- Bitcoin should keep above $100K for the uptrend to proceed.

- BTC has skilled a slight pullback over the previous day, dropping by 2.55%.

After experiencing a sustained uptrend to hit $106K over the previous day, Bitcoin [BTC] has retraced. In truth, of this writing, BTC was buying and selling at round $102K. This marked a 2.55% decline on day by day charts.

Previous to this drop, Bitcoin had been on an upward trajectory, mountain climbing by 8.85% on weekly charts. Inasmuch, CryptoQuant analyst Crazyyblock urged that Bitcoin should maintain above $100K assist stage, and right here’s why.

Why $100K is important for Bitcoin

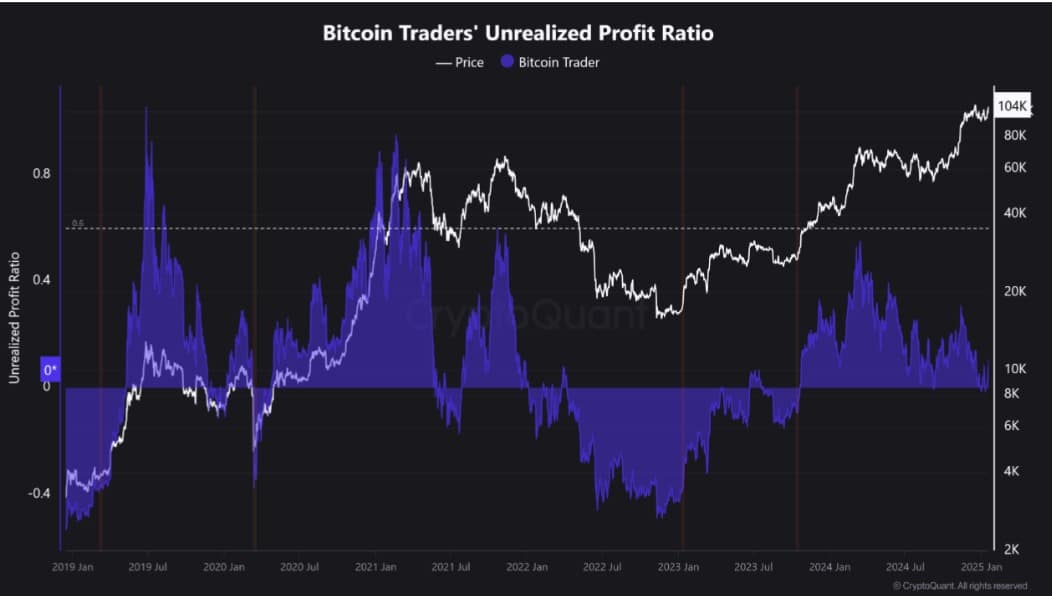

In keeping with Crazyyblock, Bitcoin should maintain above $100K, just because the profitability of present holders now hinges on sustaining this stage.

A failure to carry this important psychological stage may lead to panic promoting or loss-induced liquidation amongst market members.

It is because Bitcoin buyers on this class are holders inside 1 to 3-month age bands. The group is infamous for emotional promoting, as they react swiftly to market adjustments, and so have interaction in short-term methods.

Subsequently, if Bitcoin fails to take care of a $100K assist stage, many of those members may select to promote even at a loss, creating potential promoting strain.

Thus, the king coin’s means to defend this stage will form the market’s route, making it a pivotal level for both an upward or draw back.

Can BTC keep the uptrend?

In keeping with AMBCrypto’s evaluation, Bitcoin remained in a bullish section regardless of the lately witnessed pullback. Notably, the market situations at press time pointed in direction of one other upward motion.

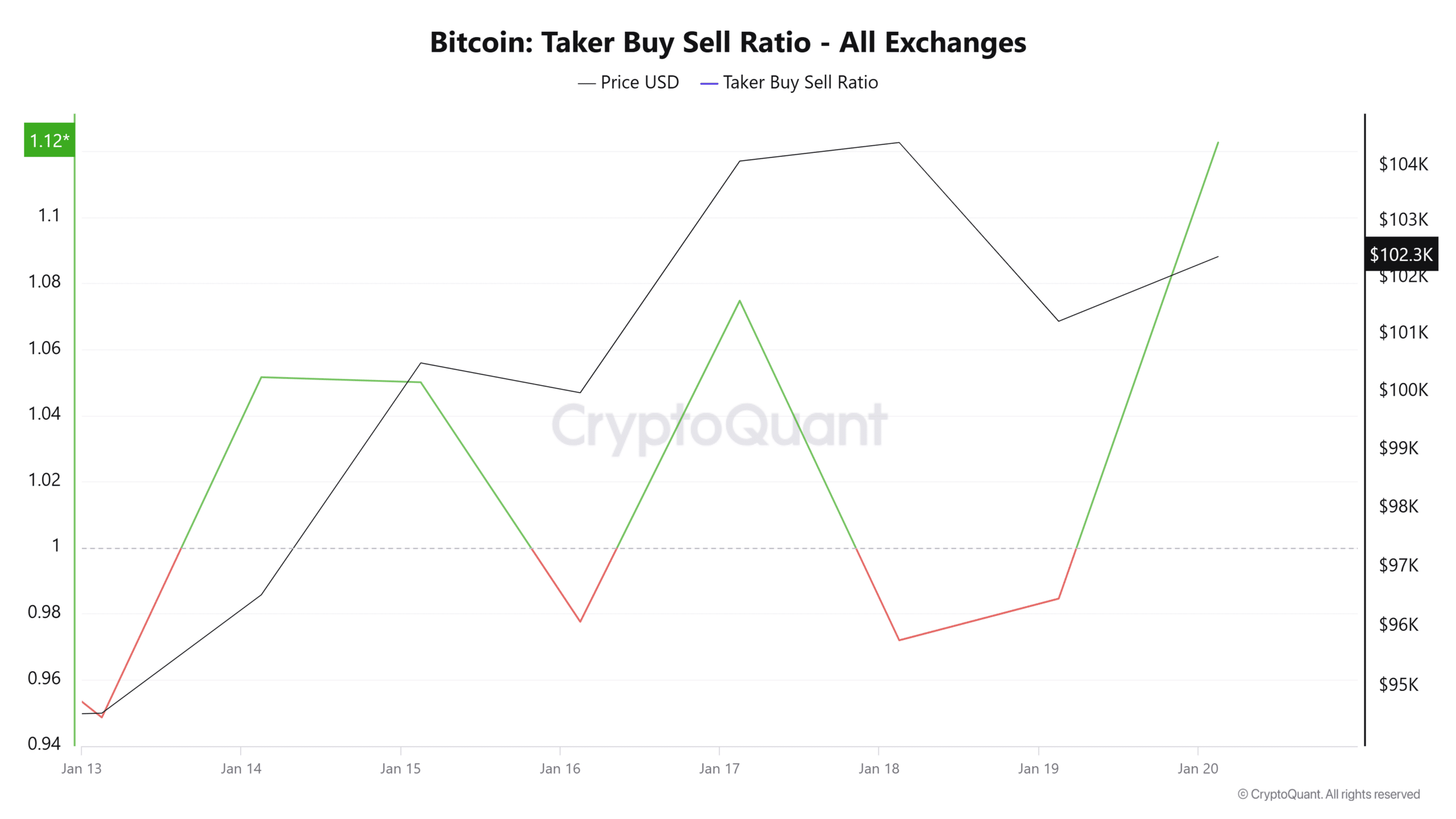

For instance, Bitcoin’s Taker Purchase Promote Ratio remained at 1.12, suggesting that patrons have been dominating the market. As such, there was larger shopping for strain.

This mirrored bullish sentiments as buyers accrued BTC, anticipating additional positive factors.

On the similar time, Bitcoin had began to expertise sturdy upward momentum, as evident by means of the rising RVGI and ADR. On the time of writing, the RVGI had moved upward, since making a bullish crossover 4 days in the past.

This signaled a robust upward momentum, because the bears appeared to lose the spark. Equally, Bitcoin’s ADR urged that BTC was making extra positive factors than losses.

Merely put, the lately witnessed decline looks as if a mere market correction earlier than trying one other uptrend. That is so as a result of most market members stay bullish and anticipate costs to rise.

Learn Bitcoin’s [BTC] Worth Prediction 2025–2026

Subsequently, if the present sentiment holds, BTC will reclaim $105K and try a breakout above $106K, the place it has confronted a number of rejections.

Nevertheless, if the correction prolongs, it’d drop beneath $100K, leading to an extra dip to $98K.