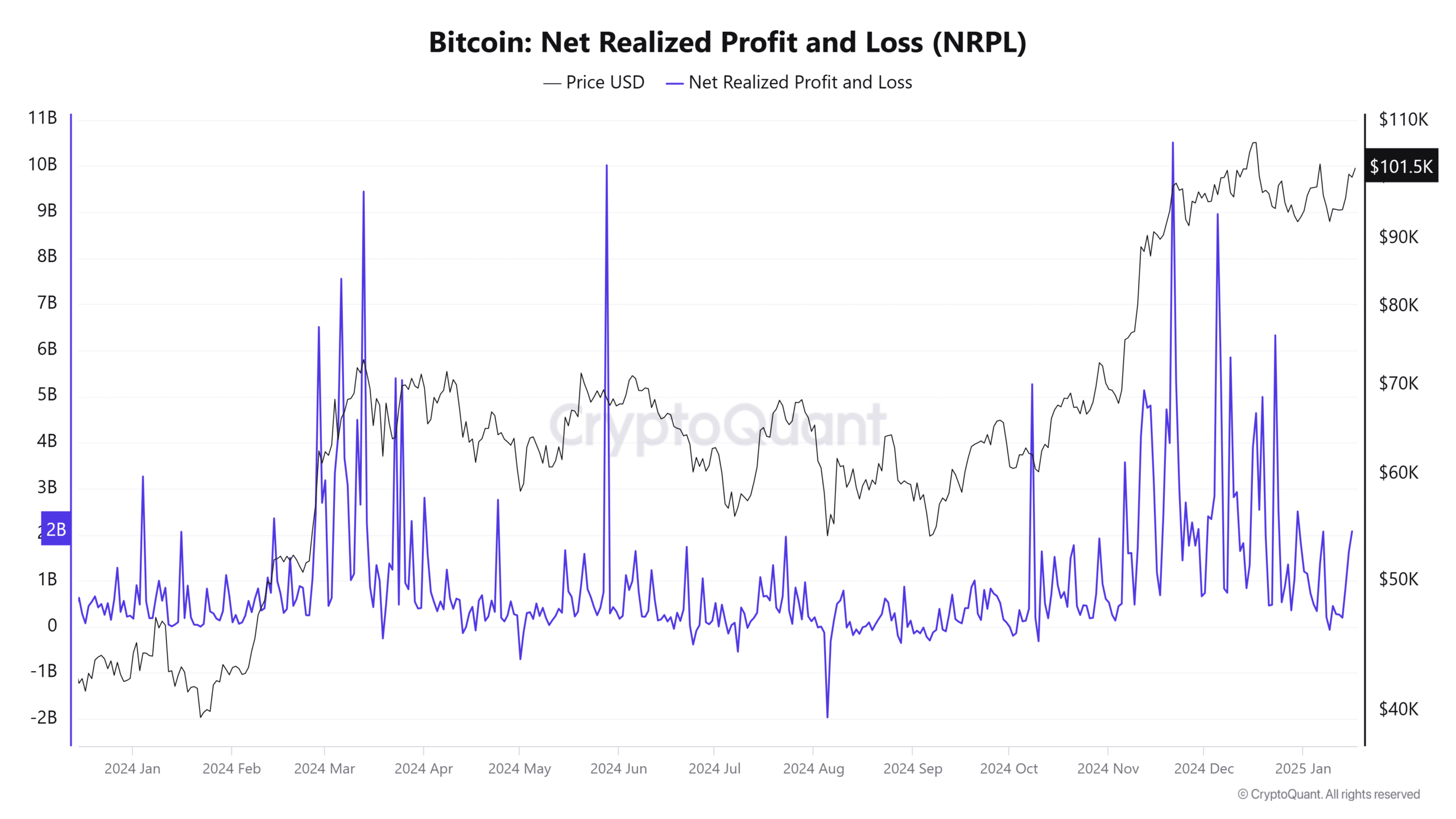

At press time, the Internet Realized Revenue and Loss indicated heightened profit-taking throughout Bitcoin’s rallies, displaying sturdy market confidence at increased worth ranges.

Spikes in NRPL usually correspond with new peaks in BTC’s worth, signaling sturdy investor participation.

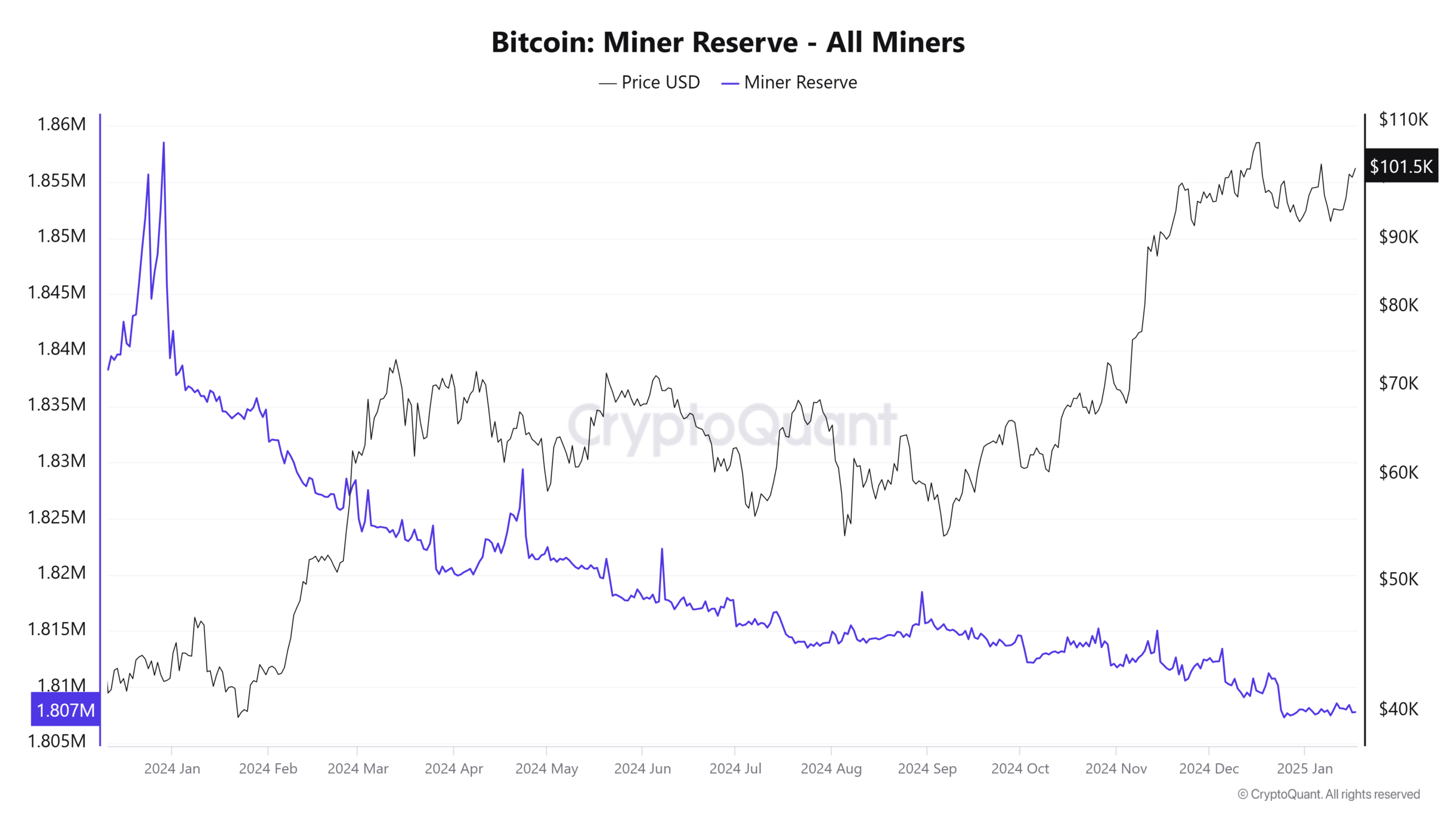

Concurrently, the decline in miner reserves highlighted supply-side constraints as miners more and more liquidate holdings, probably in anticipation of upper costs. This declining development in reserves aligns with a fall in promoting strain, creating a good atmosphere for upward worth momentum.

Learn Bitcoin’s [BTC] Value Prediction 2025-26

Comparability to previous cycles

Bitcoin’s historic bull runs in 2017 and 2021 revealed a sample of exponential development pushed by adoption cycles and macroeconomic components. The 2017 peak of $20,000 marked Bitcoin’s emergence as a speculative asset, fueled by retail euphoria. In distinction, the 2021 peak of $69,000 was characterised by institutional adoption, widespread acceptance of crypto as an asset class, and narratives surrounding inflation hedging.

CryptoQuant’s 2025 projections recommend the subsequent development section may surpass prior cycles in scale and maturity. The higher goal of $249,000 is according to Bitcoin’s long-term logarithmic development curve and displays growing shortage, amplified by halving occasions and constrained miner reserves.

In contrast to previous cycles, the 2025 trajectory hinges on structural shifts – just like the anticipated pro-crypto rules and capital inflows through ETFs – that will drive sustained demand.