- Whales accumulate over 100k Bitcoin in per week.

- Metrics prompt potential bullish breakout as promoting stress subsided.

Every thing appears to be buzzing within the cryptocurrency market resulting from current developments in Bitcoin [BTC].

Whales, technical patterns, and on-chain metrics all mixed to point a possible change within the worth trajectory of BTC.

Is that this the second that can result in the subsequent massive rally?

The calm earlier than the storm?

Bitcoin has witnessed its justifiable share of ups and downs these weeks, transferring between shopping for and promoting pressures.

BTC lately began to stabilize after a slight dip, signaling that the market is perhaps positioning itself for a major transfer.

This may very well be the setup for a doable breakout, with massive traders heightened curiosity.

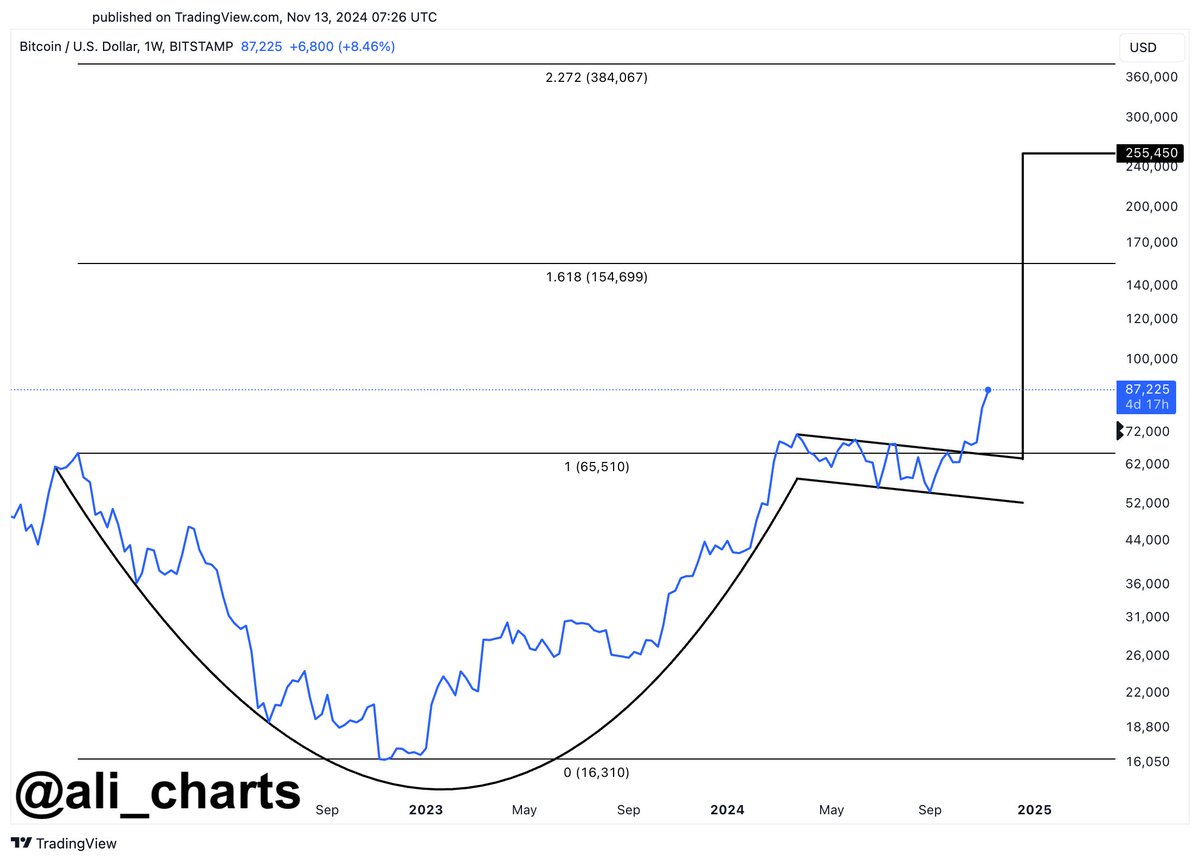

In accordance with a current tweet from analyst Ali Martinez, Bitcoin’s current worth motion pointed to the formation of a possible cup-and-handle sample, recognized for its bullish implications.

If this sample holds, BTC may intention for a goal worth as excessive as $255K.

BTC whales make strikes

On-chain information additional bolstered this outlook, showcasing varied supportive indicators. In accordance with the identical analyst, whales have purchased over 100K BTC up to now week, valued at round $8.60 billion.

Such large-scale BTC shopping for sometimes correlates with upward worth actions, as whales usually set the tempo for market sentiment.

Revenue-taking or diamond fingers?

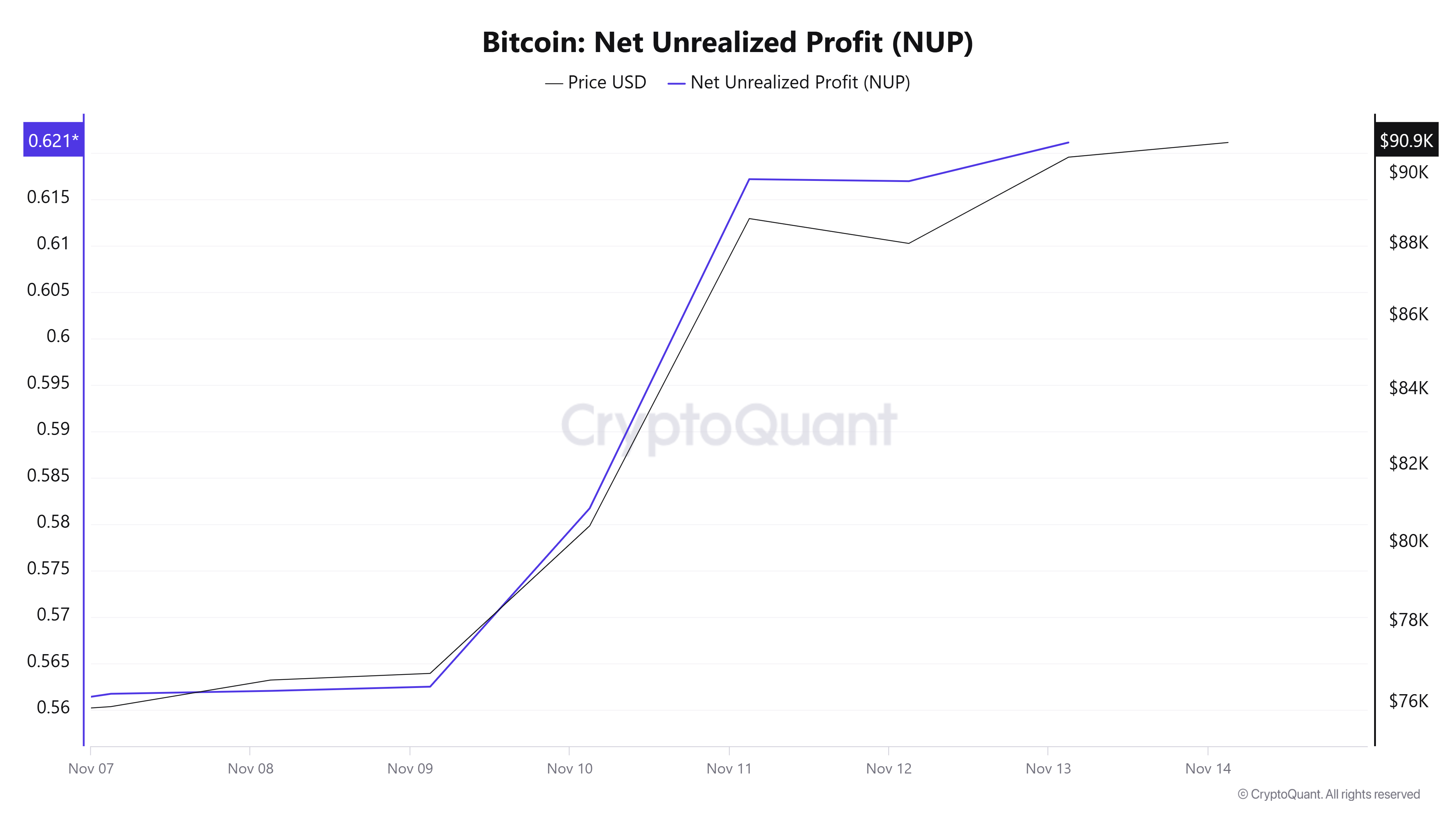

AMBCrypto evaluation of Santiment revealed that internet unrealized earnings climbed between the ninth and the eleventh of November, indicating a part of elevated promoting stress.

Nonetheless, this has leveled out since then, suggesting much less promoting and a extra secure holding sample. The change could pave the way in which for additional BTC’s potential development.

What does the MVRV have in retailer?

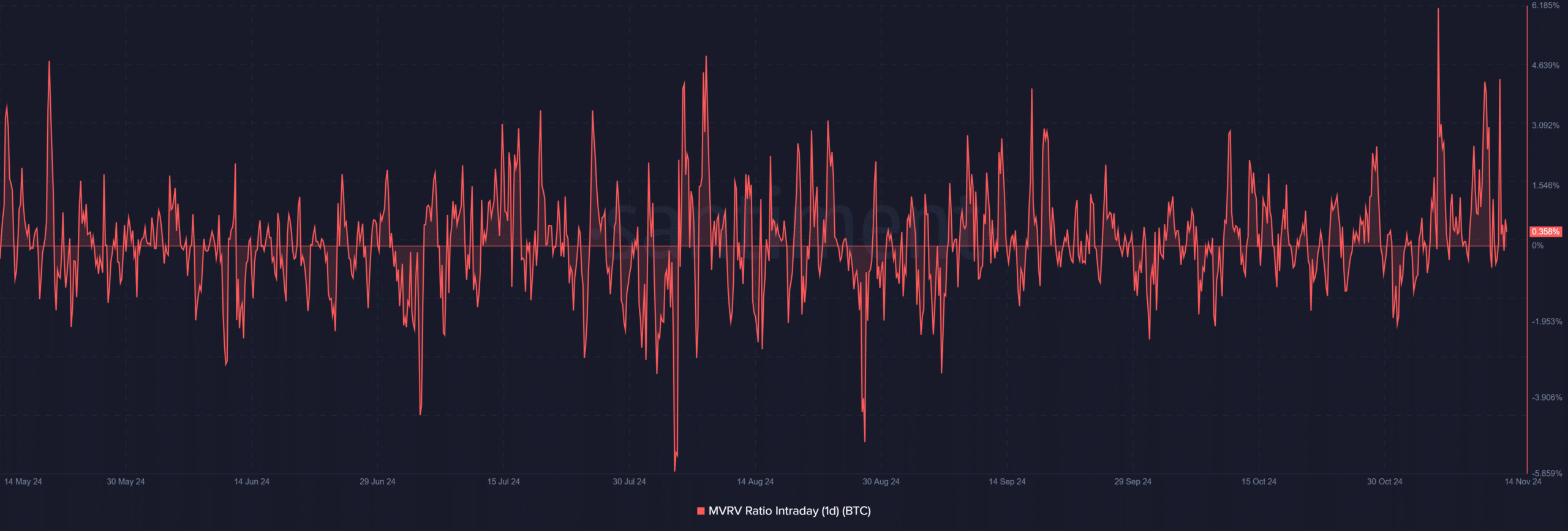

Including to the aforementioned constructive sentiments, the BTC Market Worth to Realized Worth (MVRV) ratio was at 0.36%, positioning BTC simply above its realized worth.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

This prompt that Bitcoin is just not overbought and retains potential for upward motion.

Traditionally, comparable MVRV ranges have usually preceded worth rallies, signaling a promising Bitcoin setup for continued development.