- ETF buzz focuses on Ethereum and Bitcoin, with BlackRock difficult Grayscale’s dominance.

- Bitcoin’s value fluctuates amid ETF pleasure, with analysts eyeing potential market shifts.

ETFs appears to have turn into the discuss of the city amid the extremely anticipated approval of Ethereum [ETH] spot exchange-traded funds.

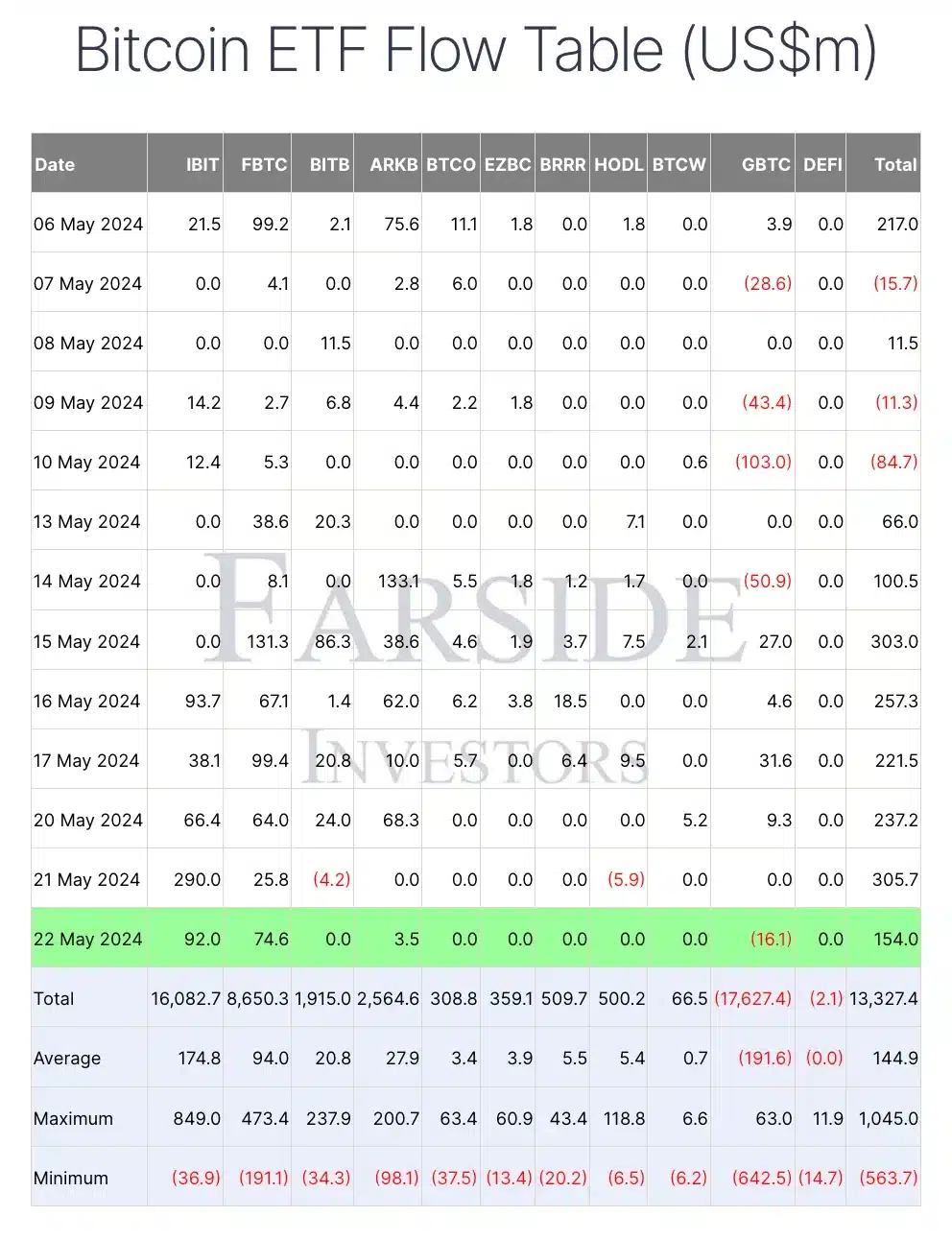

Apparently, on the twenty second of Could, Bitcoin [BTC] spot ETFs noticed a web influx of $154 million, marking the eighth consecutive day of web inflows, based on information from Farside Buyers.

BlackRock overpowers Grayscale

The ETF that garnered important consideration was Grayscale’s GBTC, which skilled an outflow of $16.09 million.

In distinction, BlackRock’s IBIT recorded a single-day influx of $91.95 million, whereas Constancy’s FBTC noticed an influx of $74.57 million on the identical day.

This has raised a key query amongst buyers: Is BlackRock on the verge of overtaking GBTC as the most important Bitcoin ETF with probably the most property underneath administration?

BlackRock steps forward in Ether ETF approval

Amidst such speculations, BlackRock has made a big transfer on ETH ETFs. The SEC not too long ago requested public feedback on spot Ethereum ETF purposes.

Responding to this, on 22d Could, BlackRock and others filed amended 19b-4 types, eradicating ether staking provisions that posed regulatory challenges.

Sharing his remarks on the identical, an X consumer stated,

“BlackRock seals the deal for me. They’ve only lost ONCE when trying to get an ETF approved. The Ethereum spot ETF is coming!!”

This highlights robust confidence in BlackRock’s capacity, given its spectacular observe report with ETF approvals.

Commenting on the spectacular efficiency of BTC ETFs, HODL15Capital took to X and famous,

“Bitcoin ETFs hit a record high of 850,000 BTC held today. Global ETFs are closing in on 1 million Bitcoin held.”

From the US to the UK

The ETF craze isn’t restricted to the US. On twenty second Could, WisdomTree introduced it acquired authorization from the UK Monetary Conduct Authority (FCA) to introduce Bitcoin and Ethereum Change-Traded Merchandise (ETPs) on the London Inventory Change (LSE).

Regardless of the spectacular efficiency of Bitcoin ETFs, the main cryptocurrency retraced from the $70K degree this week.