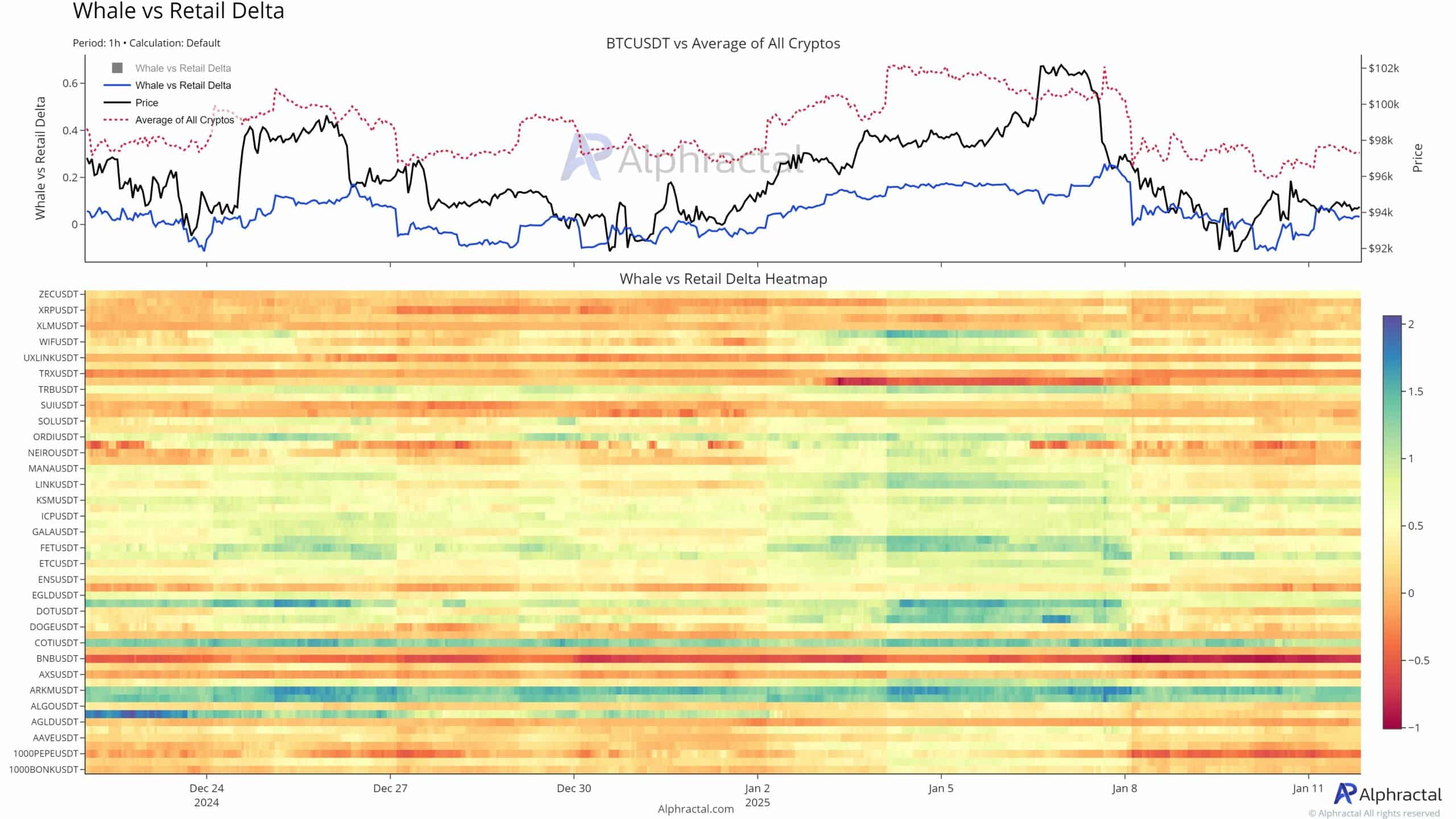

The retail lengthy/brief ratio heatmap revealed clear developments in altcoin positioning. Main the cost in lengthy positions are belongings resembling SUI and SOL, with sustained inexperienced zones indicating elevated retail bullishness.

Then again, cash like TRX and XRP exhibited larger ranges of brief curiosity, suggesting merchants count on draw back actions.

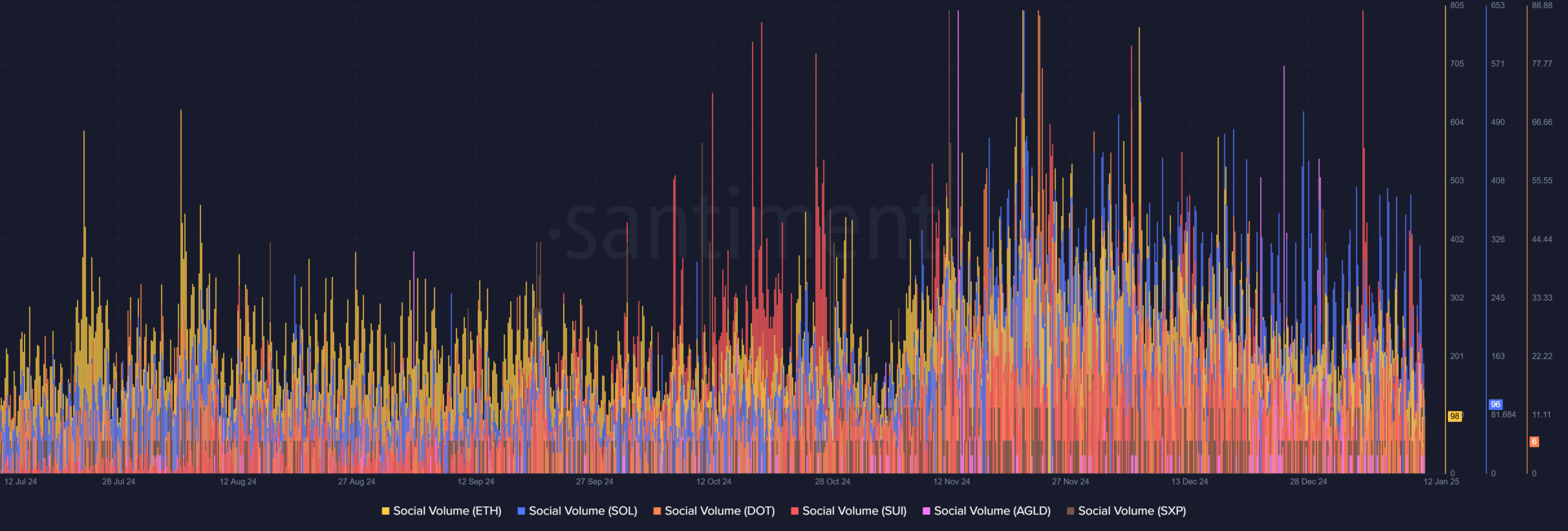

Social quantity information echoed this sentiment. As may be seen on the chart, whereas Ethereum [ETH] maintained excessive engagement ranges, SUI and Solana have been quickly closing the hole, buoyed by community developments and community-driven hype. Altcoins like DOT and AGLD additionally noticed spikes in social quantity, pointing to their rising recognition in buying and selling discussions.

Regardless of the optimism round altcoins, Bitcoin gave the impression to be in a impartial to barely bearish zone. The typical retail lengthy/brief ratio for BTC was near parity, reflecting warning amongst merchants amid slower worth momentum.

This divergence is proof of evolving market dynamics – Merchants are looking for larger risk-to-reward setups in altcoins whereas Bitcoin’s dominance wanes in speculative fervor. For now, the altcoin rally appears to be pushed by a mixture of speculative retail curiosity and bettering social sentiment.

Bitcoin’s lengthy/brief ratio indicators warning

Bitcoin’s impartial lengthy/brief ratio highlighted its alignment with macroeconomic uncertainty and merchants’ choice for stability.

With slower worth momentum and a scarcity of decisive pattern indicators, contributors seem hesitant to take giant directional bets, favoring hedging methods over speculative performs.

The Whale v. Retail Delta heatmap revealed muted whale curiosity in BTC in comparison with different altcoins, indicating that giant holders should not considerably accumulating or offloading. As an alternative, their habits appeared to be according to sustaining stability slightly than amplifying volatility.

This, in sharp distinction with cash like TRX or GALA, the place pronounced retail exercise – typically unbalanced by whale trades – fuels sharper worth swings.

Learn Bitcoin’s [BTC] Worth Prediction 2025-26

Diverging optimism – Altcoins and market stability

The uneven sentiment throughout altcoins prompt the market is at a crossroads. Cash like SUI and SOL noticed concentrated bullish momentum, but this optimism isn’t common. Quick positioning in belongings resembling TRX and XRP alluded to rising skepticism in different pockets of the market.

This bifurcation appears to be hinting at a possible liquidity tug-of-war, the place overly optimistic performs in some altcoins would possibly amplify volatility spillovers. For market stability, this fragmented sentiment introduces dangers.

If speculative euphoria in sure altcoins unwinds abruptly, it might dampen broader confidence and result in contagion results. Conversely, sustained optimism in choose belongings might entice sidelined capital, fueling a wider rally.