- Arthur Hayes believes BTC may slip beneath $50k into the weekend

- Bitget’s Gracy Chen maintains a long-term bullish outlook although

Bitcoin’s [BTC] weak spot hiked in September because the world’s largest digital asset struggled beneath $60k on the charts. In reality, in keeping with Arthur Hayes, Co-Founding father of BitMEX and CIO at VC fund Maelstrom, BTC may drop additional down and slip beneath $50k over the weekend.

“$BTC is heavy, I’m gunning for sub $50k this weekend. I took a cheeky short.”

Extra BTC losses within the brief time period?

Earlier within the week, Hayes made a bearish name for BTC within the brief time period, arguing that the anticipated Fed price cuts wouldn’t rally crypto markets. This, earlier than rate of interest merchants elevated bets on a 0.25% and 0.50% Fed price lower forward of the U.S jobs report on Friday.

Based on the exec’s argument. U.S liquidity is squeezed as monetary establishments have opted for the Fed’s RRP (reverse repurchase settlement) for increased yields, quite than betting on dangerous property like Bitcoin. This is able to imply internet damaging liquidity, which may decrease BTC costs regardless of the possible Fed price cuts, he added.

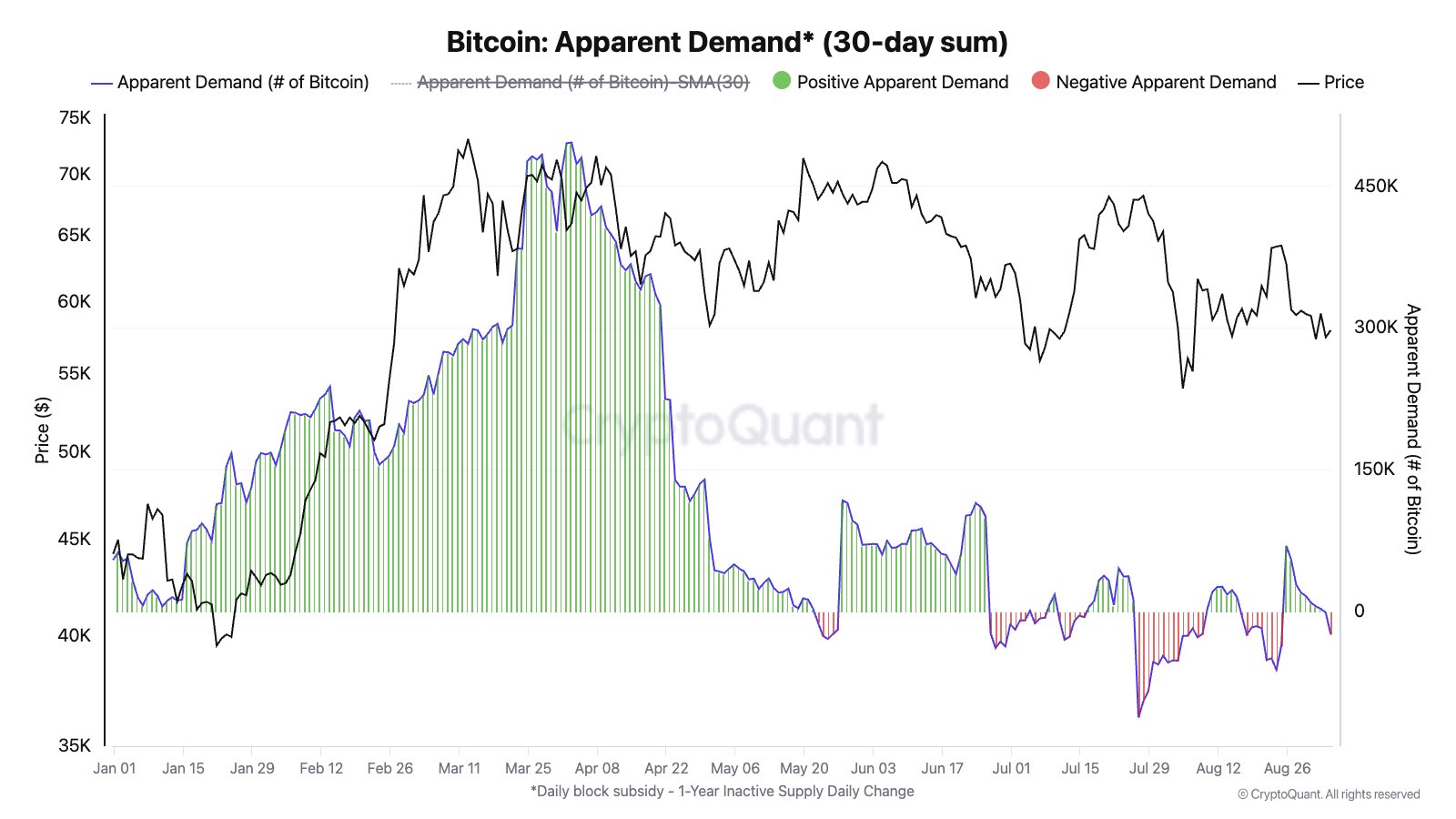

Right here, it’s price declaring that demand for the crypto has additionally tapered considerably since Q1. Based on CryptoQuant knowledge, investor demand hit report lows at press time, which may additional put downward strain on the crypto’s worth.

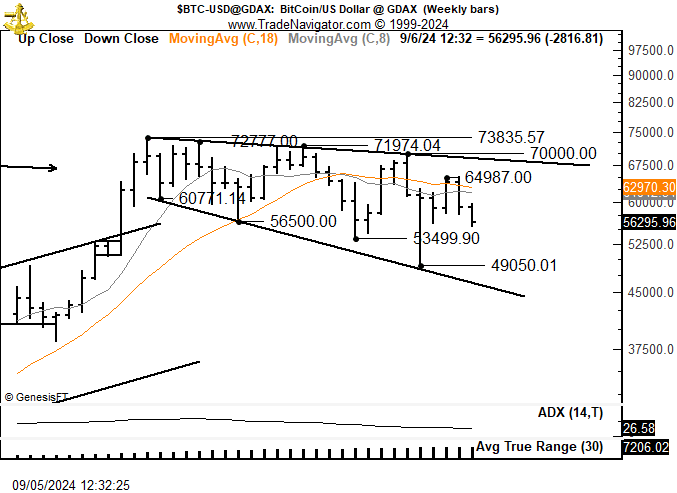

For his half, Peter Brandt recommended that BTC would see extra promoting than shopping for, given its present megaphone worth chart sample. In a worst-case situation, Brandt projected that BTC may drop to as little as $46k.

Quite the opposite, some market insiders stay bullish in the long term. Gracy Chen, CEO of crypto change Bitget, advised AMBCrypto that September losses could be the ‘”ast drop” earlier than a possible BTC rally in This autumn and 2025.

“The recent market decline at the beginning of September is often referred to as the ‘last drop,’ with prices expected to hit new highs by the end of the year. Many analysts remain quite optimistic about Bitcoin’s price outlook for Q4 2024.”

Given the long-term bullish outlook, Chen projected that BTC may climb above $100k by November.

“In a scenario without any black swan events, Bitcoin could potentially break through the $100,000 threshold by November, experience a correction, and then begin its climb toward the $200,000 range.”

BTC was valued at $56.4k at press time as merchants and traders waited for the U.S Jobs report.