- Bitcoin’s present retracement is seen as a precursor to a possible main rally in the direction of $73,000.

- Market metrics and evaluation point out sturdy foundations for BTC, regardless of a drop in energetic addresses.

Bitcoin [BTC] has lately exhibited important bullish conduct, marking a notable rise of practically 10% from final week’s low of $65,000 to a excessive of $71,000 this week.

Nonetheless, the cryptocurrency has seen a slight retreat, presently buying and selling at $68,659. This pause within the upward momentum is seen by analysts as a precursor to a possible main rally.

A return to $73,000 might sign the beginning of what’s termed because the “escape velocity” section for Bitcoin, indicating a doable acceleration away from present value ranges into new highs.

Analyzing market metrics and investor conduct

Crypto analyst James Verify, in a latest market report dated twenty first Might, described this $73,000 value level as essential for Bitcoin’s trajectory.

The time period “escape velocity,” borrowed from astrophysics, is used right here to indicate the minimal pace Bitcoin would wish to interrupt free from its present vary and begin a extra aggressive value climb with out extra push.

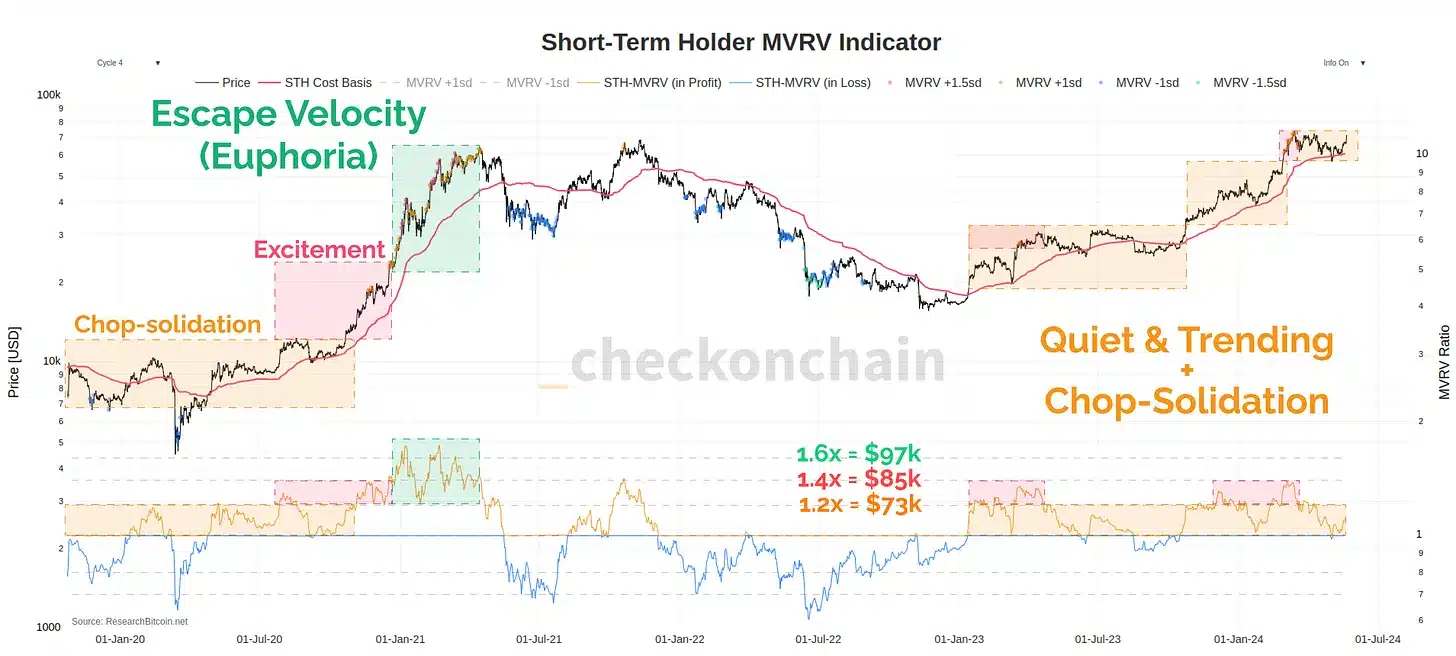

James Verify factors out the significance of the Brief-Time period Holder (STH) Market Worth to Realized Worth (MVRV) metric, which he believes exhibits the market just isn’t but “overstretched, overbought, and oversaturated.”

Verify means that whereas the market is enthusiastic, it has not but entered a section of euphoria that always precedes a major pullback.

The analyst disclosed that the market is constructing sturdy foundations for a rally, with $73,000 being a crucial level that would set off a extra substantial rise in Bitcoin’s value.

Nonetheless, there’s additionally warning round this value degree. Brief-term holders, outlined as wallets which have held Bitcoin for lower than 155 days, are in “sufficient profit” at this level, which could result in some resistance attributable to potential promoting stress.

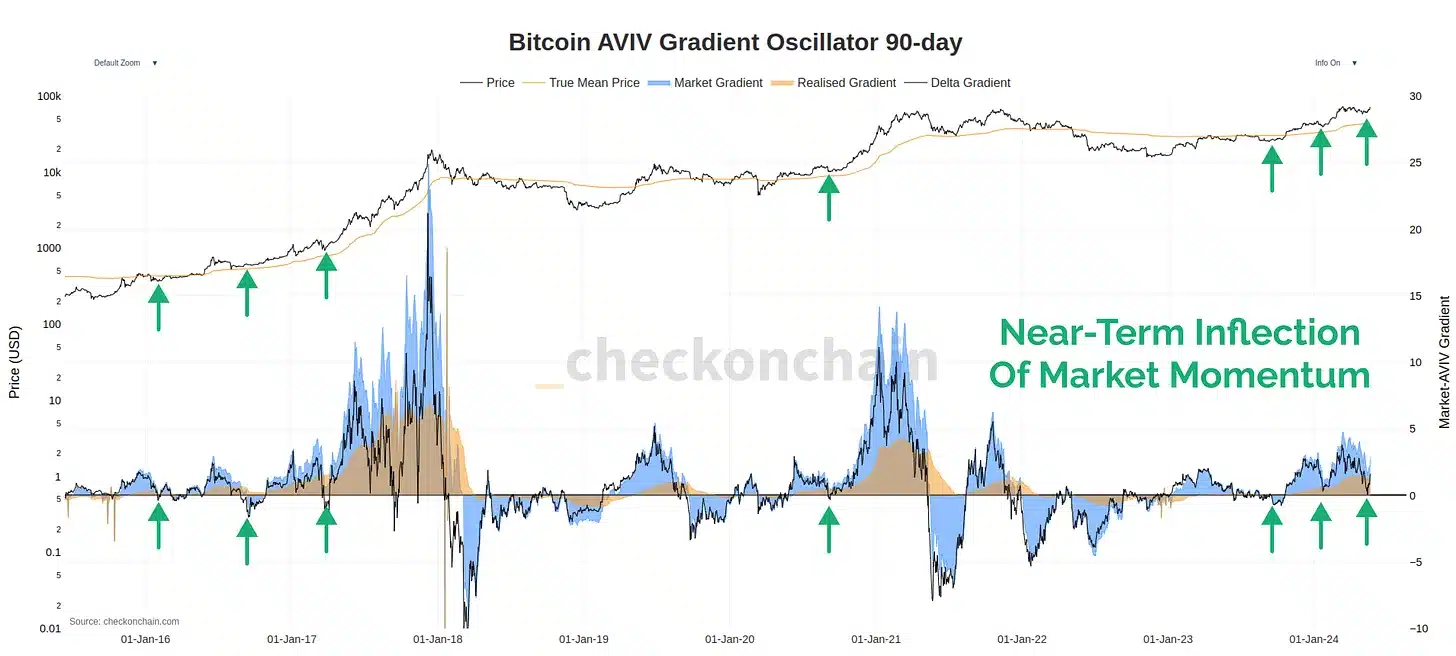

The AVIV momentum oscillator, notably over a 90-day interval, has been supportive, exhibiting that value actions relative to on-chain capital inflows are recovering strongly, typical of a bull market section.

Key observations from on-chain information

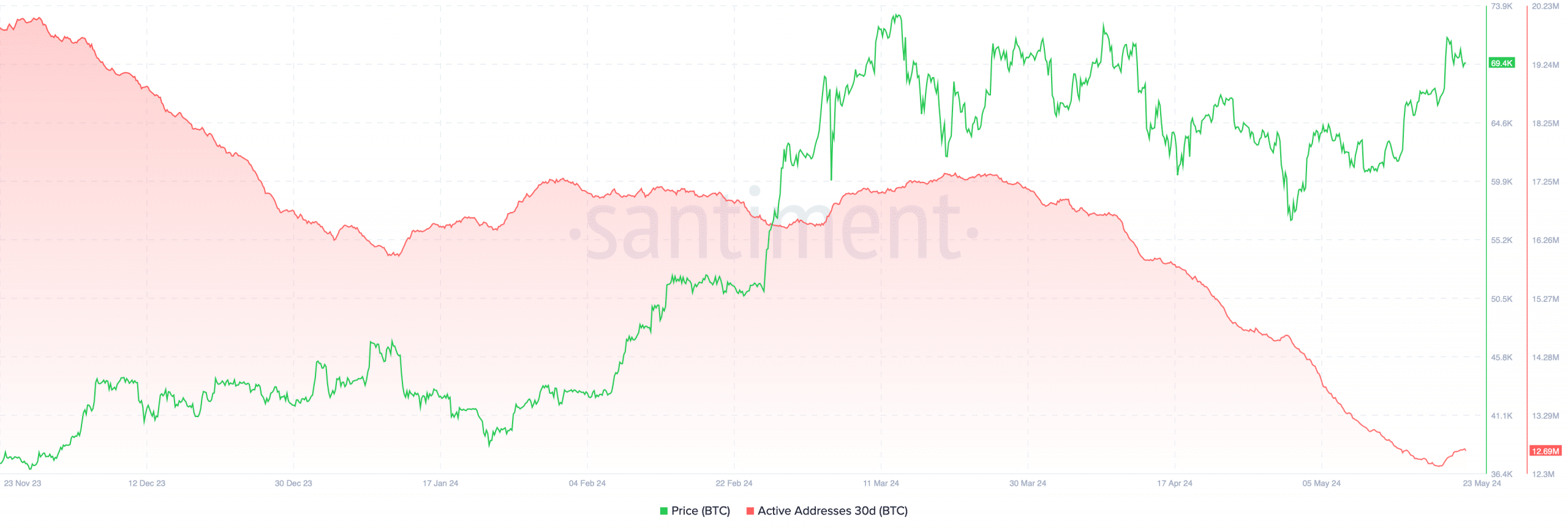

AMBcrypto’s evaluation, supported by information from Santiment, signifies a decline in Bitcoin’s energetic addresses from over 17 million in March to beneath 13 million presently.

Regardless of this lower, Bitcoin has continued to point out bullish strikes, breaking via a number of resistance ranges. This means that whereas the community’s exercise is lowering, the value remains to be being pushed upwards by different elements.

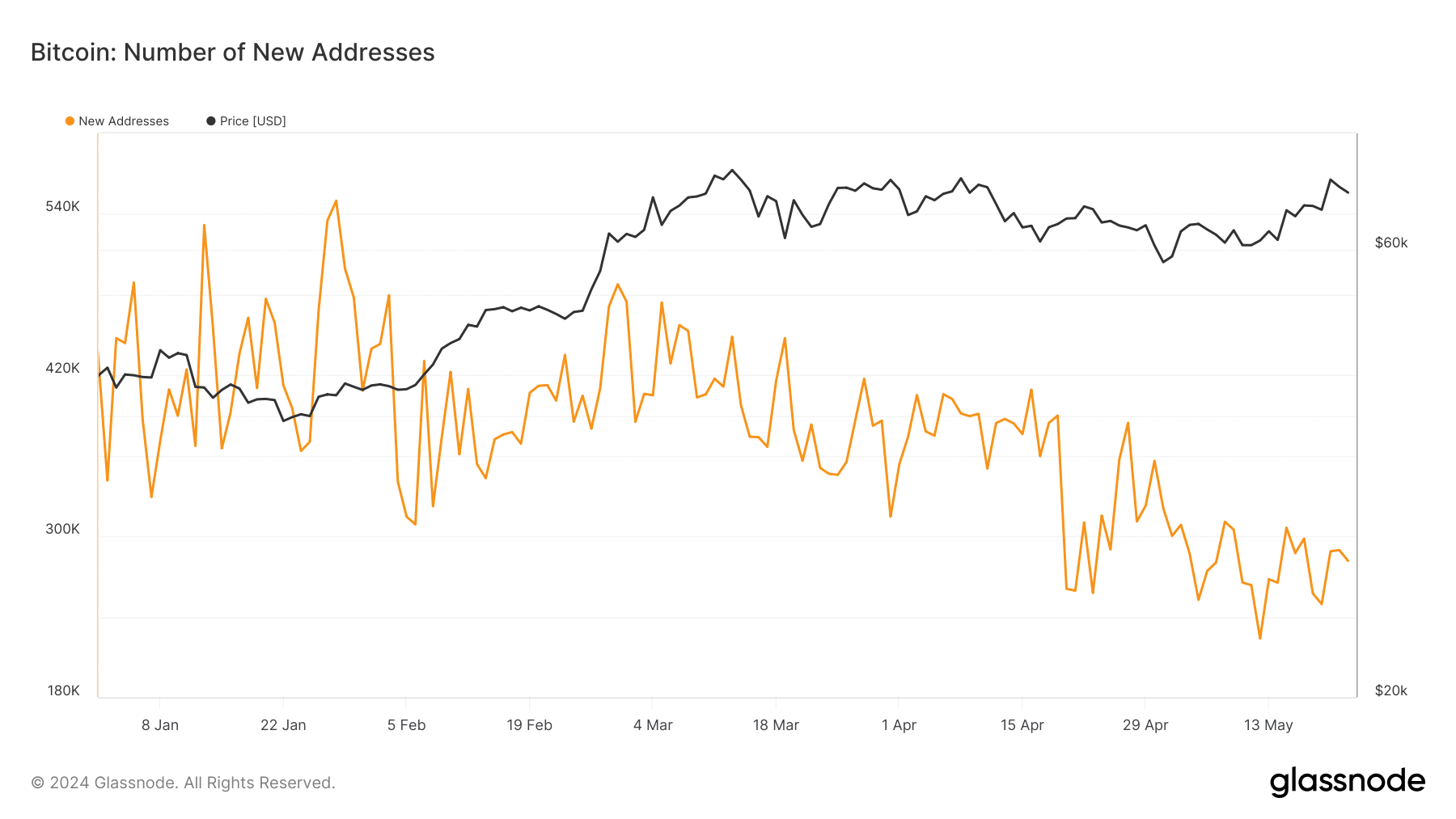

Glassnode’s information additional confirmed that the variety of new addresses has additionally been declining, making a sample of decrease highs and lows. This helps Verify’s view that the Bitcoin market has not reached a state of euphoria, which usually alerts an overheated market.

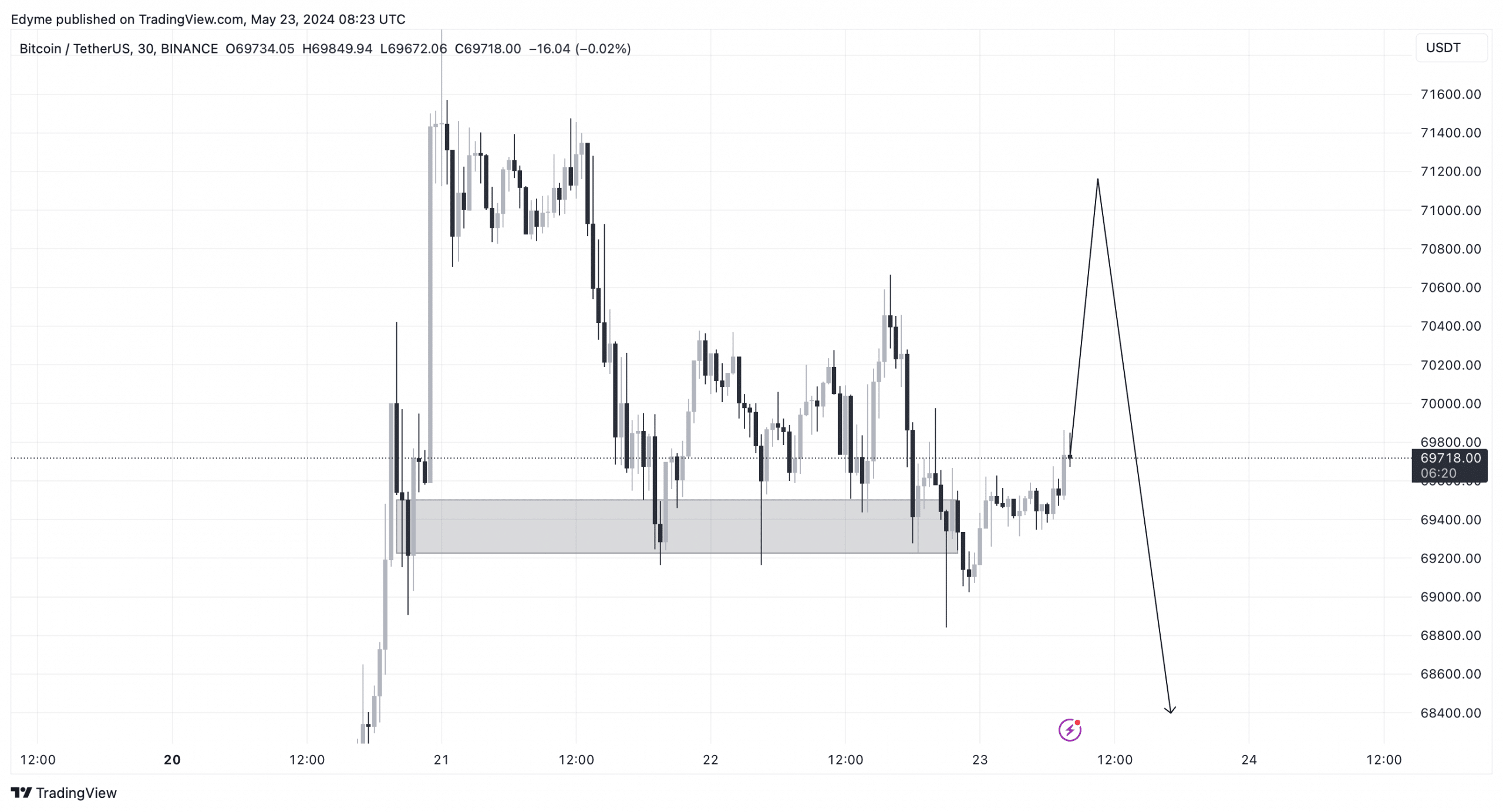

On the 30-minute chart, Bitcoin has lately damaged via a vital demand zone, hinting that the asset may retrace additional to collect extra liquidity earlier than resuming its uptrend.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

A key degree to observe, as per AMBCrypto’s latest report, is round $71,500. A weekly candle shut above this mark may very well be the set off for Bitcoin to interrupt out from its present re-accumulation vary.

This degree aligns with Verify’s evaluation {that a} push previous $73,000 might provoke the escape velocity section, marking a doubtlessly explosive subsequent stage in Bitcoin’s market cycle.