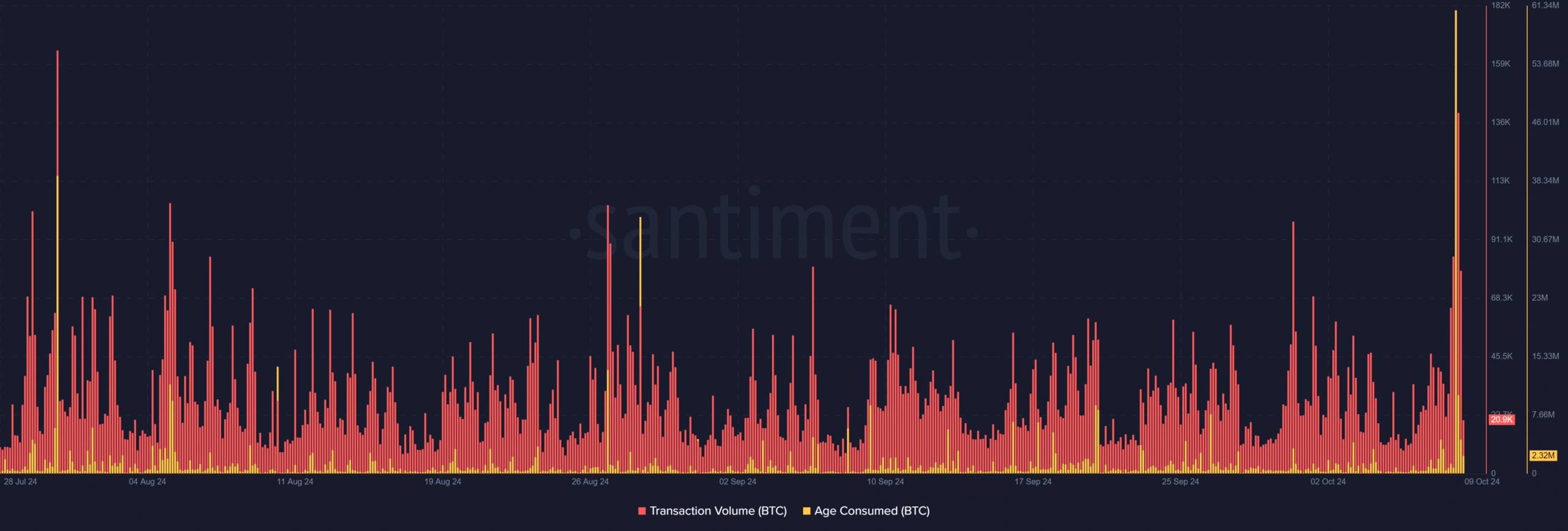

- BTC’s on-chain exercise surged, with transaction quantity exceeding 180,000 BTC for the primary time in seven months.

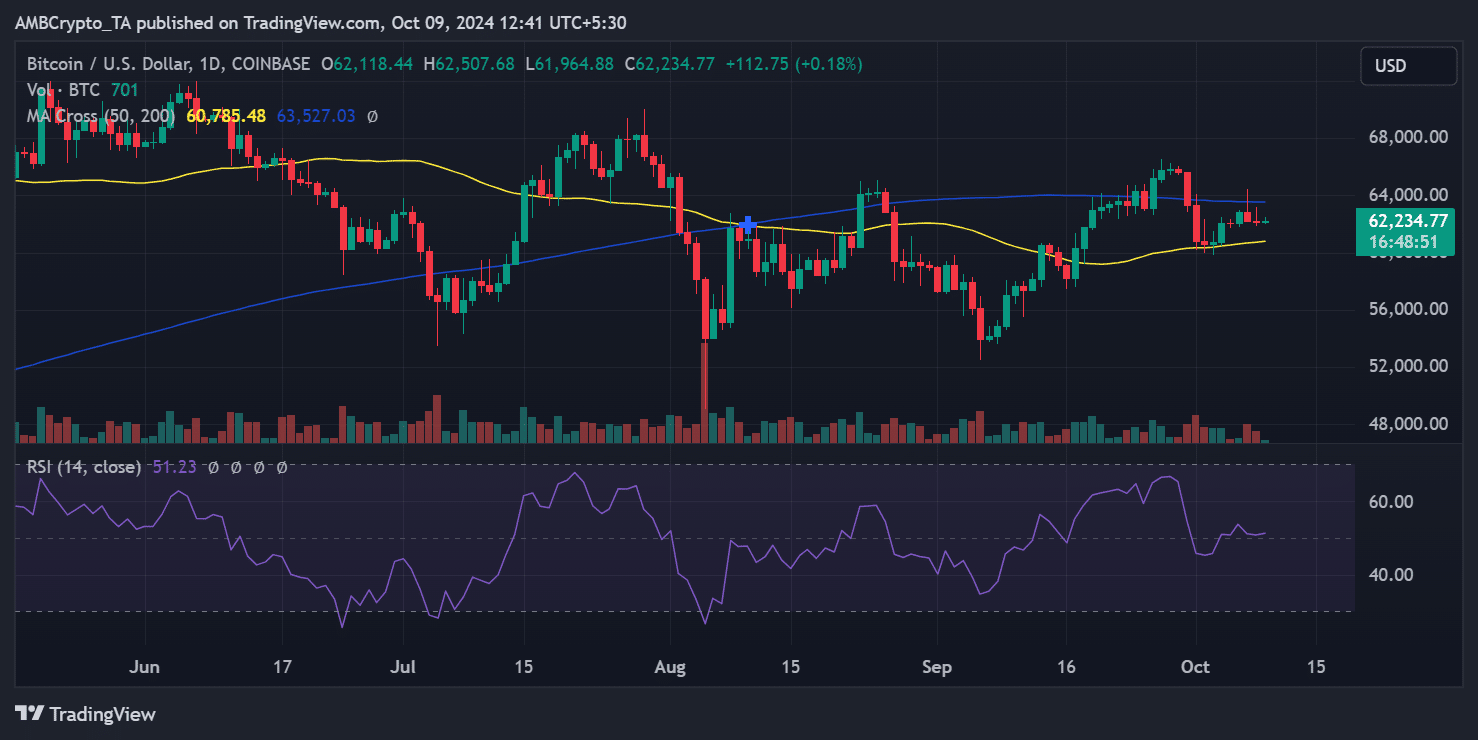

- BTC has remained within the $62,000 worth area.

Bitcoin [BTC] whales have ramped up their exercise prior to now few days, accumulating extra BTC because the market faces worth uncertainties.

This surge in whale exercise coincided with an increase in dormant Bitcoin transferring again into circulation, suggesting a possible shift in market dynamics.

Bitcoin whales accumulate extra BTC

Knowledge from Lookonchain revealed that Bitcoin whales have turn out to be extra lively over the past two days.

One tracked tackle gathered 250 BTC on the eighth of October, valued at roughly $15.6 million.

Following this, the identical tackle acquired an extra 750 BTC, value about $46.8 million, bringing its whole to 1,000 BTC inside 24 hours.

Curiously, this whale tackle had remained dormant for the previous six months after amassing over 10,000 BTC earlier this 12 months.

The renewed shopping for exercise from such giant holders might sign rising confidence available in the market’s future potential.

Elevated exercise spurs on-chain actions

The latest spike in Bitcoin whale exercise has additionally led to a noticeable enhance in BTC transaction quantity, based on information from Santiment.

Evaluation exhibits that transaction quantity surged to over 180,000 BTC, equating to greater than $37 billion. This quantity spike is especially notable because it marks the primary time such excessive ranges have been reached in seven months.

Moreover, the age-consumed metric—which tracks the motion of long-held BTC—spiked to over 60.7 million BTC, a stage not seen in months.

Traditionally, a surge in dormant BTC returning to circulation has been a optimistic sign for future worth actions.

This enhance aligns intently with the renewed accumulation of Bitcoin whales, indicating a possible shift available in the market.

BTC exhibits indicators of stability

Regardless of the elevated whale exercise, Bitcoin’s worth stays comparatively regular. A each day chart evaluation exhibits that Bitcoin closed the final buying and selling session with a slight dip, buying and selling at round $62,122, enduring a 0.13% decline.

Nevertheless, the present buying and selling session exhibits a minor enchancment, with Bitcoin buying and selling at roughly $62,240, reflecting a slight enhance of lower than 1%.

The continued accumulation by Bitcoin whales is a promising signal that might affect a optimistic shift within the worth development quickly.

Learn Bitcoin’s [BTC] Value Prediction 2024-25-

As Bitcoin whales turn out to be extra lively and long-held BTC strikes again into circulation, the market could also be getting ready for a shift.

Whereas the worth has but to see a big uptick, the renewed curiosity from giant holders means that the market might quickly expertise extra optimistic momentum.