- BTC’s futures open curiosity climbs to its highest stage since January 2023.

- The coin’s value is trending inside a spread.

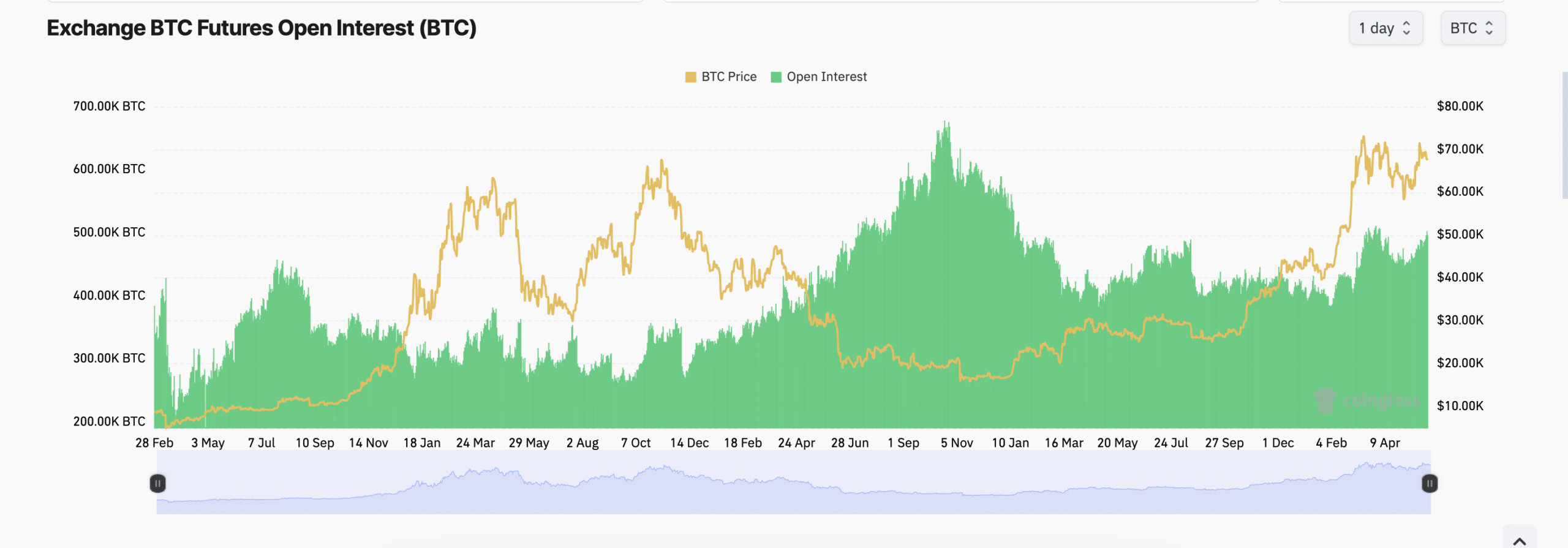

Bitcoin’s [BTC] futures open curiosity has surged to its highest stage in 16 months, based on Coinglass’ information.

Based on the on-chain information supplier, the main coin’s combination futures open curiosity climbed to 516k BTC on twenty ninth Could. The final time BTC’s futures open curiosity was this excessive was in January 2023.

BTC’s futures open curiosity tracks the whole variety of excellent futures contracts or positions that haven’t been closed or settled. When it rises, it alerts a spike in market exercise or a optimistic change in merchants’ sentiment.

It means that extra market contributors are opening new positions.

Along with BTC’s rising open curiosity, its funding price throughout cryptocurrency exchanges has remained optimistic, even because it continues to face vital resistance on the $70,000 value stage.

Funding charges are utilized in perpetual futures contracts to make sure that the contract value stays near the spot value.

When an asset’s futures funding price is optimistic, it signifies sturdy demand for lengthy positions. This bullish sign suggests a possible for continued value development of the asset.

Based on Coinglass information, BTC’s funding price was 0.0106% a press time.

BTC lingers in a spread

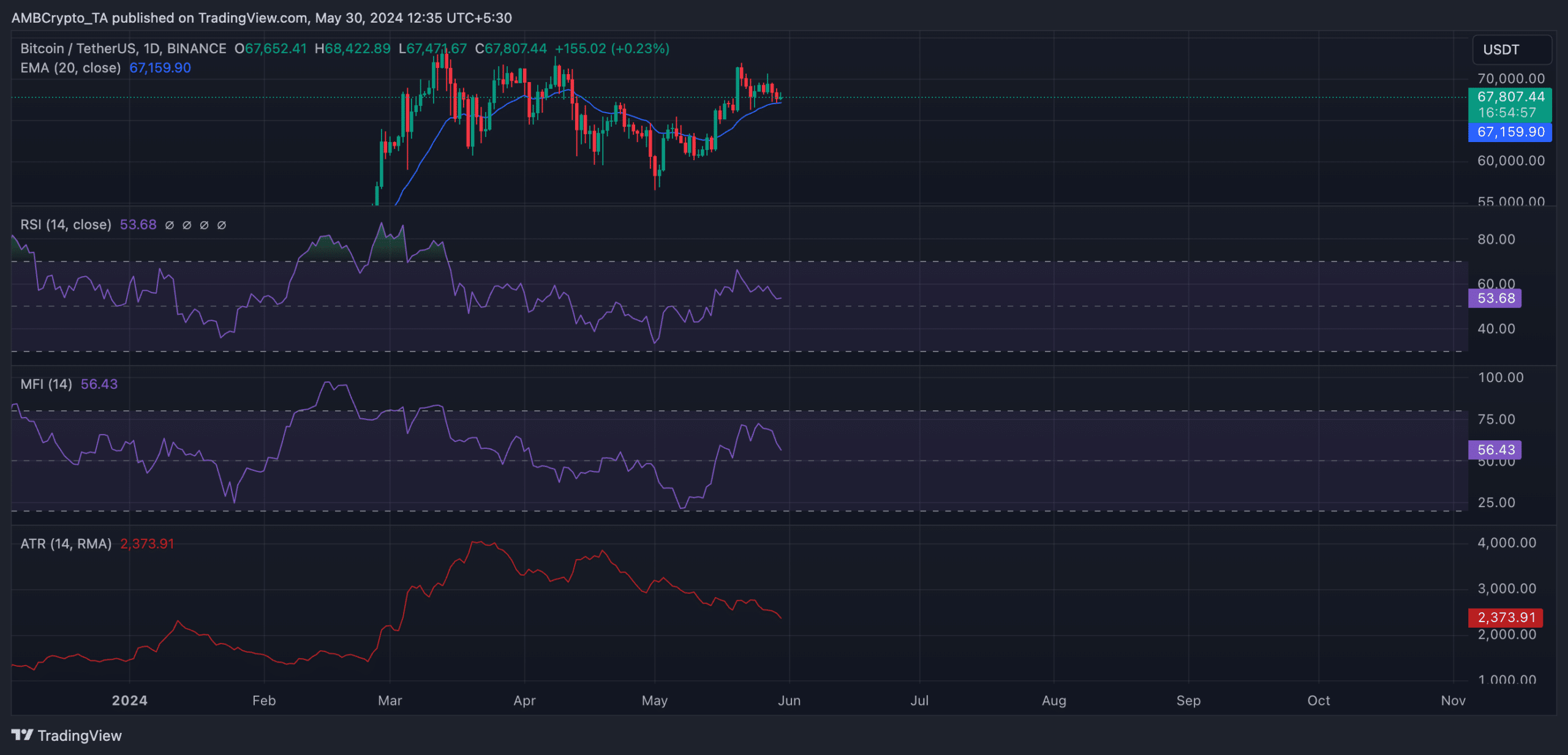

AMBCrypto discovered that BTC has traded near its 20-day Exponential Transferring Common prior to now seven days. When an asset trades on this method, the market is alleged to be in consolidation.

It’s because such actions imply that neither consumers nor sellers are exerting sturdy management over the market.

BTC’s narrow-range motion prior to now few days was additionally confirmed by its declining Common True Vary (ATR). At 2,373 at press time, the coin’s ATR has fallen by nearly 10% within the final week.

An asset’s ATR measures its value volatility over a selected interval. When it traits downward, this can be taken as an indication of consolidation.

Is your portfolio inexperienced? Try the BTC Revenue Calculator

Additional, the values of BTC’s Relative Energy Index (RSI) and Cash Circulation Index (MFI) have been 53.85 and 57.94, respectively, at press time.

At these values, these indicators confirmed that neither consumers nor sellers have been in full management because the coin’s value continued to consolidate or fluctuate inside a spread.