- New Bitcoin buyers are exhibiting extra resilience in comparison with previous bearish development.

- New Bitcoin buyers are sitting on minimal losses as BTC holds ranges above $60,000.

Bitcoin [BTC] has made a stable restoration for the reason that U.S. Federal Reserve introduced a 0.5% drop in rates of interest.

Not too long ago, BTC reached a five-week excessive above $64,000, and whereas it has since retreated to commerce at $63,685 at press time, bullish indicators proceed to emerge.

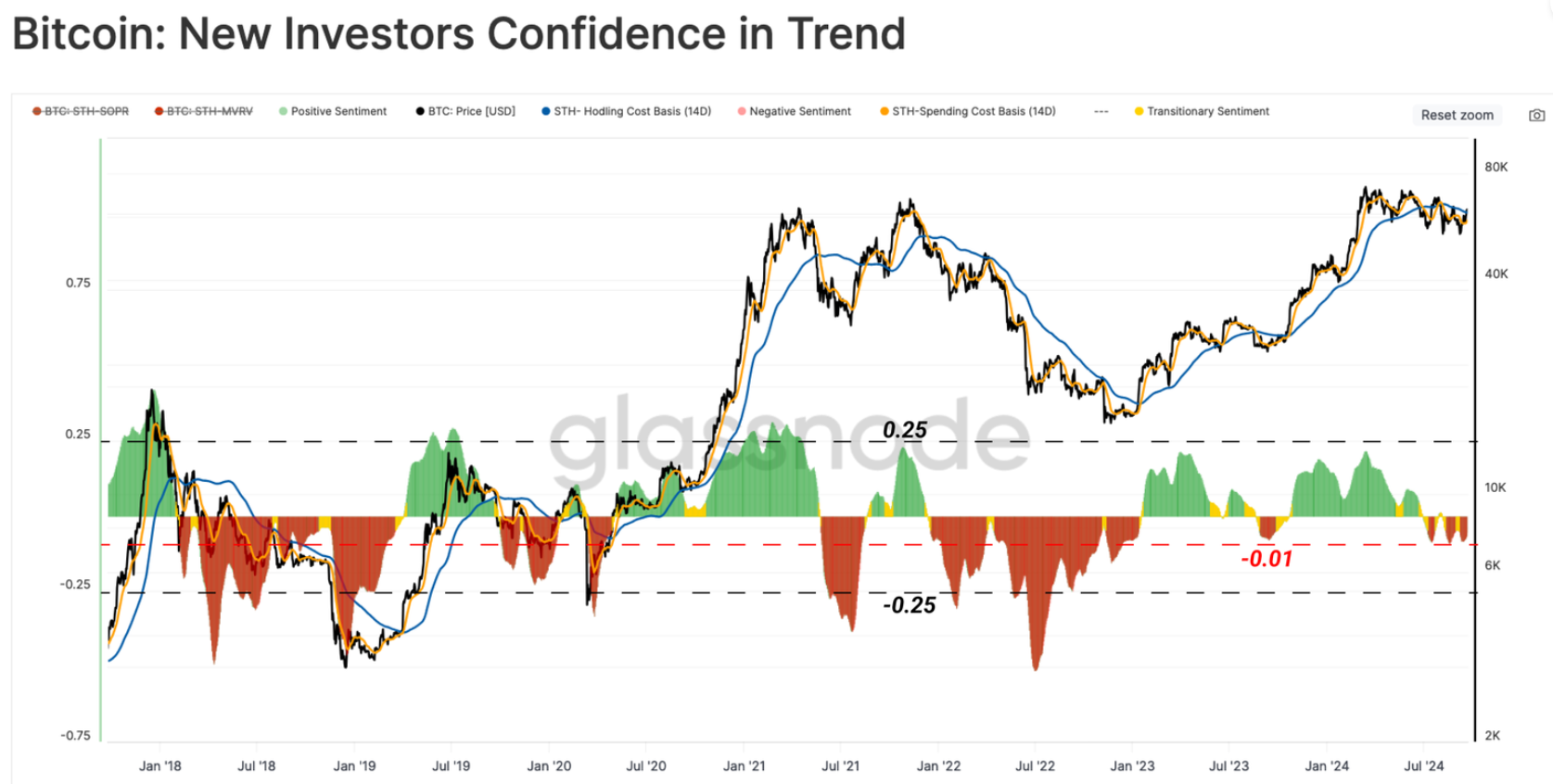

Per Glassnode, merchants who purchased Bitcoin within the final 155 days or much less are exhibiting the next “degree of resilience” in comparison with previous market cycles.

New Bitcoin investor habits

Brief-term Bitcoin holders are inclined to trigger short-term worth volatility as they’re extra reactive to cost actions.

Within the final 5 months, BTC costs have oscillated between $71,000 and $49,000, suggesting {that a} important variety of new buyers who bought on the excessive costs are underwater.

In line with the New Buyers Confidence in Development metric by Glassnode, short-term holders are exhibiting confidence and deviating from earlier patterns the place they have an inclination to panic throughout bearish traits.

The explanation behind this shift in sentiment is that the magnitude of losses suffered by this group has been comparatively low.

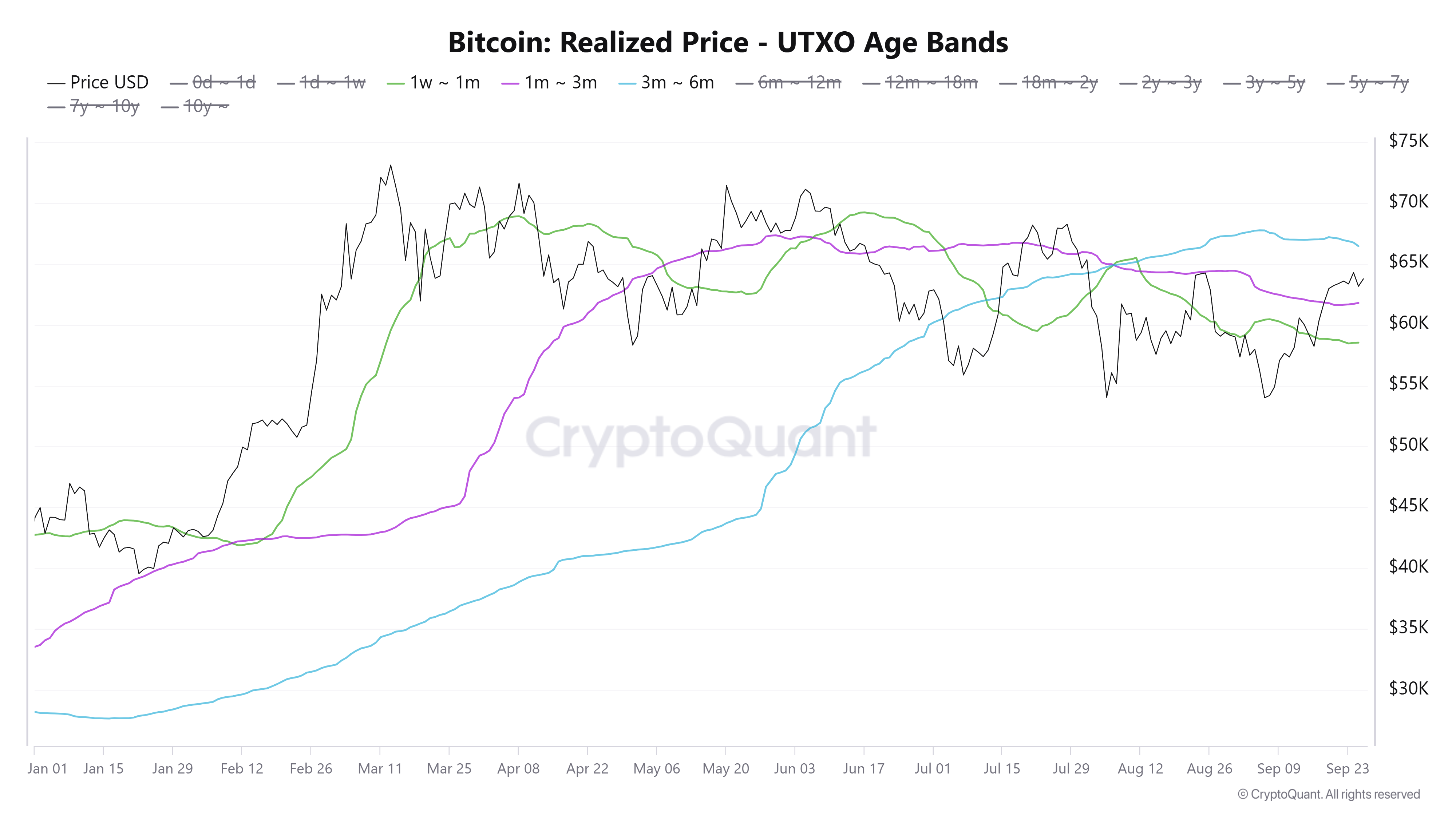

A have a look at the Bitcoin Realized Value by Age Bands on CryptoQuant additionally reveals that merchants who’ve held BTC for no more than three months have been above their buying worth since costs crossed above $61,000.

Moreover, those that have held Bitcoin for 3–6 months will break even as soon as the worth crosses $66,500. This knowledge additional reveals that short-term holder losses are minimal.

Per an earlier evaluation by AMBCrypto, short-term holder profitability may very well be the important thing to BTC breaking above $70,000.

Shift within the Futures market

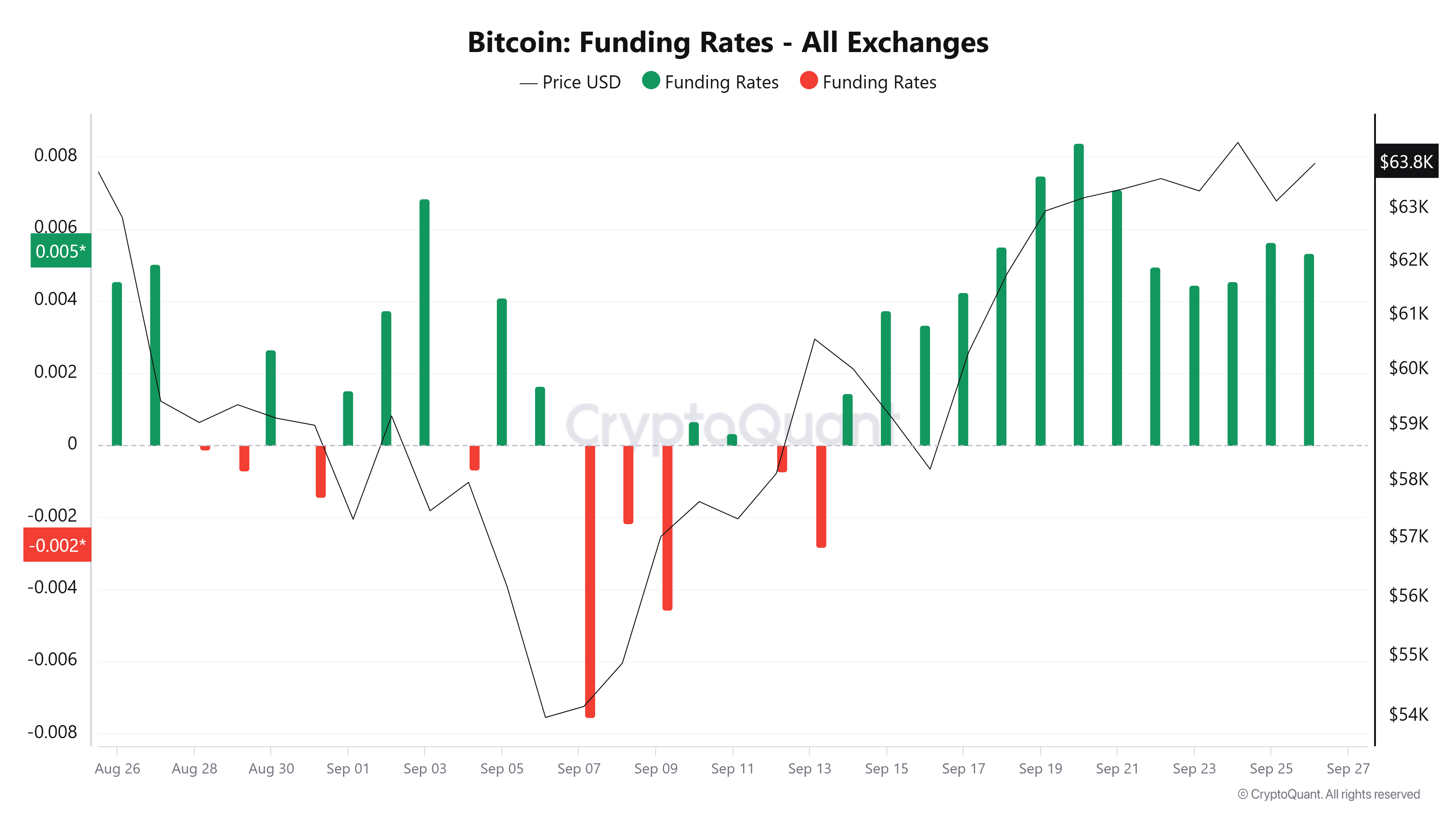

The Bitcoin Futures markets confirmed an uptick in exercise. Since BTC broke above $60,000 on seventeenth September, Funding Charges have spiked, and have been predominantly optimistic.

Because of this lengthy merchants betting on additional worth will increase have outnumbered brief sellers. These merchants are keen to pay a premium to keep up their lengthy positions, which reveals bullish sentiment.

Knowledge from Coinglass additional reveals a bullish bias as lengthy merchants dominate.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

At press time, 52% of merchants held lengthy positions whereas 47% had been holding brief positions, indicating that fewer merchants are predicting that the costs will drop.

The optimistic sentiment can be seen within the Bitcoin Worry and Greed Index which has recovered from a state of worry to impartial, additional shedding mild on market confidence.