- Bitcoin has surged by 1.04% over the previous day.

- The king coin should maintain above $96k to strengthen bullish sentiments.

Over the previous week, Bitcoin [BTC] remained caught inside a consolidation vary, because the king coin failed to take care of an upward momentum and reclaim increased resistance.

As such, it has continued to hover round $96k, making it a crucial level for STHs, in line with CryptoQuant analyst Shayan.

Why $96k is vital for Bitcoin

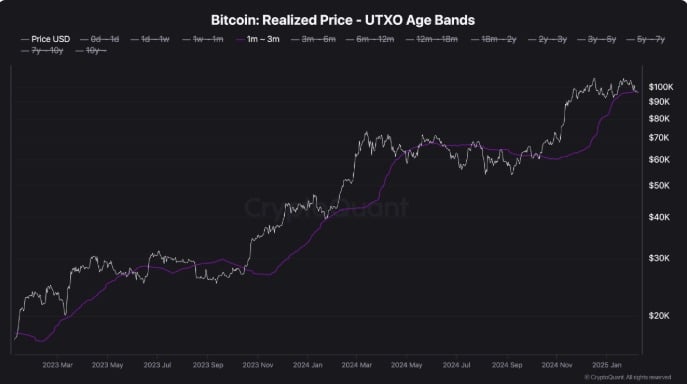

In his evaluation, Shayan noticed that Bitcoin’s realized value for the 1–3 month cohort sat at $96k.

Traditionally, when BTC declines to this stage after an uptrend, it acts as crucial assist, suggesting that STHs are assured with their positions regardless of the surging costs.

Holding above this key stage is essential because it reinforces bullish market sentiment, thus rising the probability of an prolonged upward development.

Conversely, if Bitcoin fails to carry this assist at this crucial threshold and breaks beneath, it might trigger a shift in sentiment. As such, market sentiment will shift in the direction of worry, doubtlessly resulting in a distribution section.

Subsequently, the following transfer round this level will play a key position in shaping Bitcoin’s quick to mid-term trajectory.

Can BTC maintain above $96k?

With Bitcoin remaining caught round $96k, the query is whether or not the king coin can maintain above it and reinforce bullish sentiment amongst short-term holders.

In line with AMBCrypto’s evaluation, though Bitcoin lacks upward momentum, traders are optimistic and imagine one other leg up is forward.

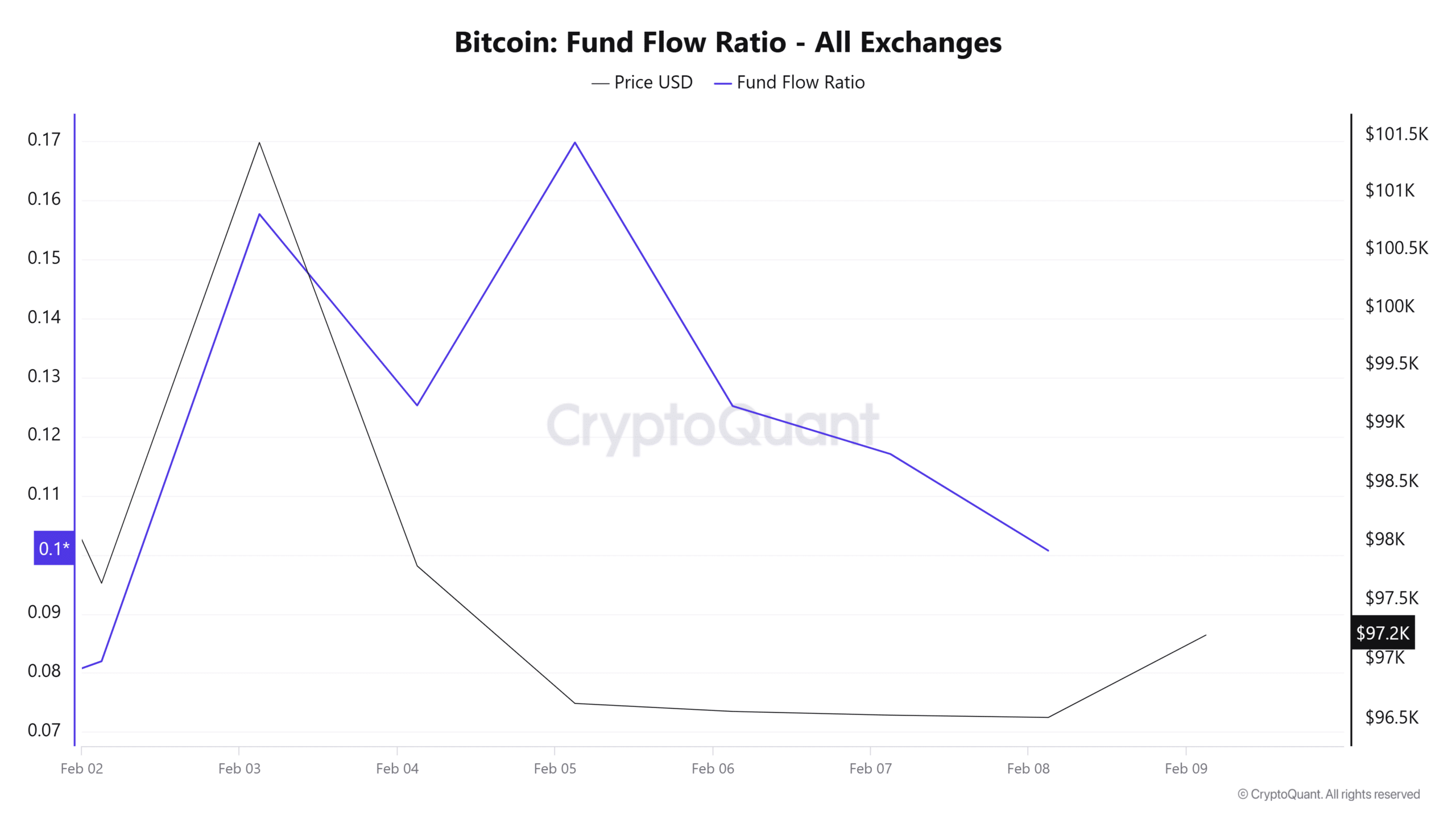

For instance, Bitcoin’s Fund Move Ratio has declined for 3 consecutive days. This implied {that a} smaller portion of BTC transactions contain exchanges.

Such a development means that traders are holding their property fairly than promoting. This market habits usually aligns with the buildup section earlier than costs rise.

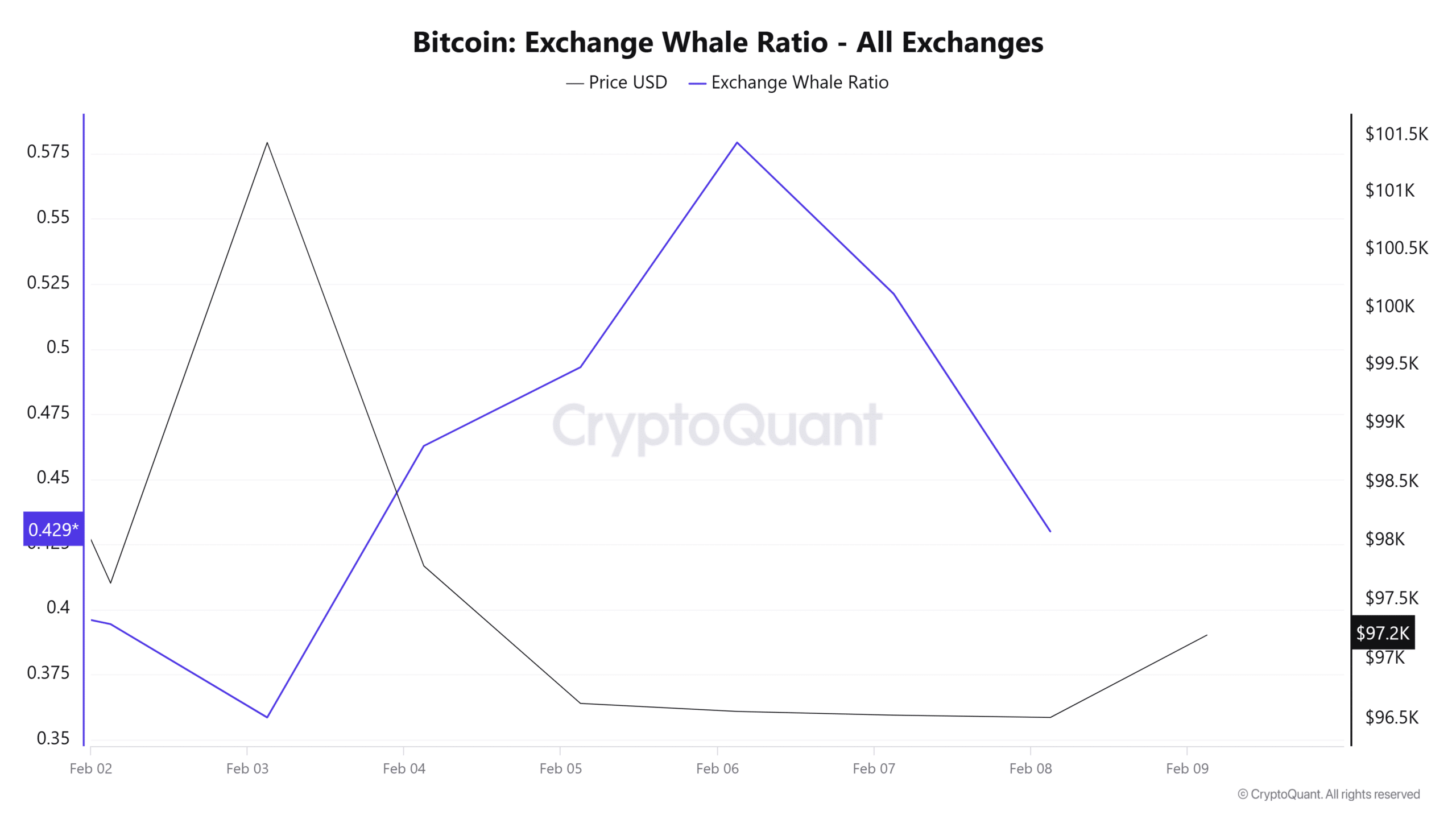

This accumulation additionally seems to be sturdy amongst whales. That is confirmed by the declining Wxchange Whale Ratio, which has dropped over the previous three days.

Such a decline implied that whales continued to carry BTC as they anticipated additional value positive aspects.

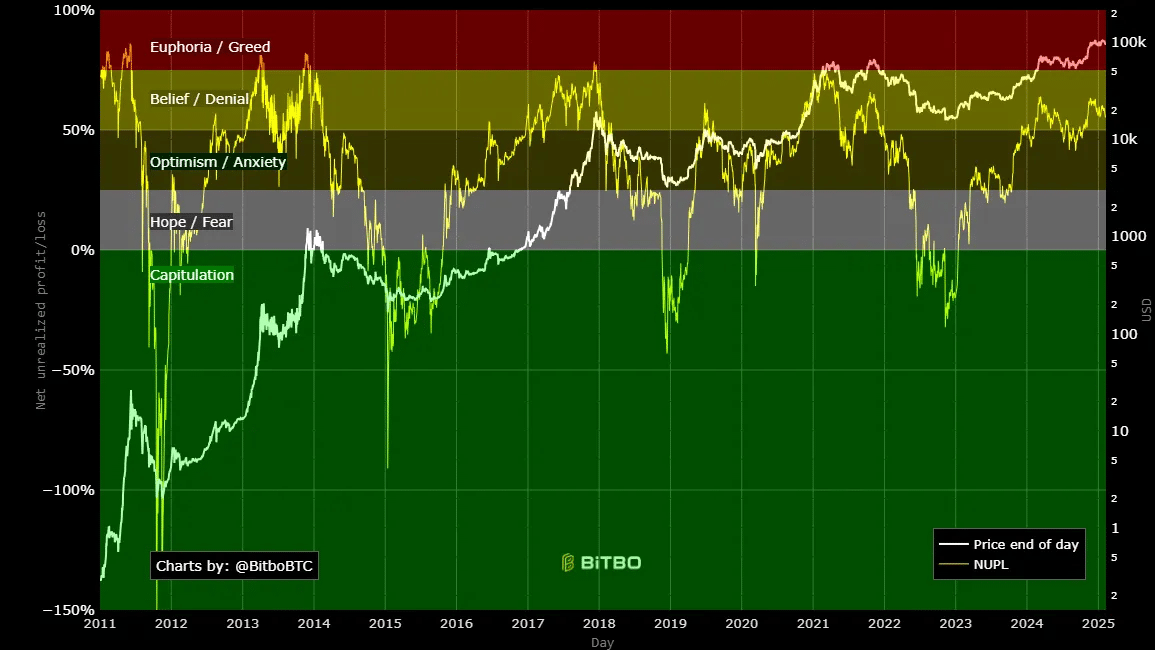

Lastly, Bitcoin’s NUPL nonetheless remained inside the perception/denial zone. At this stage, BTC was nonetheless in a bullish section, climbing in the direction of cycle highs.

With NUPL at 58%, the uptrend nonetheless has room for progress earlier than reaching the market high.

Learn Bitcoin’s [BTC] Value Prediction 2025–2026

Merely put, though Bitcoin has struggled to carry above $96k, the crypto nonetheless has room for progress. With extra positive aspects, STHs confidence will probably be bolstered, additional strengthening bullish sentiments.

With traders nonetheless optimistic, BTC might make a transfer above this stage, try $98900, after which face $100k resistance. Nevertheless, if it fails to carry above this stage, BTC might drop to $94k, risking additional decline.