- BTC would possibly eye $84K subsequent, based on CryptoQuant knowledge.

- There was extra headroom for BTC development amid renewed whale bets.

On the twenty ninth of October, Bitcoin [BTC] tapped $73K and prolonged its market dominance to a brand new excessive of 60%. The additional rally made it nearer to a recent all-time excessive (ATH) as analysts projected extra development potential.

Is $84K the following goal?

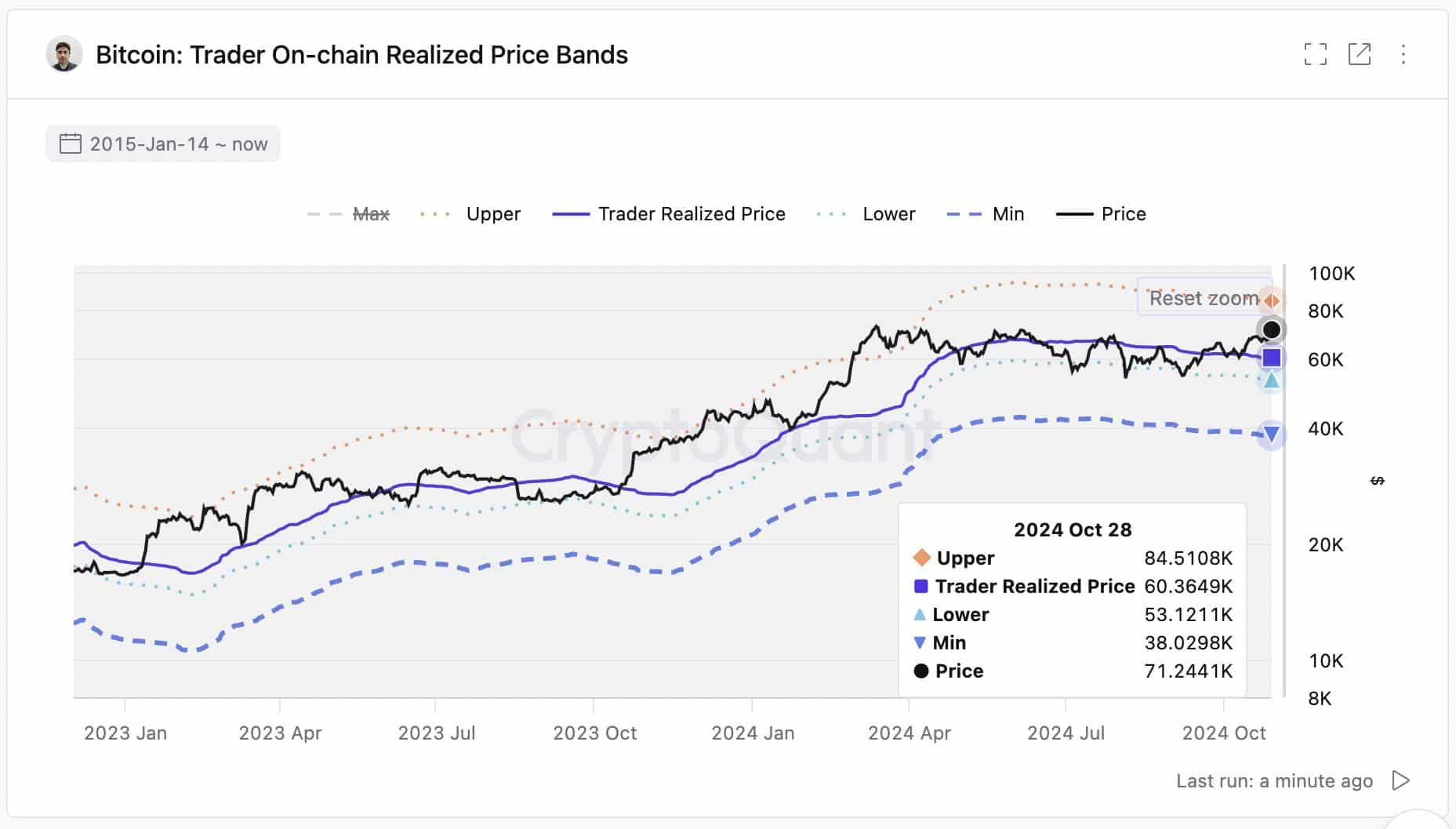

In response to CryptoQuant’s head of analysis, Julio Moreno, the following goal could be $84K if March’s ATH of $73.7K was cleared. He stated,

“Bitcoin is near a fresh ATH. Under a valuation perspective, $84K would be the next target (the “upper” band.”

For the unfamiliar, the dealer on-chain realized value band is a valuation metric primarily based on historic BTC value knowledge.

It makes use of realized value (the common value foundation for BTC short-term merchants) as a reference level, with higher and decrease bands as resistance and help ranges.

Because the present value motion was above the realized value, the following and quick goal was the higher band (resistance) at $84K, offered BTC costs stayed above $60K.

Nicely, the $84K goal isn’t far-fetched, on condition that BTC choices merchants eyed $80K by the tip of November, no matter subsequent week’s US elections consequence.

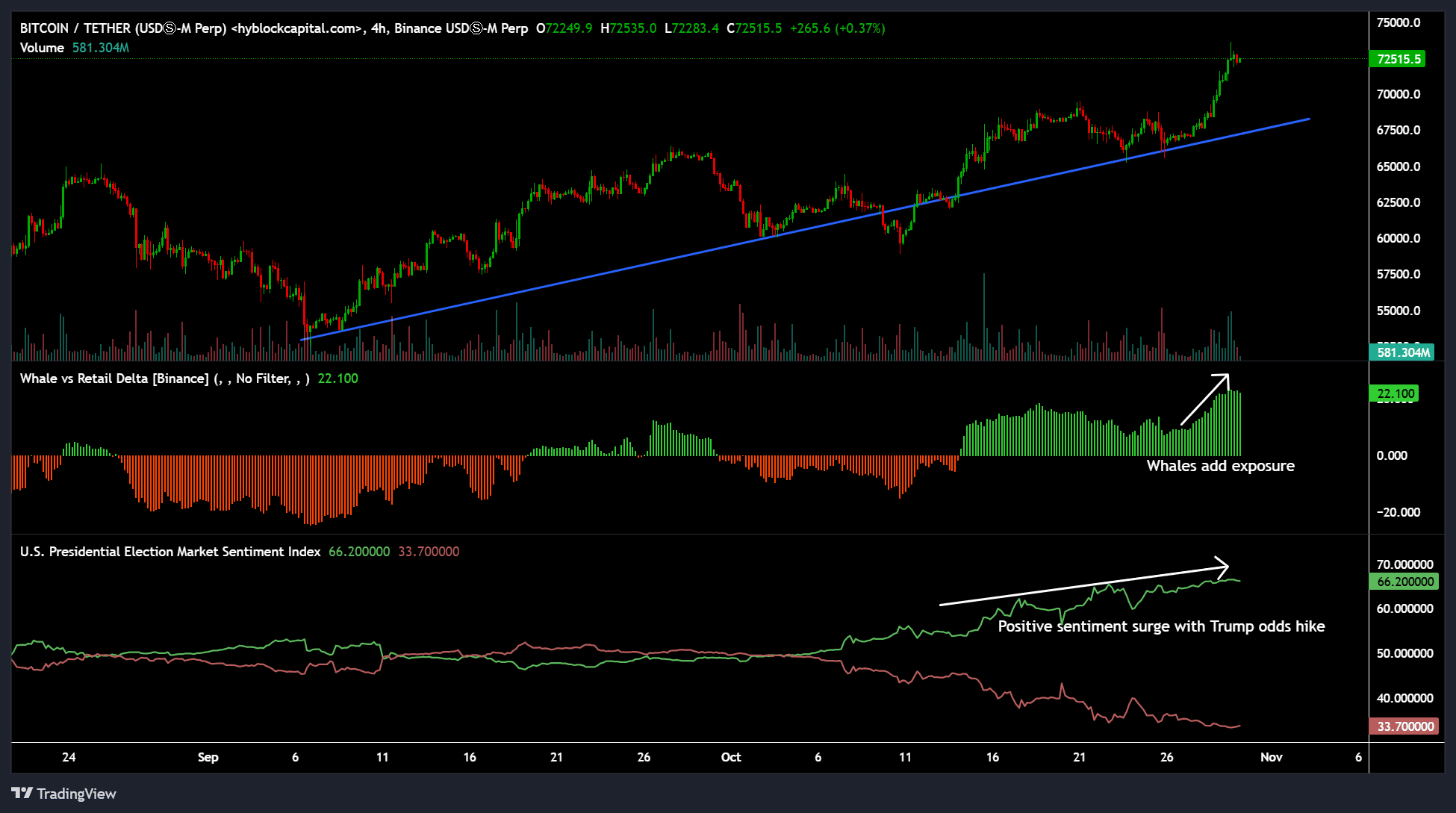

That stated, the present market construction additionally confirmed extra headroom for development, as famous by Mathew Siggel, VanEck’s head of digital property analysis.

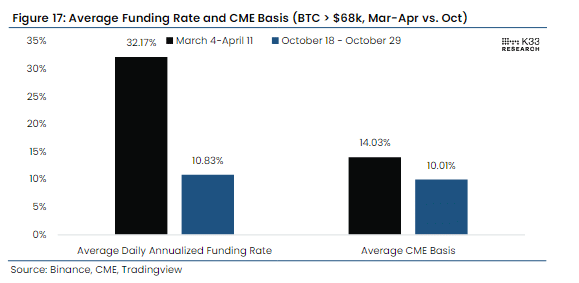

Siggel stated that regardless of BTC nearing recent ATH, the market was not as overheated as seen throughout March/April.

“Past BTC peaks have coincided with surging perp premiums, hardly the environment today. Also, current spot volumes are half of March/April, indicative of substantially less panic buying from retail participants – a welcome observation for continued strength.”

Briefly, the market was extra secure and more healthy, not like the large euphoria seen in March when BTC hit a brand new ATH.

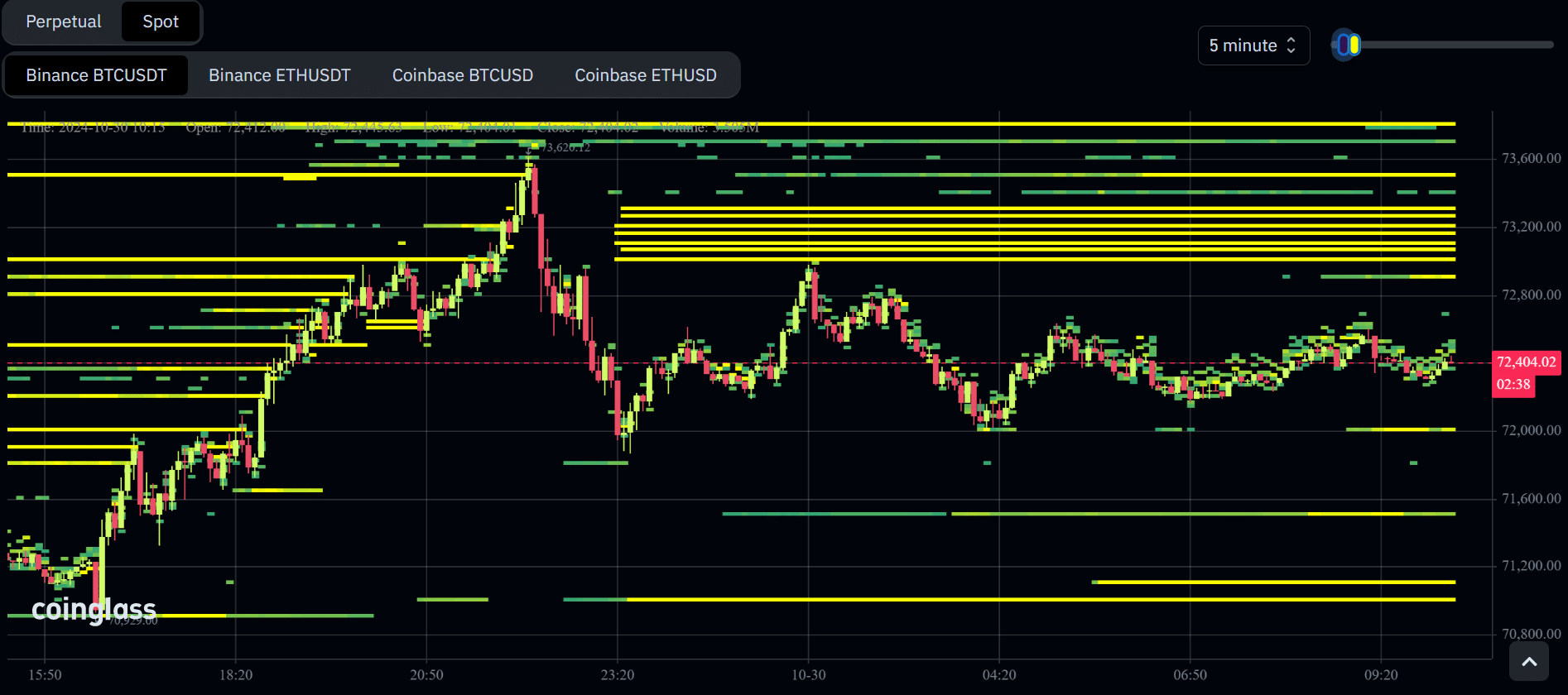

However there was a slight caveat within the quick time period. There have been appreciable promote partitions (yellow traces at $73.2K and $73.8K) on the Binance spot, proper on the March ATH, which may turn out to be a roadblock for a couple of hours or days.

Learn Bitcoin [BTC] Worth Prediction 2024-2025

Nonetheless, whales remained adamant and confirmed excessive constructive conviction. The truth is, the run-up to $73K appeared to be pushed largely by massive gamers as they added extra publicity up to now 5 days.

This was illustrated by the rising Whale to Retail Delta indicator, suggesting that giant gamers had been extra bullish on BTC than retail at present ranges.