- BTC’s key on-chain metric hinted at value volatility.

- Nonetheless, technical indicators on a value chart refuted that declare.

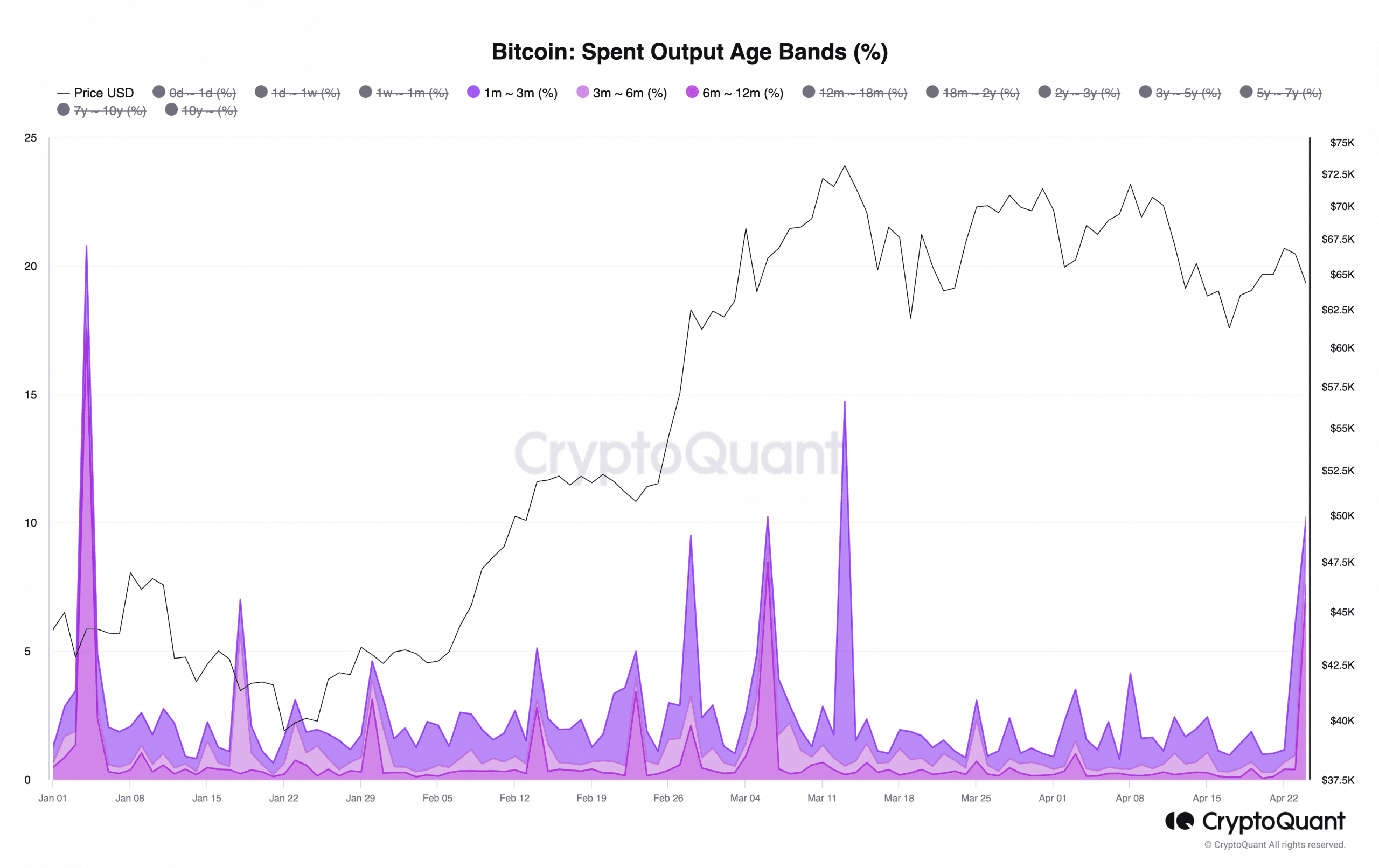

Bitcoin’s [BTC] spent outputs for traders which have held their cash for one to 12 months have witnessed a spike, hinting at the opportunity of a value swing, in line with CryptoQuant’s information.

BTC’s spent outputs for various age bands of traders supply insights into coin holders’ spending habits.

For instance, it could actually monitor whether or not cash held by short-term holders are being moved, indicating an uptick in profit-taking exercise.

Volatility within the BTC market?

When the quantity of spent output for short-term BTC holders will increase, it typically suggests a rally in market volatility.

In a latest report, pseudonymous CryptoQuant analyst Mignolet mentioned,

“Movement of this entity can be seen as data for volatility confirmation rather than for price increases or decreases. It appears that volatility is likely to emerge soon.”

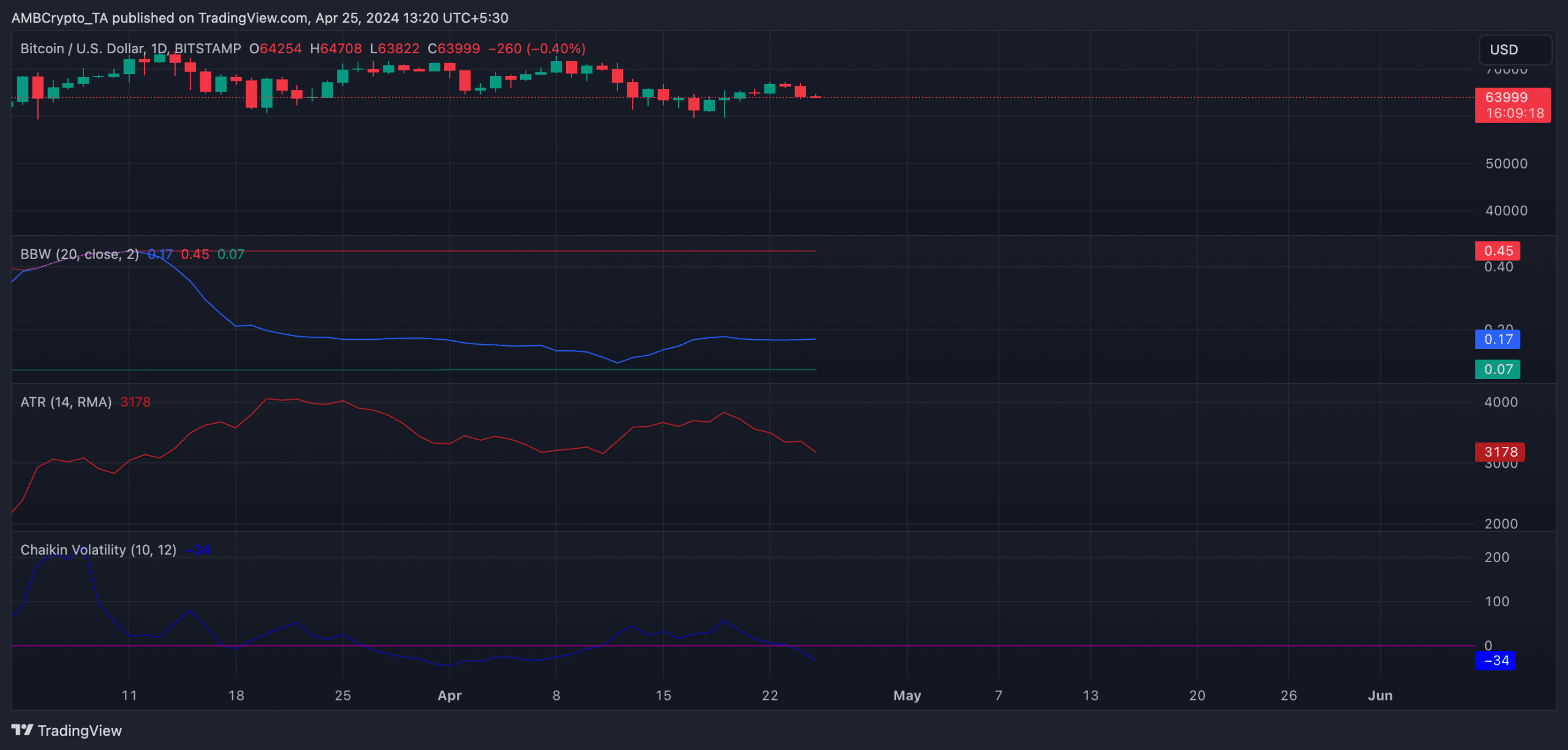

Nonetheless, an evaluation of the coin’s key volatility markers on a day by day chart advised minimal danger of any important short-term value swings.

Readings from the BTC’s Common True Vary (ATR) confirmed that it has steadily declined because the nineteenth of April.

This indicator measures the common vary of value actions over a specified interval. When it falls, it signifies a discount in market volatility.

Confirming the decline in market volatility, BTC’s Chaikin Volatility was noticed in a downtrend at press time. Because the nineteenth of April, the worth of the indicator has dropped by 162%.

This indicator measures an asset’s value volatility by evaluating the present vary between the excessive and low costs to a earlier vary over a particular time period.

When it declines this fashion, it means that an asset’s market is changing into much less risky as a result of the vary between its excessive and low costs is contracting.

Additional, BTC’s flat Bollinger Bandwidth (BBW) lent credence to the low volatility within the coin’s market.

Learn Bitcoin [BTC] value prediction 2024 -2025

When an asset witnesses a flat BBW, it means that its value is experiencing low volatility and its actions are comparatively steady and confined to a slender vary.

At press time, the main crypto asset exchanged arms at $64,241. Based on CoinMarketCap’s information, its worth has climbed by 5% prior to now seven days.