- Bitcoin’s worth fell considerably over the previous couple of days and slipped previous the common price foundation of short-term holders

- Miner income declined, which might add extra promoting stress on BTC miners

Bitcoin’s [BTC] current dip under the $60,000-mark despatched shockwaves throughout the crypto-sector, resulting in excessive uncertainty out there and large liquidations.

Will short-term holders present paper fingers?

Earlier than recovering a day later, on 2 Might, Bitcoin closed at $57,700, barely under the common price foundation of short-term holders, which stood at $58,500. This meant that the worth of BTC fell under the common price of acquisition for short-term holders.

When this occurs, essentially the most fast consequence is unrealized losses for short-term holders. Since their common buy worth is larger than the present worth, they are going to technically lose cash on their funding in the event that they promote. This may result in panic promoting and additional exacerbate the market decline.

Nevertheless, for optimistic short-term holders with a powerful perception in Bitcoin’s long-term potential, this worth drop may also be seen as a shopping for alternative. They’ll common down their price foundation by buying extra Bitcoin at a lower cost.

It stays to be seen how these short-term holders will probably be affected by the decline in BTC’s worth.

Is your portfolio inexperienced? Take a look at the BTC Revenue Calculator

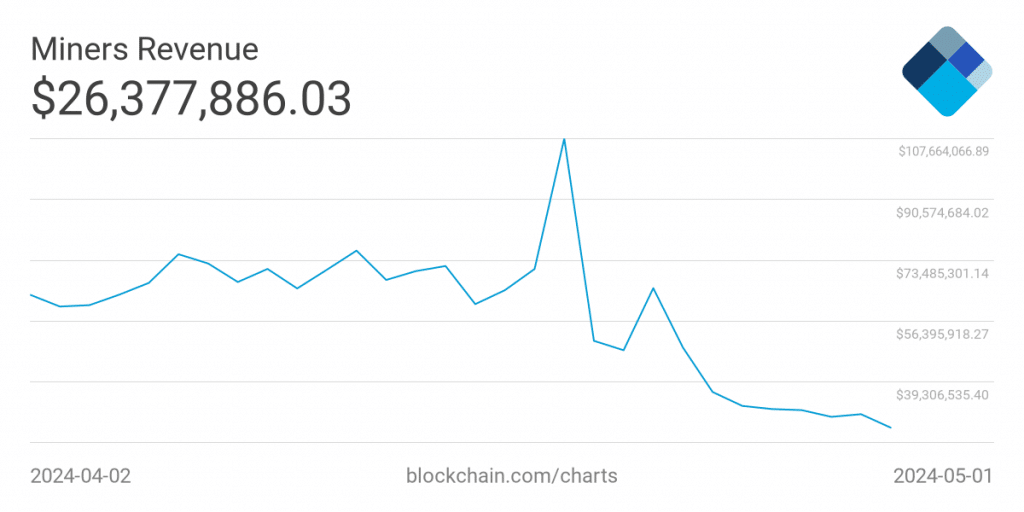

One other issue that may affect BTC’s worth and the promoting stress on the king coin, could be the state of miners. Over the previous month, the income collected by miners has declined considerably. If miners proceed to see this development, they are going to be compelled to promote their BTC holdings to stay worthwhile. This may improve promoting stress on the miners and might impression BTC negatively in the long term.

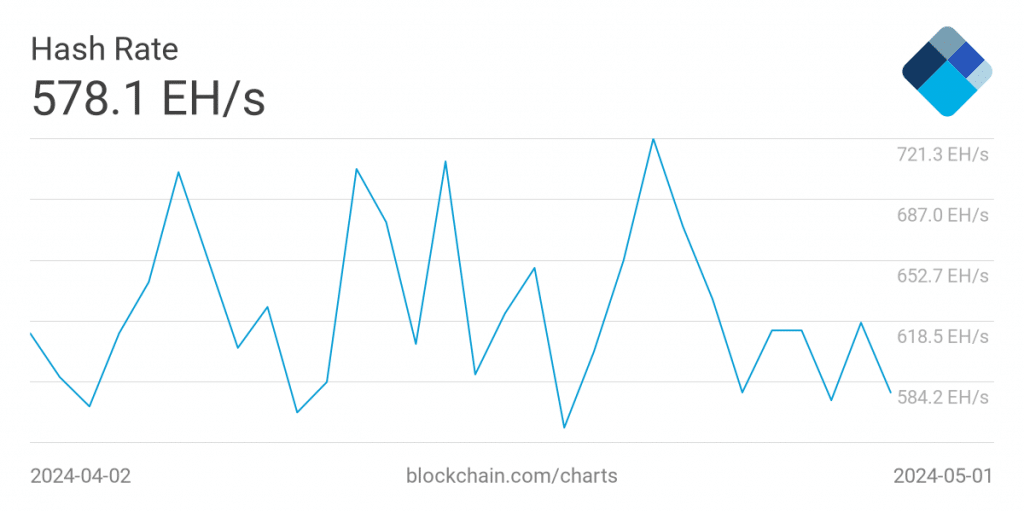

The whole hashrate for Bitcoin fell materially as effectively. For miners who stay lively, a decrease hashrate can imply much less competitors. This may translate to simpler block discovery and probably larger earnings, particularly if the worth of Bitcoin stays the identical.

Solely time will inform whether or not Bitcoin miners can stay worthwhile sooner or later.

Exercise on the community

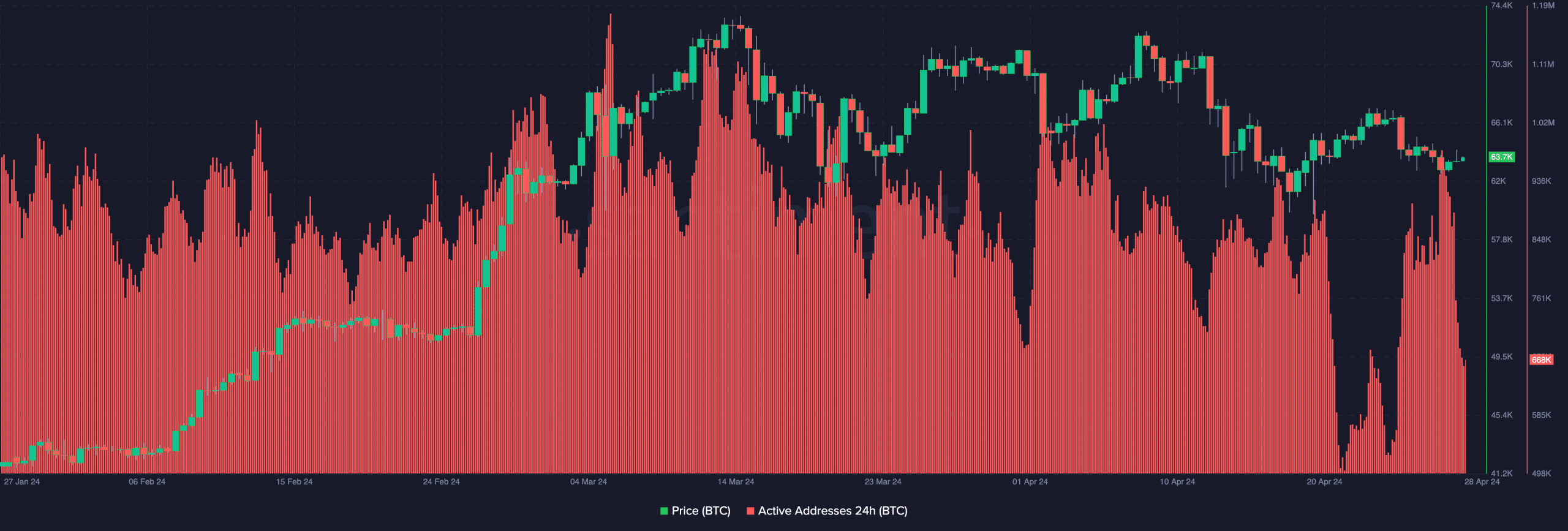

Lastly, an element that can play an enormous position in serving to miners keep afloat would be the general exercise on the Bitcoin community. This, as a result of miners can accumulate transaction charges because of the exercise.

AMBCrypto’s evaluation of Santiment’s knowledge revealed that the exercise on the community has remained the identical over the previous couple of days – A optimistic for BTC in the long term.